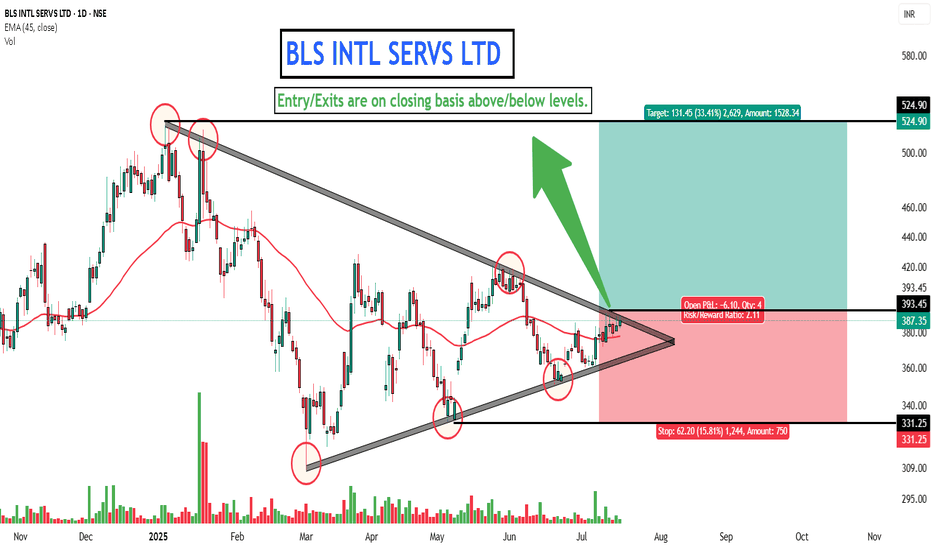

BLS INTL SERVS FOR YOU!Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

Kindly dm for further assistance it is for free just for this stock.

Thank you and invest wisely.

BLS trade ideas

BLSBLS International's all-time high was ₹521.80 on January 3, 2025, and its 52-week high was also ₹521.80.

With the current price at ₹406.40, the stock is down:

- 22.1% from its all-time high

- 22.1% from its 52-week high

The stock has seen a significant correction from its peak, but it remains well above its 52-week low of ₹277.95, Watch it carefully above 422, Price movement can be expected 430, 450, 460

BLS International Services - Towards 200 - Wolfe wave patternBLS International services has formed a bearish wolfe wave pattern om weekly time frame.

With this pattern it has potential to reach up to 200 on Fib support with following targets;

Target1: 320

Tagrte2: 265

Target3: 265

Being bearish wolfe wave it can also touch 105 in a worst situation.

SL: 395 to 400 on a week candle close.

Amazing breakout on Weekly Timeframe - BLSCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN LOWER TIMEFRAME AND RETRACE IF NEEDED. SL IS NEARER SUPPORT ZONE IN Daily TIMEFRAME.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:1

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

BLS INTL SERVICES - Ready for a short term Up MoveThe stock had undergone a big correction even before the recent small cap index correction. The stock fell almost 28% from 475 to 340. It was pushed below the 200 DMA, from where it has been recovering. Even during the recent correction in the small cap index, the stock was in fact showing lot of strength and the relative strength compared to the small cap index is positive now. It is also making higher highs in the daily frame while it is still continuing to make the higher highs and higher lows in the weekly time frame as well. Now, it has also crossed above the short-term moving averages and the previous daily pivot. So, the stock looks likely to test 475 levels. So, I am looking at 15% returns in the short term from the stock. Of course, one has to always keep in mind the overall market weakness.

BLS INTL SERVS- Base-On-Base- LOOK FOR A BUY

1. VCP Analysis:

- Multiple Contractions : The stock is forming a VCP pattern where volatility has decreased with each successive pullback. You can see that each decline in price gets progressively smaller, which indicates that sellers are getting exhausted, and buyers are stepping in earlier at each pullback.

- Tightening Price Action : The pattern shows price action tightening, with the stock forming higher lows. This is typical in a VCP setup, as volatility contracts before a breakout.

2. Moving Averages (9 SMA and 21 SMA):

- 9 SMA (Blue Line) : The stock price has been trading above the 9 SMA for a considerable time. This suggests that short-term momentum remains bullish.

- 21 SMA (Red Line) : The stock is also above the 21 SMA, confirming that the medium-term trend is upward. Additionally, the 9 SMA crossing above the 21 SMA earlier signals a bullish crossover , a positive indication for the stock.

- Support from Moving Averages : The 9 SMA is offering short-term support, while the 21 SMA serves as a secondary support. If the stock pulls back, these two SMAs will be crucial levels to watch.

3. Breakout and Price Action :

- Resistance Break : The stock has recently broken through a resistance level around ₹404. This level has now turned into support. The breakout is a positive signal, especially in a VCP setup, as it often leads to continued upward movement.

- Volume Confirmation : Volume during the breakout appears significant, supporting the price movement. However, volume has decreased post-breakout, indicating potential consolidation before another move higher.

4. Key Levels:

- Support Levels:

- The first support is around ₹414, where the breakout occurred.

- The next level of support is likely the 21 SMA (currently around ₹438).

- Resistance:

- The immediate resistance zone is around ₹460-₹470. If the stock clears this level, it could indicate further upside potential.

5. Volume Consideration:

- Volume Contraction : Volume seems to have contracted during pullbacks, which is typical in a VCP setup. The most recent breakout above the ₹404 level came with an increase in volume, confirming the strength of the move.

- Recent Volume: As the stock approaches resistance, volume has diminished, which could indicate a period of consolidation before the next leg up.

Conclusion:

The stock is showing a well-formed **VCP** with tightening price action and decreasing volatility, a bullish sign. The breakout above ₹414, supported by volume, suggests further upside is possible. Watch for the stock to maintain its position above the 9 and 21 SMAs for continued strength. Keep an eye on the ₹460-₹470 resistance area, and monitor the volume for confirmation of any further breakouts.

BLS INTL SERVS - ROUND BOTTOM BREAKOUTRound Bottom breakout

BUY PRICE : 430

SL : 358 (only for swing traders)

TARGET : 600 (40%)

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

50 SMA RISINGI am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

50 SMA Rising Strategy. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep trailing with 50 days SMA if price close below 50 SMA then Exit or be in the trade some time trade can go for several months.

BLS International - Nearing big box breakout after long consolidBLS International - Nearing big box breakout after long consolid

Stock with good fundamentals and great FY-Q1 results..

Buy @ CMP or above 403 for long term holding with a target of 30-40% upside

Disclaimer:

This analysis is for informational purposes only and does not constitute investment advice. Trading involves significant risk and may result in the loss of capital. Always conduct your own research or consult a financial advisor before making investment decisions. I am not responsible for any actions taken based on this analysis.

BLS - Gearing up for 15% - 20% move ?In early Feb, the stock faced price rejection around 430 levels and was pushed back to the 200 DMA levels. From there, it has been consolidating for almost three months. Now it is attempting to move up, it is about to cross the current price rejection level at 358. The relative strength is also turning positive and the money also started flowing into the stock. The volumes have been increasing including the delivery volumes indicating committed buyers are stepping in. The momentum has and Buying Pressure have been increasing recently. Once we have a positive close above 358 levels, we could see the stock testing the supply zone around 430 levels. This is a stock to watch.

How to Trade BLS InternationalBLS Intl, now at 343 on March-14-2024 :

2 ongoing patterns can be seen

#1. Per EW, the major Motive wave is completed and retracement is done closer to 0.382 and rising again, So, invest few now, invest until 256 for target of 604.5 in 1-1.5 yr holding period

#2. Per another ongoing pattern ( highlighted zone ), One can invest until 300 for a target of 604

As strict stoploss of 255

Expected Gains from curent price --> 76.2%

Prefer to invest regularly in this

BLS International - Looks Good!The price has recently broken out to the upside after a period of consolidation, indicating that the prior upward trend is likely to continue.

A Symmetrical Continuation Triangle with a bullish bias is characterized by two converging trendlines. During this formation, prices make lower highs and higher lows, creating a tightening range. As the pattern evolves, trading volume tends to decrease, reflecting market uncertainty and indecision. It's important to note that the breakout occurs before the triangle reaches its apex, the point where the trendlines meet.

What's particularly noteworthy is that the price breaks above the upper trendline with a noticeable surge in trading volume, serving as confirmation that the pattern is a signal for a continuation of the previous uptrend. This breakout suggests that the market sentiment has shifted back to a more bullish stance, potentially leading to further price appreciation.

Note at below RSI Vs Price divergence also noticed!

PLEASE NOTE THAT:

This chart analysis is only for reference purpose.

This is not buying or selling recommendations.

I am not SEBI registered.

Please consult your financial advisor before taking any trade