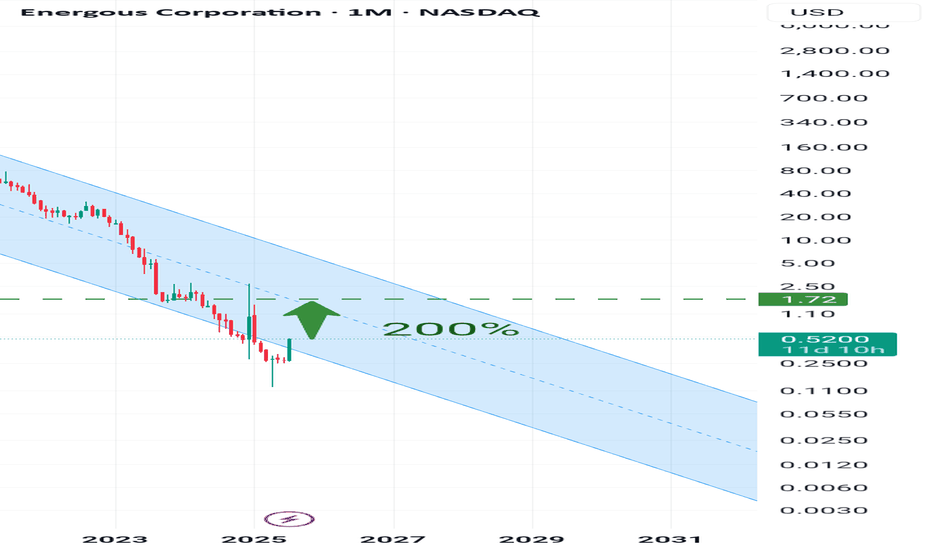

WATT trade ideas

WATTDisclaimer:

The information provided is for informational purposes only and should not be construed as financial, investment, or business advice. This analysis is based on publicly available data and does not account for all market conditions or specific circumstances of individual companies. Investing in or acquiring companies like Energous Corporation (WATT) involves significant risks, including but not limited to market volatility, financial instability, and the potential for loss of investment.

Readers should conduct their own research, consult with financial advisors, and consider all risks before making investment decisions. This discussion does not constitute an endorsement or recommendation of any particular company or strategy.

Energous Corporation (WATT) appears to be an intriguing speculative play in the tech and EV-related space, particularly given its unique wireless charging technology. Let's break it down further to assess the implications if an EV company were to acquire this company:

Pros of Acquisition by an EV Company

Strategic Synergy:

WATT's radio frequency (RF)-based charging could complement EV wireless charging infrastructure, especially for IoT-enabled vehicle systems, in-car sensors, or auxiliary devices like key fobs, wearables, and infotainment systems.

Integration of WattUp technology could reduce reliance on traditional charging ports in EV accessories, enhancing the convenience and futuristic appeal of the brand.

Growth Potential:

WATT's technology aligns with the growing EV ecosystem, especially as smart homes and IoT connectivity continue to expand.

EV companies focusing on innovation and cutting-edge features (like Tesla or Rivian) could use WATT to differentiate themselves from competitors.

Forecasted Growth:

A revenue growth forecast of 206.52% per year highlights strong potential in WATT's niche market. An EV company's resources and distribution network could help capitalize on this potential.

Affordable Acquisition:

With a market cap of just $3M, acquiring WATT would be inexpensive for any established EV company. The low valuation provides an opportunity to acquire promising intellectual property without significant financial risk.

R&D and Intellectual Property:

WATT’s expertise in RF-based charging systems could be leveraged to develop next-gen charging technologies for EVs and expand wireless energy solutions beyond IoT.

Risks and Challenges

Revenue and Market Cap Concerns:

WATT's revenue is less than MIL:1M annually, signaling a company that is far from profitability and reliant on external funding. An acquirer must be prepared to invest heavily to commercialize the technology.

Dilution and Financial Health:

Shareholder dilution indicates potential challenges in managing equity and sustaining operations without further funding. This might deter EV companies focused on stable financial performance.

Uncertain Market Demand:

RF-based wireless charging is promising but remains niche compared to inductive charging. EV companies would need to evaluate if this technology can achieve widespread adoption.

Volatility:

WATT's volatile share price and small scale may make it challenging to predict long-term stability, even with an acquisition.

Regulatory and Integration Hurdles:

Adapting RF technology for EVs might involve significant R&D and face regulatory hurdles, particularly for safety in high-power applications.

Final Thoughts

An EV company acquiring Energous Corporation could be a bold move with potential strategic benefits, especially for integrating innovative wireless charging solutions into the IoT and EV ecosystem. However, such a move would only make sense if:

The EV company has the resources to scale WATT's operations and adapt its technology for automotive applications.

There is a clear roadmap for commercialization and a plan to address WATT’s financial and operational weaknesses.

In essence, while the technology is exciting and offers differentiation potential, the acquirer would need a long-term vision and tolerance for high risk.

WATT 16 month bullish call ideaI LOVE getting in on long term calls when a stock price is really low (like under 10, definitely under 5), cause the options are priced SOOO freaking low. This thing is under 1.50. Calls for Jan 2024 are around 0.50. In the past year it has gotten above 6. If we have a roll over in the market and early next year might look to pick up some Calls for Jan 2025. Thing looks very promising for next year or so. Not betting house, be responsible.

WATT LongDemand Zone Conformation

WR crossed -80

OBV is not good yet

Entry 2.73

Stop 2.00

Target 7.2

Risk management is much more important than a good entry point.

The max Risk of each plan should be less than 1% of an account.

I am not a PRO trader. I trade option to test my trading plan with small cost.

$WATT Possible Bullish Reversal Indicator - Morning Star PatternWATT just formed a beautiful Morning Star candlestick pattern which may have identified $2.25 as a new bottom. Morning Stars are usually good reversal points, and as long as it doesn't close below $2.25 then it will remain as the new bottom. The Oscillators aren't that tempting to enter into a new trade, but if WATT can break $3.00 then I would be happy to enter. I would be even more excited if there was a high volume day. For now everything is still significantly low, so no one is sure if it's worth the squeeze yet!

WATT -- READY TO POP!!The upside its overwhealming. The resistance being broken resulted in huge moves before and rejected strong uptrend to turn them into neutral movements for many bars. Now it its moment to shine and break through this milenarian resistance.

Good luck, though you wont need it for this one.

Just a thought,

Enjoy!

Two optionsThe entered market is in a crash mood. However, let' see beyond the psychological panic effect.

One thing I learned through my life experiences is that behind every negative event, there is always a hidden opportunity.

Almost all stocks are in consolidation, pennant, falling wedge or bullish flag. getting ready either for another deep or a rally. I believe that discipline and patience is the key to surviving. Let's learn from mistakes and grow wiser.

I am inclined to option 2 here due to the huge potential of this stock.

WATT Potential Over-Correction BreakoutWATT (Energous Corp.) Identifying the primary breakout levels indicates a high probability for a breakout event beginning on 21/3/8. WATT has had two prior breakout events at the 3.80 level, first on a descending trend and second on an ascending trend, with a high peaks realized following descending trend lines (Over-Correction). The current scenario is occurring on a descending trend line at the point of uptrend reversal. Other factors include the ongoing market correction that caused a steep down trend to occur last week. This increases the probability for an over-correction up to approximately 4.33 (+/-) in the up trend.

Full disclosure, I currently have no position in WATT so this projection just my unbiased opinion of a probable movement, based solely on previous performance.

WATTImagine just sitting or standing in a room where all of your devices are charging simultaneously without the need for a cord or device to connect your phone too. Imagine that....

I love this innovation and they have some good news behind them.

Like, Follow, Agree, Disagree!

What do you think?

Details in photo.