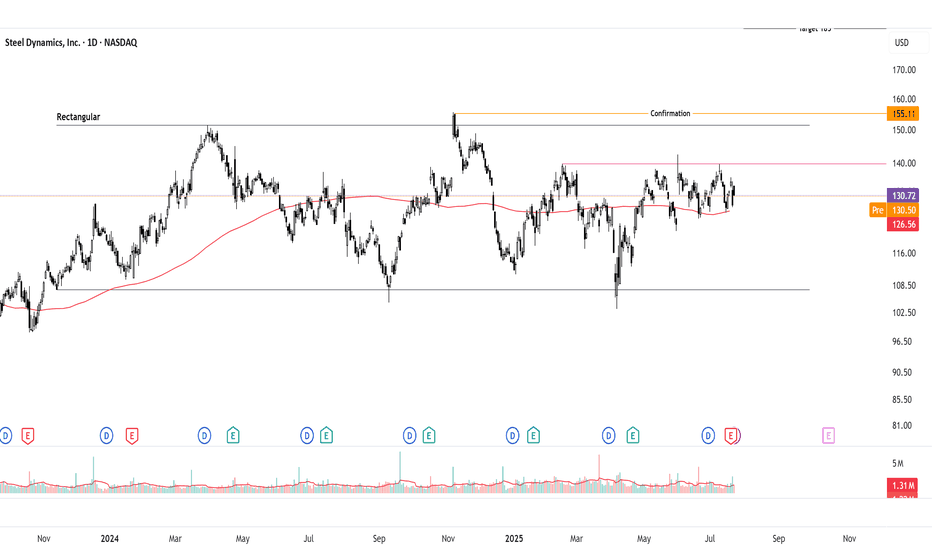

Bullish Breakout Watch on Inverted Head & ShouldersSteel Dynamics ( NASDAQ:STLD ) is consolidating on the daily chart but forming an inverted head and shoulders (IHS) pattern, signaling potential bullish reversal. Neutral until breakout above 140 pivot, but bias leans bullish with supportive steel fundamentals. Long idea on confirmation; current p

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.88 USD

1.54 B USD

17.54 B USD

139.00 M

About Steel Dynamics, Inc.

Sector

Industry

CEO

Mark D. Millett

Website

Headquarters

Fort Wayne

Founded

1993

FIGI

BBG000HGYNZ9

Steel Dynamics, Inc. engages in the production of steel and recycling of metals. It operates through the following segments: Steel Operations, Metals Recycling Operations, Steel Fabrication Operations, and Aluminum Operations. The Steel Operations segment is composed of electric arc furnace (EAF) steel mills, production of steel from ferrous scrap and scrap substitutes, utilization of continuous casting, automation of rolling mills and steel coatings, processing lines, and warehouse operations. The Metals Recycling Operations segment is involved in ferrous and nonferrous scrap metal processing, transportation, marketing, brokerage, and provision of scrap management services. The Steel Fabrication Operations segment includes New Millennium Building Systems plants that serve non-residential construction industry throughout the United States. The Aluminum Operations segment consists of recycled aluminum flat rolled products mill being constructed in Columbus, Mississippi, and satellite recycled aluminum slab centers in Arizona and Mexico. The company was founded by Keith E. Busse, Mark D. Millett, Richard P. Teets, and John C. Bates in 1993 and is headquartered in Fort Wayne, IN.

Related stocks

Steel DynamicsNASDAQ:STLD bounced from the long term multiyear trendline

Steel demand not going anywhere (I'm not an expert but don't see it going down simply because of steel's versatility and usage)

high volume node and 50/200 daily SMAs above that can act as resistance, I accumulate shares every month, so not

STLD Long STLD made a bullish candle last week. Earnings on 1/22. Materials and steels sectors have been in recession, a lot of them have underperformed. STLD relative strength and tested important supports marked in the chart. Break 132 will confirm bullish thesis. I would expect it to go to ATH in the long

Steel Dynamics: Trendline BrokenSteel Dynamics slid in recent quarters, but now it may be going the other way.

The first pattern on today’s chart is the series of lower highs between April and September. The steelmaker began October by pushing above that falling trendline, which may suggest its intermediate-term decline has cease

STLD from $105.5 to $116MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Sq

Steel Dynamics ($STLD) Stock Hits a Record HighSteel Dynamics ( NASDAQ:STLD ) reports current quarter guidance that was above estimates as it sees profitability potentially stronger than the previous quarter. The steelmaker said the gains were driven by its flat-rolled steel operations.

Steel Dynamics added that because of its confidence in the

STLDCurrent Price: 105.5

Entry: 104.28

Profit level: 115.2(10.46%)

S/L: 101.95 (2.24%)

Risk & Reward Ratio: 4.66

Bullish Signal

Symmetrical triangle pattern is forming

Price> EMA 5, 18, 20, 150, 200

Short-term EMAs are crossing the long-term EMAs

MACD curves almost cross and start turning upward

Relati

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

STLD5059254

Steel Dynamics, Inc. 3.25% 15-OCT-2050Yield to maturity

7.00%

Maturity date

Oct 15, 2050

STLD6026369

Steel Dynamics, Inc. 5.75% 15-MAY-2055Yield to maturity

6.00%

Maturity date

May 15, 2055

STLD6026368

Steel Dynamics, Inc. 5.25% 15-MAY-2035Yield to maturity

5.10%

Maturity date

May 15, 2035

STLD4486793

Steel Dynamics, Inc. 5.0% 15-DEC-2026Yield to maturity

5.06%

Maturity date

Dec 15, 2026

STLD5841327

Steel Dynamics, Inc. 5.375% 15-AUG-2034Yield to maturity

5.00%

Maturity date

Aug 15, 2034

US858119BM1

STEEL DYNAM 20/31Yield to maturity

4.89%

Maturity date

Jan 15, 2031

STLD4923720

Steel Dynamics, Inc. 3.45% 15-APR-2030Yield to maturity

4.57%

Maturity date

Apr 15, 2030

STLD5059253

Steel Dynamics, Inc. 1.65% 15-OCT-2027Yield to maturity

4.49%

Maturity date

Oct 15, 2027

See all STLD bonds

Frequently Asked Questions

The current price of STLD is 122.37 USD — it has decreased by −4.07% in the past 24 hours. Watch Steel Dynamics, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Steel Dynamics, Inc. stocks are traded under the ticker STLD.

STLD stock has fallen by −3.96% compared to the previous week, the month change is a −7.02% fall, over the last year Steel Dynamics, Inc. has showed a −7.69% decrease.

We've gathered analysts' opinions on Steel Dynamics, Inc. future price: according to them, STLD price has a max estimate of 155.00 USD and a min estimate of 145.00 USD. Watch STLD chart and read a more detailed Steel Dynamics, Inc. stock forecast: see what analysts think of Steel Dynamics, Inc. and suggest that you do with its stocks.

STLD reached its all-time high on Nov 6, 2024 with the price of 155.56 USD, and its all-time low was 2.06 USD and was reached on May 22, 2000. View more price dynamics on STLD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

STLD stock is 4.85% volatile and has beta coefficient of 1.41. Track Steel Dynamics, Inc. stock price on the chart and check out the list of the most volatile stocks — is Steel Dynamics, Inc. there?

Today Steel Dynamics, Inc. has the market capitalization of 18.17 B, it has decreased by −7.21% over the last week.

Yes, you can track Steel Dynamics, Inc. financials in yearly and quarterly reports right on TradingView.

Steel Dynamics, Inc. is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

STLD earnings for the last quarter are 2.01 USD per share, whereas the estimation was 2.24 USD resulting in a −10.25% surprise. The estimated earnings for the next quarter are 2.80 USD per share. See more details about Steel Dynamics, Inc. earnings.

Steel Dynamics, Inc. revenue for the last quarter amounts to 4.57 B USD, despite the estimated figure of 4.72 B USD. In the next quarter, revenue is expected to reach 4.83 B USD.

STLD net income for the last quarter is 298.73 M USD, while the quarter before that showed 217.15 M USD of net income which accounts for 37.57% change. Track more Steel Dynamics, Inc. financial stats to get the full picture.

Yes, STLD dividends are paid quarterly. The last dividend per share was 0.50 USD. As of today, Dividend Yield (TTM)% is 1.57%. Tracking Steel Dynamics, Inc. dividends might help you take more informed decisions.

Steel Dynamics, Inc. dividend yield was 1.61% in 2024, and payout ratio reached 18.69%. The year before the numbers were 1.44% and 11.61% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 13 K employees. See our rating of the largest employees — is Steel Dynamics, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Steel Dynamics, Inc. EBITDA is 1.80 B USD, and current EBITDA margin is 13.81%. See more stats in Steel Dynamics, Inc. financial statements.

Like other stocks, STLD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Steel Dynamics, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Steel Dynamics, Inc. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Steel Dynamics, Inc. stock shows the neutral signal. See more of Steel Dynamics, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.