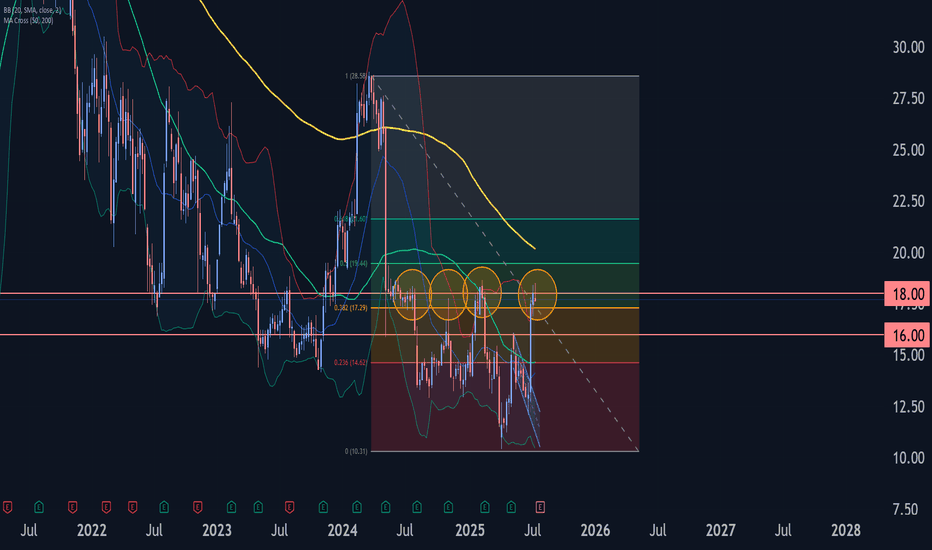

Trip Wave Analysis – 16 July 2025- Trip reversed from resistance area

- Likely to fall to support level 16.00

Trip recently reversed down from the resistance area located at the intersection of the strong resistance level 18.00, upper weekly Bollinger Band and the 38.2% Fibonacci correction of the weekly downtrend from 2024.

The

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.38 USD

5.00 M USD

1.83 B USD

110.21 M

About TripAdvisor, Inc.

Sector

Industry

CEO

Matthew A. Goldberg

Website

Headquarters

Needham

Founded

2000

FIGI

BBG001M8HHB7

TripAdvisor, Inc. is an online travel company, which owns and operates a portfolio of online travel brands. It operates through the following segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travelers and experience seekers an online global platform for travelers to discover, generate, and share authentic user-generated content. The Viator segment enables travelers to discover and book iconic, unique, and memorable experiences from experience operators around the globe. The TheFork segment provides an online marketplace that enables diners to discover and book online reservations. The company was founded by Nicholas Shanny and Stephen Kaufer in February 2000 and is headquartered in Needham, MA.

Related stocks

Trip Wave Analysis – 1 July 2025- Trip broke daily down channel

- Likely to rise to resistance level 14.50

Trip recently broke the resistance trendline of the daily down channel from the start of May (inside which the price has been falling in the last few weeks).

The breakout of this down channel accelerated the active short-te

Trip Wave Analysis – 11 March 2025

- Trip reversed from multi-month support level 13.00

- Likely to rise to resistance level 14.20

Trip recently reversed up from the support area between the multi-month support level 13.00 (which has been reversing the price from September) and the lower daily Bollinger Band.

The upward reversal f

TRIP at a Make-or-Break Moment: Reversal Incoming?TRIP is currently testing a major descending trendline resistance around $18.85-$19.00, a critical level that could determine its next move. If price breaks and holds above this resistance, it may trigger a shift in trend, with the next key target at $27.15. However, failure to break out could resul

Bullish Breakout $TRIPTripAdvisor, Inc. is an online travel company, which owns and operates a portfolio of online travel brands. It operates through the following segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travelers and experience seekers an online global platform for traveler

TripAdvisor | TRIP | Long at $14.83Travel Boom: Commence. TripAdvisor, Viator, and TheFork NASDAQ:TRIP

Pros:

Profitable company

Earnings are forecast to grow by an average of 30.9% per year for the next 3 years

Debt to equity is 0.94x (low)

My historical simply moving average is approaching the price (which may lead to

TRIP Tripadvisor Buy TF H1 TP = 16.83On the hour chart the trend started on August 28 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 16.83

But we should not forget about SL = 15.18

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am v

Stock to buy. Trip Advisor Could Make Your Portfolio ExplodeIf you're looking for a growth stock to add to your portfolio, you may want to consider TripAdvisor (NASDAQ: TRIP). The online travel company has seen its stock price nearly lose 50% of its value in the past year and is currently trading at all-time lows with a strong weekly demand level in control.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where TRIP is featured.

Frequently Asked Questions

The current price of TRIP is 17.82 USD — it has decreased by −0.45% in the past 24 hours. Watch TripAdvisor, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange TripAdvisor, Inc. stocks are traded under the ticker TRIP.

TRIP stock has risen by 0.62% compared to the previous week, the month change is a 32.00% rise, over the last year TripAdvisor, Inc. has showed a 2.35% increase.

We've gathered analysts' opinions on TripAdvisor, Inc. future price: according to them, TRIP price has a max estimate of 24.00 USD and a min estimate of 13.00 USD. Watch TRIP chart and read a more detailed TripAdvisor, Inc. stock forecast: see what analysts think of TripAdvisor, Inc. and suggest that you do with its stocks.

TRIP reached its all-time high on Jun 30, 2014 with the price of 111.24 USD, and its all-time low was 10.43 USD and was reached on Apr 9, 2025. View more price dynamics on TRIP chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TRIP stock is 2.49% volatile and has beta coefficient of 1.40. Track TripAdvisor, Inc. stock price on the chart and check out the list of the most volatile stocks — is TripAdvisor, Inc. there?

Today TripAdvisor, Inc. has the market capitalization of 2.33 B, it has decreased by −2.86% over the last week.

Yes, you can track TripAdvisor, Inc. financials in yearly and quarterly reports right on TradingView.

TripAdvisor, Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

TRIP earnings for the last quarter are 0.14 USD per share, whereas the estimation was 0.03 USD resulting in a 316.70% surprise. The estimated earnings for the next quarter are 0.41 USD per share. See more details about TripAdvisor, Inc. earnings.

TripAdvisor, Inc. revenue for the last quarter amounts to 398.00 M USD, despite the estimated figure of 386.23 M USD. In the next quarter, revenue is expected to reach 529.64 M USD.

TRIP net income for the last quarter is −11.00 M USD, while the quarter before that showed 1.00 M USD of net income which accounts for −1.20 K% change. Track more TripAdvisor, Inc. financial stats to get the full picture.

TripAdvisor, Inc. dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 2.86 K employees. See our rating of the largest employees — is TripAdvisor, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TripAdvisor, Inc. EBITDA is 225.00 M USD, and current EBITDA margin is 11.93%. See more stats in TripAdvisor, Inc. financial statements.

Like other stocks, TRIP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TripAdvisor, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TripAdvisor, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TripAdvisor, Inc. stock shows the buy signal. See more of TripAdvisor, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.