BSE trade ideas

BSE💼 BSE Trade Plan Details

Parameter Value

Entry Price 2079

Stop Loss (SL) 1861

Risk 218 pts

Reward 1924 pts

Target 4003

Risk:Reward (RR) 8.8

🔎 Reference Data

Last High 3026

Last Low 2049

Point Var 977

✅ Key Observations & Strategic Notes

Trend Strength: All HTF, MTF, and ITF are in a confirmed uptrend.

Entry Zone: 2079 is right around the MTF average proximal zone — indicating a strong base for long entry.

Stop-Loss Safety: SL at 1861 is just below the weekly demand zone — providing a safe cushion.

Reward: A target of 4003 gives you a clean Risk:Reward ratio of 8.8, which is highly favorable.

Volume Play: Since price is near the recent low (2049), any break above recent consolidation could trigger momentum toward 3000+ zone.

60M Distal Zone at 8544 seems like a data error (likely a typo) — not aligned with other ITFs or HTFs.

⚙️ Recommendation

Entry looks optimal with alignment across MTF.

If BSE consolidates between 2040–2080, consider adding more positions with tighter SL using ITF (60m) confirmations.

Consider partial profit booking near 3000, then trail SL for extended target at 4003.

📈 BSE Multi-Timeframe (MTF) Analysis Summary

All timeframes signal a strong bullish trend, confirming buy-side conviction across HTF, MTF, and ITF.

🔷 High Time Frame (HTF) – Long-Term Demand Zones

Timeframe Trend Analysis Proximal Distal Avg

Yearly UP RALLY RALLY 857 641 749

Half-Yearly UP RALLY RALLY 1078 702 890

Quarterly UP Breakout + Demand 2038 1654 1846

HTF Avg 1324 999 1162

🔷 Mid Time Frame (MTF) – Medium-Term Demand Zones

Timeframe Trend Analysis Proximal Distal Avg

Monthly UP Support 2038 1654 1846

Weekly UP Support 2038 1861 1950

Daily UP DMIP + BUFL Demand 2162 2088 2125

MTF Avg 2079 1868 1974

🔷 Intraday Time Frame (ITF) – Short-Term Demand Zones

Timeframe Trend Analysis Proximal Distal Avg

240 Min UP DMIP Demand 2162 2088 2125

180 Min UP DMIP Demand 2162 2088 2125

60 Min UP DMIP Demand 2079 8544 5312

ITF Avg 2134 4240 3187

BSE - BUY THE FEAR, SELL THE GREED !"Buy the fear, sell on greed" is an investment strategy that means you should buy assets when most investors are scared and selling (during periods of fear), and sell those assets when most investors are excited and buying (during periods of greed).

Why does this work?

⦁ When fear dominates the market, prices often drop below their true value because people panic and sell at low prices. This creates opportunities for disciplined investors to buy quality assets at a discount.

⦁ When greed takes over, prices often rise above their real worth because people are eager to buy, hoping for quick gains. This is usually a good time to sell, as the risk of a downturn increases.

How do emotions affect markets?

⦁ Fear leads to panic selling, causing prices to fall further and often locking in losses for those who sell at the bottom.

⦁ Greed leads to speculative buying, driving prices higher and sometimes creating bubbles that eventually burst.

Why is it hard to follow?

⦁ While the idea is simple, it is emotionally difficult to buy when everyone else is pessimistic and selling, or to sell when everyone else is optimistic and buying. Most people act on emotion rather than logic, which is why few consistently succeed with this approach.

Practical example:

During a market crash, negative news and panic cause many to sell at low prices. A disciplined investor who buys during this fear can benefit when the market recovers. Conversely, when markets are booming and everyone is rushing to buy, selling at this point can help lock in gains before a potential correction.

Key takeaway:

This strategy is about removing emotion from investing decisions and taking a contrarian approach—buying when others are fearful and selling when others are greedy—rather than following the crowd. This approach has been used by successful investors like Warren Buffett to achieve long-term success by focusing on value and maintaining emotional discipline.

Fresh buying and selling entry in BSEAs we can watch it is falling 50 days moving average (green line) and fall from its support of 2509 and currently selling entry is possible in it till 2176.35 and if it more fall the next level of support is 1907.

Fresh buying is possible at near 2176.35 level and SL is 1907 and TPs are 2509 and 3048.

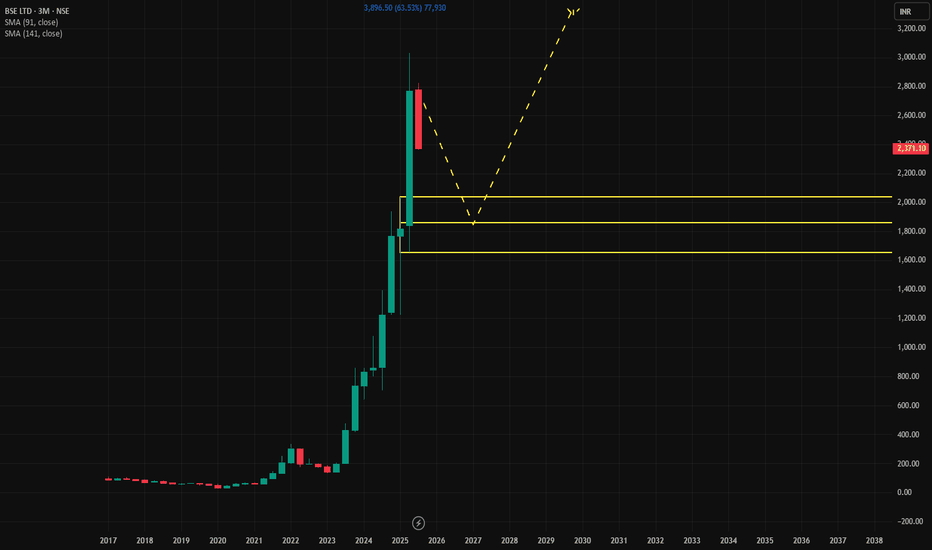

BSE Ltd – Completion of a 5-Wave ImpulseBSE Ltd appears to have completed a five-wave impulsive advance following a prior flat correction. Wave 5 has reached the 1.618 Fibonacci extension of Wave 1 and touched the upper boundary of a well-defined ascending channel — suggesting a potential short-term top.

If a correction unfolds from here, it may take the form of a zigzag or a flat. Key Fibonacci retracement levels to watch:

Target 1: 2,159 – 0.382 retracement

Target 2: 1,981 – 0.5 retracement

Target 3: 1,803 – 0.618 retracement

The invalidation level for this setup is around 2,736.20 . A sustained move above this would indicate that the uptrend may still be in progress.

Price action in the coming sessions will be key to confirming the next direction.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

BSE - 1000 Points move on cards? Up or Down?It's ready to move 1000 points but which direction? we shall work on directionless move but the length of the move.

Current Price: 6359

Mid-point: 6383.75

upside levels: 6928.36, 7228.75, 7545.63 and 7862.50

Downside levels: 5840.19, 5538.75, 5221.88 and 4905.00

Stop loss: 6141.64

Resistance: 6627.98

BSEBSE

MTF MTF-Zone TREND MTF Analysis Logic Average

HTF Yearly UP BSEYearly Demand RR 2,275

HTF Half-Yearly UP BSE6 Month Demand RR 2,609

HTF Qtrly UP BSEQtrly Demand BUFL RBR 3,945

MTF Monthly UP BSEMonthly Demand RR 3,945

MTF Weekly UP BSEWeekly Demand DMIP 3,958

MTF Daily UP BSEDaily Demand DMIP BUFL 5,953

ITF 240M UP BSE240Mn Demand BUFL 5,953

ITF 180M UP BSE180 Mn Demand BUFL 5,953

ITF 60M UP BSE60 Mn Demand BUFL 5,953

Trade Plan ENTRY-1

Entry-1 6040

Entry-2 4825

SL 4270

RISK 1770

REWARD 4602

Target as per Entry 10642

RR 2.6

Last High 6162

Last Low 3861

BSE - BSE Ltd. (45 mins. chart, NSE) - Long Position; short-termBSE - BSE Ltd. (45 mins. chart, NSE) - Long Position; short-term research idea.

Risk assessment: High {volatility risk}

Risk/Reward ratio ~ 3

Current Market Price (CMP) ~ 6480

Entry limit ~ 6370 to 6430 (Avg. - 6400) on April 23, 2025

1. Target limit ~ 6500 (+1.56%; +100 points)

2. Target limit ~ 6700 (+4.69%; +300 points)

Stop order limit ~ 6300 (-1.56%; -100 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

BSE BSE

As of now the stock is close to daily Supply

-Price Can Retest Weekly & Daily Demand

Add : 4563:

Add: 4233

Add : 3978

MTF Analysis Remarks

BSEYearly Demand 2,595

BSE 6 Month Demand 3,264

BSE Qtrly Demand 4,200

BSEMonthly Demand 4,200

BSEWeekly Demand DMIP 4,233 BUY

BSEDaily Demand Demand SOE 4,563 BUY

BSEDaily Demand DMIP CAP-DMIP 3,978 BUY

ENTRY -1 Long 4,233

SL 3,800

RISK 433

Target as per Entry 8,685

RR 10

Last High 6,183

Last Low 3,681

BSE LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

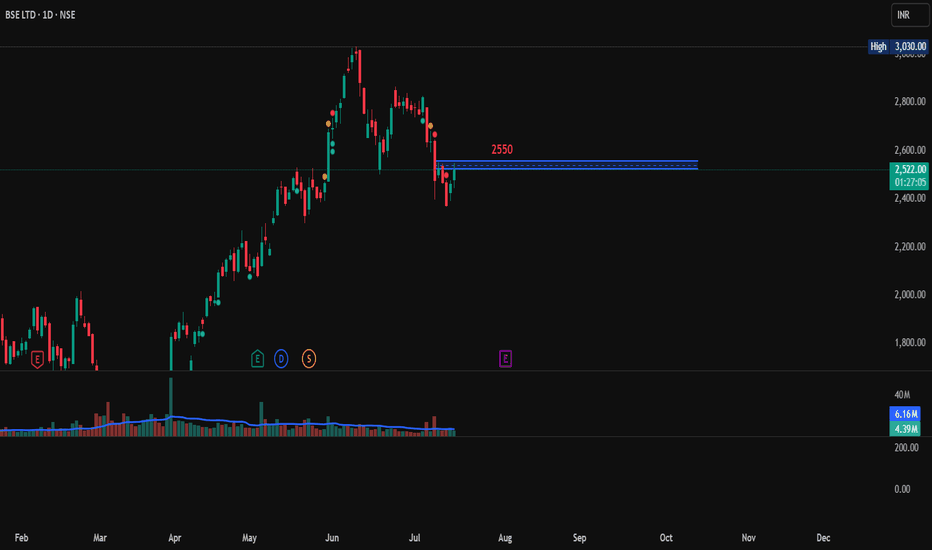

Short BSE LtdHuge run up in last one year almost 10x and 2.5x in last 6 months

Lower High twice (need to do thrice for formation to complete)

Bearish Engulfing made at resistance level which was support of previous swing

Follow through after bearish engulfing

SL and Entry price mentioned in Chart

Track sector to gauge strength of Sector

AngelOne is weak on Chart