BANKINDIA trade ideas

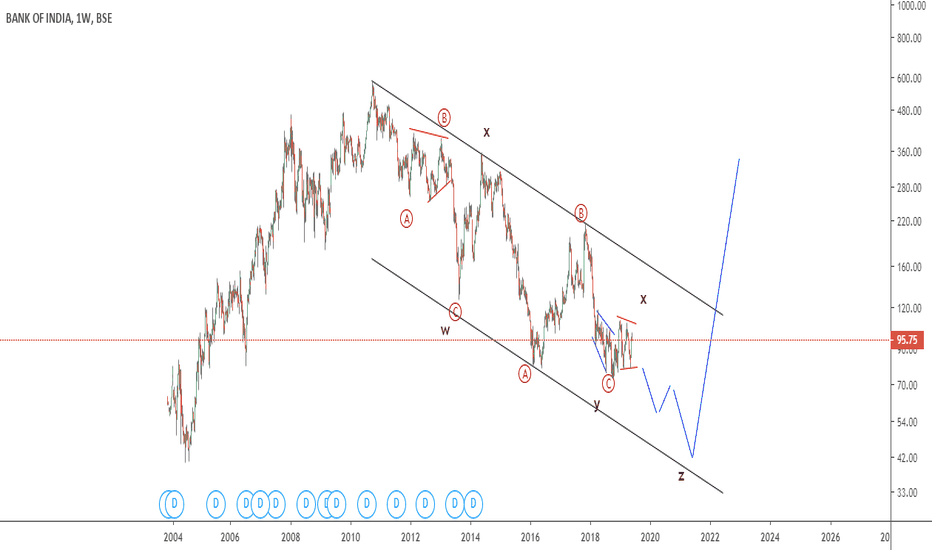

BOI Has been consolidating in a range for ayear between 80 to 110

So one can play the stock in this range

It is likely that current movement is on budget expectations so be cautious.

for positional traders Once if you see 110 getting taken out, a big rally can ensue with

targets for 150 and above

short term traders can keep stops at 88

#BANKINDIABANK OF INDIA

Sector: Financials

Industry: Banks

Employees: 45613

Bank of India is an India-based bank. The Bank's segments include Treasury Operations, Wholesale Banking and Retail Banking. The Treasury operations segment includes the entire investment portfolio, which is dealing in government and other securities, money market operations and foreign exchange operations. Its Wholesale Banking segment includes all advances, which are not included under Retail Banking. Its Retail Banking segment includes exposures, which fulfill criteria, including exposure (the maximum aggregate exposure of approximately five crore rupees), and the total annual turnover is over 50 crore rupees, which means the average turnover of the last three years in case of existing entities and projected turnover in case of new entities. It operates through a branch network of approximately 5,020 domestic branches and over 60 overseas branches. Its subsidiaries include BOI AXA Investment Managers Pvt. Ltd., BOI AXA Trustee Services Pvt. Ltd and Bank of India (Tanzania) Ltd.

Bank of India : ButterFly Patter on Daily - ShortThe analysis is only for educational purpose.

Butterfly Rules

AB can retrace up to 78.6% of the XA leg - Condition satisfied

BC can retrace between 38.2% – 88.6% of AB Condition satisfied

CD can be an extension of 1.618% – 2.618% of AB Condition satisfied

CD can also be an extension of up to 1.272% – 1.618% of XA leg Condition satisfied

The point D is known as the PRZ or Potential Reversal Zone

Targets are determined as 0.382 and 0.618 Fibonacci retracement levels of the CD leg

Ideally Stops losses are placed a below or above the high or low of point X.

Weekly Chart shows Bullish engulfing candlestick as well.

T1: ~ 97

Bank of india - Bullish channel upBank of india perform a great bullish run from May last years. After touch fibonacci retracement 50%, BANKINDIA return at major channel up.

RIght now, again BANKINDIA perform small correction from fibonacci 38.2 at resistance channel to support channel around 139.80 with maximal dropdown at fibonacci retracement 23.6

Its a good idea to enter long from that position (139.80) and aim target at 195.64

Disclaimer :

This analysis not include personal feeling/opinion, and pure base on technical analysis

Trading foreign currencies can be a challenging and potentially profitable opportunity for investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk appetite. Most importantly, do not invest money you cannot afford to lose.

Bank of India, Bank IndiaHi all,

This entity has open and started below cloud today as well as major 20-50 MA crossover. Wait for it to retrace near 114 level and then short it for good risk reward ratio of 1:2 for first target and 1:3 for a second target.

However, if close below 110 today one can STBT it for immediate first target.

Trade with atleast 2 lots in option and book profit at each target with trailing the rest at breakeven.

Thanks.