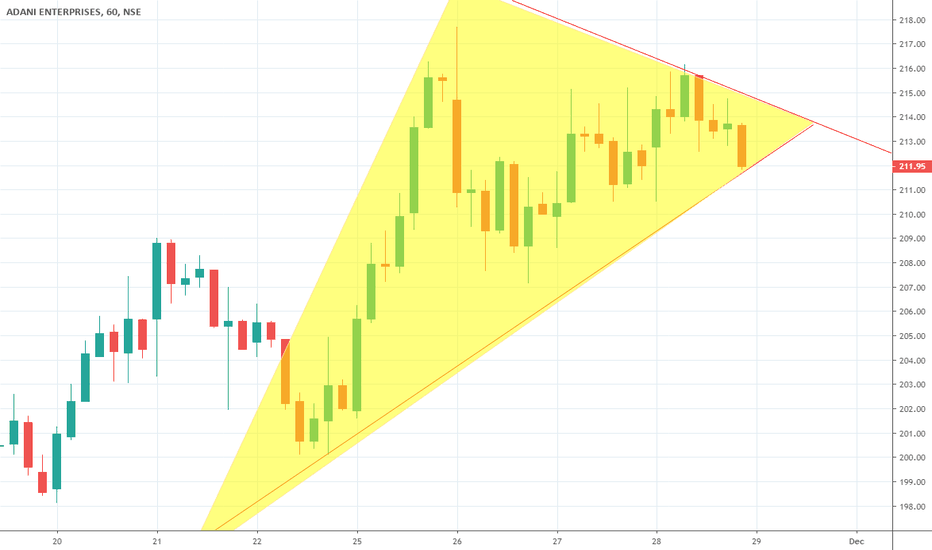

ADANIENT trade ideas

Adani Enterprises By simple Support and Restistance ! Hello friends,

How are you doing? If you like my TA then please like it and comment it gives me motivation to work hard

Here we go,

As you can see in the chart at upper-Value Area price is rejected by 2 nd time with strong showing rejection by pinbar that's goods sign of being reversed from this area You can short below arrow line at 146 for Target toward 140-136-130

Thanks

ADANIENT SHORTEconomic Nerd

Technical analysis on FOREX and INDIAN MARKETS. We are not SEBI REGISTERED ANALYSTS The views expressed here are for our record purposes only. Please consult your personal financial advisor before investing. We are in no way responsible for your profits / losses what so ever.

Short ADANIENT

Watch out for Adani Ent !!After a handsome rally of close to 40% in less than a fortnight ( for obvious friendly news and announcements), the stock is currently trading very close to the upper limit of its 9 months uptrend channel. We have seen 2 big corrections from the upper channel bound in the past 9 months and in all likelihood, we should see another one here. Booking profits (if not done already) can be looked at and also creating new short can be a good proposition. Obviously with a strict SL (at close to 200)