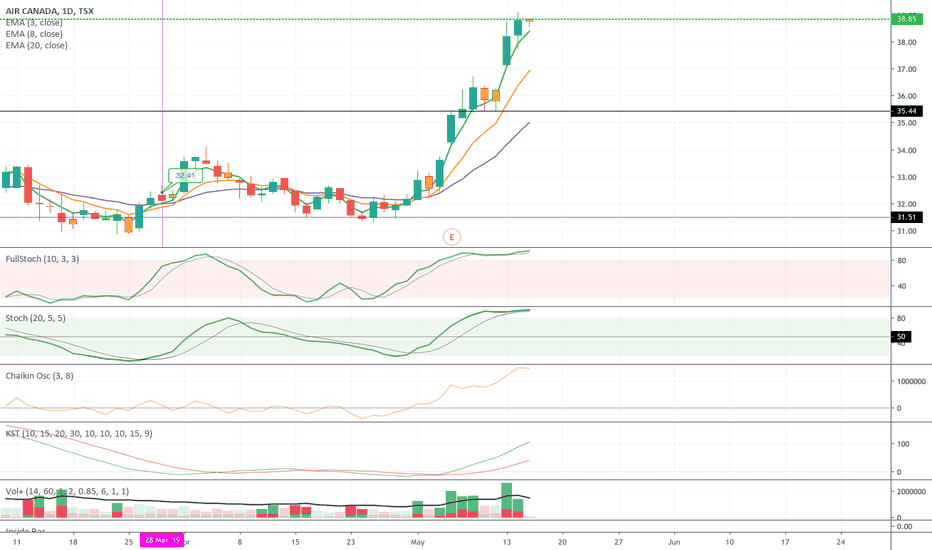

AC trade ideas

$40 target on Air CanadaAverage analysts price target $52 and a buy rating, we see $40 as a reasonable target in the short term.

COMPANY PROFILE

Air Canada provides airline transportation services. It engages in full-service airline, scheduled passenger and cargo services, serving more than two hundred airports on six continents. It operates flights in Canada, the USA, Latin America, Europe, Australia and Asia. The company was founded on April 11, 1936 and is headquartered in Saint-Laurent, Canada.

Air Canada sideways channelLooks like I found another possible sideways channel where I can trade sideways and take advantage of the ping pong effect.

The support line being at around $22.0 and the Resistance line being at $26.20.

From Nov 13 to Jan 3rd, it tried to penetrate the 50 MA. It successfully did but was only stopped by the $26.20 resistance line.

Now it is doing the same thing for Jan 9th to Feb 15. It tried to penetrate the 50 MA and it did on the 16th of Feb. It is on its way to

to hitting the resistance line. 20 EMA just crossed over the 40 EMA. MACD is on a bullish momentum.

Adding to Air Canada PositionAC.TO trading at a PE of under 4x heading into holiday sales figures after their annual report could pull them back up from this clean support line touch in today's session. I already have a position of AC starting around $22.00 and will be using this pull-back to add to my position.

Entry Point AIR CANADAI called the reversal about 3 weeks ago and I think that AC is trying to prove that this was just a temporary sell-off. The stock has fallen from highs of $28.50 to $21 and is now trading at $24.93. Fundamentally AC is strong with a good position in the Canadian market. It is showing on the chart attached that it is hovering around support zones and will probably continue to keep trickling upwards until it has a reason for a bigger breakout to new highs. RSI is showing that the stock is not overbought nor oversold, but it's hovering in the 45-55 range which could indicate this is building up a base. Furthermore, the 50, 100, and 200 moving averages are converging which could show that this is pent up and ready for a breakout.

Potential Inflection Point for Air Canada

Good morning all, I hope your weekend was spent well and are ready for another trading week.

Air Canada is my favourite stock pick of the year, I was long at $21 a couple of months back and I have seen a solid 26% gain. However, I feel as though we are in for a trend reversal. I still like where I own the stock and will be buying on pullbacks. I can see this chart going one or two ways.

First, AC will have a pullback towards its 50day moving average and continue its up-trend going forward. The stochastic RSI is showing underbought symbols, however, what puzzles me is the potential convergence/divergence point in the MACD indicator, its been bouncing along giving weak buy signals and that is making me question the strength of this up-trend.

I would either hedge Air Canada with a few medium-term put options, enter short, or buy the dip. This one can truly go either way.

Stay sharp out there.