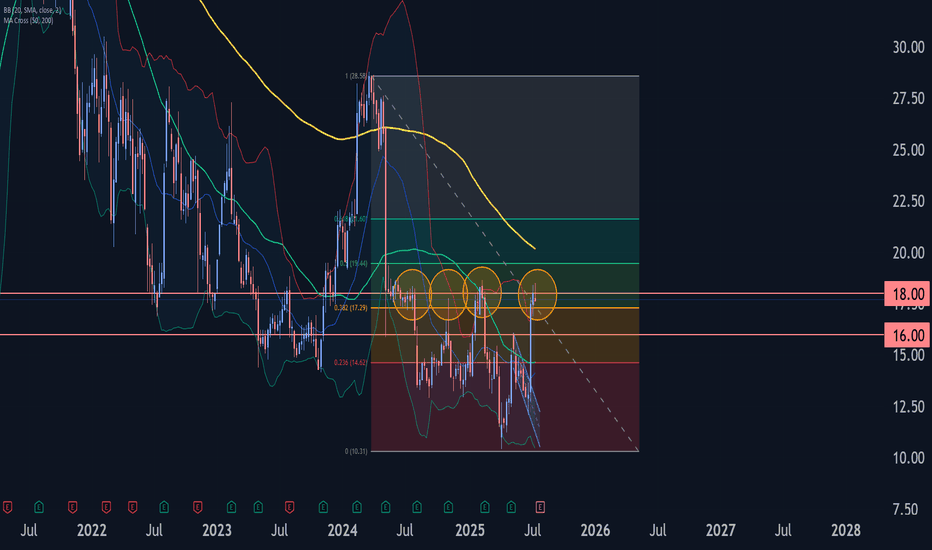

Trip Wave Analysis – 16 July 2025- Trip reversed from resistance area

- Likely to fall to support level 16.00

Trip recently reversed down from the resistance area located at the intersection of the strong resistance level 18.00, upper weekly Bollinger Band and the 38.2% Fibonacci correction of the weekly downtrend from 2024.

The downward reversal from this resistance area stopped the earlier weekly impulse waves i and C.

Given the strength of the resistance level 18.00 and the overbought weekly Stochastic, Trip can be expected to fall to the next support level 16.00.

TRIP trade ideas

Trip Wave Analysis – 1 July 2025- Trip broke daily down channel

- Likely to rise to resistance level 14.50

Trip recently broke the resistance trendline of the daily down channel from the start of May (inside which the price has been falling in the last few weeks).

The breakout of this down channel accelerated the active short-term corrective wave (ii) – which is part of the downward impulse wave C from last month.

Trip can be expected to rise to the next resistance level 14.50 (which reversed the previous waves ii and (2) at the start of June).

Trip Wave Analysis – 11 March 2025

- Trip reversed from multi-month support level 13.00

- Likely to rise to resistance level 14.20

Trip recently reversed up from the support area between the multi-month support level 13.00 (which has been reversing the price from September) and the lower daily Bollinger Band.

The upward reversal from this support area stopped the previous downward impulse wave (3).

Given the strength of the support level 13.00 and the oversold dally Stochastic, Trip can be expected to rise to the next resistance level 14.20.

TRIP at a Make-or-Break Moment: Reversal Incoming?TRIP is currently testing a major descending trendline resistance around $18.85-$19.00, a critical level that could determine its next move. If price breaks and holds above this resistance, it may trigger a shift in trend, with the next key target at $27.15. However, failure to break out could result in a pullback to the $16.00-$17.00 support zone. The increasing volume suggests renewed interest, but the stock remains in a downtrend until proven otherwise. If momentum weakens here, a potential retest of lower supports near $12.00 could occur. This is a pivotal moment—either TRIP breaks out and signals strength, or it remains trapped within its multi-year downtrend.

Disclaimer:

This analysis is for educational purposes only and should not be considered financial advice. Trading and investing involve risk, and independent research or consultation with a professional is recommended before making any financial decisions.

Bullish Breakout $TRIPTripAdvisor, Inc. is an online travel company, which owns and operates a portfolio of online travel brands. It operates through the following segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travelers and experience seekers an online global platform for travelers to discover, generate, and share authentic user-generated content. The Viator segment enables travelers to discover and book iconic, unique, and memorable experiences from experience operators around the globe. The TheFork segment provides an online marketplace that enables diners to discover and book online reservations. The company was founded by Nicholas Shanny and Stephen Kaufer in February 2000 and is headquartered in Needham, MA

TripAdvisor | TRIP | Long at $14.83Travel Boom: Commence. TripAdvisor, Viator, and TheFork NASDAQ:TRIP

Pros:

Profitable company

Earnings are forecast to grow by an average of 30.9% per year for the next 3 years

Debt to equity is 0.94x (low)

My historical simply moving average is approaching the price (which may lead to price spike)

Cons:

P/E is 68.37x

No dividend

A lot of industry competition

Insiders recently exercising options

I anticipate a global travel boom, particularly in the US, as a wealth transfer occurs and baby boomers spend their money. Thus, at $14.83, NASDAQ:TRIP is in a personal buy zone.

Target:

$17.00

$19.00

$25.00

$34.00 (very long-term outlook)

TRIP Tripadvisor Buy TF H1 TP = 16.83On the hour chart the trend started on August 28 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 16.83

But we should not forget about SL = 15.18

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelieveInTrading

Stock to buy. Trip Advisor Could Make Your Portfolio ExplodeIf you're looking for a growth stock to add to your portfolio, you may want to consider TripAdvisor (NASDAQ: TRIP). The online travel company has seen its stock price nearly lose 50% of its value in the past year and is currently trading at all-time lows with a strong weekly demand level in control. The imbalance is trading at HKEX:18 per share. This demand imbalance has a lot of potentials to help TripAdvisor stock rally in the following weeks.

TRIP Bullish inclined naked puts 24 Feb expiryWhats The Plan/Trade/Thought

It looks like in the short term traders will be more concerned about interest rates and the impact it will have. The sentiment now seems to be that recession will be a soft landing. I think we need to trade on this optimism at least for the next month.

Lets look at categories with strong fundamentals where money might flow into given it’s stability

Travel Services (Exclude Airlines) - As international tourism increases we can expect this category to start playing catchup

- Growing annual revenue since 2021

- Quarterly revenue is estimate to drop Q4 2022 and Q1 2023

- 7.56% Short interest

- D1 - Above 100EMA

- H1 - Above 100EMA

Risk Mitigation

21.61 This is the Trade Risk Point. If it breaks this, it means I was wrong on the direction

Can You Trade The Opposite Side (Y/N)

No

Trade Specs

Sold 510 Puts @ 0.21

Strike 20

17% to Strike

BP Used: 110k

Max Gain: 10.7k

It's time for a TRIP- BUY TripAdvisorShe's coming down now but this looks like a re-test of the accumulation zone. Over-sold now since breaking down from $39.00. I think this one is ripe for the picking. I'll put my head on the block here and say, anything between between $32.50 and $33.20 is a buy. You heard it here first. Have a nice trip.

Buy Setup with Good Risk/Reward #TRIPDue to pandemic travel industry has been severely hit but now with opening of economy and lesser travel restrictions, #TRIP is gaining some interest from smart money and it seems smart money has been taking positions slowly. Buy #TRIP at current prices with SL 28 for targets much higher 100+ with in next 1-2 years.

Disclaimer :

Trading is never ever recommended as it is injurious to mankind. This is purely my study based on technical charts and for educational purpose only. Please do your analysis before taking any trades given by me. I MUST not be held responsible for any profit or loss out of any trades you take on our advice. All Disclaimers Apply.