TTEC Holdings Inc, 500% return for the shrewd** long term forecast, the months ahead **

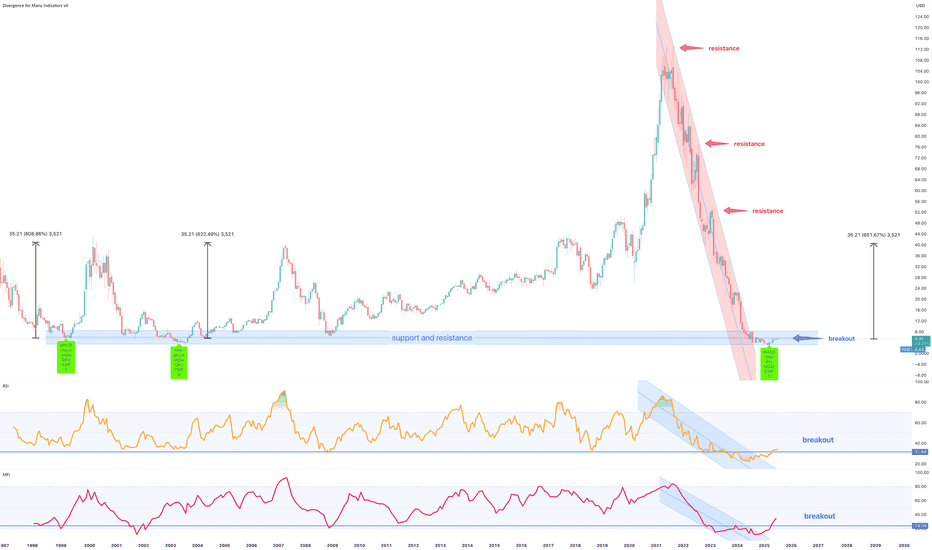

A 97% correction is shown on the above 16 day chart. As of 2021 price action has collapsed from $112 to circa $5 today. A number of reasons now exist for a bullish outlook.

Support and resistance

Price action, Relative Strength Index (RSI), and Money Flow Index both print resistance breakouts.

Look left. Price action is now on legacy support from 1999, 2003, and 2009 market bottoms. This is not the place to be a seller.

The trend

Something interesting in the RSI and MFI (orange and pink lines below chart). They are showing signs of a trend reversal, with higher highs and lower low prints after the breakouts. Exactly what happened in 1999, 2003, and 2009. A deja vu moment.

Positive divergence

Multiple oscillators print positive divergence with price action. Ready to be dazzled? Not only multiple oscillators as in previous years but the same oscillators!

The Stock

Two notes of interest,

1. No share splits.

2. Short interest 18%

Fundamentals

If you’re not chasing businesses who seek to implement AI into their operations, then you’re going to be miss out on some of the best returns in the years ahead. Crypto currency was yesterday, now in decline and dying. Today the narrative is AI, follow the money.

Is it possible price action continues to correct? Sure.

Is it probable? No

Ww

TTEC trade ideas

Update Watchlist US-Market Sep 8thThe general market action is discussed using the large US market indices and our updated watchlist is presented:

www.tradingview.com

The updated watchlist includes the following stocks:

SHOP, ATKR, AFG, WIRE, MT, FND, SCU, POOL, VRTS, IDXX, AIG, HCA, BLDR, CNOB, ON, CAMT, CSTM, TTEC, AXON, CATO, PNFP

TTEC- Write Covered Call (Lesson)The covered call involves writing a call option contract while holding an equivalent number of shares of the underlying stock. It is also commonly referred to as a "buy-write" if the stock and options are purchased at the same time.

*REFER TO CHART: for further information:

1) Buy in lots of 100 shares TTEC

2) Current price: $36.80

3)Purchase price: $36.80

4) Number of shares purchase: 100

*Total Cost: $3,680

Option:

Buy or write: WRITE (Being the Banker or Casino and SELLING options is best...why? they always win)

Option: 20th July $40.00 Call

Price per option: 0.88

Contracts: # 1 x 100

Total cost: $88.00<--- CREDIT,goes immediately back into your account.

Max. Risk: $3592

Max. Return: $408 at a price of $40 at expiry or HIGHER

Break-evens at expiry: $35.93

This option strategy is conservative in retirement accounts, or investing. Just have to buy stocks/option at same time. If PA stays in between current PA of $36.80-$40.00 now & in between 7/20/18- you still make $88.00, then get $3,680 back in account minus margin account fees. *Is $408 in profit more then you could make in interest on $3,680 in your bank? at 1%-6%? My guess is yes. Trading is all about having a solid foundation to trade off of.