TD trade ideas

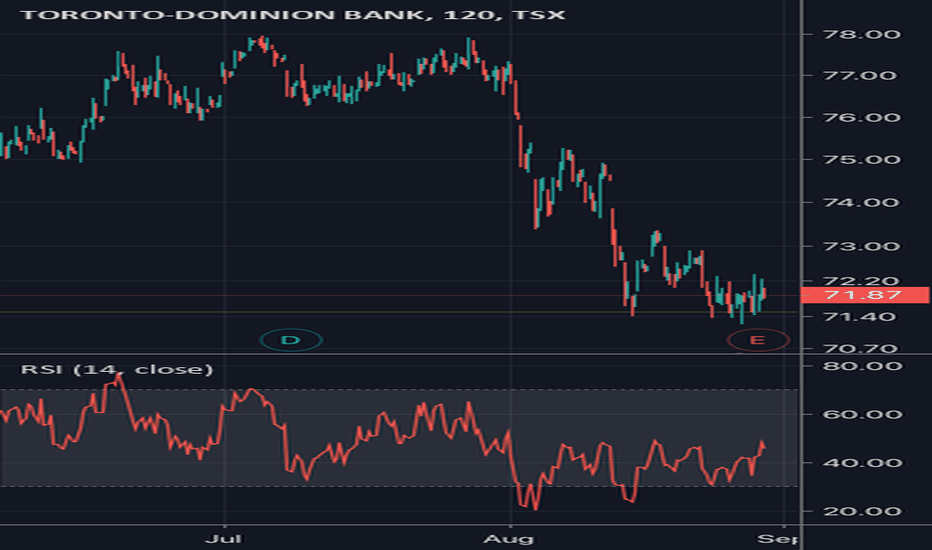

VOLATILITY: Using RSI, AO, KST and TSX IndexHey there, first idea, trying to get reputation for chat so I can learn more.

I'm using RSI to get an idea of when a stock is over/under sold as an indicator for a reversal.

I'm using AO to get an idea of short-term vs long term trends as an indicator for a reversal trend.

I'm using KST for the same reasons.

I compare these against the current trend of the stock and the TSX Index.

I see our current situation as a channel of volatile uncertainty in a general upward trend that will continue until full economic revoery and we'll end-up with an L shape.

You Think a Bank Going Up 18% in 1 Day is Normal? LOL No.We saw a hilarious 7%+ rally in the last 25 minutes in the US indices and Canadian markets but that's all it will end up being - hilarious.

This was nothing more than a mega algo pump for cheap short accumulation and this will come home to roost in a likely Monday and Tuesday historic bloodbath.

I mean lets be honest, do you really think a Canadian bank could legitimately pop 18% in a single day? That my friends is what we call a total joke.

Please visit my ideas below to see what I believe will happen, why and the timing. Overall, we will see VIX shoot past 90 and financials and energy sectors will get completely obliterated (amongst the entire market).

We are about to witness a historic crash like no other with the years of malaise like the dotcom bubble, but the 50% severity of the financial crisis.

- zSplit

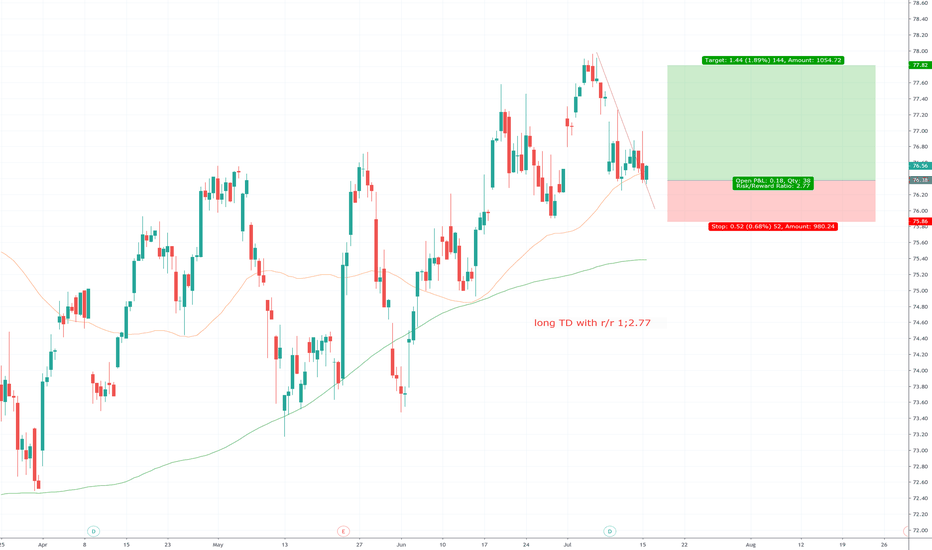

Td bank bullish entryClose to 6mth low.

RSI showing oversold scenario.

Earnings just released, revenue positive, just that Act EPS didn’t beat estimates.

MA cross didn’t cross yet but I have a feeling that it should in a couple of days.

Dividend yield 4-5% very promising to keep paying out dividends.

Stay Put & Keep WatchingThis is the time to exercise your patience guys!

Last week I thought that TD was breaking out of the resistance of $77.46 which it did.... FOR ONLY LIKE 2 DAYS!!

Then it retraces back to the 20/50 EMA. TD is playing it safe and so are the investors.

Can we expect future events from the chart? Maybe.

I see that the MACD is also moving sideways and it has no intention of changing to a bull direction.

Majority of the stock I am look at is either bearish or moving sideways. It is getting comfortable doing just that.

Looking at the TSX it is struggling to breakthrough its resistance as well.

So just sit tight and wait it out.

TD Bank Max high and low until Sept/oct 2019Maybe setting up for a right shoulder like it did back in 2007. I don't see how banks can outperform now.. housing is slowing down.. the fed's have distorted the markets with their rate schemes. Even customers don't even know what to do but complain, lose debit cards, and try to dispute fees. That's today's banking. I don't see what would cause to break to record highs and go higher in this economy and mind set.