BANDHANBANKNSE:BANDHANBNK

Note :

1. One should go long with a Stop Loss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Management and Risk Appetite.

Disclaimer :

>You are responsible for your profits and loss.

>The idea sha

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.75 INR

27.45 B INR

249.15 B INR

818.15 M

About BANDHAN BANK LTD

Sector

Industry

CEO

Parthapratim Sengupta

Website

Headquarters

Kolkata

Founded

2014

ISIN

INE545U01014

FIGI

BBG00JNBB158

Bandhan Bank Ltd. engages in the provision of banking and financial services. It operates through the following segments: Treasury, Retail Banking, Corporate and Wholesale Banking, and Other Banking Business. The Treasury segment includes investments in sovereign securities and trading operations and central funding unit. The Retail Banking segment offers lending to individuals and small businesses through the branch network and other delivery channels and comprises liability products, card services, internet banking, mobile banking, ATM services, and NRI services. The Corporate and Wholesale Banking segment refers to corporate relationships not included under retail banking. The Other Banking Business segment covers banking activities like third party product distribution and other banking transactions. The company was founded by Chandra Shekhar Ghosh on December 23, 2014 and is headquartered in Kolkata, India.

Related stocks

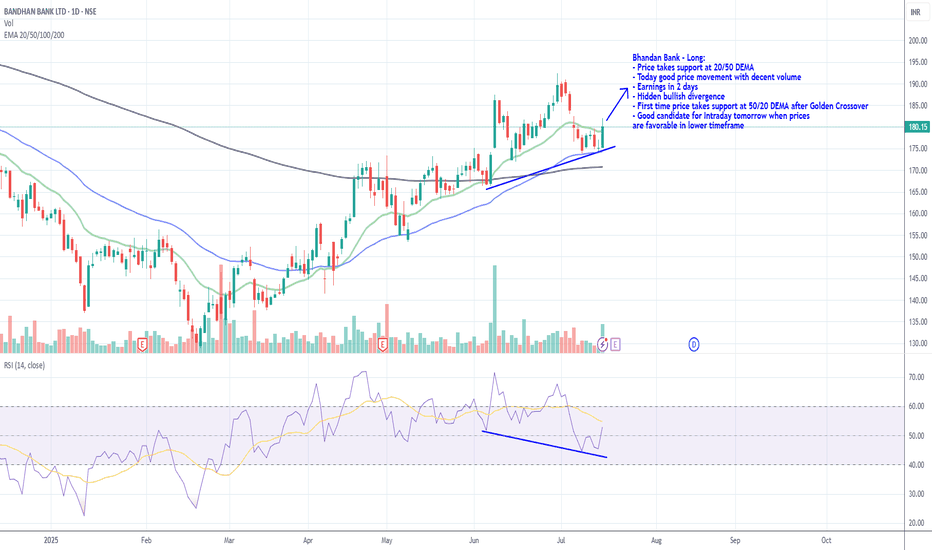

Bhandan Bank - Long - Support @ 20/50 DEMABhandan Bank - Long:

- Price takes support at 20/50 DEMA

- Today good price movement with decent volume

- Earnings in 2 days

- Hidden bullish divergence

- First time price takes support at 50/20 DEMA after Golden Crossover

- Good candidate for Intraday tomorrow when prices

are favorable in lower ti

Bandhan Bank - first major trend reversal! Upside to ₹215–230Thesis:

Bandhan Bank has broken out above the ₹185 zone after constructing a multi-month rounded base between ₹130 and ₹185. This marks the first major structural reversal after a multi-year downtrend. The breakout is backed by above-average volume and positive momentum.

Technical Structure:

BANDHAN BANK on weekly chart form a Cup & Handle patternBandhan bank Forming Cup & Handle pattern ,Breakout of this pattern will be above 210 level ,Stoploss will arround 190 & Target will be arround 250 ...Accumulation can be done from current level ,But actual movement will start after crossing 210 level

BANDHAN BANK LONG SETUPTechnical Analysis

Chart Observations:

Price: Closed at ₹151.53

Candle: Strong green candle, breaking recent resistance

Volume: Healthy volume (approx. 4.92M) — confirms price action

RSI: 61.59 — bullish but not yet overbought, still room to go

Structure : Ascending structure since

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BANDHANBNK is 173.44 INR — it has decreased by −1.77% in the past 24 hours. Watch BANDHAN BANK LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange BANDHAN BANK LTD stocks are traded under the ticker BANDHANBNK.

BANDHANBNK stock has fallen by −3.24% compared to the previous week, the month change is a −5.40% fall, over the last year BANDHAN BANK LTD has showed a −14.56% decrease.

We've gathered analysts' opinions on BANDHAN BANK LTD future price: according to them, BANDHANBNK price has a max estimate of 225.00 INR and a min estimate of 130.00 INR. Watch BANDHANBNK chart and read a more detailed BANDHAN BANK LTD stock forecast: see what analysts think of BANDHAN BANK LTD and suggest that you do with its stocks.

BANDHANBNK reached its all-time high on Aug 9, 2018 with the price of 741.80 INR, and its all-time low was 128.16 INR and was reached on Feb 18, 2025. View more price dynamics on BANDHANBNK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BANDHANBNK stock is 2.58% volatile and has beta coefficient of 1.44. Track BANDHAN BANK LTD stock price on the chart and check out the list of the most volatile stocks — is BANDHAN BANK LTD there?

Today BANDHAN BANK LTD has the market capitalization of 281.76 B, it has increased by 3.17% over the last week.

Yes, you can track BANDHAN BANK LTD financials in yearly and quarterly reports right on TradingView.

BANDHAN BANK LTD is going to release the next earnings report on Oct 24, 2025. Keep track of upcoming events with our Earnings Calendar.

BANDHANBNK earnings for the last quarter are 2.30 INR per share, whereas the estimation was 2.56 INR resulting in a −9.98% surprise. The estimated earnings for the next quarter are 2.19 INR per share. See more details about BANDHAN BANK LTD earnings.

BANDHAN BANK LTD revenue for the last quarter amounts to 34.83 B INR, despite the estimated figure of 32.17 B INR. In the next quarter, revenue is expected to reach 34.68 B INR.

BANDHANBNK net income for the last quarter is 3.72 B INR, while the quarter before that showed 3.18 B INR of net income which accounts for 17.00% change. Track more BANDHAN BANK LTD financial stats to get the full picture.

Yes, BANDHANBNK dividends are paid annually. The last dividend per share was 1.50 INR. As of today, Dividend Yield (TTM)% is 0.86%. Tracking BANDHAN BANK LTD dividends might help you take more informed decisions.

BANDHAN BANK LTD dividend yield was 1.03% in 2024, and payout ratio reached 8.80%. The year before the numbers were 0.83% and 10.84% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, BANDHANBNK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BANDHAN BANK LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BANDHAN BANK LTD technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BANDHAN BANK LTD stock shows the sell signal. See more of BANDHAN BANK LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.