SOFI trade ideas

$SOFI earnings TuesdayNASDAQ:SOFI earnings Tuesday morning! 4 straight quarters of profitability is inbound and bears won’t be able to see @SoFi as an unprofitable company anymore. 180m shares that have been sold short are now officially underwater.

Q3 Estimate

Members: 715,000k

Products: 1.1m

Revenue: $650m

EPS: $0.05

$SOFI top after earnings? Downside under $10NASDAQ:SOFI had a positive reaction to earnings, but has since sold off. It looks to me like earnings marked a high and that we're going to see price fall down to the support levels below.

We've now retested the area we broke down from, we've only had 4/5 waves to the downside, so to me, it looks like a last fall is likely before we see a longer term recovery.

Let's see how it plays out.

SOFI more of a fintech company than a traditional bankSoFi Technologies, Inc. (SOFI) is often viewed as more of a fintech company than a traditional bank due to its tech-driven approach to financial services. While SoFi does hold a bank charter and offers conventional banking products like checking, savings, and loans, its core value proposition lies in its fully digital platform that integrates lending, investing, banking, and financial planning.

SoFi was built from the ground up as a technology-first company, prioritizing user experience, automation, and mobile-first functionality. Unlike legacy banks that are adapting to digital, SoFi was born in the cloud, positioning itself more as a modern financial technology platform aiming to be a one-stop-shop for personal finance.

Trading Analysis for SoFi Technologie

**Current Price:** $12.31

**Direction:** **LONG**

**LONG Targets:**

- **T1 = $13.50**

- **T2 = $14.00**

**Stop Levels:**

- **S1 = $11.90**

- **S2 = $11.50**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in SOFI.

**Key Insights:**

SOFI is currently being buoyed by renewed investor optimism surrounding the resumption of student loan repayments and the company's ability to benefit from prolonged tailwinds in consumer fintech. Analysts observe that SOFI is positioned to scale up its profitability as it diversifies its lending and financial services, adding sustainability to its growth trajectory. The price action has shown strong demand around critical support levels, with a notable push toward multi-month resistance at $13.80.

The macroeconomic environment has shifted favorably for SOFI as rising interest rates may improve net interest margins over time. In addition, trader sentiment is increasingly bullish as earnings week approaches, with many attributing anticipatory momentum to analysts' predictions of improving operating efficiency within the company.

**Recent Performance:**

SOFI recently staged an impressive rally, surging nearly 21% over the past week to trade as high as $13 before retracing slightly. This marks a 60% recovery from its year-to-date low of $8 in April. The stock has managed to break above its 50-day moving average, a key technical level, and is now testing resistance at its longer-term 150-day moving average. Should SOFI maintain its upward bias and surpass $13.80, it could attract significant buying interest, leading to sustained momentum.

**Expert Analysis:**

Technical indicators suggest bullish strength in SOFI's current setup, with the Relative Strength Index (RSI) moving closer to overbought territory, indicating positive momentum but also a need for attention to resistance hurdles. Analysts point to fundamentally supportive elements such as technological innovation in SOFI's products and the expected resumption of student loan payments, which may drive higher revenues in the coming quarters. Recent options market activity signals cautious optimism with robust demand for call contracts near the $13 mark.

**News Impact:**

Recent news about the reinstatement of student loan payments has been a pivotal factor in boosting sentiment around SOFI. Investors are counting on SOFI's infrastructure to handle increased volumes effectively, leading to expected revenue growth. Earnings speculation has also created a sense of opportunity, with traders watching closely for any upward revisions to guidance during the results announcement. Broader market trends and recovery in the financial sector further bolster a favorable outlook.

---

**Trading Recommendation:**

Based on SOFI's current price dynamics and market sentiment, a LONG position is recommended with an initial target (T1) of $13.50 and a secondary target (T2) of $14.00. Traders should manage risk effectively with stop levels at $11.90 (S1) and $11.50 (S2). The fundamental narrative, combined with near-term technical strength, suggests favorable conditions for upward momentum, especially if SOFI crosses the key resistance level at $13.80. Buyers should remain vigilant for earnings news and macroeconomic shifts that may impact volatility. The stock offers solid potential for mid-term appreciation, backed by a strong growth catalyst.

```

Break Out or Fall Back or Fluctuate?SOFI has made its third contact on the daily parallel channel, and it has earning this Tuesday.

Price has appeared to cycle to the top of the channel and is pressing against a key level 13.10.

Stochastic RSI overbought but buyers appear to still have the upper hand, RSI is at a healthy level, and it appears to be rising. CCI level is very strong at 166 and not near 200 reversal levels. If SOFI rises and closes above $13.10, possible targets are 13.48 and 13.87 if it rejects possible price target 12.32. Please be mindful of volume and fake outs. Please observe chart for key levels.

Possible Reverse? SOFI maybe at the start of a trend reversal, we recently had a breakout from the 10 EMA and the downward parallel channel. Full confirmation will be when we have a break of structure BOS from the 13.88 price area. The oscillators are healthy also, let's hope we get an RSI breakout also. Please see chart for key levels and please remember other Fundamental news like upcoming Earnings and the geopolitical landscape and the "fake outs".

SoFi Technologies (SOFI) Shows Signs of Wyckoff Shakeout Near 20Stock Analysis – SoFi Technologies Inc. (NASDAQ: SOFI)

SoFi Technologies (SOFI) is showing a classic Wyckoff shakeout pattern, signaling that a strong upside move could be imminent. The stock has successfully defended its 200-day moving average, a major technical level, and is now displaying signs of renewed strength.

After flushing out weak holders during the recent shakeout, SOFI rebounded quickly – a textbook "spring" move in Wyckoff terms. This sharp recovery, accompanied by a rise in buying volume, suggests that smart money may be accumulating shares in anticipation of a breakout.

With current price action stabilizing above the 200-day MA and momentum starting to build, SOFI appears ready to break out of its consolidation zone. A decisive move above nearby resistance could trigger a strong rally, potentially catching many off guard.

Why SOFI Could Be Ready to Surge:

Clear Wyckoff shakeout + spring formation

200-day MA providing reliable support

Volume picking up on green days – accumulation signal

Breakout above resistance could ignite a sharp bullish move

Technical traders and investors watching the Wyckoff method will recognize the pattern unfolding: SOFI looks ready for a powerful upward move, and early positioning could offer a favorable risk-reward setup.

SOFI TRADE LEVELSTickers like SOFI I enjoy swing trading while simultaneously buying shares of equity.

Currently in a very clean downtrending channel. Perfect for swing trades.

As this ticker moves around $2 per week, the day trading levels are very precise entries; this ticker is built for swinging and investing.

SOFI: Is this what happening to SOFI? A bear caseThe recovery so far for SOFI hasn't been that great. After breaking key support of $10.44, price is trying to bounce back. Last week it tried to get over the resistance at $11.65, but stalled. So far, this recovery is a 3 waves move. It can go higher, in fact, I think, the first A wave is still in progress. We should see B and C waves after this ongoing wave taking price to around $13.5 to $14.9 before the next leg of the correction. Until price can break above the downward channel and above $18.42, this will be the primary idea.

The alternate idea calls for a leading diagonal that is currently correcting. That will still need a move up and then a larger move down but cannot break below the low. Either way, it will take quite a bit of time to play out. It is really in the middle of the range and needs to in the watchlist only. If the financial crisis hits as many are predicting, it can get really, really bad for banks...

TrendlineIf price can break and close above the downward trendline we can have price action to the 11.20 area and then possibly to the orange 200 EMA 11.80 area. However, if we have price rejection at the downward trendline; than we might have possible price movement to the purple 50 EMA at 10.59 or below. Please be careful and watch out for fakeouts and after market hours activity.

Intraday ActionPrice is at a make or break point at 10.70, where if price does not hold it may return to the 10.05 area the bottom of the range. If price overcomes the 10.70 area price may rise to the 10.99 or 11.40 targets. Oscillators levels are healthy and Chris Moody MACD indicator levels are healthy, price previously had two successful consolidations and break outs. There may also be the possibility of a golden cross purple 50 EMA crossing over the orange 200 EMA. Be advised of premarket activity.

SoFi Technologies (SOFI) – Prepping for Liftoff?Analysis Overview:

The chart suggests that SOFI may be setting up for a major bullish reversal, but confirmation is still needed. Let’s break it down:

Key Bullish Factors:

✅ Optimal Trade Entry (OTE)

Price is currently sitting at an OTE level, a premium zone for long setups often used by smart money. These zones historically mark powerful reversal points.

✅ Monthly Fair Value Gap (FVG) Respected

The stock tapped into a monthly FVG—a high-probability demand zone—suggesting institutional interest. A break and close above this zone would strengthen the bullish case significantly.

✅ 30 Moving Average (MA) as Confirmation

Price is still below the 30MA. A clear break and close above the 30MA would serve as the first strong confirmation that buyers are regaining control.

✅ Massive Upside Potential

If this plays out, the first target is the previous buy-side liquidity at $18.33, and if momentum sustains, we could even see a long-term move toward the all-time high at $28.54—a potential 228% gain from current levels.

What We Want to See Before Full Confidence:

🔹 Price to break and close above the 30MA

🔹 Clear displacement through the Monthly FVG

🔹 Sustained bullish volume stepping in

Conclusion:

SOFI could be gearing up for a powerful upside run, but let the market confirm it. Watch the 30MA and how price behaves around the FVG. If those get respected and price pushes higher—this could be a sleeper play to watch in 2025.

🧠 As always... DYOR (Do Your Own Research)!

SOFI at Reversal Zone! Will Bulls Defend This Level or Below 11?🔍 Market Structure & Smart Money Concepts (SMC):

* Current Structure: SOFI is in a clean downtrend channel with consecutive CHoCHs and a recent Break of Structure (BOS) to the downside.

* Price has consolidated into a red SMC Reversal Zone, just below the prior CHoCH level, signaling potential short-term relief or further breakdown.

* Bulls have failed to reclaim control post-CHoCH from March 26–27. Lower highs and aggressive sell-offs dominate.

📉 Technical Indicator Summary:

* MACD: Currently flat but slightly converging—no strong bullish momentum yet.

* Stoch RSI: Resetting from oversold, but not giving a decisive bullish reversal yet. Caution warranted for early longs.

* Trendlines: Price is pressing against a lower trendline, and any break below ~$11.70 could accelerate toward the $11.00 level or lower.

🔧 Support & Resistance:

* Resistance:

* $12.34: Structure high and minor supply.

* $13.89: Former CHoCH and Gamma Call Resistance.

* Support:

* $11.70: Current demand/put wall zone.

* $11.00: Second major PUT Wall and psychological round number.

* $10.85: Fib confluence / key GEX support.

💥 Options & GEX Analysis (from GEX + Options Oscillator):

* IVR: 56.6 (elevated, signaling potential high options premium)

* IVx Avg: 102.2 — suggests volatility pricing is very high

* Options Sentiment:

* CALLs: 26.1%

* GEX: 🔴🔴🔴 (Bearish Gamma setup)

* Put Walls:

* $12.00: Highest negative NET GEX (key support!)

* $11.00: 2nd Put Wall (danger zone if breached)

* Call Resistance:

* $13.00–$13.89: Gamma Wall, strong selling pressure zone

* Bias: Bearish-to-neutral until bulls reclaim $12.34 or break above descending trendline.

📊 Trade Setups (For Educational Purposes Only):

🔴 Bearish Continuation:

* Entry: Below $11.70

* Target: $11.00 → $10.85

* Stop-loss: Above $12.00

🟢 Bullish Reversal Setup (Speculative):

* Entry: On reclaim of $12.34 with volume

* Target: $13.00 → $13.89

* Stop-loss: Below $11.70

🔮 Outlook Summary:

SOFI is trading inside a tight bearish channel near key GEX support. Unless bulls reclaim $12.34 or show aggressive demand near $11.70, the trend favors bears. Keep an eye on GEX and IVR behavior into April 4 OPEX.

🛑 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

Sofi - ready to run?Sofi is peaking its head above the resistance level, held down by two Fibonacci pivot points. I’d like to see it break above $7 with high volume, that would mark the end of many months of lower highs and lower lows.

Definitely keeping an eye on this one. I would have liked it to have touched $6 but buyers are stepping in and we are trying to reclaim the golden Fibonacci ratio as support.

Keep an eye out for a breakout trade, not financial advice

Why Going Long on SoFi Stock SoFi Technologies (SOFI) is at a pivotal moment, presenting a strong long opportunity as it enters the 5th wave of an Elliott Wave cycle. This final leg typically brings explosive upside momentum, signaling a potential breakout.

While a brief dip below $10 is possible, this could act as a springboard for a powerful rally toward $20 and beyond. The stock's bullish structure, combined with SoFi's growing financial services business, makes it an attractive bet for long-term investors.

With momentum building, now may be the perfect time to go long on SoFi before the next surge begins.

🚨 This is not financial advice. Do your own due diligence (DD) before making any investment decisions. 🚨

SOFI AwaySOFI has changed its course over the last week and seems to be putting in new highs. We have a gap to close between 13.43 and 13.57 with a support and resistance being around 13.57.

The short squeeze seems to be slowing and volume seems to be returning. VWAP is sitting at 16.14, this could and possibly will retest that area once again, with time. RSI is in the oversold area at 46.81.

With an $0.80 a day move, we could see 13.50 within the next few days, provided the market or sector doesn't fall apart. If not, of course it could move back to 12 with a stop loss at 11.18.

As always, do your own research and due diligence. Let's see where it goes.

Ascending Channels ✅ Bullish Case (If Price Holds Above ChoCh - $12.39)

Entry: Above $12.50 (Confirmation of 50 EMA break).

Stop-Loss: Below $12.30 (Invalidation of ChoCh).

Target 1: $13.07 (Key Resistance).

Target 2: $13.46 (Major Resistance).

❌ Bearish Case (If Price Falls Below ChoCh - $12.39)

Entry: Below $12.30 (Confirmation of failure).

Stop-Loss: Above $12.50 (Invalidation).

Target 1: $11.41 (Key Support).

Target 2: $10.92 (Major Support).

$SOFI - Working against the trendline and VWAP resistanceNASDAQ:SOFI declined to the 200-day moving average (DMA) area, which was the breakdown target, and then bounced. It’s remarkable how technical targets are hit with such high accuracy.

Currently, it is testing the channel trendline and VWAP resistance. If it can break above $13.70 and hold above that level, it could serve as a launchpad for the next leg.

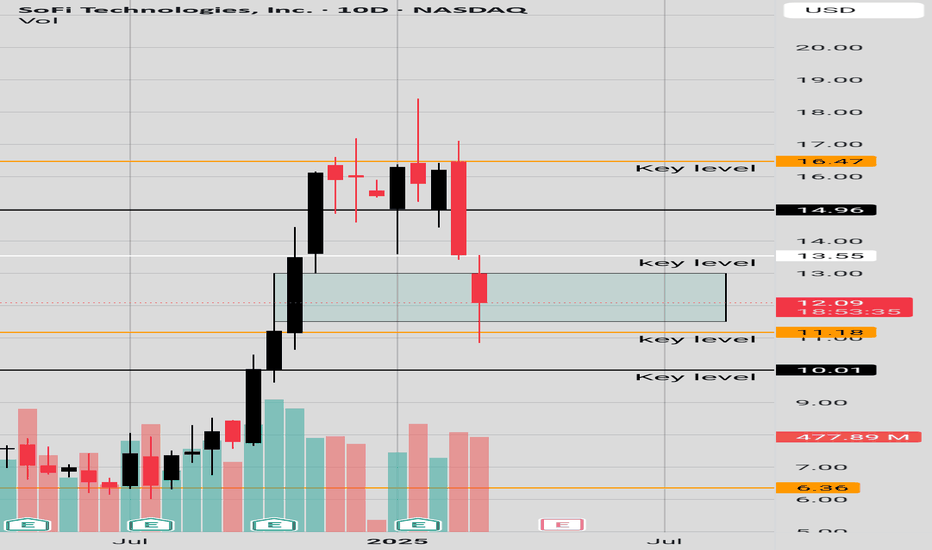

10Day High Wave CandleOn the 10Day Chart price had a serious correction, investors want to know is it over.

RSI is kind of bearish/neutral. Stochastic RSI says there is more room for price to decline. However, we have a high wave candle in a bullish FVG zone with price rejection around the 11.00 price range. On the 10Day Chart we are going to need price to clear 13.55 price for more signs of upward growth.