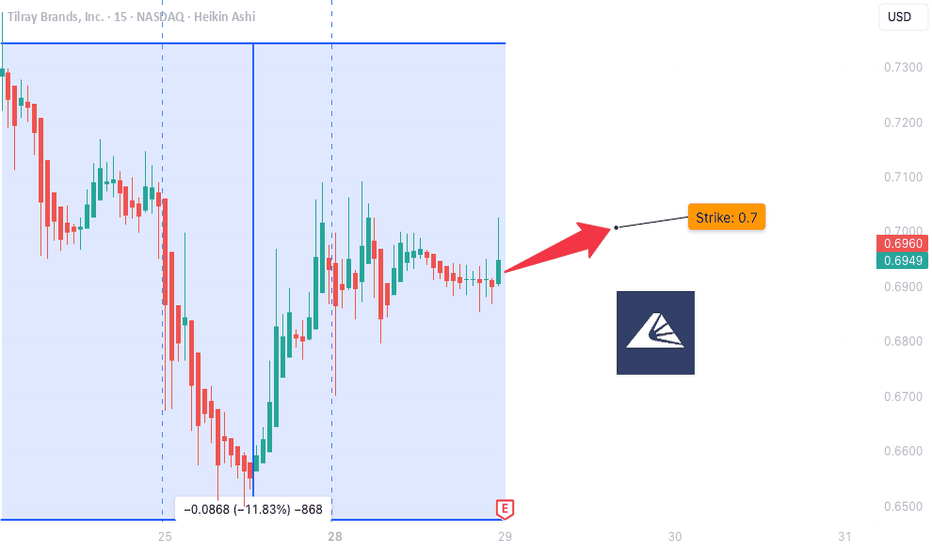

TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating M

Key facts today

Tilray Brands Inc posted a quarterly adjusted loss of $1.30 per share for the period ending May 31, improving from a loss of 4 cents per share last year.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.3090 USD

−2.19 B USD

821.31 M USD

1.03 B

About Tilray Brands, Inc.

Sector

Industry

CEO

Irwin David Simon

Website

Headquarters

Leamington

Founded

2018

FIGI

BBG00L7XTP60

Tilray Brands, Inc. is a global cannabis-lifestyle and consumer packaged goods company, which focuses on medical cannabis research and the cultivation, processing, and distribution of cannabis products worldwide. It operates through the followings segments: Cannabis Business, Distribution Business, Beverage Alcohol Business, and Wellness Business. The Cannabis Business segment focuses on cultivation, production, distribution, and sale of both medical and adult-use cannabis products. The Distribution Business segment is involved in purchase, resale, and distribution of pharmaceutical and wellness products. The Beverage Alcohol Business segment refers to the production, marketing, and sale of beverages. The Wellness Business segment represents the production, marketing, and distribution of hemp-based food and other wellness products. The company was founded on January 24, 2018 and is headquartered in Leamington, Canada.

Related stocks

TLRY Trade Update – Island Reversal in Play?🚨 TLRY Trade Update – Island Reversal in Play? 🚨

I’ve been tracking Tilray (TLRY) for a while now. While the company has struggled, it’s now trading well below book value and showing some life on the charts. Here’s what I’m seeing — and how I’m positioned.

My Position:

50 contracts Jan 2026 $0.50

TLRY BUYBUY TLRY at .10 to .06, riding it back up to 2.90 to 4.90 as Profit Targets, Stop Loss is at .01!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from th

$NASDAQ:TLRY Up in Smoke or Waiting for the Puff and Pump?NASDAQ:TLRY Up in Smoke or Waiting for the Puff and Pump?

Left for Dead or a Sleeper Rocket in the Making? 🚀

Alright, let’s talk about Tilray (TLRY). I know what you’re thinking: this thing’s been taken behind the woodshed, beaten, and then fed through the wood chipper—twice. Technically speakin

54% move completed. here's why this is the bottom.MARKETSCOM:TILRAY

we have just completed the 54% move down after the breakdown. you are supposed to take the highest move in the pattern and put it at the point of breakdown. the expected move after breakdown was 54% and we just hit that around 79 cents. this should be the local bottom. i have an

TLRY - A Last Gasp of a Dying Industry, Or?.....Cannabis stocks have been nothing short of annihilated lately.

The last administration failed to deliver on their hot air promises and now the current one has done nothing to help the industry. Yet.

We're headed either toward mass bankruptcy or the beginning of a new cycle.

TLRY around 25 on t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where TLRY is featured.

Frequently Asked Questions

The current price of TLRY is 0.5769 USD — it has decreased by −17.55% in the past 24 hours. Watch Tilray Brands, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Tilray Brands, Inc. stocks are traded under the ticker TLRY.

TLRY stock has fallen by −17.59% compared to the previous week, the month change is a 39.48% rise, over the last year Tilray Brands, Inc. has showed a −68.82% decrease.

We've gathered analysts' opinions on Tilray Brands, Inc. future price: according to them, TLRY price has a max estimate of 1.50 USD and a min estimate of 0.60 USD. Watch TLRY chart and read a more detailed Tilray Brands, Inc. stock forecast: see what analysts think of Tilray Brands, Inc. and suggest that you do with its stocks.

TLRY reached its all-time high on Sep 19, 2018 with the price of 300.0000 USD, and its all-time low was 0.3507 USD and was reached on Jun 23, 2025. View more price dynamics on TLRY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TLRY stock is 26.99% volatile and has beta coefficient of 1.14. Track Tilray Brands, Inc. stock price on the chart and check out the list of the most volatile stocks — is Tilray Brands, Inc. there?

Today Tilray Brands, Inc. has the market capitalization of 598.89 M, it has decreased by −5.40% over the last week.

Yes, you can track Tilray Brands, Inc. financials in yearly and quarterly reports right on TradingView.

Tilray Brands, Inc. is going to release the next earnings report on Oct 2, 2025. Keep track of upcoming events with our Earnings Calendar.

TLRY earnings for the last quarter are −1.30 USD per share, whereas the estimation was −0.02 USD resulting in a −5.43 K% surprise. The estimated earnings for the next quarter are −0.02 USD per share. See more details about Tilray Brands, Inc. earnings.

Tilray Brands, Inc. revenue for the last quarter amounts to 224.53 M USD, despite the estimated figure of 232.23 M USD. In the next quarter, revenue is expected to reach 205.66 M USD.

TLRY net income for the last quarter is −1.27 B USD, while the quarter before that showed −789.44 M USD of net income which accounts for −61.23% change. Track more Tilray Brands, Inc. financial stats to get the full picture.

No, TLRY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tilray Brands, Inc. EBITDA is 25.68 M USD, and current EBITDA margin is 3.13%. See more stats in Tilray Brands, Inc. financial statements.

Like other stocks, TLRY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tilray Brands, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tilray Brands, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tilray Brands, Inc. stock shows the sell signal. See more of Tilray Brands, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.