BEL🛒 Trade Plan Summary – Long Entry

Parameter Value

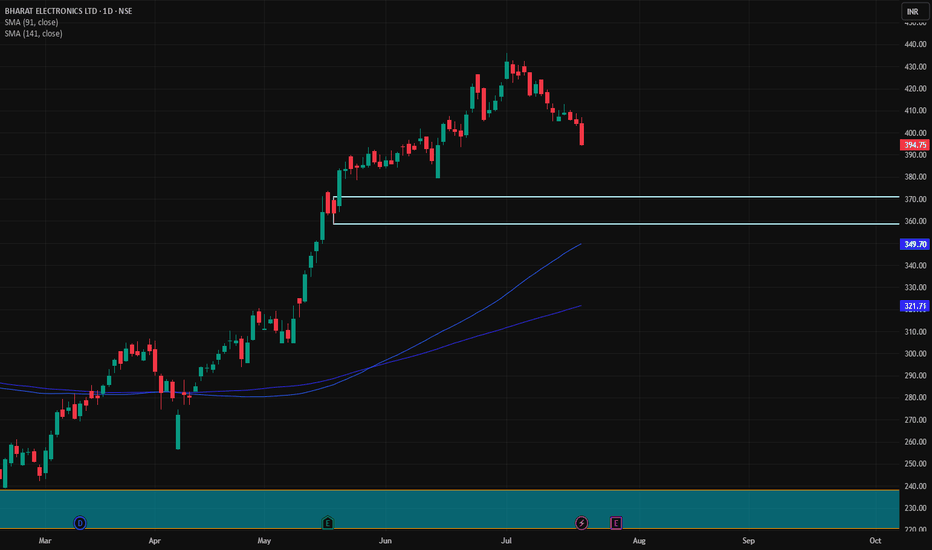

Entry 371

Stop Loss (SL) 358

Risk 13 pts

Target 535

Reward 164 pts

Risk-Reward (RR) 12.6 (High Conviction Trade)

🧠 Market Context

Last High: 436 – A possible resistance before final target.

Last Low: 337 – Still above HTF proximal zone, reinforcing support.

Point Var: 99 – Broad range for volatility management.

🔎 Conclusion

✔️ Trade Strength: Very High (Aligned across all timeframes)

✔️ Reward-to-Risk: Exceptional (RR 12.6)

✔️ Entry Zone: Ideal – sitting right inside strong demand

📍Summary: This trade is a textbook bullish setup with limited downside and exceptional upside. If BEL maintains 358+, this offers one of the cleanest, high-probability long entries across technical charts.

BEL trade ideas

BHARAT ELECTRONICS LTD – Is in Uptrend …. What NextBEL: CMP: 363.90 RSI: 80.47

BEL is consistently making new highs and is currently in a strong uptrend. The RSI indicates that the stock is in the overbought zone, following a sharp price expansion over the past week. Wave analysis suggests there is still an upside potential of 20–22% from current levels . However, some consolidation around these levels is likely in the near term. BEL could be a good trading candidate if approached with the following strategy:

Entry: 346-335

Target: 435

Stoploss: 318 (on closing basis)

✅ For more trading ideas like this, make sure to share and follow my Idea Stream! ✅

BEL : Flying High, creating new Highs.BEL : Flying High, creating new Highs.

After a Buy Signal as displayed on Chart , it never looked back .

3 Months Time Frame Chart .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Range breakout | Impulse of bull starthi Traders,

1. The swing formation is solid

2. BEL has taken the ascending trend line support.

3. The the range bound is weekly has broke upward, leading to impulse wave of bull trend.

4. Projected Target 1 and Target 2 with 20% and 40% returns from the CMP with 1:81 and 1:4.01 risk reward ratio respectively.

Bharat Electronics Ltd view for Intraday 19th May #BEL Bharat Electronics Ltd view for Intraday 19th May #BEL

Resistance 365-366 Watching above 366 for upside momentum.

Support area 358 Below 360 ignoring upside momentum for intraday

Watching below 357 for downside movement...

Above 362 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Bharat Electronics Ltd view for Intraday 14th May #BEL Bharat Electronics Ltd view for Intraday 14th May #BEL

Resistance 340 Watching above 341 for upside movement...

Support area 330 Below 335 ignoring upside momentum for intraday

Watching below 328 for downside movement...

Above 335 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

BELBEL

MTF MTF-Zone TREND MTF Analysis Logic Proximal

HTF Yearly UP BELYearly Demand RR 185

HTF Half-Yearly UP BEL6 Month Demand RR 185

HTF Qtrly UP BELQtrly Demand BUFL BUFL 217

MTF Monthly UP BELMonthly Demand RR 217

MTF Weekly UP BELWeekly Demand DMIP 263

MTF Daily UP BELDaily Demand DMIP SOE 265

ITF 240M UP BEL240Mn Demand BUFL 301

ITF 180M UP BEL180 Mn Demand BUFL 301

ITF 60M UP BEL60 Mn Demand BUFL 301

Trade Plan ENTRY-1

Entry-1 301

Entry-2 265

SL 244

RISK 57

REWARD 194

Target as per Entry 495

RR 3.4

Last High 340

Last Low 243

Bharat electronics Given breakout BEL 314 has given breakout . Support at 290. Target 380.

Valuation

Good Dividend payout across aerospace sector

FII's have increased stake hold.

In April 2025, has got 2 orders.

India's Bharat Electronics gains on 22-bln rupee order win from Airforce

BEL - GETS ORDER WORTH 5.93 BILLION RUPEES

P/E is at 46 while sector P/E is at 60

10 Years ROE is 20%

BEL : BEL is Bullish BEL : BEL is Bullish

In a Buy trajectory.

Back to back Strong green Candles

Surpassed the previous resistance of 310.

All indicators are positive as displayed on the chart (Daily Time frame).

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

BELOne can make an entry in BEL after breakout from cup and handle pattern.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

free fall in stock market Reason For Freefall of Stock Market

A **free fall** in the stock market refers to a rapid and significant decline in stock prices over a short period, often triggered by panic selling, economic concerns, geopolitical events, or major financial crises. It typically leads to widespread losses for investors and can indicate market instability or the onset of a bear market.

### **Possible Causes of a Stock Market Free Fall:**

1. **Economic Slowdown/Recession** – Weak economic data, such as declining GDP or rising unemployment.

2. **Interest Rate Hikes** – Central banks raising interest rates can reduce liquidity and hurt stock valuations.

3. **Geopolitical Events** – Wars, political instability, or trade conflicts can trigger investor panic.

4. **Corporate Earnings Disappointments** – Weak earnings reports from major companies can spook investors.

5. **Banking or Financial Crises** – Failures of major banks or financial institutions can lead to a loss of confidence.

6. **Black Swan Events** – Unexpected crises like the COVID-19 pandemic or the 2008 financial crash.

7. **Algorithmic Trading & Stop Loss Triggers** – Automated trading can accelerate sell-offs when key support levels are broken.

### **What Happens During a Free Fall?**

- **Heavy Selling Pressure** – Investors rush to sell stocks, leading to sharp declines.

- **Increased Market Volatility** – Indices like the VIX (Volatility Index) spike.

- **Liquidity Issues** – It becomes harder to find buyers at stable prices.

- **Margin Calls** – Investors using leverage may be forced to sell assets to cover losses.

- **Potential Trading Halts** – Stock exchanges may implement circuit breakers to temporarily stop trading.

### **Examples of Past Free Falls**

- **1929 Stock Market Crash** – Led to the Great Depression.

- **Black Monday (1987)** – Dow Jones fell 22% in a single day.

- **2008 Financial Crisis** – Market collapse due to the housing bubble burst.

- **March 2020 COVID-19 Crash** – S&P 500 dropped over 30% in a month.

### **What Should Investors Do?**

- **Stay Calm & Avoid Panic Selling** – Rash decisions can lock in unnecessary losses.

- **Assess Portfolio & Diversify** – Reduce risk exposure and hold defensive assets (e.g., bonds, gold).

- **Look for Buying Opportunities** – Some stocks may become undervalued.

- **Follow Market News & Expert Advice** – Stay informed about economic and policy changes.

Are you seeing signs of a market free fall right now, or are you just looking for general information?

BEL Support and Resistance(SR) chart Bel is moving in a downward parallel channel the crucial points to keep an eye for BEL would be 280 and 250. it might have a breakout after 300 or dip further from 250, so these should give you a target and stop loss strategy to ponder. please do your analysis, this is just my opinion

Review and plan for 31st January 2025Nifty future and banknifty future analysis and intraday plan.

Stocks with results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

BEL - Stage AnalysisThere are generally four stages that you can identify on stock analysis charts, such as those on Trading View:

Stage 1: Basing Phase

During this stage, businesses are working on building their models and fine-tuning operations to achieve steady, but very slow, profitability.

Stage 2: Mega Compounding Phase

In this stage, the business experiences rapid growth and high profitability, thanks to previous investments in capital and sales channels. The company shows strong momentum, and its stock price may hit all-time highs or several 52-week highs.

Stage 3: Profit-Taking Phase

After the high growth in Stage 2, the business begins to show signs of slower growth. Investors who made good returns in Stage 2 may start selling their stocks to lock in profits.

Stage 4: Downtrend Phase

In this final stage, stock prices may fall due to various factors, such as business defaults, lack of revenue or profit growth, emerging new trends, or management struggles.