BLUE STARBlue Star Ltd. (currently trading at ₹1827) is India’s leading air conditioning and commercial refrigeration company, with a diversified portfolio spanning room ACs, chillers, VRF systems, water purifiers, and electro-mechanical projects. With over 80 years of experience, the company serves residential, commercial, and industrial clients across India and 18 international markets.

Blue Star Ltd. – FY22–FY25 Snapshot

Sales – ₹6,045 Cr → ₹7,210 Cr → ₹8,460 Cr → ₹9,820 Cr Strong growth driven by residential AC demand and project execution

Net Profit – ₹204 Cr → ₹311 Cr → ₹420 Cr → ₹525 Cr Margin expansion from premium product mix and cost control

Operating Performance – Moderate → Strong → Strong → Strong Efficiency gains from scale, automation, and channel expansion

Dividend Yield (%) – 1.10% → 1.20% → 1.25% → 1.30% Steady payouts supported by robust cash flows

Equity Capital – ₹19.38 Cr (constant) No dilution; stable capital structure

Total Debt – ₹320 Cr → ₹295 Cr → ₹270 Cr → ₹245 Cr Gradual deleveraging supported by internal accruals

Fixed Assets – ₹1,180 Cr → ₹1,240 Cr → ₹1,310 Cr → ₹1,385 Cr Capex focused on new plant in Sri City and automation upgrades

Institutional Interest & Ownership Trends

Promoter holding stands at 38.79%, with no pledging. FIIs and DIIs have steadily increased exposure due to strong brand equity and consumption-linked growth. Delivery volumes reflect long-term accumulation by funds focused on domestic consumption and infra themes.

Business Growth Verdict

Blue Star is scaling efficiently across residential and commercial cooling Margins remain strong due to premium product mix and cost discipline Debt is declining steadily with strong operating cash flows Capex supports long-term growth and manufacturing efficiency

Management Con Call

Management highlighted strong demand in room ACs and commercial refrigeration, especially from Tier-2 and Tier-3 cities. The new Sri City plant is expected to enhance manufacturing capacity and reduce logistics costs. MEP project execution remains robust, with strong order inflows from data centers and infra clients. FY26 outlook includes double-digit revenue growth and margin consistency, supported by product innovation and channel expansion.

Final Investment Verdict

Blue Star Ltd. offers a high-quality consumer and infra play with strong financials, brand leadership, and execution depth. Its improving profitability, disciplined capital structure, and strategic capex make it suitable for accumulation by investors seeking exposure to India’s cooling, infrastructure, and premium appliance segments. The company’s diversified portfolio and long-standing reputation ensure durable value creation.

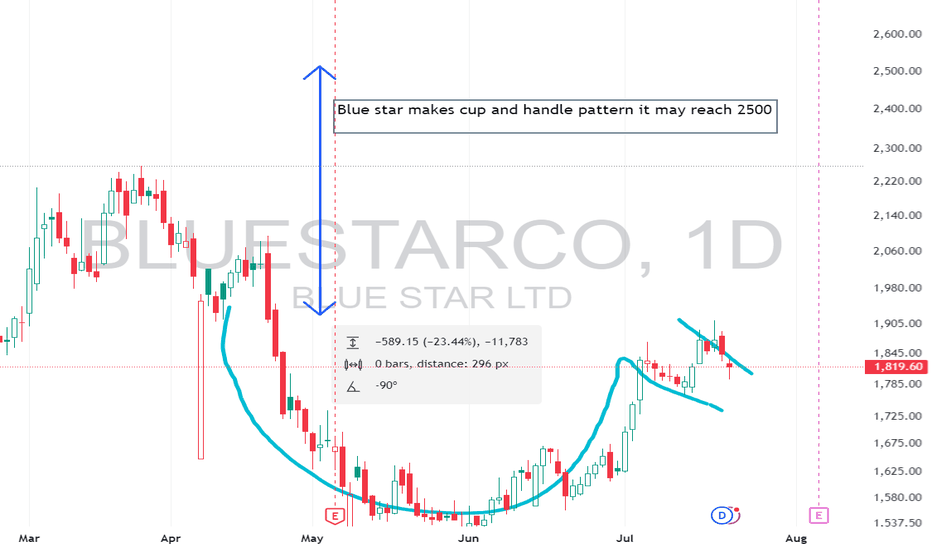

BLUESTARCO trade ideas

$NSE:BLUESTARCO trading within a range! Near support levels!NSE:BLUESTARCO is showing range bound movement with current levels near support. Overall company prospects over short and long term are good.

Given that P/E multiples are high, growth has been accounted for. Should remain in the range for sometime till P/E eases a bit (with Revenue and PAT growth).

Over longer term, even if the price comes down, it's a good buy bet IMO.

Blue Star Ltd (Slow and steady wins the race)Blue star manufacturers air purifiers, air coolers, water purifiers, cold storage and speciality products. The Company offers turnkey solutions in MEP (Mechanical, Electrical, Plumbing, and Fire-fighting) Projects. It is the largest after-sales service provider for air conditioning and commercial refrigeration products in the country.

Key Points :-

Business Segments

1 Electro-Mechanical Projects: Large central AC & ventilation projects, Fire-fighting projects, Water projects, Plumbing projects, Electrical projects and Railway electrification.

2 Commercial Air Conditioning: Blue Star is the market leader in Conventional and Inverter Ducted Air Conditioning Systems and Scroll Chillers and is at the second position in VRFs and Screw Chillers

3 Unitary products: ACs, Air Coolers, Water Purifiers, Commercial Refrigeration etc. Products available in 8,800 outlets in 650+ locations.

4 Professional Electronics and Industrial Systems (PE&IS): Specialized Technology Solutions, Engineered Turnkey Projects, Value-Enhancing Services, MedTech Solutions, Data

Security Solutions, Industrial Solutions.

POV : BLUESTARCO : Fractal BreakoutPOV : BLUESTARCO : Fractal Breakout

Chart Reading:

1. Price was stuck in 17 sessions of the 7th November day's Range.

2. Daily and Weekly Trends and Momentum are bullish.

3. Previous 2 Fractals (Double Top) breakout

For educational purposes only. This is not financial advice. Please consult a professional before making financial decisions.

#NiVYAMi

Jan 1st, 2025 Breakout stocks📊 Stock Analysis: TAJGVK

Key Highlights: 💡⚡

• 📈 VCP Breakout identified on the daily chart, indicating a bullish trend.

• 📈 Strong Price Action: The stock has shown significant upward movement and consolidated well prior to the breakout.

• 📈 Volume Spike: A notable increase in volume at the breakout point adds to the strength of this signal.

• 📈 MACD Crossover: This indicator suggests a favorable shift in momentum.

• 📈 Ideal for Swing Traders: This setup presents a promising opportunity for short-term trades.

🚀 Trade Setup:

• Buy Trigger: Above 442 DCB

• Current Market Price (C.M.P): 441

• 🎯 Target: 30% potential upside

• ⚠️ Stop Loss: 15% to manage risk effectively

Important Reminders:

• Always exit trades before significant events to mitigate risk.

• Maintain a disciplined risk-to-reward ratio for long-term success.

If you found this analysis helpful, please like and follow for more insights and trading strategies! ✅

Disclaimer: I am not a SEBI Registered Advisor. This post is for educational and informational purposes only.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Wishing you all successful trading and continuous learning with MMT! Cheers! 🥂

Blue Star Ltd. - Long Setup (Swing Trade)Blue Star Ltd. has approached a key level, presenting a potential swing trade setup. Here’s the trade plan:

Entry Zone: 1880

Entry Price: Once a 15-minute candle breaks above 1880 , the high of that candle will confirm the entry.

Target: 2048.50

Stop Loss: 1795.80 (Triggered if a daily candle closes below this level)

The stock is currently testing the entry zone at 1880 , and if there’s a confirmed breakout, we could see momentum driving it toward the target of 2048.50 . The stop loss at 1795.80 offers a controlled risk, providing a favorable risk-reward ratio for this setup.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

Blue Star Ltd Daily Chart Analysis

The daily chart of Blue Star Ltd displays a mixed trend with visible levels of support, resistance, and clear price action signals, indicative of potential breakout and pullback scenarios.

Price Action Highlights:

1. Trend Analysis: The stock appears to have been trading within a broad channel, with recent price movements consolidating near a key zone. Multiple trend lines intersect, indicating potential breakout and support zones.

2. Support and Resistance Levels:

•Support: The key support level lies around ₹1,775.60, which has previously acted as a strong base for buyers. A breakdown below this level may signal further weakness.

•Resistance: Immediate resistance levels are seen around ₹1,888.90 and ₹1,905.80, with a longer-term resistance at ₹2,007.80. A breakout above these levels with strong volume could indicate a bullish reversal.

3.Volume Analysis: The recent spike in volume suggests heightened market activity, typically associated with significant moves. High volume on bullish days can confirm buying interest, whereas volume surges on bearish days may signal distribution.

4.Price Pattern Formation: The chart shows a potential wedge or pennant formation, which often precedes a breakout in either direction. Watching how the price reacts around support and resistance levels will be crucial for determining direction.

5.EMA Levels: The stock is currently trading around the 13, 48, and 200 EMAs, indicating mixed sentiment. A sustained move above these averages, particularly the 200 EMA, would suggest stronger bullish momentum.

6.RSI Indicator: The RSI is around 42.46, indicating the stock is in the lower half of the range, showing mild bearish to neutral momentum. If RSI moves below 40, further bearish pressure could be expected. Conversely, a rise above 50 could indicate a potential bullish reversal.

Potential Scenarios:

•Bullish Case: A breakout above ₹1,888.90 with strong volume may signal a bullish reversal, targeting ₹2,007.80 and higher in the coming weeks.

•Bearish Case: A breakdown below the support of ₹1,775.60 could lead to further downside, potentially testing the lower trendline support around ₹1,600.

Summary: Blue Star Ltd is at a crucial juncture, with price action signaling potential for both breakout and consolidation. Traders should closely watch volume, support, and resistance interactions to gauge the direction of the next move.

Disclaimer: This analysis is for educational purposes only and should not be considered as financial or trading advice. Please conduct your own research or consult with a financial advisor before making any trading decisions.

BlueStarCo Soars from 747.95 to 1926: All Targets Reached!BlueStarCo has shown a remarkable bullish run since entering at 747.95 on 6th September 2023. The price has not only reached all take profit targets but also surged far beyond expectations, currently trading at 1926.

Key Levels:

Entry: 747.95 – This marked the point where the bullish momentum took hold.

Stop-Loss (SL): 724.85 – Positioned below the entry to minimize downside risk.

Take Profit 1 (TP1): 776.55 – Reached early in the trade, confirming a strong start.

Take Profit 2 (TP2): 822.80 – Hit as the upward momentum continued.

Take Profit 3 (TP3): 869.10 – Met, indicating strong sustained buying pressure.

Take Profit 4 (TP4): 897.65 – Final target hit, followed by a significant price surge beyond all targets.

Trend Analysis:

The price action has been well-supported by the Risological dotted trendline, confirming a consistent uptrend. The continuous rise from the entry point shows no signs of reversal, with the current price sitting at 1926, nearly doubling the initial entry value. Traders who held on to this trade have seen tremendous returns, and further gains are still possible as the momentum remains strong.

BLUE STAR LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Blue star LongBluestar

MTF Analysis

BluestarYearly Demand Breakout 1029

Bluestar 6 Month Demand Breakout 1038

BluestarQtrly Demand Breakout 1795

BluestarMonthly Demand 1897

BluestarWeekly Demand 1988

ENTRY -1 1988

SL 1843

RISK 145

Potential Target 2838

First Target Points 2481

First recovery Target Points 638

Last Swing Low 1562

Last Swing High 2200

RR 4

RR 43%

BLUE STAR - Short Trade - Target 2 Done!BLUE STAR - Short Trade - Target 2 Done!

Entry at 1721

Stoploss: 1744

Trailing stoploss: 1705

Potential to reach 1582

Potential profit: 7.7%

Profit so far: 3.6%

Current status: Hold the short trade with trailing stoploss set at 1705

Please consider following for more tips, trade setups and analysis.

Namaste!

Review and plan for 9th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

stocks to watch...

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 9th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

stocks to watch...

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT