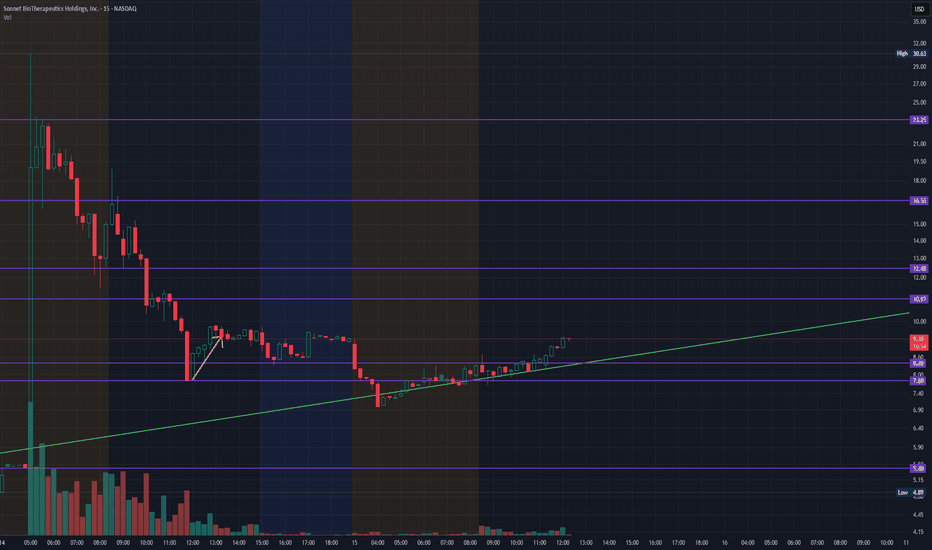

SONN - Sonnet BioTehrapeutics - Continuation to $16 50% FibAfter SONN broke out to $30.63 from $4.20 in yesterday's pre-market, after announcing entering an agreement to become a Public Cryptocurrency Treasury Company. We entered NASDAQ:SONN at $8.28 this morning in's pre-market during the completion of consolidation and convergence on the EMAs from the Consolidation Downtrend. Looking for a $16 PT / 50% Fib Retrace Retest on the 15-Min.

FINANCIAL NEWS:

Sonnet BioTherapeutics shares climbed after the oncology-focused biotechnology company said it entered into an agreement to become a public cryptocurrency treasury company.

Shares more than doubled to $13.50 on Monday. Shares were up 78.5% over the past year.

Sonnet BioTherapeutics , which entered the business combination agreement with Rorschach and other sponsors, said it plans to build a reserve of HYPE, the token of the Hyperliquid Layer-1 blockchain.

Sonnet BioTherapeutics will transform into a new entity called HyperLiquid Strategies at the agreement's close. The new company is expected to hold 12.6 million HYPE tokens and gross cash invested of at least $305 million , for a total assumed closing value of $888 million .

The company will name David Schamis , chief investment officer and co-founder of Atlas Merchant Capital , as chief executive of HyperLiquid Strategies.

SONN trade ideas

SONN - long - catalyst - low floaterSonnet BioTherapeutics Holdings Inc is a clinical-stage biotechnology company. The company has developed FHAB (Fully Human Albumin Binding) technology which is well suited for drug development across a range of human disease areas, including in oncology, autoimmune, pathogenic, inflammatory, and hematological conditions. The firm's pipeline products include SON-080 (low-dose IL-6), SON-1210 (IL15- FHAB-IL12), SON-1010 (IL12-FHAB), and others.

This is not a financial advice!

2 upcoming catalyst on 31st of March 2024 and 30rd of June.

We need to stay in a bullish overal sentiment of the market. If we see a corretion, this play might doesn't work.

Shs. Float of 2.78M

Rel. Vol. of 12.13 today

Keep an eye on 2.6 level, needs to get broken for a further upmove. You can take partial profits at these levels if u want to lock in gains.

SL under 1.3

TPs approx. 4.5 , 6.7, 10

Most info on the chart.

Trade carefully!

$SONN A Pillar For Immuno OncologySome drugs address specific illnesses, while others enhance the pharmacokinetic responses of other drugs, which basically means that it assists other drugs. Sonnet BioTherapeutics Holdings, Inc. (NASDAQ: SONN)’s FHAB™ compound does both by causing swelling around tumors which assists in the immune response and catalyzes the effect of other treatments. As is, SONN has secured a path free of cash burn worry while developing its aforementioned treatments thanks to its existing cash balance which is nearly worth the company’s entire market cap. With a phase 1-2 trial expected to conclude in October, SONN stock could be one of the undervalued stocks to watch closely.

SONN Fundamentals

The field of Immuno-oncology is home to many notable biotech stocks like IN8bio, Inc. (Nasdaq: INAB) for a reason. It is developing rapidly, and as a result, many new and exciting treatments are introduced reflecting a brighter and more exciting future. SONN stock is notable among them due to the fact that its products not only treat tumors but also work hand in hand with other immuno-oncology treatments to catalyze the effects of other products. A prominent example of this is the use of FHAB™ with the immuno-oncology treatment recombinant interleukins which increased efficacy by more than 30-fold.

The Future of Immuno Oncology

It is almost poetic that SONN is developing a treatment for Chemotherapy-induced Peripheral Neuropathy. If the field of immuno-oncology develops substantially, it is likely that society will eventually view chemotherapy as a barbaric medical practice. As is, immuno-oncology treatment is poised to acquire substantial chunks of the chemotherapies gargantuan market which is projected to grow from $157 billion in 2022 to $331 billion by the end of 2032.

Furthermore, SONN stock is in a unique position thanks to its FHAB™ compound which enhances the pharmacokinetics of active immuno-oncology treatments. That basically means that in the future FHAB™ oriented treatments might be prescribed to aid other immuno-oncology treatments. In this way, SONN’s revenues could be tied to the progression of the entire immuno-oncology field in case its treatment is approved by the FDA which might lead to SONN stock soaring.

Currently, SONN’s SON 080 is in phase 1-2 clinical trials for treating chemotherapy-induced peripheral neuropathy and this trial is expected to conclude in October 2023. As trial results may come out in the coming months, SONN stock could surge on positive data since its treatment would be a step closer to FDA approval.

An Undervalued Gem?

According to its Q2 report, SONN has $11.3 million in its cash balance, which is promising since its market cap is $14 million. Due to this fact, SONN stock could be undervalued at current levels as it is trading near its cash per share value. Additionally, SONN stated that its cash is projected to last until January 2024 which indicates that SONN might not resort to dilution anytime soon.

Short Data

There is a possibility that SONN Stock may experience a short squeeze due to its increasing short data. Currently, SONN has a short interest of 14.4%, 14.5% of its float on loan, and its cost to borrow is 115.4%. Considering the momentum SONN stock is witnessing, a short squeeze could occur sending the stock near the $1 mark – especially with the SON 080 trial results potentially being shared in the coming months.

SONN Financials

SONN’s Q2 Balance sheet is very promising. Its assets ballooned from $5.8 million at the beginning of the year, to $13.3 million in Q2. This was mostly due to its growing cash balance which increased from $3 million to $11.39 million. Meanwhile, its liabilities decreased from $8.3 million to $7.9 million.

The most positive note in SONN’s income statement is its decreasing expenses, which decreased from $8.3 million to $5.7 million YoY. This decrease resulted in SONN stock’s net loss waning substantially from $8.2 million to $5.6 million. That said, its decreasing expenses is also a positive indicator of the longevity of its cash balance.

Technical Analysis

SONN stock is in a bullish trend with the stock trading in an upwards channel. Looking at the indicators, SONN is trading above the 200, 50, and 21 MAs which are bullish indications. Meanwhile, the RSI is neutral at 60 and the MACD is bearish. It is worth noting that there are gaps on the chart near $.59, $.7, and $1.06 which could be filled as SONN continues to gain momentum.

As for the fundamentals, SONN is seeing an increasingly bullish sentiment as it might be undervalued at current levels thanks to its cash balance. With the SON 080 trial set expected to be completed in October, SONN could soar on positive results especially since it has a low float of 20.9 million.

SONN Forecast

One of the most common problems for biotech companies is cash burn, that being said, SONN mitigated that issue because of its $11.3 million cash balance and its shrinking expenses. As is, it can focus on its immuno-oncology treatments which both treat cancer and catalyze the effects of other oncological drugs. SONN’s trial for chemotherapy-induced peripheral neuropathy is expected to be completed in October and the results might come out soon afterward triggering a short squeeze. That said, in the long run, SONN’s growth could become tied to the entirety of the immuno-oncology field due to FHAB™’s catalyzing effect which translates to more revenues and a higher PPS.

SONN 1W test

Sonnet BioTherapeutics Holdings, Inc. engages in the development of biologic drugs with enhanced single or bispecific mechanisms. Its technology utilizes a fully human single chain antibody fragment that binds to and hitch-hikes on human serum albumin for transport to target tissues. The company was founded in 2011 and is headquartered in Princeton, New Jersey.

SONN 15Min Scalpers editiontest

Sonnet BioTherapeutics Holdings, Inc. engages in the development of biologic drugs with enhanced single or bispecific mechanisms. Its technology utilizes a fully human single chain antibody fragment that binds to and hitch-hikes on human serum albumin for transport to target tissues. The company was founded in 2011 and is headquartered in Princeton, New Jersey.

SONN Technical Analysis 🧙Sonnet BioTherapeutics Holdings Inc is a clinical-stage biopharmaceutical company. The company has developed FHAB (Fully Human Albumin Binding) technology which is well suited for drug development across a range of human disease areas, including in oncology, autoimmune, pathogenic, inflammatory, and hematological conditions. The firm's pipeline products include SON-080 (low-dose IL-6), SON-1210 (IL15- FHAB-IL12), SON-1010 (IL12-FHAB), and others.

If you understand the idea,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

FDA Covid-19 Plasma Nod1. Sonnet Bio Spikes 70% In Pre-Market On FDA Covid-19 Plasma Nod

(FDA) has granted an emergency authorization to use blood plasma from recovered Covid-19 patients as a treatment for the disease.

finance.yahoo.com

2. Sonnet BioTherapeutics Receives $10.5 Million from Exercise of Series A Warrants

as part of the previously announced warrant exchange agreement, all 3,300,066 Series A Warrants have been exercised at a price of $3.19 per share. Gross proceeds to the Company were $10.5 Million.

After the exercise of these warrants, there are no additional Series A warrants outstanding, which leaves the Company with 2,308,663 Series B Warrants and 11,329,461 Series C Warrants outstanding.

In the event all the Series C Warrants are exercised for cash, the Company could receive up to an additional $36.1 million. With this Series A Warrants exercise, Sonnet's outstanding share count and pro forma fully diluted share count equals 14.7 million and 29.3 million, respectively."

finance.yahoo.com