Scared? Become a BuyerHello I am the Cafe Trader.

With heightened interest in SOFI, I am seeing many worried posts, and skepticism. Before taking profits early, consider these levels fist.

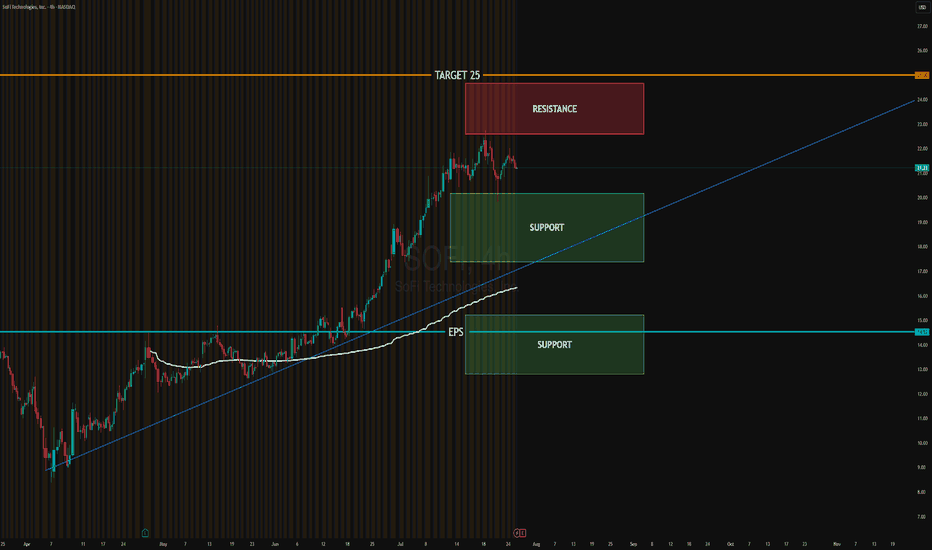

Years Old Supply.

This Supply zone (marked in the red box) has been sitting here for years. It is no suprise that we get a dynamic reaction at this level.

Welcome to the Range

Now that you know there is a seller sitting there, If this doesn't jump back up and close above 24.71 by friday, expect to be sitting in a range for months.

Bulls are in Control

Even with that massive reacion, All previous bulls are still in tact and ready to accumulate more. Top of demand will fae the most pressure, but there are alot of buyers at that strong demand level. Be patient, and you can get great pricing.

Long Term

For those looking to get into SOFI, I have some prices that should line up with your personal sentiment.

FOMO Aggressive = $21.67 ( i dont recommend)

Aggressive = 20.40

Good price = 17.50 - 17.75

STEAL - 7.50-9.50

That's all for SOFI. Comment below if you want to see any other analysis!

Happy Trading

@thecafetrader

SOFI trade ideas

Getting ready for another Sofi longSofi as expected had tremendously good earnings. The CEO is executing and I believe this will continue. At the current moment most of my Sofi trades have been LEAPs. I am planning on entering again with ultra safe in the money options. Stochastic is resetting, volatility was heating up and needs to cool off. Their stock offering right as the stock pumped was a good idea to quell the pump imo, and to get a good deal on offered shares (20.85$ share price). The fact that the stock has maintained the 5 EMA on the weekly for so long is astounding to me.

My plan:

If Sofi moves into the buy zone I will buy Jan 2027 15/17$ spread calls for exposure in my long account. I may or may not keep these to exercise, but I want exposure again. The last time I did this I rode them up 400-650%.

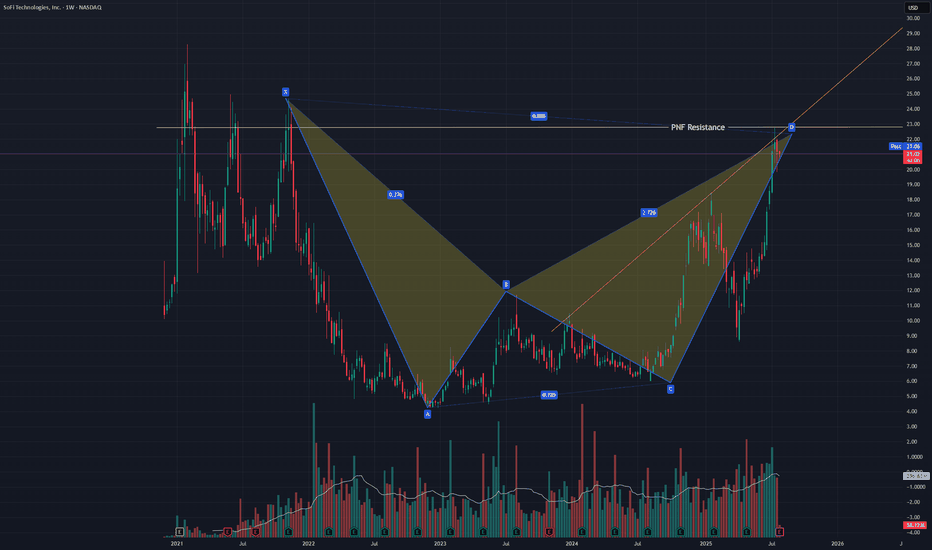

SOFI Pullback most likely comingNASDAQ:SOFI just finished a bearish bat harmonic and failed to break a resistance line I have from a PNF chart. It also failed a back test of a trendline of resistance in this uptrend. A pullback is likely but in this irrational market any thing could happen. I did a strangle +-5% just in case. I would not be surprised if I can close both with 20%+ profit.

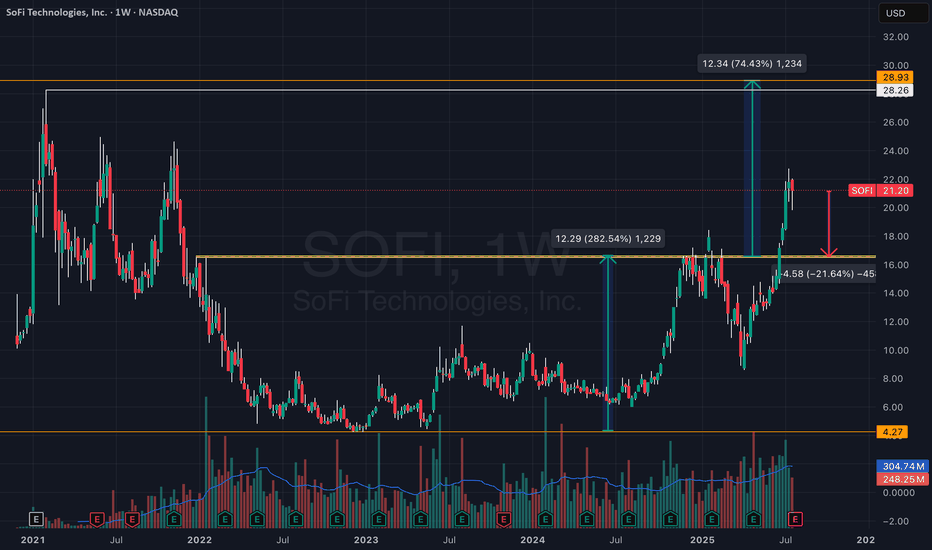

SoFi: On the Road to ATH ResistanceAfter clearing over 100 lines off my chart, I wanted to take a clean, fresh look at SoFi heading into the upcoming earnings report — just to gain a new perspective on where we stand.

Weekly chart. As simple as it gets.

What I’m seeing: a breakout from a classic cup-and-handle formation, with the breakout point around $16.5.

This setup carries potential for a move toward all-time highs near $28.

— Important note:

A pullback to the $16.5 zone would still not break the breakout structure — in fact, this would be a textbook retest of the breakout level.

Yes, there’s still room for a ~20% downside from current levels, but this would still be within the structure of a larger bullish move toward ATH.

No doubt in my mind — if we revisit $16.5, I’ll be loading up on SOFI like crazy.

SOFI Breakout to 30$SoFi Technologies is primed for a major rally. The weekly chart is displaying a classic cup and handle formation, which is one of the most reliable bullish patterns in technical analysis. With the handle nearing completion, the stage is set for a breakout—often marking the start of strong upward moves as traders and investors take notice.

What gives this technical setup extra weight is SoFi’s recent earnings performance. The company delivered robust results, surpassing analyst expectations and showcasing significant growth in its key lending and technology divisions. This mix of a textbook bullish pattern and solid fundamentals sets the stock up for a rapid advance, making a $30 target look more achievable in the near term. As momentum builds, both the technical traders and fundamentals-focused investors could fuel the next leg higher for SoFi.

My thoughts for the coming weeksWe are at a tough patch now unfortunately looking at the charts, and so I think it's safe to assume we will see some selling and slowing down in upward price action, until we find more momentum to carry us into price discovery.

As you can see, we're heading towards some very important areas. One being an old support level, now resistance. Following that we have the Fibonacci golden zone at an arms reach as well. If we manage to blow past those, we then have the big one which completely ruined us for years.

Conclusion:

As you can see from my comments on the chart, I can see us in the coming weeks cooling off, and eventually selling down towards the $10 range, to then eventually gain momentum and try again.

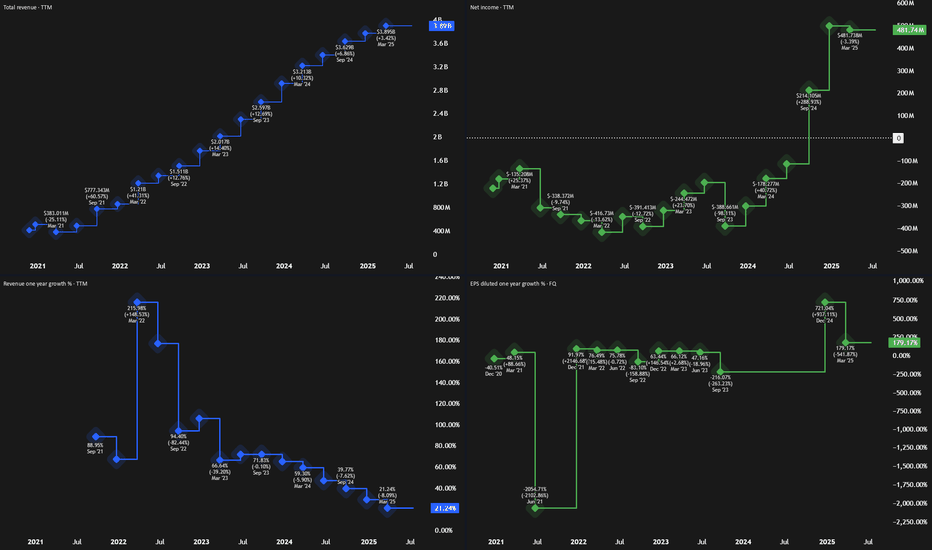

Why We See 100%+ Upside In SoFi Over The Next 3 YearsAfter soaring to nearly $28 per share during the SPAC-fueled fintech boom in 2021, SoFi Technologies (SOFI) crashed back to earth, trading under $5 as rising interest rates, regulatory headwinds, and lack of profitability dimmed investor optimism. But the tide has turned.

Over the past year, SoFi has reshaped its business and posted significant growth. Shares are now up 247% since our previous bullish call at $6. With the company now profitable and diversifying revenue, we'd argue there’s still upside ahead.

💼 A Stronger, Diversified Business

SoFi has evolved from a student loan-focused lender into a full-spectrum fintech platform. It now operates across:

Lending: $413M in Q1 revenue

Financial Services (consumer banking): $303M

Technology Platform (B2B): $103M

While lending still makes up the majority, the tech and services segments are growing fast—especially financial services, which doubled revenue YoY and tripled profit. SoFi's white-label platform also gives it a SaaS-like recurring revenue profile.

Q1 results showed:

Revenue: $770M (+33% YoY)

EPS: $0.06, with a $31M revenue beat

This business mix gives SoFi more stability and better scalability than many traditional financial firms.

💰 Valuation: Pricey vs. Banks, Cheap vs. Fintech

Critics point to SoFi’s rich valuation—trading at over 8x sales—as a concern. But when compared to other fintechs like NuBank (12x sales) and Robinhood (28x), SoFi looks much more reasonably priced.

On a forward earnings basis, SoFi trades at ~32x GAAP EPS, and if growth continues, this could drop below 30x. That’s appealing for a company expected to grow:

Revenue: ~25% annually

Net income: ~33% annually

By 2027, analysts project $1B in operating income, double today’s figure. If SoFi maintains current valuation multiples, this alone could double the stock in 3 years.

⚠️ Risks to Watch

Regulatory scrutiny in the financial sector

Cyclicality of consumer lending

Intense competition from firms like Robinhood, Chime, and Coinbase

Despite these challenges, SoFi’s expanding ecosystem and growing brand strength position it well.

✅ Final Take: Still a 'Strong Buy'

With accelerating revenue, expanding margins, and a scalable business model, SoFi has moved beyond its hype-fueled origins and is now a real fintech contender. Even after its rally, its valuation still leaves room for meaningful upside.

Rating: Strong Buy

SOFI Setup Before Gamma Squeeze?

## 🐂 **SOFI WEEKLY OPTIONS BREAKOUT SETUP (Aug 4–8)**

**🔥 Bullish Momentum + Institutional Volume Surge = \$22 CALL in Play**

---

### 📌 Summary:

* **Weekly RSI** rising 📈

* **Volume** 2.5x average – strong institutional presence 🏦

* **Options Flow** favors calls: aggressive accumulation

* **Gamma Risk** into Friday + VIX stable ✅

* **Daily RSI** soft = potential dip before rip

---

### 🛠️ Trade Setup:

| Type | Direction | Strike | Expiry | Entry | Stop | Target | Confidence |

| ------ | --------- | ------- | ------ | ------ | ------ | ------ | ---------- |

| Option | CALL | \$22.00 | Aug 8 | \$0.34 | \$0.17 | \$0.68 | 70% ✅ |

💡 **Watch for breakout over \$21.50** — potential gamma squeeze to \$23+

📉 Manage risk below \$21.00 / VIX spike

⚠️ Earnings & macro could add volatility

---

### 🧠 Model Consensus:

* **Grok/xAI**: Strongly bullish, confirms flow & breakout potential

* **Claude & Meta**: Volume confirms upside, but caution on RSI

* **Gemini**: Neutral on daily, bullish long-term

* **DeepSeek**: Momentum trend intact, supports call strategy

---

### 📊 Tag Zone:

`#SOFI #Options #TradingView #Bullish #GammaSqueeze #CallOption #VolumeBreakout #WeeklySetup #MomentumTrading #SmartMoney`

SOFI - Pricing inside the Up trend channelHello Everyone,

Happy Sunday to All.

Today my second anaylze for SOFI Technologies .

It is still in UP trend and pricing in BLUE Channel.

I drew 2 possible scenario in Graphs as Yellow and Red.

If it will break 20.30 then it could reach the 18.30 - 18.10 which is buttom level of UP Trend worst case scenario 17.70 - 17.80.

You can monitor these levels then you can make your decisions.

Second option is hit 20.20 - 20.30 and go up and try to hit Above level of UP trend line.

25.00 - 25.20 is TP1

27.30 - 27.50 is TP2

If it will break the 27.50 then I can anaylze later but most probably it will continue to go UP after this level.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovelly Sunday

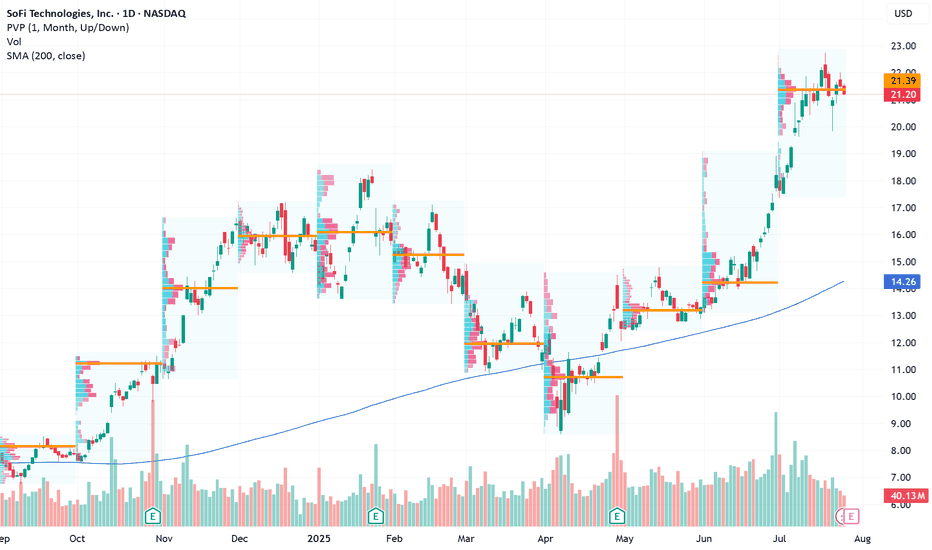

Positioned for an Earnings-Driven Upside Opportunity Current Price: $21.20

Direction: LONG

Targets:

- T1 = $22.80

- T2 = $23.60

Stop Levels:

- S1 = $20.60

- S2 = $19.90

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in SOFI.

**Key Insights:**

SoFi Technologies has demonstrated impressive momentum recently, gaining 34% over the past 22 trading sessions. However, it’s essential to consider the technical risks posed by a rising wedge pattern, which can indicate potential bearish reversals. The firm’s upcoming earnings report represents a critical market driver, likely to weigh heavily on stock volatility and direction. Fintech stocks remain resilient and favorable due to macro-level growth trends and technological adoption patterns.

**Recent Performance:**

SoFi's stock price surged 34% in just 22 trading days. This remarkable performance highlights growing investor confidence, fueled by the company's solid fundamentals and broader enthusiasm within the fintech sector. Rising technical patterns, however, warrant caution as wedge formations can signal a near-term ceiling for price acceleration.

**Expert Analysis:**

While SoFi’s stock has benefited from impressive bullish strength, traders are closely monitoring its response to earnings, set to release early next week. Analysts highlight that SoFi shows favorable alignment with sector trends, supported by increasing consumer adaptation of innovative banking service platforms. Earnings surprises could invalidate historical market patterns, offering strong upside if the figures exceed expectations.

**News Impact:**

The anticipated earnings report is expected to heavily influence market sentiment regarding SoFi and the fintech sector as a whole. The release coincides with major earnings updates from leading players, including Microsoft and Visa—macro-level catalysts for tech and finance stocks. Investors should prepare for heightened volatility surrounding the event window.

**Trading Recommendation:**

Given recent price action, sector resilience, and the imminent earnings release, SoFi Technologies represents a strategic long opportunity for traders targeting positive earnings performance. Targets of $22.80 and $23.60 reflect compelling upside potential, though monitoring stop-loss levels of $20.60 and $19.90 is essential to mitigate risk during volatile moves. The trade idea is grounded in disciplined entry around support levels and a focus on breakout possibilities.

SoFi's Surge: Unveiling 2023 and What Lies Ahead in 2024Technical Analysis Overview

Current Price : $10.34, a 3.77% increase.

Weekly Trend : Showing a positive trend with a 5.35% increase over the last five days.

1-Month Trend : A significant increase of 51.96%, indicating strong bullish sentiment.

6-Month and Yearly Trends : A 17.04% increase over the last six months and a 124.51% increase year to date, highlighting a robust bullish trend.

Advanced Technical Indicators

Relative Strength Index (RSI) : 70.41 - Indicating that SOFI is nearing overbought territory, which could lead to a potential reversal or consolidation in the short term.

Moving Average Convergence Divergence (MACD) : 0.63 - Suggesting bullish momentum, indicating a strong buying trend.

Other Indicators : STOCH (83.28), STOCHRSI (84.02), ADX (37.09), Williams %R (-8.57), CCI (104.63), ATR (0.46), Ultimate Oscillator (54.76), and ROC (24.66) all contribute to a picture of current bullish momentum but with potential for short-term volatility or pullback.

Market Sentiment and External Factors

Market Capitalization : $9.904B USD.

Trading Volume Analysis : A high trading volume of 35,199,288, suggesting active market participation and interest in the stock.

Recent News Coverage Impacting SOFI

Bullish Outlook for 2024 : Analysts predict SOFI stock could continue its rally in the new year, benefiting from expected interest-rate cuts. A notable analyst has set a high price target of $14 for SOFI stock, implying significant upside potential ( InvestorPlace ).

Focus on Non-Lending Businesses : Analysts appreciate SoFi's shift towards non-lending businesses, improving earnings quality despite a higher-for-longer interest-rate policy.

Central Bank Policy Changes : Potential interest rate cuts in 2024 could benefit SoFi's lending business, as lower rates tend to spur borrowing and lending activity.

Conclusion

SOFI's stock shows strong bullish signs in the medium to long term, but the current overbought condition warrants caution for short-term traders.

The recent news and analyst predictions provide a positive outlook for 2024, making SOFI an interesting stock for both traders and long-term investors.

SOFI meets 25 out of 28 technical & fundamental criteria – SwingEntered at $22.55 after full validation through our 28-criteria system.

✅ Strong earnings (positive revenue growth & stable forward guidance)

✅ Dilution concerns cleared (no new share offering)

✅ Breakout confirmed above VWAP with clean pullback

✅ Accelerated momentum and rising premarket volume

✅ Healthy RSI (no overbought in 4h or daily chart)

✅ No major resistance until the $24.90–$25.20 zone

📍Key Levels:

🎯 Entry: $22.55

🛑 Stop Loss: $21.80

🎯 Target: $25.00

⏳ Expected duration: 1–2 days (swing)

🔁 Risk/Reward: 2.5:1

Fibonacci insight:

Price respected the 38.2% level during the pullback. The 161.8% extension points right to the $25 zone.

📊 Context:

Fintech sector is gaining strength, and SOFI is leading with strong fundamentals and bullish momentum.

If we open above $22.50 with strong volume, I expect a bullish continuation.

I'm tracking every trade as part of a new system currently under test.

If you want to follow this signal to the end, feel free to follow along. ✌️

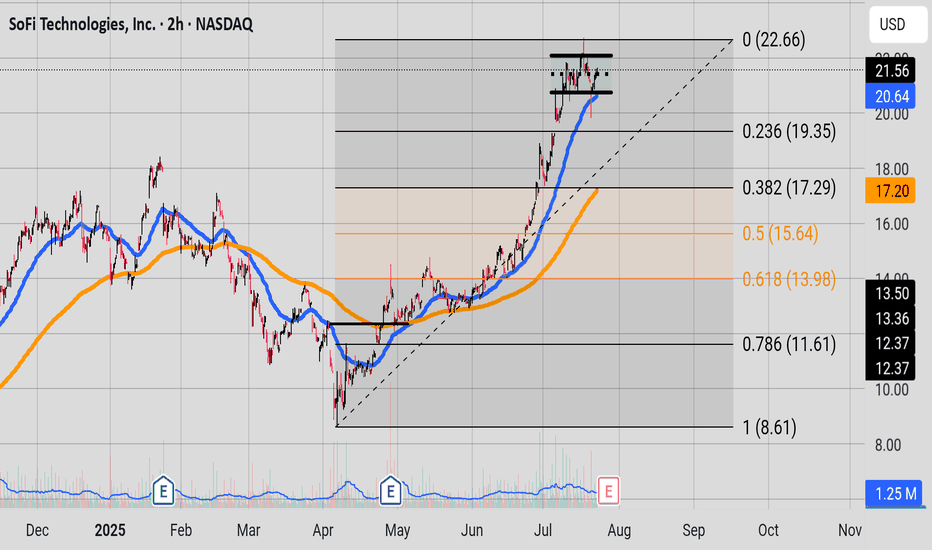

Parallel StructureWe have a nice parallel structure sitting on top of a 50 EMA (in blue). A consolidation is happening. Interestly enough the 200 EMA(in orange) is close to the 0.382 Fib level. On the weekly chart you can see the bears gearing up. But the bulls are still in charge. Price needs to hold the 20.64 price range for the bulls.

High Wave CandleSOFI has finally reached it's resistance level around 23.84. Last week candle was a High Wave Candle. If we get a strong close above 23.84 that probably means the bulls are marching on, if we get a bearish close below 19.55 that may mean the bears have stepped in and are looking to pull prices down to the golden zone of the Fib Level. Observe the bearish divergence with the RSI and price, also observe how Stochastic RSI and RSI are in overbought territory.

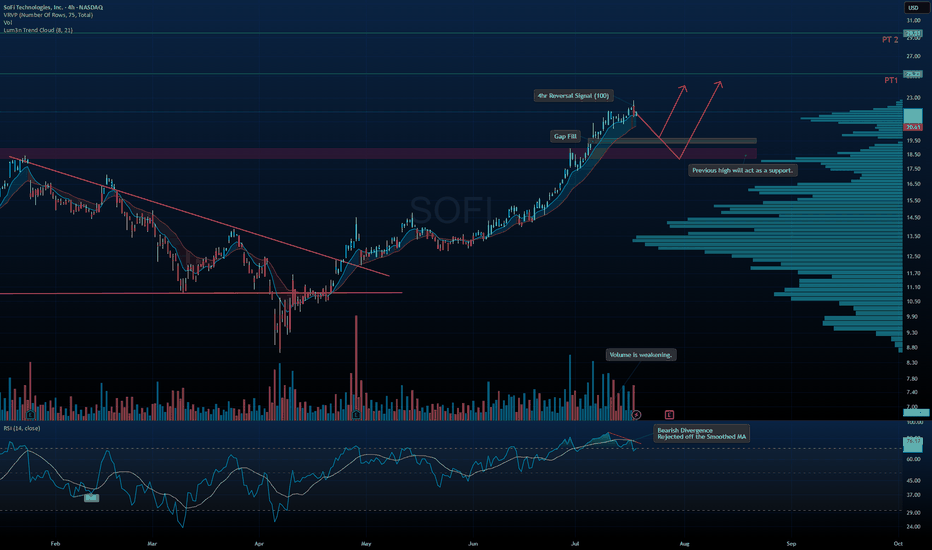

$SOFI - Long-Term Setup Brewing? Pullback First?I’m extremely bullish on SoFi long-term, but the chart is signaling a potential pullback opportunity before the next leg up.

🔹 Technical Breakdown:

• Bearish Divergence on RSI with rejection off the smoothed MA

• Volume weakening as price moves higher – classic sign of exhaustion

• 4hr Reversal Signal flashing near local highs

• Gap Fill zone near $19.50 + previous highs = strong support zone

• Lum3n Trend Cloud still bullish — trend intact unless breakdown occurs

🎯 Targets:

• PT1 → $23.25

• PT2 → $29.50 (longer-term structure extension)

🧠 Thesis:

Letting price come to us is the smarter move here. I’m watching the $19.50–$20.00 zone closely for potential accumulation. That level has strong confluence with volume shelf, support, and fib structure.

How to Do Your “Trading Homework” (The Smart Way)

If you’ve been following this channel, you’ve heard me say it many times:

Trading is war — and you should never enter a battle unprepared.

But here’s the real question:

How exactly do you prepare?

The answer lies in a powerful strategy I use called:

💡 Thematic Investing

Read more here →

Instead of chasing news or signals in isolation, thematic investing means:

You first understand where the world is heading

Then you position yourself ahead of that move

It’s not about reacting. It’s about anticipating.

---

❌ What Most Traders Do Wrong

Most beginners:

Follow one tweet

See one red or green arrow

Watch one chart pattern

Then they jump in blindly.

That’s not trading — that’s guessing.

News headlines and chart moves reflect what already happened.

But your edge comes from understanding what’s likely to happen next.

---

✅ What I Do Instead (with QS AI)

Back in the day, doing thematic analysis manually could take hours of reading across dozens of news sites, earnings calls, and macro reports.

But now?

QS AI does the heavy lifting for you — in seconds.

Here’s how I do my “trading homework” every week using QS signals:

---

🧠 Step 1: Start with the News Theme

Go to 📰news-signal — let the AI scan hundreds of headlines and summarize the key themes shaping the week.

Ask yourself:

What’s the main event or policy shift?

Which sectors are directly impacted?

Who are the winners and losers?

---

🔎 Step 2: Zoom Into Sectors or Stocks

Once you spot a theme, use other QS signals to dig deeper:

⏰0dte for fast-moving trades (same-day catalysts)

📅weekly-options for 1–5 day plays

💸earning-signal for earnings-related positioning

🔄swing-signal for broader trend/position trades

---

📈 Real Examples of Thematic Trades

Let me walk you through a few past trades — all built off this exact process:

✅ BBB Defense Play

Theme: Bill passed removing EV credits, boosting defense

Strategy: Long PLTR / Short EV sector using 📅weekly-options

✅ Robinhood Crypto Tokenization

Theme: Robinhood’s crypto product event

Strategy: Crypto stocks pump → took profits early

✅ Tesla Robotaxi Week

Theme: TSLA reveals AI & robotaxi push

Strategy: Long TSLA / Short UBER

✅ Earnings Play: MSFT vs AAPL

Theme: MSFT cloud beat, AAPL revenue drop

Strategy: Long MSFT / Short AAPL using 💸earning-signal

All these trades started with thematic awareness → followed by precise signal-based execution.

---

⚙️ Your Homework Checklist (The QS Way)

Before every week or trade, ask:

📰 What is the major theme driving markets this week?

🧠 What sectors or companies are most impacted by this theme?

🔀 Can I find a relative strength/weakness pair to trade?

⏳ What’s the best time frame? (0DTE, weekly, swing?)

📊 What do QS signals say about timing, momentum, and volatility?

---

🤖 Why QS AI Gives You the Edge

Doing this manually would take you 5–10 hours a week.

But with QS AI:

You scan the entire news cycle in 10 seconds

Get real-time themes and reactions

Pair it with high-quality trade setups

Prepare your game plan before the market opens

This is how we prepare smarter, not harder.

No more chasing arrows.

No more gambling.

Just clean, thematic, risk-aware, high-conviction trades.

---

🏁 Final Thought

There are no guarantees in trading.

But there is a smarter way to prepare.

Thematic investing + QS AI gives you the best shape to step into the market and fight with confidence.

Follow where the world is going — one theme at a time.

That’s how we trade with QS. That’s how we print. 🧠💥💰

LONG 4HR Wave Count Possibilities

Using the Weekly time frame, Wave 1+3 of a larger degree shows a possible extension to the 1.68 extension which is a common wave 5 of a larger degree target . That Price Target being $26.35.

In April of this year the price reacted to a Reversal Pivot Point but failed to form a proper impulse for wave 1. Price then gapped above the price resistance line for the year of 2025 and the 100 WMA.

As of now, price is expect to target $19.43 in a move to finish out wave 3 of a macro degree. Wave 4 typically retracing to the 0.236 or 0.382 level has been displayed to align with the current uptrend trendline.

I have also displayed the possible points of interest for Fib levels for an approach to finish out wave 5 of a macro degree. I expect Price to stall and face resistance in the golden pocket extension of the Fib levels.

None of this is financial advise and strictly for educational purpouses.

SOFI 4-Hour — “Measured-Move” Breakout Toward $20.8 → $22Structure: Price broke out of a year-long falling-wedge and then punched through an ascending trend-line confluence at ≈ $17.00–$17.50.

Impulse Leg (Yellow): The vertical rally that followed is ≈ $3.75 tall. Projecting that height from the breakout pivot ($17.00) gives 100 % extension = $20.78.

Target Zone (Violet Box): $20.8 – $22.0 aligns with

100 % measured-move projection

Prior all-time swing high (~$20.5, Jan-2024)

A thin volume-profile “air pocket” between $19 and $22 (little resistance until the upper edge).

Next Level Up: 127.2 % fib extension sits at $24.15—that becomes the stretch target only if $22 is cleared decisively.

Long for now but would suggest taking profits. Even though major move already happened, I can see it going to 20-21.5 before we hit supply and head lower into next buy zone, unfortunately I don't see strong support until 15 area. Macd's play a role as momentum from buying is going to turn into selling soon.