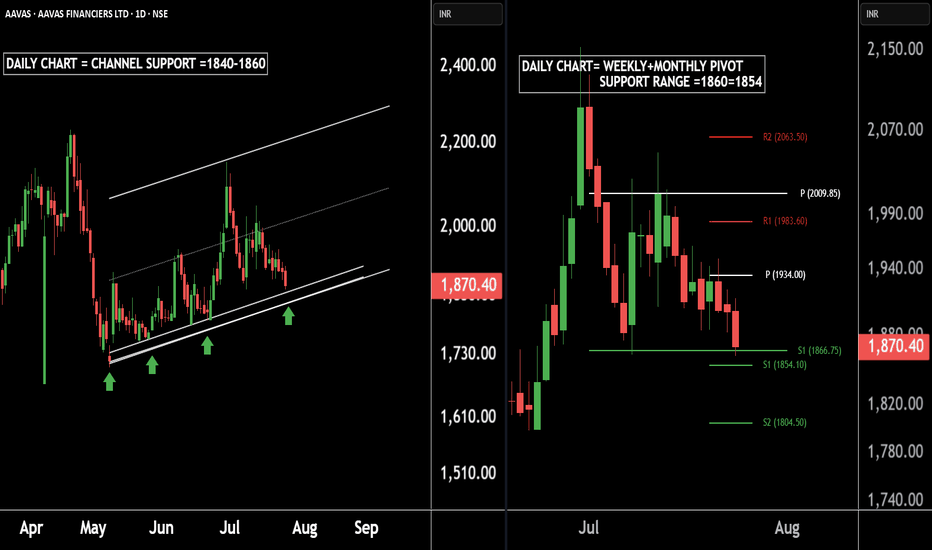

AAVAS Housing – A Hidden Gem for Medium-Term InvestorsThere are two charts of AAVAS FINANCIERS.

On the first chart AAVAS FINANCIERS is moving in a well defined parallel channel with support near at 1840-1860.

On the second chart AAVAS FINANCIERS is taking Weekly + Monthly support near at 1866-1854.

If this level is sustain ,then we may see higher prices in AAVAS FINANCIERS LTD.

Thank You !!

AAVAS trade ideas

AAVAS -----BULLISH HARMONICS running 75 mins short to medium This stock is exhibiting a bullish harmonics wave structure.

correction wave leg seems completed

Investing in declines is a smart move for short/ long-term players.

Buy in DIPS recommended

Long-term investors prepare for strong returns over the next two to five years.

Every graphic used to comprehend & LEARN & understand the theory of Elliot waves, Harmonic waves, Gann Theory, and Time theory

Every chart is for educational purposes.

We have no accountability for your profit or loss.

aavASAavas Financiers said the launch of Pradhan Mantri Awas Yojana (PMAY) 2.0 scheme, including the interest subsidy scheme for urban housing, will be pivotal in improving loan accessibility for economically weaker sections and low-income groups, empowering countless individuals to realise their dreams of homeownership. This bold initiative reflects the government's steady commitment to ensuring that every Indian has access to safe and affordable housing, driving inclusive growth and prosperity for all.

in the past two months, the stock price of Aavas Financiers has outperformed the market by surging 20 per cent as the company’s Assets under Management (AUM) grew by 20 per cent year-on-year (Y-o-Y) and stood at Rs 19,238 crore as on December 31, 2024 (Q3FY25). Disbursements during Q3FY25 grew by 17 per cent Y-o-Y and 23 per cent sequentially to Rs 1,594 crore. Further, in the April to December 2024 period (9MFY25), disbursement grew by 11 per cent Y-o-Y to Rs 4,099 crore.

Aavas Finance Build Bullish Trend 1. **Aavas Financiers Ltd.** is a leading housing finance company in India, primarily catering to low- and middle-income customers in semi-urban and rural areas.

2. The company was incorporated in 2011 and is headquartered in Jaipur, Rajasthan.

3. It provides home loans, mortgage loans, and related financial services to individuals who lack formal income documentation.

4. Aavas Financiers follows a customer-centric approach, offering customized loan solutions with flexible repayment options.

5. The company has a strong presence across multiple states in India, with an extensive branch network.

6. **Management Team:** The company is led by CEO **Vishal Pagaria**, with a professional leadership team overseeing operations, finance, and risk management.

7. Aavas focuses on leveraging technology and digital platforms to enhance loan processing and customer experience.

8. The company has received strong credit ratings due to its robust asset quality and risk management framework.

9. Aavas Financiers has shown consistent financial growth, with a focus on sustainable lending practices.

10. The company is listed on the NSE and BSE, with a commitment to transparency, governance, and long-term value creation for stakeholders.

Aavas finAll is well

Good day

Just my view and educational purposes only I'm not a SEBI registered advisory...trade on your own risk.

This is simple ORB Strategy with volume breakout..i will enter EOD 3.25pm if the price trade above the blue line and after entry I will wait for my target or stoploss (D candle should close below the red line) in valid if direct not triggered and closed below red line..

Just a view educational purposes only

# AAVAS NSE DTF/WTF/MTF Range Breakout Confirmation POSITIONAL ONLY.

#AAVAS Financials NSE has Broken Out of a Range of 64Weeks or 15months, WYCKOFF Cycle Typical with Accumulation after a Downtrend

The 50 EMA Golden Crossover on 6th June ...

The Price is now Ready for Entry @1870 -1900 Price,Strong Support 1690 SL at 1800

Targets 1900, 2400, 2630.. All Time High 3340...

SWING IDEA - AAVAS FINANCIERSConsider a compelling swing trade opportunity in Aavas Financiers , a leading housing finance company in India.

Reasons are listed below :

Bullish Marubozu Candle on Weekly Timeframe : Aavas Financiers shows a strong bullish candlestick pattern, indicating robust buying pressure and potential upward momentum.

Engulfing 22 Weekly Candles : The stock's bullish momentum is evident by engulfing 22 previous weekly candles, signaling a significant shift in market sentiment.

Breakout from 5-Month Consolidation : Aavas Financiers breaks out from a 5-month consolidation phase, suggesting a breakout from range-bound trading and potential sustained upward movement.

Formation of Double Bottom Pattern : The absence of new lower lows and the formation of a double bottom pattern suggest a trend reversal and bullish sentiment.

Sudden Surge in Volumes : A notable surge in trading volumes indicates increased market interest and potential accumulation by investors, supporting the bullish outlook.

Target - 1815 // 2400

Stoploss - weekly close below 1300

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - AAVASPrice action has recently shown a good change from Lower High Lower Low to starting with Higher High to Higher Lows.

MACD has successfully made a cross on the Monthly charts too indicating a good momentum upward.

Weekly MACD cross looks healthy too.

Marubozu candle on 1st week of April indicates a good move too.

Stock exactly trading above recent Marubozu candle levels as well.

Lets Go!!!

Down by 55% now, one should you buy or avoid it !Here in Aavas Financiers are already declined by 55% in the last few months and currently trading at the 1353 level with strong support at 1335 & 1330. Look like it will take reversal from this level now and again fly high for a strong target as below :

Buy Above 1385 level on a closing basis

Target 1 - 1510

Target 2 - 1588

Target 3 - 1700

Strict Stop loss - 1300

Please consult your financial advisor before taking any trade on my analysis.

Review and plan for 13th June 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

aavasMortgage bank lender's assets under management (AUM) up 22% y/y as of March-end, disbursements up 20%

** Citi believes AVAS can maintain margins despite rise in financing costs, sees AUM rising 24% in FY25 and 25% in FY26

** Jefferies maintains "Buy", with PT of 1,940 rupees; says it sees growth improving on the back of tech rollout, other initiatives