BHEL trade ideas

RESURRECTION - Stair's or Elevator ?ENTRY 24.30 - 28

SL 23.85

TARGET 57.95

Since this was trending on twitter thought i'd have a quick look at it .( should get some volume due to the interest )

The government owns 60% of it and is planning on offloading 40% this also happens to be THE big boy power generation equipment manufacture so assuming the country's need for demand should increase.

Golden cross on the daily waiting to happen its been in a downtrend since November 2007 so keeping in mind that each country is focussed on becoming more self reliant i believe this company shall be the force behind our resurrection .

The levels are on the chart and this should fly once it flips 60 to 135.

Shall post a LTF later.

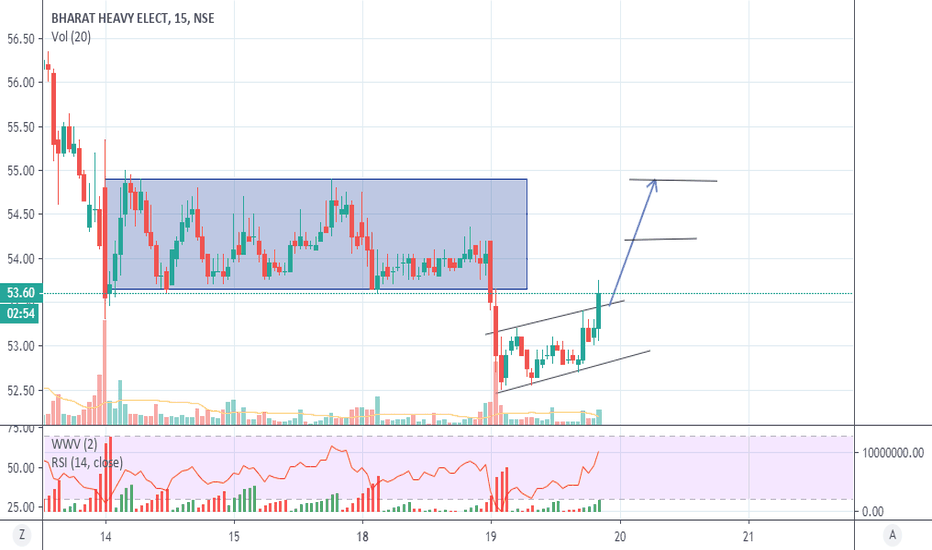

Bhel Broke ascending traingle pattern upsideBhel Broke ascending traingle pattern to upside with volume

If it sustain 26.60 tomorrow closing in downward and give tomorrow closing above today high 27.25 then can see a target of 28.35 and then 32.10 respectively.

further support and resistance given on the chart.

BHEL- Portfolio Stock - Long Term View Hey everyone,

I consider NSE:BHEL for my Portfolio stock. Will explain everything why I am considering this stock in my Portfolio and what will be My entry Point.

Key Factors

================

1- BHEL has offered partnerships at its 16 manufacturing facilities across the country

2-Company has 14000 acres land parcels at different towns and cities in India. Taking conservative per acre land price at Rs 50 lakhs, the land value is pegged at Rs. 7000 Cr. Further, company has Rs. 5000 Cr cash. So total value of land + cash is Rs. 12000 Cr. Currently company market cap at Rs. 7700 Cr.

3-BHEL has floated an expression of interest form foreign companies to use its idle facilities to set up manufacturing of electrical equipment, solar modules, lithium ion cells, transportation equipment, LCD panels. Can be a big beneficiary of companies looking to diversify manufacturing from China post covid 19.

4-BHEL has mainly fallen due to fall in sales and increase in inventory and trade receivables.

5-BHEL stock has declined 66 per cent in the past one year due to weak power demand, delay in new orders and deteriorating receivables position. The stock offers an attractive risk-reward profile with its current market cap at Rs 8,300 crore against FY19 cash and cash equivalent of Rs 7,503 crore. The stock, with a dividend yield of 8.5 per cent, is currently trading at 0.3 times its book value. Considering its net assets of Rs 35,810 crore as on FY19 and outstanding shares of Rs 348 crore,

Fundamental View

===================

www.dropbox.com

Technical View

====================

BHEL strongest support and demand zone is near about 8-12 rupees. There is lot of confirmation on this price and this is the best price we can get in Upcoming years. We should need to consider a long position from this price.

BHEL -- LongBHEL Analysis -- BHEL has been one of the beaten-down stock in PSU universe. The stock has taken support in the zone of 41-42 multiple times over the past 3 months indicating that a strong base is formed around this zone and breaching this zone is difficult considering the Govt's proposal to disinvest some stakes and/or monetizing the assets in PSU's we can see huge value unlocking in BHEL over the course of time.

Technical Analysis -- Per data available in NSE, there has been study raise in trading volumes/ delivery and OI increase at current levels indicating that the downside would be limited and the upside is huge favoring the bulls.

Conclusion -- Basis the above analysis - One can make this stock as a portfolio basis the risk appetite.