Review and plan for 18th July 2025Nifty future and banknifty future analysis and intraday plan.

Analysis of quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

-

Key facts today

Axis Bank Limited's AGM approved key resolutions, including audited financial statements for the fiscal year ending March 31, 2025, dividend declaration, and director re-appointment.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

90.00 INR

280.55 B INR

1.55 T INR

3.06 B

About AXIS BANK LTD

Sector

Industry

CEO

Amitabh Chaudhry

Website

Headquarters

Mumbai

Founded

1993

ISIN

INE238A01034

FIGI

BBG000BD62G0

Axis Bank Ltd. engages in the provision of financial solutions to retail, small and medium enterprises, government, and corporate businesses. It operates through the following segments: Treasury, Retail Banking, Corporate or Wholesale Banking, and Other Banking Business. The Treasury segment includes investments in sovereign and corporate debt, equity and mutual funds, trading operations, derivative trading and foreign exchange operations on the proprietary account and for customers and central funding. The Retail Banking segment constitutes lending to individuals or small businesses subject to the orientation, product and granularity criterion and also includes low value individual exposures not exceeding the threshold limit. It also covers liability products, card services, internet banking, ATM services, depository, financial advisory services and NRI services. The Corporate or Wholesale Banking segment involves in corporate relationships, advisory services, placements and syndication, management of public issue, project appraisals, capital market related and cash management services. The Other Banking Business segment encompasses para banking activities such as third party product distribution and other banking transactions. The company was founded on December 3, 1993 and is headquartered in Mumbai, India.

Related stocks

Axis Bank Hi,

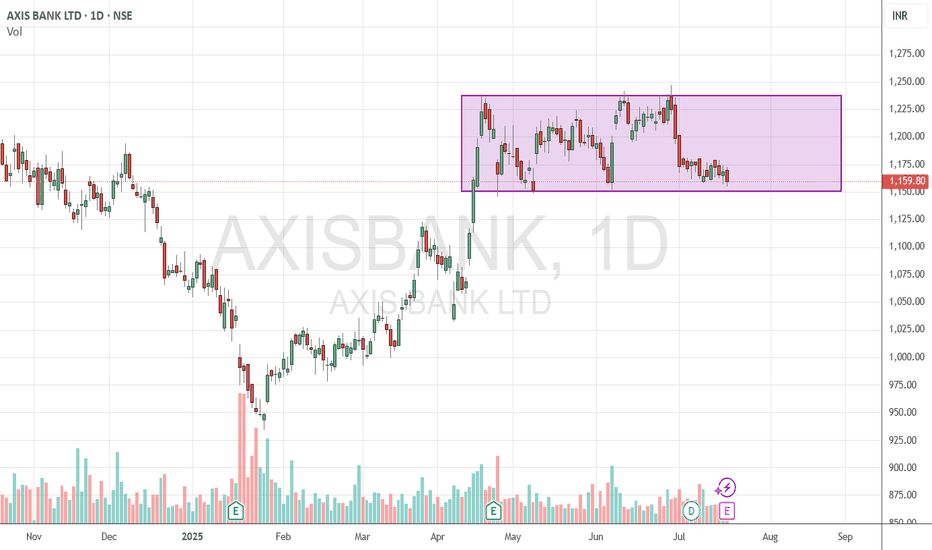

price Trade in zone . And currently it is available at support area.

So it's possible that price will move above The support area

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given

AXIS BANK at Best Support !!Here are two charts of Axis Bank — one in the 4-hour timeframe and the other in the 1-hour timeframe.

4-Hour Timeframe Chart:

In this chart, Axis Bank is moving within a parallel channel, with the support zone lying in the 1150–1160 range.

1-Hour Timeframe Chart:

Axis Bank is forming a descending

AXIS BANK - FOR SWING TRADEOn a weekly time frame price has given a curve line breakout and currently price is in a range .

Previous week a Pin bar candle has formed in it's Fib 50% level which is also a good support area.

Current price is 1219

This week price can give us a good upside move, if not then price will be in the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AXISBANK is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of AXISBANK is 1,086.10 INR — it has decreased by −0.82% in the past 24 hours. Watch AXIS BANK LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange AXIS BANK LTD stocks are traded under the ticker AXISBANK.

AXISBANK stock has fallen by −0.36% compared to the previous week, the month change is a −11.43% fall, over the last year AXIS BANK LTD has showed a −9.49% decrease.

We've gathered analysts' opinions on AXIS BANK LTD future price: according to them, AXISBANK price has a max estimate of 1,691.00 INR and a min estimate of 827.00 INR. Watch AXISBANK chart and read a more detailed AXIS BANK LTD stock forecast: see what analysts think of AXIS BANK LTD and suggest that you do with its stocks.

AXISBANK reached its all-time high on Jul 12, 2024 with the price of 1,339.65 INR, and its all-time low was 55.65 INR and was reached on Mar 9, 2009. View more price dynamics on AXISBANK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AXISBANK stock is 2.30% volatile and has beta coefficient of 1.30. Track AXIS BANK LTD stock price on the chart and check out the list of the most volatile stocks — is AXIS BANK LTD there?

Today AXIS BANK LTD has the market capitalization of 3.40 T, it has decreased by −1.18% over the last week.

Yes, you can track AXIS BANK LTD financials in yearly and quarterly reports right on TradingView.

AXIS BANK LTD is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

AXISBANK earnings for the last quarter are 18.70 INR per share, whereas the estimation was 20.10 INR resulting in a −6.97% surprise. The estimated earnings for the next quarter are 19.48 INR per share. See more details about AXIS BANK LTD earnings.

AXIS BANK LTD revenue for the last quarter amounts to 208.18 B INR, despite the estimated figure of 204.85 B INR. In the next quarter, revenue is expected to reach 203.99 B INR.

AXISBANK net income for the last quarter is 62.44 B INR, while the quarter before that showed 74.75 B INR of net income which accounts for −16.47% change. Track more AXIS BANK LTD financial stats to get the full picture.

Yes, AXISBANK dividends are paid annually. The last dividend per share was 1.00 INR. As of today, Dividend Yield (TTM)% is 0.09%. Tracking AXIS BANK LTD dividends might help you take more informed decisions.

AXIS BANK LTD dividend yield was 0.09% in 2024, and payout ratio reached 1.10%. The year before the numbers were 0.10% and 1.17% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 104.45 K employees. See our rating of the largest employees — is AXIS BANK LTD on this list?

Like other stocks, AXISBANK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AXIS BANK LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AXIS BANK LTD technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AXIS BANK LTD stock shows the neutral signal. See more of AXIS BANK LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.