AVANTIFEED trade ideas

Bullish on AVANTIFEEDAVANTIFEED is now showing good price movement for a Bullish expansion.

There has been a significant price correction since April 2025.

Thereafter, price has recovered and consolidated well with good HL formations which indicate that now Bulls are in control.

I've taken Long position on the stock on swing basis.

TGT: 1005 + levels

P.S. Not a recommendation. Pls do your own due diligence.

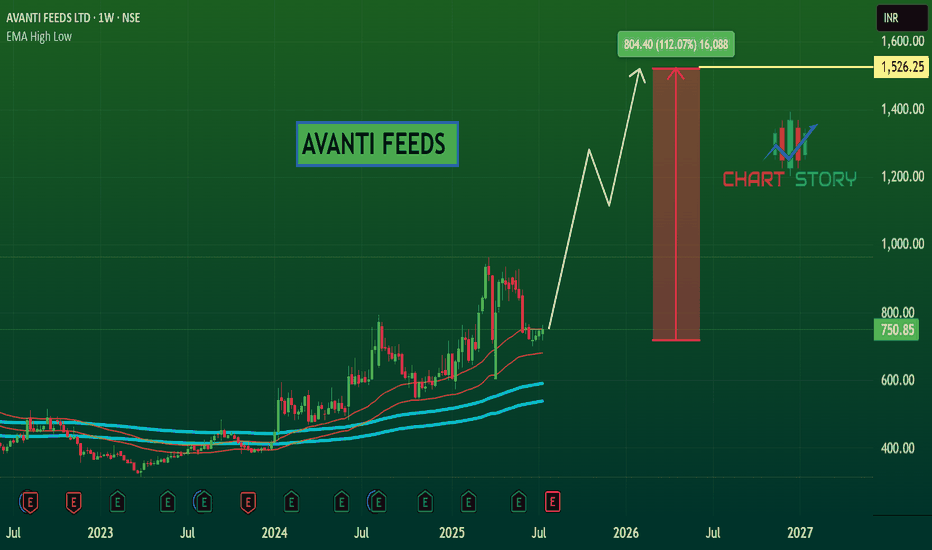

AVANTIFEED - Forming a good base on Weekly ChartAVANTIFEED forming a good base on weekly with strong volumes. Should be a good long term positional trade for a year or so.

This material is only for informational purposes. Please look at your own risk management and enter any positions or get in touch with a financial advisor for the same.

AVANTI FEEDS LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Ready to rise after consolidation and BreakoutAfter a long bull run, a long consolidation and a bullish Triangle pattern breakout, the stock seems to be ready to rise again.

Double Digit ROE and ROCE

Stock PE < Industry PE

FII Stake has increased

DII presence stable

Rising EPS

PE in buy zone.

Only an analysis not a buy/sell recommendation.

Key Support / Resistance Breakout - Swing TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Key Support & Resistance Breakout. Stock has give Breakout of Resistance level. Keep in watch list. Buy above the high. Suitable for Swing Trade. Stop loss & Target Shown on Chart.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think.

50 SMA Rising - Positional TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Its 50 SMA Rising Strategy. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep trailing with 50 days SMA if price close below 50 SMA then Exit or be in the trade some time trade can go for several months.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think

Avanti feeds Ltd for long term swing#As you can see in chat that the stock is ready to move upward direction and read to touch all time high

First the two trand line were we can see a channel moving upwards and a brake out

And crossing the golden brake out

And the stock cross 100 Ema allread and above it

AVANTIFEED - Bullish oNStock name - Avanti Feeds Ltd.

✅#AVANTIFEED trading above resistance 1.

✅Next resistance 1016.

✅Moved 41% in 29 weeks.

Weekly chart

Chart is self explanatory

Master score - B

Disclamer : This is for demonstration and education purpose only. This is not buying and selling recommendation. I'm not SEBI registered.

SWING IDEA - AVANTI FEEDSAvanti Feeds , a leading manufacturer of shrimp feed and prawn processor, is showing technical indicators that suggest a potential swing trading opportunity.

Reasons are listed below :

Multiple Tests at 600-650 Zone : The 600-650 level has been tested multiple times, indicating it as a significant resistance zone. The price is now attempting to break through this level, suggesting strong bullish momentum.

Symmetrical Triangle Pattern Breakout : The stock is breaking out of a symmetrical triangle pattern, a bullish continuation pattern indicating potential upward movement.

Strong Bullish Engulfing Candle on Weekly Timeframe : The formation of a bullish engulfing candle on the weekly chart indicates strong buying pressure and suggests potential for further upward movement.

50 and 200 EMA Support on Weekly Timeframe : The stock is finding support at both the 50-week and 200-week exponential moving averages (EMA), reinforcing the overall bullish sentiment and providing strong support levels.

Break of Consolidation Zone of 5+ Years : Avanti Feeds is breaking out of a long consolidation phase that lasted over 5 years, signaling a potential new bullish trend.

Spike in Volumes : A noticeable increase in trading volumes confirms the strength of the price move, indicating strong investor interest and participation in the current trend.

target - 770 // 900 // 975

Stoploss - weekly close below 485

Disclaimer :

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

AVANTHI FEEDS LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It's important to remember that while these indicators can be useful, they are not foolproof. Always consider the broader market context and consult with a qualified financial advisor before making any investment decisions.

Recent Rally in Shrimp Exporters' Stocks I Avanti FeedsStop Loss and Technical plotted on the chart.

Key Drivers Behind the Surge:

1. Record Seafood Exports:

- Indian seafood exports hit an all-time high of 17.81 lakh metric tons worth ₹60,000 crore in FY23-24.

- Frozen shrimp remains the leading export item, with growing demand supporting shrimp farming expansion.

2. Government Support and Budget Announcements:

Sunrise Sector: The fisheries sector is recognized for its potential, with the government aiming to create 55 lakh jobs through new initiatives.

Budget Measures:

- Financial Support: Nucleus breeding centers for shrimp brood stock to reduce reliance on imports and improve hatchery quality.

- Infrastructure Development: NABARD to cover 80% of project costs for aquaculture farmers, with up to 3% interest subvention.

3. Industry Growth Prospects:

- Long-Term Growth: The budget’s emphasis on boosting the aquaculture sector indicates strong growth potential for the industry, benefiting shrimp exporters like Avanti Feeds, Apex Frozen Foods, and Zeal Aqua.

Future Outlook:

- Continued Expansion: With robust government support and a thriving export market, the aquaculture sector is expected to continue growing, driving further interest in stocks of companies involved in shrimp farming and export.

- Investment Consideration: The strong performance and positive outlook make these stocks attractive, but it's essential to stay informed about industry developments and consult with a financial advisor for personalized advice.

---

For the latest updates and insights, consult with a qualified financial advisor to tailor your investment strategy.

AVANTI FEEDS S/RSupport and Resistance Levels: In technical analysis, support and resistance levels are significant price levels where buying or selling interest tends to be strong. They are identified based on previous price levels where the price has shown a tendency to reverse or find support.

Support levels are represented by the green line and green shade, indicating areas where buying interest may emerge to prevent further price decline.

Resistance levels are represented by the red line and red shade, indicating areas where selling pressure may arise to prevent further price increases. Traders often consider these levels as potential buying or selling opportunities.

Breakouts: Breakouts occur when the price convincingly moves above a resistance level (red shade) or below a support level (green shade). A bullish breakout above resistance suggests the potential for further price increases, while a bearish breakout below support suggests the potential for further price declines. Traders pay attention to these breakout signals as they may indicate the start of a new trend or significant price movement.

20 EMA: The yellow line denotes 20 EMA, to interpret the 20 EMA, you need to compare it with the prevailing stock price. If the stock price is below the 20 EMA, it signals a possible downtrend. But if the stock price is above the 20 EMA, it signals a possible uptrend.

Disclosure: I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It is important to consult with a qualified financial advisor before making any investment decisions. Tweets neither advice nor endorsement.