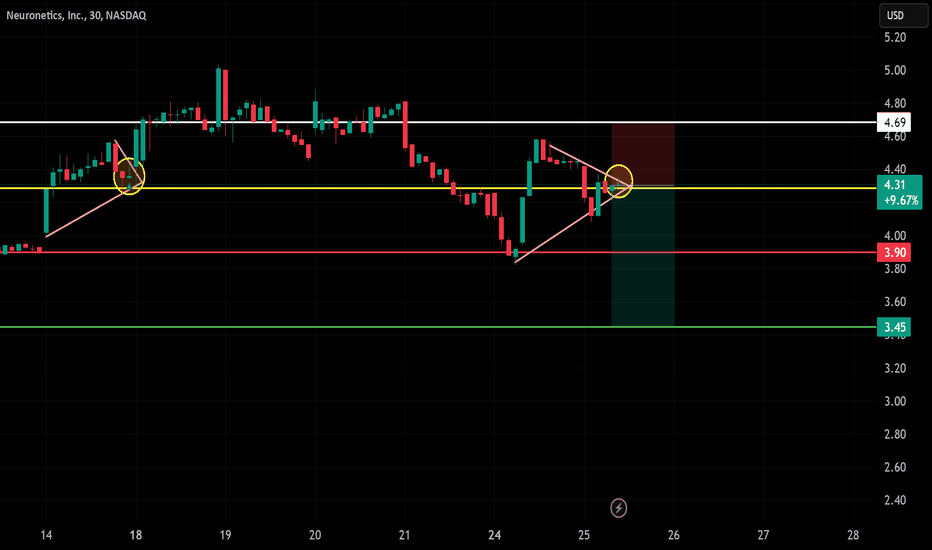

STIM/USD – 30-Min Short Trade Setup !📌📉

🔹 Asset: Neuronetics, Inc. (STIM/USD)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown Trade

📌 Trade Plan (Short Position)

✅ Entry Zone: Below $4.29 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $4.69 (Break of Resistance & Trendline)

🎯 Take Profit Targets

📌 TP1: $3.90 (First Support Level)

📌 TP2: $3.45 (Final Target – Extended Bearish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $4.69 - $4.29 = $0.40 risk per share

📉 Reward to TP1: $4.29 - $3.90 = $0.39 (1:0.97 R/R)

📉 Reward to TP2: $4.29 - $3.45 = $0.84 (1:2.1 R/R)

🔍 Technical Analysis & Strategy

📌 Bearish Trendline Rejection: STIM attempted a breakout but faced rejection at $4.29, indicating seller dominance.

📌 Descending Pattern Formation: The price formed a lower high, confirming potential downside momentum.

📌 Breakdown Confirmation: A strong bearish candle closing below $4.29 with increased volume will confirm the move.

📌 Momentum Shift Expected: If price stays below $4.29, a move toward $3.90 (TP1) and $3.45 (TP2) is likely.

📊 Key Support & Resistance Levels

🔴 $4.69 – Strong Resistance / Stop-Loss Level

🟡 $4.29 – Entry / Breakdown Level

🟢 $3.90 – First Support / TP1

🟢 $3.45 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong selling volume below $4.29 before entering.

📈 Trailing Stop Strategy: Move SL to entry ($4.29) after TP1 ($3.90) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $3.90, let the rest run to $3.45.

✔ Adjust Stop-Loss to Break-even ($4.29) after TP1 is reached.

⚠️ Fake Breakdown Risk

❌ If price bounces back above $4.29, it could indicate a false breakdown—exit early.

❌ Wait for a strong bearish candle close below $4.29 for confirmation before entering aggressively.

🚀 Final Thoughts

✔ Bearish Setup – Breaking below $4.29 could lead to lower targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:0.97 to TP1, 1:2.1 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #STIM #ShortTrade #BreakdownTrade #TechnicalAnalysis #MomentumStocks #ProfittoPath #TradingView #StockMarket #SwingTrading #RiskManagement #ChartAnalysis 📉🚀

STIM trade ideas

Long Trade Setup Breakdown for Neuronetics, Inc. (STIM) - 30-Min📊

🔹 Asset: Neuronetics, Inc. (STIM)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Ascending Triangle Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: $4.35 (Breakout Confirmation)

✅ Stop-Loss (SL): $3.99 (Below Support)

🎯 Take Profit Targets (Long Trade):

📌 TP1: $4.76 (First Resistance)

📌 TP2: $5.18 (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (Stop-Loss Distance):

$4.35 - $3.99 = $0.36

📈 Reward to TP1:

$4.76 - $4.35 = $0.41

💰 Risk-Reward Ratio to TP1: 1:1.14

📈 Reward to TP2:

$5.18 - $4.35 = $0.83

💰 Risk-Reward Ratio to TP2: 1:2.3

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: Strong buying momentum above $4.35 signals continuation.

📌 Pattern Formation: Ascending Triangle Breakout, indicating bullish movement.

📊 Key Support & Resistance Levels:

🟢 $3.99 (Strong Support / SL Level)

🟡 $4.35 (Breakout Zone / Entry)

🔴 $4.76 (First Profit Target / Resistance)

🟢 $5.18 (Final Target for Momentum Extension)

🚀 Momentum Shift Expected:

If price sustains above $4.35, it could push towards $4.76 and $5.18.

A high-volume breakout would confirm the strength in trend continuation.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure buying volume remains strong after breakout.

📈 Trailing Stop Strategy: If price reaches TP1 ($4.76), move SL to entry ($4.35) to lock in profits.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $4.76, let the rest run to $5.18.

✔ Adjust Stop-Loss to Break-even ($4.35) after TP1 is hit.

⚠️ Fake Breakout Risk:

If price drops below $4.35, be cautious and watch for a retest before re-entering.

🚀 Final Thoughts:

✔ Bullish Setup – If price holds above $4.35, higher targets are expected.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.14 to TP1, 1:2.3 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #STIM #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath

STIM Long Trade Setup (30-Min Chart) !🚀 📈🔥

🔍 Stock: STIM (NASDAQ)

⏳ Timeframe: 30-Min Chart

📈 Setup Type: Bullish Reversal

📍 Trade Plan:

✅ Entry Zone: $3.05 - $3.10 (Falling Wedge Breakout + Support)

🚀 Take Profit 1 (TP1): $3.41 (Key Resistance)

🚀 Take Profit 2 (TP2): $3.74+ (Extended Target if momentum continues)

🔻 Stop-Loss (SL): $2.84 (Below support for risk control)

📊 Risk-Reward Ratio: Favorable for a bullish setup 📉📈

🔹 Technical Analysis & Setup:

✅ Pattern: Falling Wedge (Bullish Reversal Pattern) 📉 → 📈

✅ Support Zone: Strong buyer interest around $3.05 - $3.10 (Yellow Zone)

✅ Breakout Confirmation Needed: Price needs to break above the wedge with volume

✅ Momentum Shift Expected: Higher lows forming, signaling bullish pressure

🔥 Trade Strategy & Refinements:

📊 Volume Confirmation: Look for increased buying volume at breakout above $3.10 📈

📉 Trailing Stop Strategy: Once price reaches TP1 ($3.41), adjust SL higher to secure profits

💰 Partial Profit Booking: Take partial profits at TP1 and let the rest ride towards TP2 ($3.74+)

⚠️ Watch for Fake Breakouts: If price drops below $3.05, reconsider the setup

🚀 Final Thoughts:

✅ Bullish Reversal Expected – High probability of breakout 📈

✅ Strong Support at $3.05 - $3.10 – Ideal entry for risk-reward optimization 💰

✅ Momentum Shift Possible – A push above $3.41 could drive STIM to $3.74+ 🚀

📊 Trade Smart & Stick to Your Plan! 🏆🔥

Would you like any refinements or additional insights? 🚀📈

🔗

#LongTrade #StockTrading #STIM #TechnicalAnalysis #DayTrading #SwingTrading #MomentumTrading #ChartPatterns #PriceAction #BullishBreakout #TradeSetup #StockCharts #TradingView #StockSignals #TradingPlan #MarketAnalysis #RiskReward #SupportAndResistance #ProfitToPath #TradeSmart #WealthBuilding #TradingSuccess

STIM Long Trade Setup (30-Min Chart)!🚀 📈🔥

🔍 Stock: STIM (NASDAQ)

⏳ Timeframe: 30-Min Chart

📈 Setup Type: Bullish Breakout

📍 Trade Plan:

✅ Entry: $3.43 (Breakout Confirmation)

❌ Stop-Loss (SL): $3.20 (Below support level for risk management)

🎯 Target 1: $3.66 (First Resistance Level)

🚀 Target 2: $3.93 (Major Resistance Level – Moon Shot! 🌙)

🔹 Risk-Reward Ratio: Favorable setup 📊

🔹 Momentum: Strong breakout with higher highs 📈

🔹 Pattern: Ascending triangle breakout

🔥 Trade Strategy & Refinements:

📊 Volume Confirmation: Ensure strong buying volume to confirm breakout.

📉 Trailing Stop Strategy: If price reaches $3.66, consider moving SL to breakeven ($3.43) or higher.

💰 Partial Profit Booking: Take some profits at Target 1 and let the rest ride towards Target 2.

⚠️ Watch for Retest: If price retests $3.43 and holds, it's a strong confirmation for the uptrend.

🚀 Final Thoughts:

✅ High Risk-Reward Setup – Favoring bulls.

✅ Breakout Confirmation – Strong potential for upward momentum.

✅ Volume & Price Action Key – Keep an eye on confirmation signals.

Plan Your Trade & Trade Your Plan! 🏆💰

Let me know if you need further refinements! 🚀📈

#BreakoutTrading #StockMarket #TradingStrategy #TechnicalAnalysis #DayTrading #SwingTrading #MomentumTrading #ChartPatterns #PriceAction #BullishBreakout #TradeSetup #StocksToWatch #StockCharts #TradingView #StockSignals #TradingPlan #MarketAnalysis #RiskReward #SupportAndResistance #ProfitToPath #TradeSmart #WealthBuilding #TradingSuccess #MoneyMoves

STIM BullishI like the recent MACD cross and that the most recent candle tested two fib levels and closed over the .382 level. Also after an extreme sell off price seems to have bottomed at 4.61. The ADX shows a relatively strong trend with the directional indicators moving in a bullish direction.

targeting: 5.63, 5.81, 6.04

$STIM - biotech category - same indicators as the others$STIM - added to my biotech/genome category

It has the same "chicken-beak" patterns as EDIT, CRSP, BNGO and others.

I'm swinging this stock. It has buyer support at $14.00 level. We are barely above that, so feels ok to keep adding to this swing trade.

STIM BULLISH STIM looks like its ready for its next leg up as the MACD starts to cross, it broke thru the descending trendline today and today's candle closed above 6.34 (100% Fib level) assuming it can break thru resistance at 6.85 I think this goes much higher. First target 7.82 and on to 10.21 in the longer term

$STIM Neuronetics, Inc. 60% Potential Upside Neuronetics, Inc. commercial stage medical technology company. It focuses on designing, developing and marketing products for the patients suffering from psychiatric disorders. The firm offers NeuroStar TMS, a therapy system for the treatment of major depressive disorders in adult patients. It also provides a range of support services, including patient education, practice data management system, and customer and technical services to help the client start and manage TMS therapy systems. The company was founded by Steven B. Waite, Bruce J. Shook, Norman R. Weldon and Thomas D. Weldon in April 2003 and is headquartered in Malvern, PA.

Average Analysts Recommendation: BUY

Average Target Price: $5.75

Appointment of Keith J. Sullivan as President and Chief ExecutivNeuronetics Announces the Appointment of Keith J. Sullivan as President and Chief Executive Officer

Keith’s track record includes successfully growing multiple MedTech businesses, driving innovation and impressive market development

We believe that Keith’s experience in commercializing products that involve both capital equipment and recurring revenue streams is an excellent fit with Neuronetics, and I am confident his public company experience and leadership skills further position Neuronetics extremely well for strong execution

Mr. Sullivan brings over three decades of medical device industry experience to the company

Mr. Sullivan, who has more than 30 years of senior sales leadership experience in the medical device industry

Mr. Sullivan received a Bachelor of Business Administration from the College of William and Mary and is a clinical professor in the Mason School of Business at William and Mary.

www.globenewswire.com