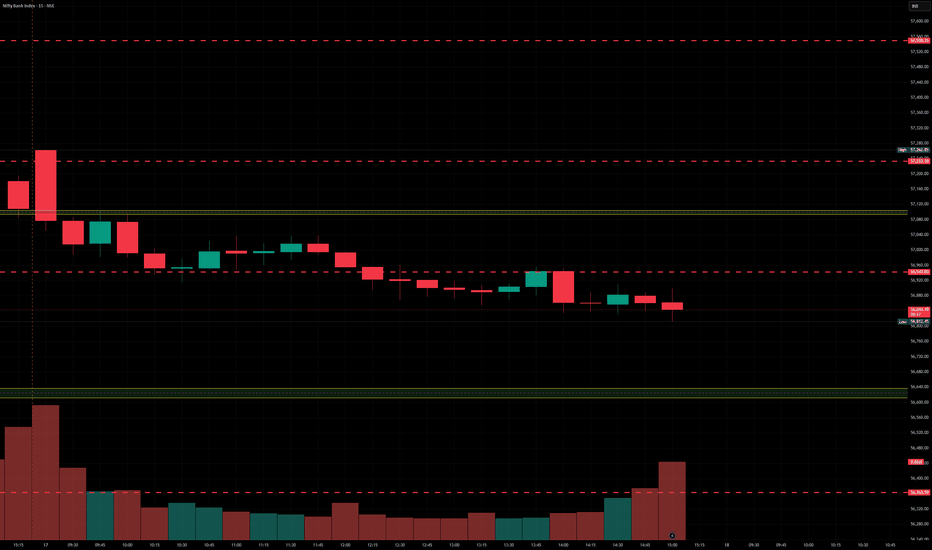

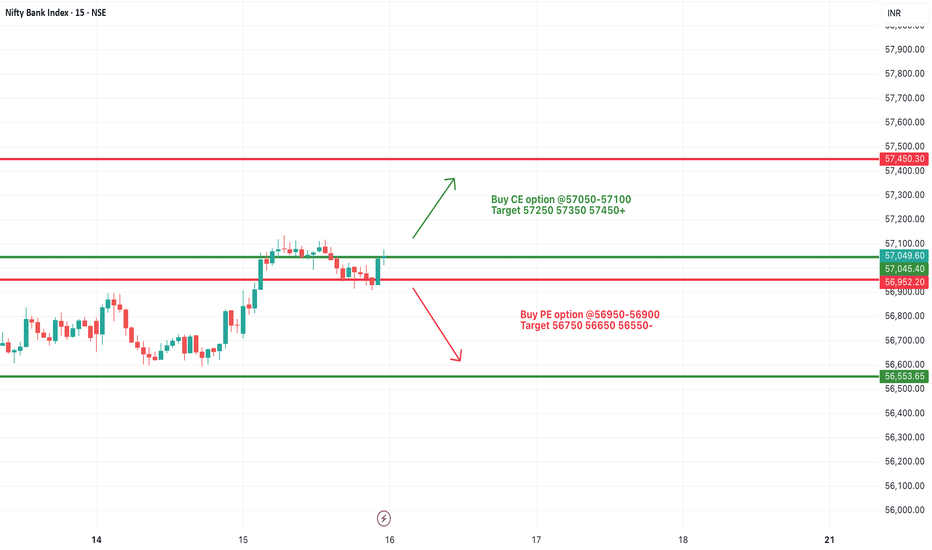

[INTRADAY] #BANKNIFTY PE & CE Levels(18/07/2025)Bank Nifty is expected to open flat around the 56800 zone, suggesting indecision in the early session. If it manages to move upward and sustain above the 57050–57100 resistance range, it could invite bullish momentum targeting 57250, 57350, and even 57450+. A breakout above this level can trigger a continuation of upward movement, but volume and price confirmation are essential.

On the downside, if the index stays weak and slips below the 56950–56900 zone, we may see fresh bearish pressure pulling it toward 56750, 56650, and 56550 support levels. This zone remains a crucial intraday pivot for traders to watch.

A reversal opportunity may also emerge if the index drops further near 56550–56600 and then shows a sharp recovery. In such a case, targets of 56750, 56850, and 56950+ are possible, making it a good support-based bounce trade. Overall, the market might remain sideways with both opportunities for quick scalps and reversals—focus on key levels and act with strict stop losses.

BANKNIFTY trade ideas

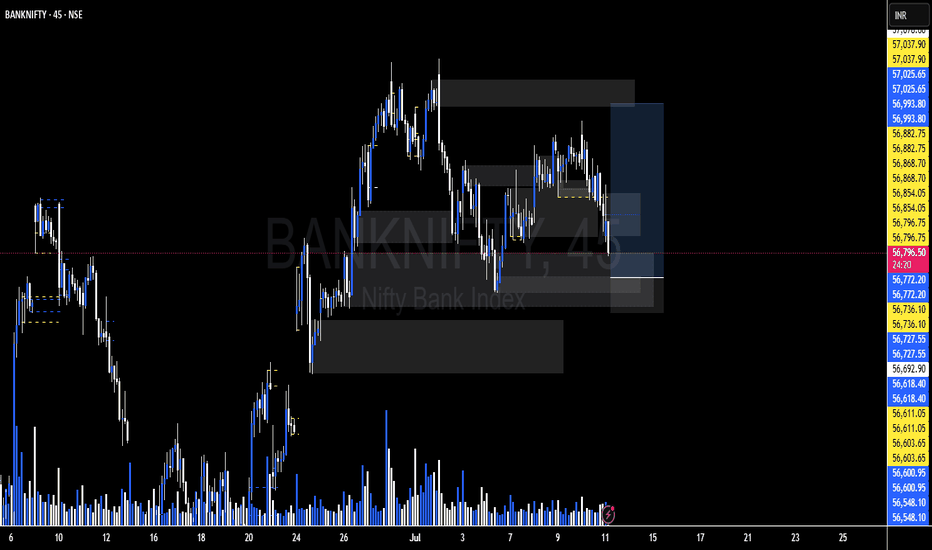

BankNifty levels - Jul 18, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

#Banknifty directions and levels for July 17thIn the previous session, both Nifty and Bank Nifty moved with ups and downs. Structurally, the sentiment still remains the same.

Even if the market opens with a gap-up, we can expect some rejection near immediate resistance.

So, my expectation is that the market may behave similarly to the previous session.

If it starts with a pullback, we may see rejection afterward.

On the other hand, if it starts with a decline, we can expect a pullback later.

The key point to note is that clear directional moves are likely only if a strong candle forms after consolidation.

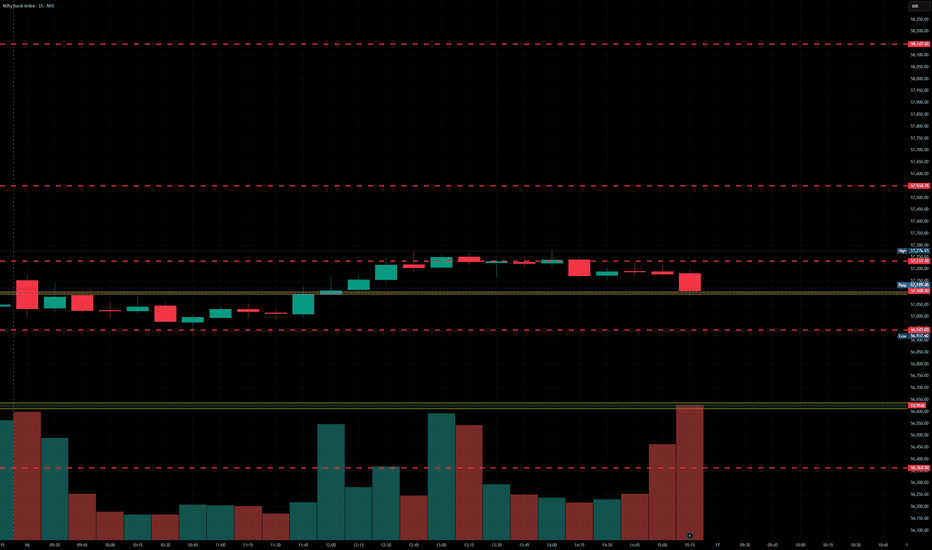

[INTRADAY] #BANKNIFTY PE & CE Levels(17/07/2025)Bank Nifty is expected to open slightly gap-up near the 57100 zone. This level is a key intraday pivot. If the index sustains above 57100, it could trigger upward momentum toward the next resistance levels at 57250, 57350, and potentially 57450+. A move beyond 57550 will likely strengthen the bullish sentiment and may stretch the rally further toward 57750, 57850, and 57950+.

On the downside, if Bank Nifty fails to hold 57050–57100 and slips below 56950–56900, it may invite selling pressure, with potential downside targets at 56750, 56650, and 56550. This zone acts as short-term support, and failure to hold here could lead to further weakness.

Overall, Bank Nifty is currently in a range with bullish bias above 57100.

BankNifty levels - Jul 17, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

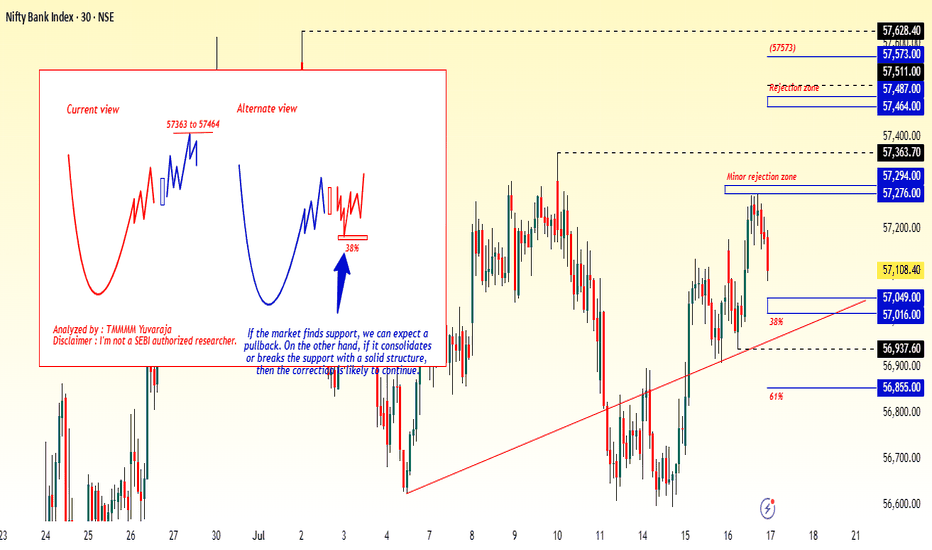

#Banknifty directions and levels for July 16th:Current View

If we look at the Bank Nifty chart from a broader perspective, it appears to be forming a bullish triangle pattern.

If we count the swings, it seems we are in the 4th wave, and the 5th downward wave is still pending.

So, if the market faces rejection near the top of the triangle, we can expect a minor correction, which may reach the bottom of the triangle pattern.

(For confirmation of the correction, the market must break the support zone at a minimum.)

Alternate View

Alternatively, if the market finds support around 56953 or at the support zone, we may see some consolidation.

After that, if it breaks above the top of the triangle, the minor rejection zone may act as a resistance before the rally continues.

[INTRADAY] #BANKNIFTY PE & CE Levels(16/07/2025)Bank Nifty is expected to begin the day on a flat note near the 57000 mark, indicating indecisiveness after the previous session's recovery. The immediate resistance zone lies between 57050 and 57100. A sustained move above this level can trigger an upward continuation toward the targets of 57250, 57350, and possibly 57450+. This zone will be key for bullish momentum, and traders can look for strength confirmation around this breakout.

On the downside, the 56950–56900 level is crucial. If Bank Nifty slips below this zone, it may invite fresh selling pressure, with intraday downside targets around 56750, 56650, and 56550. The support at 56550 and below can act as demand zones for any pullback.

BankNifty levels - Jul 16, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

BANK NIFTY -1D - BEARISH EXPECTINGChart Insights : Day Chart

Index Trading at 56800 on 15-Jul-2025

Observed RSI Divergence on Bank Nifty 1 Day Chart.

- Bearish RSI Divergence: While Bank Nifty has been making higher highs, the RSI hasn’t followed suit. This disconnect suggests buyers are losing steam.

- Rising Wedge Pattern: The index is trading within a rising wedge—a bearish formation that often precedes a pullback. Breaking Rising Wedge would confirm the same.

Lets wait and see

#Banknifty directions and levels for July 15th:Current View:

Structurally, we are still in a minor downtrend. So, if the market fails to sustain the neutral start, we can expect a minor correction in the initial stage.

if the correction comes with a solid structure or the price consolidates around the immediate support, then the correction is likely to continue.

On the other hand, if the correction reaches the support with gradual moves, then the support may hold, and we can expect a minor pullback with a bearish bias.

Alternate View:

If the market takes a pullback, we can expect a maximum of 38% to 50% retracement on the upside. However, since we are still in a downtrend, once the pullback starts correcting again, we may expect a range-bound market or further correction, similar to what we saw in the last session.

[INTRADAY] #BANKNIFTY PE & CE Levels(15/07/2025)Bank Nifty is expected to open with a gap-up near the 56950 zone. If the index sustains below the 56900–56950 resistance range after the initial up-move, it could face selling pressure. A downside move from this level may trigger a correction toward the 56750, 56650, and 56550 zones. This level becomes a key intraday resistance.

On the downside, a breakdown below the 56650 level could intensify selling, leading to further downside targets of 56250, 56150, and 56050. This zone must be monitored closely as it holds short-term support strength. A decisive move below 56650 will shift sentiment bearish for the session.

On the other hand, a breakout and sustained move above 57100 could attract bullish momentum and may lead to upside targets of 57250, 57350, and even 57450+. Price action around the 57000–57100 mark will be crucial to determine any bullish continuation.

Overall, today's session is expected to open strong but watch for follow-through near the key zones. Traders should remain cautious and wait for confirmation around 56900–57100 for direction clarity.

BankNifty levels - Jul 15, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

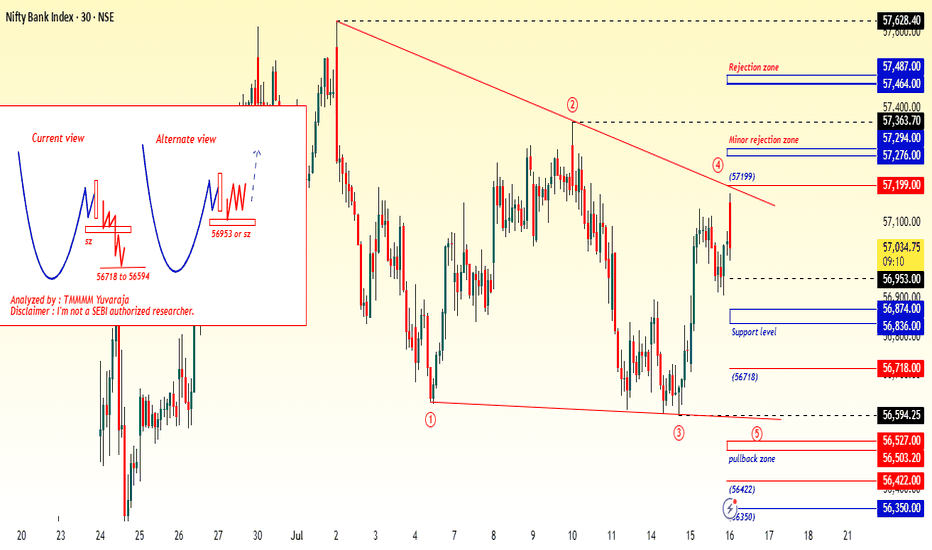

#Banknifty directions and levels for July 14th:Current View:

Structurally, there has been strong selling pressure. So, if the market consolidates or breaks the support with a solid candle, we can expect the correction to continue.

Alternate View:

On the other hand, if the market finds support near the immediate support level or if the initial move takes a pullback, we can expect a maximum 38% to 50% pullback in the minor swing.

Even if that happens, the trend may still remain bearish in the lower time frame. So, if the market starts to reject around the 38% Fibonacci level on the upside, we can expect the downtrend to resume.

In simple terms, if a pullback occurs, we may see a range-bound market.

[INTRADAY] #BANKNIFTY PE & CE Levels(14/07/2025)Bank Nifty is expected to open slightly gap-down, continuing the weakness observed in the previous sessions. The index is currently trading around the 56700 level after facing consistent resistance near the 57100 zone. If the index sustains below the 56950–56900 region, it may extend the downside toward 56750, 56650, and further down to 56550.

A break below 56650 could trigger a sharper fall, with the next key support levels placed at 56250, 56150, and 56050. These zones will be critical to watch for potential reversal or further breakdown.

On the upside, any strength and breakout above the 57050–57100 resistance zone may open the path toward higher levels like 57250, 57350, and 57450+. However, unless this zone is breached with strength, upward movement is likely to remain capped.

The overall structure indicates bearish pressure, and the price action near 56900–56650 will decide the intraday trend. Traders should remain cautious and react based on levels with proper risk management.

BankNifty July 3rd Week Analysis Banknifty closing isn't looking bearish until now , but if it breaches 56500-400 on the downside, then we can expect a retracement upto 55800-500+ . On the upside, if Banknifty successfully crosses and sustains above 57250-300, then we can expect it to continue the upside upto new highs of 57800-58000+ .

Sector Rotation Strategy🌐 Sector Rotation Strategy: A Smart Way to Stay Ahead in the Stock Market

What Is Sector Rotation?

Imagine you're playing cricket. Some players shine in certain conditions — like a fast bowler on a bouncy pitch or a spinner on a turning track. The same idea applies to stock market sectors.

Sector Rotation is the process of shifting your money from one sector to another based on the market cycle, economic trends, or changing investor sentiment.

In simple words:

"You’re moving your money where the action is."

First, What Are Sectors?

The stock market is divided into different sectors, like:

Banking/Financials – HDFC Bank, Kotak Bank, SBI

IT– Infosys, TCS, Wipro

FMCG – HUL, Nestle, Dabur

Auto – Maruti, Tata Motors

Pharma – Sun Pharma, Cipla

Capital Goods/Infra – L&T, Siemens

PSU – BEL, BHEL, HAL

Real Estate, Metals, Energy, Telecom, etc.

Each sector behaves differently at various stages of the economy.

Why Is Sector Rotation Important?

Because all sectors don’t perform well all the time.

For example:

In a bull market, sectors like Auto, Capital Goods, and Infra usually lead.

During slowdowns, investors run to safe havens like FMCG and Pharma.

When inflation or crude oil rises, energy stocks tend to do better.

When interest rates drop, banking and real estate might shine.

So, instead of holding poor-performing sectors, smart investors rotate into the hot ones.

How Does Sector Rotation Work?

Let’s say you are an investor or trader.

Step-by-step guide:

Track the economy and markets

Is GDP growing fast? = Economy expanding

Are interest rates high? = Tight liquidity

Is inflation cooling down? = Growth opportunity

Observe sectoral indices

Check Nifty IT, Nifty Bank, Nifty FMCG, Nifty Pharma, etc.

See which are outperforming or lagging.

Watch for news flow

Budget announcements, RBI policy, global cues, crude oil prices, etc.

E.g., Defence orders boost PSU stocks like BEL or HAL.

Move your capital accordingly

If Infra and Capital Goods are breaking out, reduce exposure in IT or FMCG and rotate into Infra-heavy stocks.

Real Example (India, 2024–2025)

Example: Rotation from IT to PSU & Infra

In late 2023, IT stocks underperformed due to global slowdown and US recession fears.

Meanwhile, PSU and Infra stocks rallied big time because:

Government increased capital expenditure.

Defence contracts awarded.

Railway budget saw record allocations.

So, many smart investors rotated out of IT and into:

PSU Stocks: RVNL, BEL, HAL, BHEL

Capital Goods/Infra: L&T, Siemens, ABB

Railway Stocks: IRFC, IRCTC, Titagarh Wagons

This sector rotation gave 30%–100% returns in a few months for many stocks.

Tools You Can Use

Sectoral Charts on TradingView / Chartink / NSE

Use indicators like RSI, MACD, EMA crossover.

Compare sectors using “Relative Strength” vs Nifty.

Economic Calendar

Track RBI policy, inflation data, IIP, GDP, etc.

News Portals

Moneycontrol, Bloomberg, ET Markets, CNBC.

FIIs/DII Activity

Where the big money is going – this matters!

Sector Rotation Heatmaps

Some platforms show weekly/monthly performance of sectors.

📈 Sector Rotation Strategy for Traders

For short-term traders (swing/intraday):

Rotate into sectors showing strength in volumes, price action, breakouts.

Use tools like Open Interest (OI) for sector-based option strategies.

Example:

On expiry weeks, if Bank Nifty is showing strength with rising OI and volume, rotate capital into banking-related trades (Axis, ICICI, SBI).

Sector Rotation for Long-Term Investors

For investors, sector rotation can be used:

To reduce drawdowns.

To book profits and re-enter at better levels.

To ride economic trends.

Example:

If you had exited IT in late 2022 after a rally, and entered PSU stocks in early 2023, your portfolio would’ve seen better growth.

Pros of Sector Rotation

Better returns compared to static investing

Helps avoid underperforming sectors

Takes advantage of macro trends

Works in both bull and bear markets

Cons or Risks

Requires monitoring and active management

Timing the rotation is difficult

Wrong rotation = underperformance

May incur tax if frequent buying/selling (for investors)

Pro Tips

Don't rotate too fast; let the trend confirm.

Use SIPs or staggered entry in new sectors.

Avoid “hot tips”; follow actual price and volume.

Blend sector rotation with strong stock selection (don’t just chase sector).

Conclusion

The Sector Rotation Strategy is one of the smartest, most practical tools used by both traders and investors. You don’t need to be a pro to use it — just stay alert to the market mood, economic cycles, and where the money is moving.

Think of it as dancing with the market:

“When the music changes, you change your steps.”

Keep rotating. Keep growing.

BankNifty levels - Jul 14, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

[INTRADAY] #BANKNIFTY PE & CE Levels(11/07/2025)Bank Nifty is expected to open flat today after a prolonged consolidation and a narrow trading range observed in the previous sessions. The index is hovering near the support zone of 56900–57000, which has acted as a critical level in recent price action.

If Bank Nifty sustains above 57050–57100, we may witness a rebound towards 57250, 57350, and 57450+. However, a decisive breach below the 56900 level can trigger a sharp fall, with immediate downside targets at 56750, 56650, and 56550-.

Since the index is trading close to a major support zone, today's movement could decide the next directional trend. Until a breakout or breakdown is confirmed, expect range-bound moves with limited momentum.

Banknifty Intraday Analysis for 11th July 2025NSE:BANKNIFTY

Index has resistance near 57400 – 57500 range and if index crosses and sustains above this level then may reach near 57900 – 58000 range.

Banknifty has immediate support near 56600 - 56500 range and if this support is broken then index may tank near 56100 - 56000 range.