SMH trade ideas

Opening (IRA): SMH August 15th 215 Short Put... for a 2.50 credit.

Comments: A starter position in the semiconductor ETF on a smidge of weakness here, targeting the strike paying around 1% of the strike price in credit.

Will generally look to add at intervals if I can get it at a strike better than what I currently have on.

$SMH and $NVDA Dominance: Some more room to run for bothWith NASDAQ:NVDA and NASDAQ:SMH above their respective ATH the focus returns to the fact how far we can expect for both to outperform and make new highs. In this Blog we floated the idea of NASDAQ:NVDA dominance. This indicates the % of return / price movement in NASDAQ:SMH contributed by NASDAQ:NVDA as it is a cap weighted index. It captures the outperformance of the high momentum stocks like NASDAQ:NVDA and $AVGO.

On May 12 I predicated that NASDAQ:NVDA will reach 170$ before end of summer. And we are very close to our price target.

NASDAQ:NVDA : Full on Bull mode. 170 $ before end of Summer for NASDAQ:NVDA by RabishankarBiswal — TradingView

On May 30 we also favoured NASDAQ:SMH over AMEX:HACK and said that the momentum will continue and NASDAQ:SMH will touch new ATH. And here we are with NASDAQ:SMH above 280$.

NASDAQ:SMH vs AMEX:HACK : Recent good correlation with breakout potential for AMEX:HACK by RabishankarBiswal — TradingView

Now the question comes , how far these 2 can go and the bigger question is will NASDAQ:NVDA claim its Dominance in NASDAQ:SMH ? As you can see in the chart below the NASDAQ:NVDA Dominace in NASDAQ:SMH peaked at 0.6 or 60% on Nov 11. Currently we are @ 57% and still below its ATH. My estimate is NASDAQ:NVDA will claim its Dominance and go to the highs of 65% before SMH also completes it highs in this upward slopping channel with 315$ as my price target on $SMH.

Verdict: NVDA Dominance in NASDAQ:SMH can reach 65%. NASDAQ:SMH Target 315 $. NVDA Price target remains 170$ and above.

Semiconductors into MAJOR resistanceAs you can see from this weekly chart, the semiconductors have tried three different times to get above this trend line and have gotten rejected all three times. Could it go higher from here? Of course it could, but you have to ask yourself what are the probabilities that it will continue to go up through all this heavy resistance? Not very good is the answer. A close above last weeks candle would confirm a breakout, otherwise, bearish view remains intact.

SMH BREAKOUT: Semiconductor ETF Explodes Higher After 13-Month VanEck Semiconductor ETF (SMH) - 1Y Chart Analysis

THE SETUP:

After 13 months of sideways chop between $180-$240, SMH has finally broken out with real conviction. This lengthy accumulation phase built a massive foundation for what could be the next major leg higher.

KEY LEVELS:

Breakout Level: $240 (now critical support)

Current Price: $261.59 (+1.79%)

Next Target: $300 (major psychological level)

Stop Loss: Below $240 breakout

WHAT HAPPENED:

Semis have been coiling throughout 2024, basically going nowhere while digesting the previous run. The break above $240 on solid volume tells me buyers are finally stepping in with size.

MY TAKE:

This looks like the real deal. 13 months is a long time to build a base, and when these sector ETFs finally break out of extended ranges, they tend to move fast. $300 is the obvious target - round numbers always matter in this game.

TRADE SETUP:

Long SMH with targets at $280 and $300. Stop below $240. The risk/reward here looks solid for swing traders who can handle the volatility.

Anyone else playing this breakout or waiting for a pullback? The semiconductor space has been dead money for over a year, so this could be the start of something bigger.

This is not financial advice. Trade at your own risk and size accordingly.

SMH Long Swing Setup – Buy the Dip or Overbought Trap? (2025-06-📈 SMH Long Swing Setup – Buy the Dip or Overbought Trap? (2025-06-12)

Ticker: NASDAQ:SMH | Strategy: 🟢 Equity Long Swing

Bias: Bullish with caution | Confidence: 70%

Hold Period: 3–4 weeks | Entry Timing: Market Open

🔍 Technical & Sentiment Snapshot

• Trend (Daily/Weekly): Strongly Bullish

• Short-Term (30m): Mixed – price above 50/200 EMAs, but below 10-EMA, MACD cooling

• RSI: Overbought (~77), suggests caution

• Bollinger Bands: Price hugging upper band

• MACD Daily: Mild bearish crossover – signals a potential short-term pullback

• Support Levels: 260–261 zone

• Sentiment: Falling VIX, Intel-led chip sector strength → bullish backdrop

🧠 AI Model Consensus

✅ DS, LM, GK (3 Models):

• Recommend long trade at open

• Confidence: ~70–72%

• Target range: $269–276

• Stop zone: ~$255–259

⚠️ GM Report:

• Suggests waiting – daily overbought + bearish MACD → not favorable R:R

• Recommends no immediate entry

✅ Recommended Trade Plan

🎯 Direction: LONG (Buy Shares)

💵 Entry Price: 262.85

📅 Hold Period: 3–4 weeks

🎯 Take Profit: 269.66 (+2.6%)

🛑 Stop Loss: 259.50 (–1.3%)

📏 Size: 100 shares (adjust to your risk profile)

📈 Confidence: 70%

⏰ Entry Timing: Market Open

📍 Entry Validity: Only if SMH opens at/above 262.50 and holds support (~260–261)

⚠️ Risk Factors

• 😬 Overbought RSI may cause short-term profit-taking

• 📉 Bearish MACD crossover could lead to near-term consolidation

• 🧨 Negative market surprise could invalidate long setup

• 🧮 Risk only 1–2% of your portfolio on this trade

💡 SMH bulls stay in control—but for how long?

🗣️ Are you going long, waiting for a pullback, or shorting the top? Drop your plan below 👇

📲 Follow for daily AI-generated trade signals & edge-backed setups.

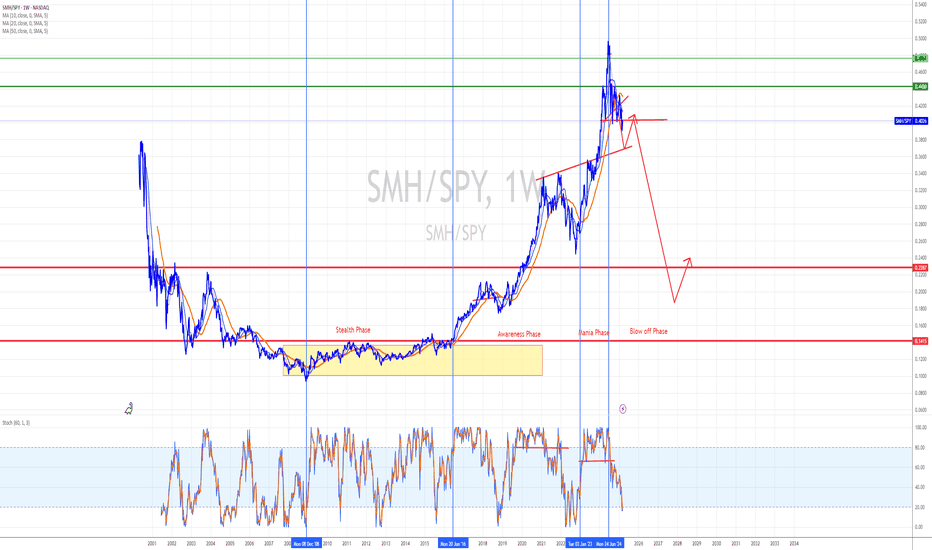

SMH/SPY | Bullish Breakout | Tech Rotation | (June 8, 2025)SMH/SPY | Bullish Breakout | Tech Rotation Signal | (June 8, 2025)

1️⃣ Insight Summary:

The SMH (Semiconductor ETF) vs. SPY (S&P 500 ETF) ratio is breaking out of a key parallel channel, signaling strong capital rotation into semiconductors. This often precedes broader tech strength — and it’s happening now.

2️⃣ Trade Parameters (Indicator View):

Bias: Bullish for SMH (and leading semis like NVDA, AVGO, TSM, AMD)

Entry Zone: Current breakout level on SMH/SPY ratio

TP1 (First Take Profit Area): Watch for continuation upside in SMH outperforming SPY

❌ No Stop Loss: This is a market strength indicator, not a direct trade setup

3️⃣ Key Notes:

✅ Breakout Context: The breakout from the parallel channel suggests relative strength in semiconductors. Historically, this precedes runs in NVDA, Broadcom, and TSM — all major SMH components.

📈 Macro Implication: When SMH outperforms SPY, it typically means one of two things is happening:

— Semiconductors are gaining strength (bullish for tech)

— The S&P 500 is weakening (capital flows into more resilient sectors)

Either way, semis benefit.

🧠 Investor Psychology: With market volatility rising (VIX 37+), investors often move into tech leaders, gold, USD, and now even BTC. SMH is a top contender in this rotation.

❌ Invalidation: If the SMH/SPY ratio falls back inside the channel, it would invalidate the breakout thesis — a sign to stay cautious.

4️⃣ Follow-Up:

I'll continue monitoring this indicator — it’s not a direct trade but a macro signal for strength in leading tech names. If it holds above the channel, the upside potential remains strong.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

SMH watch $212.82 above 209.43 below: Proven zone to form Trend SMH showing the recovery process of the chip sector.

Now testing a well proven zone defined by major fibs.

Golden Genesis fib at $209.43 and Covid fib at $212.82.

Look for a Break-and-Retest a Rejection.

If rejected, look for support at $191.23/85

===================================================

.

Opening (IRA): SMH July 18th 205 Short Put... for a 2.21 credit.

Comments: Doing some higher IV premium-selling in the ETF space, targeting the <16 delta strike paying around 1% of the strike price in credit.

Will look to add at intervals if I can get in at strikes better than what I currently have on ... .

Semiconductors ready for the next leg up - Zoom out !!!#FACTS

-Breakout in SMH was 11 years back around 2014 and uptrend started

-Last 10 years SMH just cannot be under the 200WSMA for long time

-Since 2015 the bottom is at 0.5 fib retrace & takes 9 months + atleast 25% Pullback

What are other confirming signals

-SOXL 3x leveraged etf just had 2 days of Highest Volumes ever ! (leveraged funds arent good for charting but volume is a wake up slap in the face !)

Last time that volume on soxl was 2020 bottom 2022 bottom so 2025 bottom ? MAYBE ?

Got in AMEX:SOXL at $9-$10, once confirmed I will scale in for a swing

Inverse Head-and-Shoulders FormingI see SPY, QQQ, & SMH forming inverse H&S pattern on the 4 hour chart. The Inverse Head and Shoulders pattern has a higher success rate than the regular Head and Shoulders pattern, with a success/failure ratio of 68.2% compared to 59% for the Head and Shoulders. In 98% of cases, the pattern exits upwards. Additionally, in 74% of cases, the price reaches the pattern's objective once the neckline is broken.

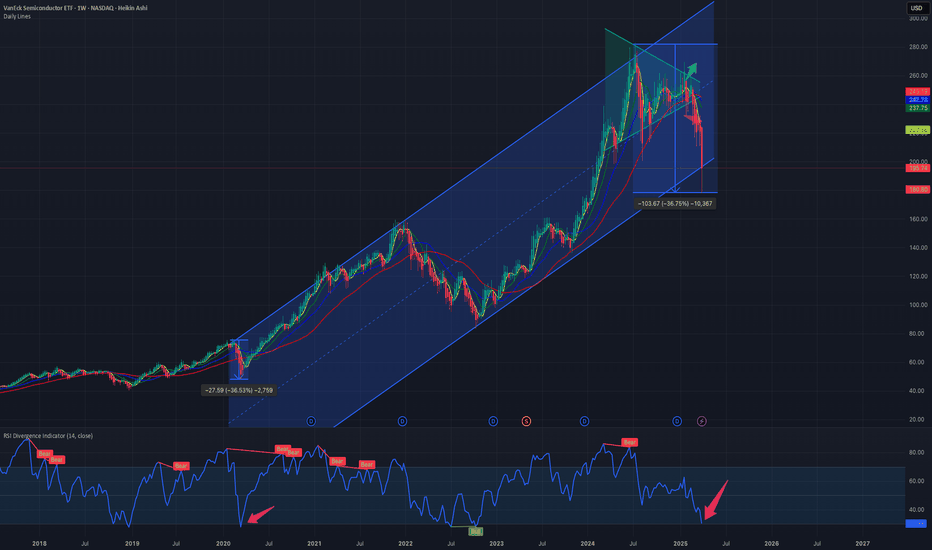

CHIP SECTOR TO CRASH SMH The chart posted is the SMH we are now in the final 5th wave and it is a classic 5th wave Diagonal in the 5th wave wave to form a double top into fib cycle peak .From here we should see a major break down in All chip stocks into Oct 2025 but we should see the first leg down low march 10/20th 2025 this should be a Very Bearish action world wide see spy and qqq as well . This is the warning to All traders EXIT INTO RALLIES THE BEST OF TRADES WAVETIMER

$SMH vs $HACK Ratio Chart: Intra Tech sector rotation NASDAQ:SMH with closing @ 180 $ on 04 April 2025 is equivalent to drawdown we saw during COVID crash. During the covid crash the semiconductor ETF lost 37% and this tariff crash we also saw 36% drawdown. But in contrast to that the current tariff environment has only a peak drawdown of 25% in $HACK. AMEX:HACK is the ETF of the largest Cybersecurity in the market. Within the Technological sector there is a intra sector rotation form Semi and Software to Cybersecurity.

This weakness in NASDAQ:SMH can be attributed to heavy weights like NASDAQ:NVDA and NASDAQ:AVGO which have been down more than 40% form their ATH. But in contrast NASDAQ:CRWD , NASDAQ:PANW and other cybersecurity stocks have shown great amount of strength.

In this ratio chart we discussed earlier in this blog that there is a head and shoulder pattern forming indicated in the blue but then the drawdown in SMH pushed it below the neckline and we went below 3.15. The next level in the ratio chart is 2.71 to which we are very close. From the peak the ratio is down almost 40% which is the same as the drawdown in $SMH. The RSI in the chart is also oversold @ 28. My expectation the second neckline will not be broken, and we will hold the 2.7 ratio.

Verdict: Overweight NASDAQ:SMH over $HACK. Both are good long-term buys.

$SMH: First the generals then the index NASDAQ:SMH with closing @ 180 $ on 04 April 2025 is equivalent to drawdown we saw during COVID crash. During the covid crash the semiconductor ETF lost 37% and this tariff crash we also saw 36% drawdown. If this tariff war on goes then we might see some more weakness. With this drawdown the NASDAQ:SMH is below its 200 Day SMA. ‘Nothing good happens below 200 Day SMA’ and the ETF is below the upward sloping channel. The RSI is also touching the lows the lows we saw during the COVID time reaching the oversold mark of 30.

This weakness can be attributed to heavy weights like NASDAQ:NVDA and NASDAQ:AVGO which have been down more than 40% form their ATH. But the question remains will the drawdown stop here or there is some more pain. But we should not forget the 3-day rule in the markets. Where the sell off peaks off in the 3rd Day. 07 April will be the 3rd Day after the tariff selloff.

Should we call the bottom here? Unless we think that there will be a recession then these are good levels to buy. But if the tariff negotiations go on for longer period, then there will be chop around for a longer period and instead of a V shaped recovery we might see a U-shaped recovery in SMH.

Verdict: Accumulate some NASDAQ:SMH here and go extra-long @ 170-180 $