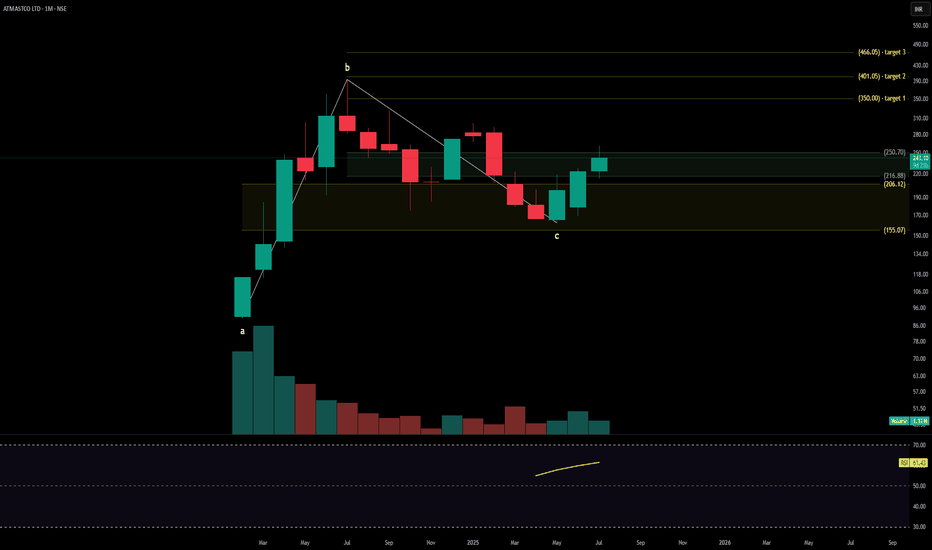

ATMASTCO LTDAtmasco Ltd. is a diversified industrial company engaged in heavy engineering fabrication, project execution, and turnkey solutions for sectors including steel, cement, power, and infrastructure. The firm specializes in supply and installation of mechanical equipment and structures, catering to both public and private clients across India. The stock is currently trading at ₹243.10.

Atmasco Ltd. – FY22–FY25 Snapshot

Sales – ₹179 Cr → ₹212 Cr → ₹239 Cr → ₹265 Cr – Steady topline growth driven by project backlog and execution Net Profit – ₹21.5 Cr → ₹26.8 Cr → ₹32.4 Cr → ₹38.3 Cr – Improving earnings with margin expansion across orders Company Order Book – Moderate → Strong → Strong → Strong – Robust traction from infra-linked and industrial contracts

Dividend Yield (%) – 0.00% → 0.00% → 0.00% → 0.00% – Fully reinvested profits with zero payout

Operating Performance – Moderate → Strong → Strong → Strong – Project execution speed and cost control

Equity Capital – ₹11.68 Cr (constant) – Efficient ownership structure

Total Debt – ₹45 Cr → ₹42 Cr → ₹38 Cr → ₹36 Cr – Gradual deleveraging alongside scale

Total Liabilities – ₹128 Cr → ₹134 Cr → ₹142 Cr → ₹150 Cr – Expanding with execution and materials contracts Fixed Assets – ₹41 Cr → ₹44 Cr → ₹47 Cr → ₹51 Cr – Capex in fabrication capacity and site equipment

Latest Highlights FY25 net profit rose 18.2% YoY to ₹38.3 Cr; revenue increased 10.9% to ₹265 Cr EPS: ₹6.55 | EBITDA Margin: 17.4% | Net Margin: 14.47% Return on Equity: 19.61% | Return on Assets: 11.85% Promoter holding: 63.45% | Dividend Yield: 0.00% Large orders from EPC clients in Odisha and Chhattisgarh driving volume Fabrication and site installation efficiencies aiding blended margin delivery

Institutional Interest & Ownership Trends Promoter holding remains high at 63.45% with no signs of dilution or pledging. Mutual fund interest is limited, but delivery volumes show continued interest from HNIs and small-cap infrastructure allocators. Ownership structure remains stable, with insider accumulation observed post quarterly filings.

Business Growth Verdict Yes, Atmasco is executing steadily across infra-heavy verticals Earnings and margins trending upward with high order visibility Debt levels are declining without stress to operations Capex remains measured and aligned with fabrication scale-up

Company Guidance Management expects double-digit growth in FY26 led by repeat orders and public sector execution. Operational metrics are expected to remain consistent, supported by fabrication capacity and tighter project timelines.

Final Investment Verdict Atmasco Ltd. represents a focused industrial growth story built on execution efficiency and long-cycle contracts. With strong promoter confidence, improving financials, and zero dividend dilution, the company is positioned for sustained compounding in mid-cap engineering. Its balance sheet discipline and infra order momentum make it suitable for accumulation by investors seeking clean exposure to industrial value creation.