SYM Trade Breakdown – Robotics Meets Smart Technical's🧪 Company: Symbotic Inc. ( NASDAQ:SYM )

🗓️ Entry: April–May 2025

🧠 Trade Type: Swing / Breakout Reversal

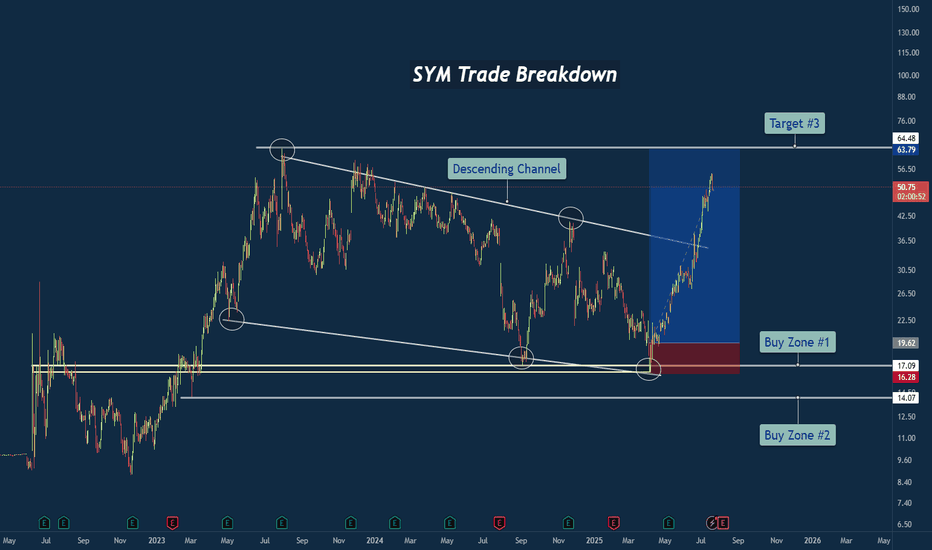

🎯 Entry Zone: $16.28–$17.09

⛔ Stop Loss: Below $14.00

🎯 Target Zone: $50–$64+

📈 Status: Strong Rally in Motion

📊 Why This Trade Setup Stood Out

✅ Macro Falling Wedge Reversal

After nearly two years of compression inside a falling wedge, price finally tapped multi-year structural support and fired off with strength. This wasn’t just a bottom — it was a structural inflection point.

✅ Triple Tap at Demand Zone

Symbotic tapped the ~$17 area multiple times, signaling strong accumulation. Volume and momentum picked up with each successive test, showing institutional interest.

✅ Clean Break of Trendline

Price broke through the falling resistance trendline decisively, confirming the bullish reversal and unleashing stored energy from months of sideways structure.

🔍 Company Narrative Backdrop

Symbotic Inc. isn't just any tech stock. It’s at the forefront of automation and AI-powered supply chain solutions, with real-world robotics deployed in major retail warehouses. That kind of secular growth narrative adds rocket fuel to technical setups like this — especially during AI adoption surges.

Founded in 2020, Symbotic has quickly become a rising name in logistics and warehouse automation, serving the U.S. and Canadian markets. With robotics in demand and investors chasing future-ready tech, the price action aligned perfectly with the macro theme.

🧠 Lessons from the Trade

⚡ Compression = Expansion: Wedges like this build pressure. When they break, the moves are violent.

🧱 Structure Never Lies: The $17 zone was no accident — it was respected over and over.

🤖 Tech Narrative Boosts Confidence: Trading is easier when the fundamentals align with the technicals.

💬 What’s Next for SYM?

If price holds above the wedge and clears the $64 resistance, we could be looking at new all-time highs in the next cycle. Watching for consolidation and retests as opportunity zones.

#SYM #Symbotic #Robotics #Automation #AIStocks #BreakoutTrade #FallingWedge #SwingTrade #TechnicalAnalysis #TradingView #TradeRecap #SupplyChainTech

SYM trade ideas

7/15/25 - $sym - RIP regards.7/15/25 :: VROCKSTAR :: NASDAQ:SYM

RIP regards.

- sizing this up

- muh robots

- but didn't do muh work

- hedge

- but seeing that -6% open on monday told me how incredibly fragile this structure is

- might head higher idk idc. one of my 10 hedges rn. you guys know

- pltr

- cvna

- qubt

- sym

- ura

- qs

- a few others ;)

V

7/3/25 - $sym - Crackhead central7/3/25 :: VROCKSTAR :: NASDAQ:SYM

Crackhead central

- it's almost laughable that i'm hedging my "risky" BTC, NXT, GAMB and OSCR/HIMS positions with

- the most crackheaded stocks, QUBT, now SYM, CVNA

- i'm really not sure if the chart bros will win this one

- but given the risk/ reward merits stepping up a position here in an effort to offset any change in mkt beta... where the magnification is likely 5-10x to 1... consider me interested

- for those of you who are interested in the "fundamentals" i think the only one that's driving this stock is softbank's involvement - kind of like a PE shop - but worse

- so enjoy it while it lasts

- but this stock is ultimately going to sub $10. you can bet on it. in the meanwhile... who knows. 50% 100% 1000% higher? i'm not the one to ask. ask one of these high fiving chart "investors"

- i'm just here playing the long game

- and just warning you... the real robotics company worth owning is NASDAQ:TSLA , even if it's worth a heck of a lot more (for a reason)

V

Ready for a comeback!This is a company that produces autonomous robots for warehouses, capable of handling goods storage using AI—the potential of this idea is insane!

At the moment, it's automating all of Walmart’s warehouses, which is its main client.

The price has been moving within a descending channel for two years and closed last week right near the upper boundary.

It might be time for a bullish breakout, with a return to previous highs or even beyond.

The first major resistance is around the $40 level.

6/18/25 - $sym - The warning signs are everywhere6/18/25 :: VROCKSTAR :: NASDAQ:SYM

The warning signs are everywhere

- what will powell do? who tf cares. buy bitcoin and chill.

- but the warning signs are everywhere in regard to how much money is floating around in this tape that needs to have a coming to reality check moment

- i have written about so many of these names

- but here's a fun one that duped me back in the day b/c 80% of shares are these super weird "insider" BS voting reach arounds

- $20 billion dollars

- here's your failed robotics company

- have fun. play dumb games, win dumb prizes.

- it's another short i've started to add.

- send it higher. not my first rodeo wrangling the donuts.

V

Symbotic Inc. (SYM) Grows With AI-Powered RoboticsSymbotic Inc. (SYM) is a leading provider of AI-powered robotics and automation systems for warehouses and distribution centers. Its advanced technology helps retailers and wholesalers improve efficiency, speed, and accuracy in inventory management and order fulfillment. The company’s growth is driven by rising e-commerce demand, labor shortages, and the need for faster, more efficient supply chains.

On the chart, we see a confirmation bar with rising volume, showing strong buying interest. The price has entered the momentum zone by breaking above the .236 Fibonacci level. Traders can use the Fibonacci snap tool to set a trailing stop just below the .236 level to secure gains while allowing room for further upside.

Breakout confirmed The price confirms last week's breakout, closing above the purple trendline.

The $17 area could also form a double bottom, but it is necessary to wait for the price to reach the neckline (around $40) to confirm it.

At the moment, the price is heading towards $34, where the weekly SMA100 (green line) is located, along with the previous high marked by the blue trendline.

SYM formed double bottom SYM formed Double bottom pattern

Company Profile

Name: Symbotic Inc.

Ticker: SYM

Exchange: NASDAQ

Sector: Technology

Industry: Robotics / AI / Supply Chain Automation

Headquarters: Wilmington, Massachusetts, USA

Business Model: Provides AI-enabled robotics systems that automate warehouse operations.

💰 Key Financials (as of recent filings)

Market Cap: ~$25–30 billion (fluctuates)

Revenue (TTM): ~$1.2 billion+

Net Income: Negative (currently unprofitable)

EPS (TTM): Negative

P/E Ratio: N/A (due to negative earnings)

Free Cash Flow: Improving but still negative

📈 Growth Metrics

Revenue Growth: Strong double-digit year-over-year (often over 100%)

Customer Base: Includes large clients like Walmart

Backlog: Significant, reflecting high demand for automation

💼 Business Strengths

AI-driven automation for supply chains – a rapidly growing sector

Long-term contracts with major retail and logistics players

Proprietary technology differentiating it from traditional robotics providers

⚠️ Risks and Considerations

Still not profitable; high R&D and operational costs

Valuation is high relative to earnings (growth stock profile)

Dependence on a few large customers

📊 Stock Performance

Strong run since going public via SPAC in 2022

Seen as a leader in warehouse automation alongside peers like Ocado, Berkshire Grey, and others

🧠 Analyst Sentiment

Generally bullish due to secular trends in warehouse automation and AI

Analysts highlight long-term potential but warn of volatility

$SYM Long term hold and bullish outlook 6 months 🤖 Strategic Expansion with Walmart

In January 2025, Symbotic completed the acquisition of Walmart's Advanced Systems and Robotics business for $200 million, with potential additional payments of up to $350 million based on future orders. This acquisition is part of a broader $520 million agreement wherein Symbotic will develop and deploy AI-enabled robotics solutions for Walmart's Accelerated Pickup and Delivery (APD) centers. If performance criteria are met, Walmart plans to implement these systems in 400 APD centers over several years, potentially increasing Symbotic's future backlog by over $5 billion

Symbotic appointed Dr. James Kuffner as Chief Technology Officer in January 2025. Dr. Kuffner brings over 30 years of experience in robotics and AI, having previously held senior positions at Toyota and Google. He is recognized for co-inventing the Rapidly-exploring Random Tree (RRT) algorithm, a significant contribution to robot motion planning

🏥 Diversification into Healthcare Robotics

In December 2024, Symbotic acquired OhmniLabs, a robotics company specializing in healthcare automation solutions, including autonomous disinfection and telepresence robots. This acquisition aims to expand Symbotic's capabilities beyond warehouse automation and into the healthcare sector

🟢 Fundamental Highlights (Bullish):

Strategic Walmart Partnership: Major growth catalyst with SEED_TVCODER77_ETHBTCDATA:5B + potential future backlog.

Revenue Growth: Strong 35% YoY revenue growth.

Cash Position: Healthy balance sheet with significant cash reserves (~$903M).

Diversification: Strategic expansion into healthcare robotics.

📉 Options Data (Contrarian Indicator):

Premium Flow: Currently overwhelmingly bearish (81.8% put premium vs. 18.2% call premium).

ITM Put Bias: Strong net put premium (0.22 Call/Put Premium Ratio), indicating pessimism.

Volume & Open Interest:

Notable put interest below current price (~$20), suggesting hedging or bearish positioning.

Contrarian interpretation: excessive bearish positioning can lead to sharp upward reversals if bearish traders are squeezed.

📈 Technical Analysis (Macro Bottom Thesis):

Price Structure:

Symbotic has tested a critical lower band (around $20), typically seen as support.

Weekly MACD histogram and squeeze indicators suggest bearish momentum is waning and preparing for a bullish reversal.

RSI & Oscillators:

RSI (41.78) indicates potential oversold conditions near reversal zones.

Serum Oscillator and SQN indicators aligning for a momentum shift upward.

Volume & VWAP:

Price is significantly below its VWAP (Value Weighted Average Price), indicating potential mean reversion to higher levels.

🎯 Trading Thesis (Bullish Contrarian Play):

Speculative Target: New highs above previous peaks (~$64).

Key Support Zone: $19 - $21, ideal for accumulation.

Invalidation: Sustained breakdown below $18 invalidates the short-term bullish scenario.

🚩 Catalysts to Watch:

Upcoming quarterly earnings updates and forward guidance.

Any announcements on further commercial agreements or partnerships.

Positive momentum and short squeeze triggered by bearish sentiment unwinding.

Symbotic Inc. (SYM) Bullish Opportunity – Growth & Momentum Play🔹 Current Price: $21.65

✅ TP1: $24.50 – Short-term bounce from support

✅ TP2: $30.00 – Key previous resistance level

✅ TP3: $40.00 – Next major resistance level ( long-term )

🔹Stop Loss: If trading with leverage, consider a stop below $18-$19.

🔥 Why Are We Bullish?

✅ Strong Revenue Growth

35% YoY revenue increase in Q1 FY2025, reaching $487 million.

Company forecasts $510M-$530M in Q2, signaling continued expansion.

✅ Strategic Expansion with Walmart

Acquisition of Walmart’s Advanced Systems & Robotics business enhances automation capabilities.

Strengthens Symbotic’s competitive edge in warehouse logistics.

✅ Positive Analyst Sentiment

MarketBeat Analyst Target: $38.20, indicating a +76% upside from current levels.

9 Buy, 7 Hold, 1 Sell – Moderate Buy Consensus

✅ Technical Setup

Strong support at $21.00-$22.00, with MACD & RSI signaling a bullish reversal.

A break above $24.50 could trigger a rally towards $30+.

📌 Conclusion:

Symbotic is in a strong growth phase, backed by fundamental strength & technical confluence. A push past $24.50 could fuel momentum towards $30-$40, making it a prime bullish opportunity for both traders & long-term investors. 🚀

SYM, setup like TSLAThis chart reminds me of TSLA so much it hurts. A multi month correction forming a massive wedge. Do I care about the fundamentals of this robotic company that serves walmart warehouses? no. Does it fit a narrative that draws attention yes. A bottomed stochastic RSI is noted with a falling BBWP. This chart has 16 attempts at breaking the resistance on the weekly, the time is now. If this does not break here it will fall hugely. The rising bottoms into the contraction noted is bullish.

My plan:

Small bet, May calls OTM on this breakout attempt

I will take the L at 26 closure

My PT1=35

PT2=40.7

PT3= golden fib at 55$

HIGH RV; Symbotic's / Short-term long potential with earnings inShort-term long potential with earnings in about two weeks. Opening a long position with a stop 8% lower.

If the price continues higher, I’ll sell the majority before earnings but may hold around 20%.

This trade is taken with a small position size.

Symbotic $25.60 Buy.2024 was a bad year for Symbotic. The company were involved in some kind of accounting scandal, I don’t know the full facts but it sounds more like someone cocked up with the numbers rather than something more sinister.

As a result of this they are now being sued by investors which doesn’t help, something I am seeing more and more of on the news wires recently.

The fundamentals of the business look solid to me, their largest customer by far is Walmart for whom they supply automated warehouse systems.

Results come out early February, let’s hope they can sort the accounts out this time.

Charts look good for me, I see a nice Chanel starting to build, expecting a comeback this year

Symbotic Hypergrowth? $850 Price TargetOverview

Symbotic Inc. is an A.I. and robotics automation company based in Wilmington, Massachusetts that is looking to increase the ability for companies to keep up with growing demand. To do this, they utilize artificial intelligence software to maintain records and warehouse organization with the assistance of SKU numbers. Autonomous robots then account for, store, and retrieve items in a fraction of the time that it would take a human being. Symbotic's mission is to increase supply capabilities through the symbiotic relationship of artificial intelligence and robots. Its origins trace back to 2007, before it was known as Symbotic, and the company went public in 2022 ( NASDAQ:SYM ).

Call it FOMO, but I think Symbotic Inc. has the potential of becoming a hypergrowth stock. I built my own fundamentals tracker to get a pulse on the tech company's vitals and, while it still is not a profitable company, it looks like it's in the early stages of becoming so. The fundamentals for Symbotic provide me the confidence to invest despite the presence of red flags which led me to performing a deep dive. My price target for Symbotic Inc. is $850 with a projected timeline before 2030.

What I Don't Like

SYM has lost nearly 60% in value since July 2023 from a high of $64.15 to its current share price of $26.87. If you look up Symbotic Inc. on a search engine then you will also see that there are numerous law firms attempting to build class action lawsuits. The headlines can't help but to sow distrust by utilizing strong statements such as "misleading investors" and "inflated revenue" within their subjects. Within the last few weeks Symbotic had to file a delayed annual report due to self-identified accounting errors within their balance sheets. Also, if you dig through their filings, you will find that Symbotic Inc. was born from a deal with SVF Investment Corp which, according to the filings, was headquartered in the Cayman Islands.

I can only assume that the business dealings with SVF Investment Corp were to facilitate equity financing and an expedited public launch for SYM. From my findings, SoftBank Group Corp ( TSE:9984 ) is an investment conglomerate and the parent company to multiple subsidiaries. You guessed it, it is affiliated with SVF Investment Corp which functions as a "blank check company" for SoftBank. In my limited knowledge, this translates as a way for SoftBank to inject a substantial investment into the company that is now known as Symbotic Inc. No matter how savvy they may have been to launch Symbotic Inc., business deals that originate in the Cayman Islands typically raise one's eyebrows.

What I Do Like

Symbotic Inc. seems to have a pretty solid vision for global expansion and has attracted some significant institutional investors such as SoftBank, Vanguard, BlackRock, and Morgan Stanley to name a few. In fact, according to the NASDAQ site, 282 institutional investors hold 82% of Symbotic Inc.'s Class A Common Stock. Symbotic Inc. was founded by Richard "Rick" Cohen who currently serves as the CEO and is a legacy to the Cohen family who founded C&S Wholesale Grocers. Symbotic's technology is used by C&S Wholesale Grocers which is one of the largest privately held companies in the United States.

Symbotic and SoftBank have partnered on a separate venture known as GreenBox which is meant to deliver automated warehouses made possible by Symbotic's hardware and software. According to the company's site, GreenBox is supplying warehouses as a service to consumers. With an increase in online shopping, I believe that Symbotic is both seeing and filling a need in an industry that its founder is very familiar with. I can also envision Symbotic spreading its reach internationally which helps fuel my massive price target. Megacap stocks need to have a global influence and extend across industries, which Symbotic appears to be preparing for.

Fundamentals

Right now, Symbotic Inc. is in its early stages and is bringing in a negative income which makes it a risky investment. However, the company's total revenue has increased by 200% from 2022-Q4 to 2024-Q4; the gross profit has also increased by 147% in the same timeframe. Symbotic's net income has revealed consistent losses since 2022, but the 2024 annual report had the smallest loss on record at a negative $84.7M which is a 39% improvement from 2022 and a 59% improvement from 2023. No matter which way you cut it, the company is still absorbing annual losses so it will be important to keep an eye on improvements and deficiencies to identify any consistent trends.

NASDAQ:SYM has 585,963,959 total outstanding shares according to the 2024 Annual Report published at the beginning of December. This is a far cry from the 106M outstanding shares reported on some financial websites and even here on TradingView. From my findings, around 100M of Symbotic's shares are Class A Common Stocks and the remaining 485M are Class V Common Stocks. My focus is on the market capitalization which is a tool that I like to use when establishing long-term price targets. For Symbotic, which has the potential for global reach and use across multiple industries, I think it's reasonable to achieve a market capitalization of $500B.

Price Target

With the current number of outstanding shares at a market cap of $500B, this would place Symbotic's share price at $853. This type of growth would turn a $1,000 investment today into $31,710 at the projected target price; a whopping 3,000% return. HOWEVER, a lot has to happen to make this come to fruition. One thing I would like to see, in addition to profitability, is for Symbotic to begin buying back its own stock.

It's become my investing philosophy that companies who believe they are undervalued will buyback their shares while companies that believe they are overvalued will issue new shares. Symbotic's total outstanding shares have increased by 5.8% since its annual report at the end of 2022. I think that my philosophy is best tailored to established companies so it is possible that Symbotic could be an exception. Because the company is so new, it may need to issue more shares to generate enough capital to stay afloat while its roots set.

Symbotic has broken out and is about to SQUEEZE! 145% UpsideSymbotic NASDAQ:SYM has broken out and is about to SQUEEZE! 145% Upside

- Green on the High Five Setup Indicator

- Bull Flag Breakout held this week

- Sitting on a large volume shelf with a free range above the ATH area.

- 17%+ Short Float

- Wr% has created support in the consolidation box.

Look Left Target: $64

Measure Move (MM): $95

NFA

SYM eyes on $29.64: Dancing on a High Wire or a Launch Pad?SYM made serious moves off the bottom.

Currently dancing on a semi-major fib.

This could be a good entry for next leg.

Early going will be tough with clear hurdles.

But we might be accumulating here to launch.

Late longs here could have SL just below fib.

$ 29.64 is the key level of interest here.

$ 30.56 - 30.87 will be first resistance.

$ 31.88 - 32.11 is a MAJOR resistance.

Break of MAJOR resistance should run strong.

========================================

Trade Review - SYMI plan to be more active and share my trades and insights regularly.

Information

I swing trade with focus on stock with short term momentum. My trades are identified through a two-step screening process. I use a passive screener outside of market hours to manually select stocks based on structure and position, to allow preparation and prevent too many options. At market open, I run an active screener to track for movement within the watchlist, as timing and momentum in selected stocks can be unpredictable. This allows me to be time efficient, I require no more than 20-30 minutes per open session.

Identified through my passive screener outside of market hours, this stock showed an initial momentum move to the upside on the daily timeframe, followed by consolidation near the mean price - a setup conducive to continuation. I occasionally check a higher timeframe (weekly) for context; in this case, it made a overextension to the downside which could follow with a pullback toward the mean (or not). The aim here isn’t to predict but to take a bet / capitalize on potential imbalances when they appear. Thus it was added to the watchlist.

At market open, this stock appeared on my active scanner, and when it reached 24.60, I entered as a clear range expansion was forming. I typically scale out at 1R and hold the remaining position for a measured move (projected from the prior momentum move). While the approach is straightforward, I occasionally adjust based on real-time conditions, as seen in this example. Execution details are shown below.

Trade Overview

• Structure: Bullish Continuation (Daily) and Bearish Pullback (Weekly)

• Position: Near mean price (Daily) and extended from mean price (Weekly).

• Entry Trigger: Range Expansion

Entry Details

• Entry Price: 24.60

• Stop Price: 22.07

• Target Price: 34.32

• Expected Risk/Reward: 3.84 R

Exit Strategy

• Exit Price: Closed 50% at 29.84 and 25% at 29.45.

Performance Summary

• Result: Price have moved 20.53% with a profit of 2R, trailing 25% with a near SL.

I wrote a bit more than usual for this review since it's my first review post, but the real approach itself is quite simple. Future posts will be more concise.

Symbotic pumping (86%)#SYM bullish signs! Hot AI-stock to watch.

In near future price could pull back a bit.

=>this should be the right time to get into the market.

The short-timeframe isnt clear enough for me to call out the specific ElliottWave structure yet (probaly forming a diagonal 1st wave).

But im expecting price to dance around the blue-band. Then meet the the green-line and find shortterm resistance. When sustainably breaking out of the green-line, price could explode.