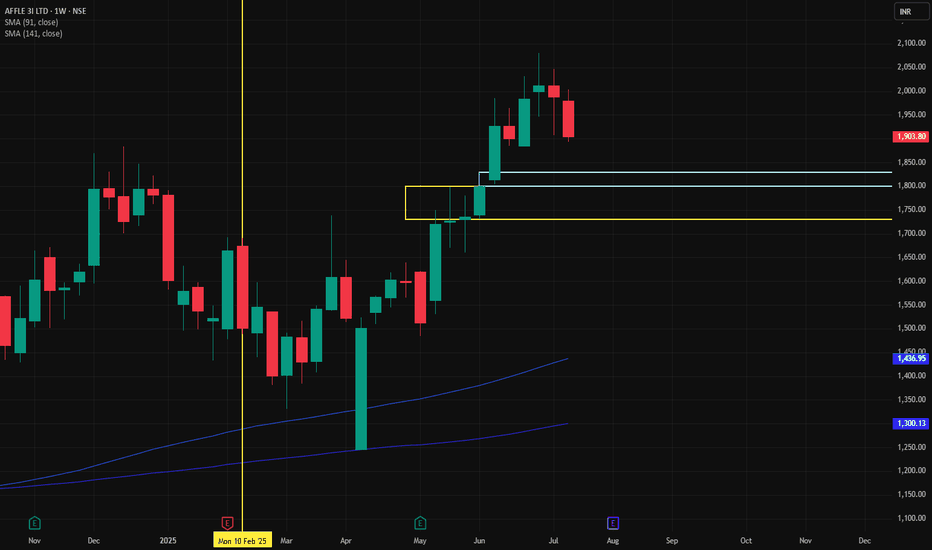

AFFLE💼 Trade Plan - Buy Setup

Parameter Value

Entry 1829

Stop Loss (SL) 1730

Target 2542

Risk 99 pts

Reward 713 pts

Risk:Reward Ratio (RR) 7.2 (Excellent)

📊 Support/Resistance Reference Points

Metric Value

Last High 1884

Last Low 1226

Point Var 658

🟡 Entry (1829) is near strong weekly/daily/60M demand

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

27.25 INR

3.82 B INR

22.66 B INR

52.33 M

About AFFLE 3I LTD

Sector

Industry

CEO

Anuj Khanna Sohum

Website

Headquarters

Gurugram

Founded

1994

ISIN

INE00WC01027

FIGI

BBG00PT8RTX6

Affle 3i Ltd. engages in the provision of mobile advertisement services. Its proprietary consumer intelligence platform delivers consumer recommendations and conversions through relevant mobile advertising. The company was founded by Anuj Khanna Sohum, Madan Sanglikar, Viraj Sinh, and Anuj Kumar on August 18, 1994 and is headquartered in Gurugram, India.

Related stocks

Affle - Cup Pattern BreakoutAffle 3i Ltd.

Cup pattern breakout and consolidating in daily time frame.

High delivery quantity this month.

Close within 52 week zone.

Stocks crossed its previous week high.

Stocks RSI crossed above 70.

Disclaimer:

For educational purpose only.

Please do your own research before taking any trade

AFFLE | SWING | POSITIONAL | LONGOne of the few Nifty 500 stocks which is showing Bullish price action is AFFLE. The stock is consistently forming Higher Lows and is now perfectly poised to breach new levels.

Notice how the price is trading comfortably above the Monthly Pivot which indicates Bulls are in control.

I've taken a long

AFFLE (INDIA) LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AFFLE is 1,801.60 INR — it has decreased by −2.90% in the past 24 hours. Watch AFFLE 3I LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange AFFLE 3I LTD stocks are traded under the ticker AFFLE.

AFFLE stock has fallen by −7.54% compared to the previous week, the month change is a −6.26% fall, over the last year AFFLE 3I LTD has showed a 30.55% increase.

We've gathered analysts' opinions on AFFLE 3I LTD future price: according to them, AFFLE price has a max estimate of 2,250.00 INR and a min estimate of 1,180.00 INR. Watch AFFLE chart and read a more detailed AFFLE 3I LTD stock forecast: see what analysts think of AFFLE 3I LTD and suggest that you do with its stocks.

AFFLE reached its all-time high on Jul 3, 2025 with the price of 2,080.00 INR, and its all-time low was 150.00 INR and was reached on Aug 8, 2019. View more price dynamics on AFFLE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AFFLE stock is 3.72% volatile and has beta coefficient of 1.47. Track AFFLE 3I LTD stock price on the chart and check out the list of the most volatile stocks — is AFFLE 3I LTD there?

Today AFFLE 3I LTD has the market capitalization of 252.99 B, it has decreased by −0.30% over the last week.

Yes, you can track AFFLE 3I LTD financials in yearly and quarterly reports right on TradingView.

AFFLE 3I LTD is going to release the next earnings report on Nov 10, 2025. Keep track of upcoming events with our Earnings Calendar.

AFFLE net income for the last quarter is 1.05 B INR, while the quarter before that showed 1.03 B INR of net income which accounts for 2.36% change. Track more AFFLE 3I LTD financial stats to get the full picture.

No, AFFLE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AFFLE 3I LTD EBITDA is 5.18 B INR, and current EBITDA margin is 21.32%. See more stats in AFFLE 3I LTD financial statements.

Like other stocks, AFFLE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AFFLE 3I LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AFFLE 3I LTD technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AFFLE 3I LTD stock shows the buy signal. See more of AFFLE 3I LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.