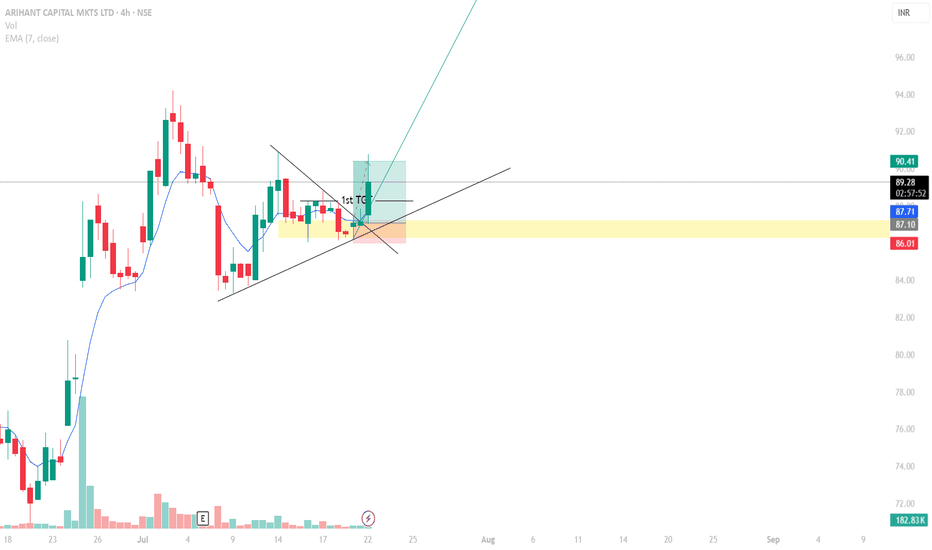

ARIHANT CAPITALSame Strategy!!!

Identified the golden zone and entered the trade.

Risk to Reward ratio of 3:1, booked a profit of Rs. 3 per share.

Although, the profit might seem small, but assume you have 1000 shares of the same stock and you are making Rs. 3000 in just 2 days,

Now you get it,

Its more about the setup and patience and hitting your TP than making profit.

ARIHANTCAP trade ideas

Arihant Capital Markets: (Swing)Arihant Capital Markets (Swing):

Chart of ACM could offer a 25-30 % reward for the upcoming days.

Keep adding at current levels and on any dips with a SL around 68.

Appropriate support, resistance levels are highlighted with target.

RR is around 1:3.

Note: Do your own due diligence before taking any action.

Arihant Capital Markets Ltd. Riding the 5th Wave ImpulseArihant Capital Markets Ltd: Riding the 5th Wave Impulse

Daily Time Frame:

Elliott Wave Analysis: Arihant Capital Markets appears to be in an impulse move on the daily time frame, with completion of wave 4 as a correction.

Current Stage: Unfolding wave 5, with (i) and (ii) completed and a potential unfolding of wave (iii).

Price Targets: Anticipating levels of 96 and 104 plus.

Invalidation Level: A strict invalidation set below 63. Current Price Trading near 76.

Technical Indicators:

Breakout Confirmation : Price has given a breakout on the daily time frame with significant volumes.

Indicator Alignment: Major indicators like MACD, RSI, RK's Magic, RK's Brahmastra, etc., are aligning positively, supporting the bullish bias.

Snapshots: Attached snapshots of the indicators for reference.

Elliott Wave Concept - 5th Wave Impulse:

The 5th wave in Elliott Wave theory is often an impulse wave that signifies the final leg of a trend.

Impulse waves are characterized by strong, directional price movements.

Wave (iii) within wave 5 is typically the most powerful and extends higher, often exceeding the peaks of wave (i).

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Breakout with good intensity of Volumes on Daily and Hourly time frames

RK's Magic says positive on Daily

RK's Brahmastra says Positive bias on Daily

Possible Elliott wave structure could be this

MACD on Daily is positive and Strong enough

MACD on weekly too

RSI showing good strength on Daily chart

Accumulate: Between 86.85 to 65.50 Arihant CapitalBullish Breakout Possible above 87 with 1 day close base

So, Accumulate small small qty between 86.85 to 65.50 Levels

Stop Loss: 60 with 1 day close below it.

One can Plan according to my instructions.

Here Target 1 is 108.20 and then we will review it for further levels.

Risk is yours and Reward is too yours totally.

Look,

Fundamentally also value investment opportunity.

Market cap: 162 Cr

Stock P/e : 8.31

Book Value: 78.1

Industry P/e : 11.4

Dividend Yield: 1.29%

EPS: 9.35

Debt to Equity: 0.19

Promoters Holding : 74.20%

Pledge % : 0

ROCE: 15%