CHOLAHLDNG trade ideas

Ye Chart Kuch Kehta Hai : Cholamandalam Financial HoldingCholamandalam Financial Holdings Limited (CFHL), a marquee name among India’s top 5 NBFCs by market capitalization and a key entity within the Murugappa Group, continues to demonstrate robust financial health and growth momentum. As a Core Investment Company registered with the RBI, CFHL offers a diversified portfolio of financial products and risk management solutions through its group companies, catering effectively to both individual and corporate clients.

Recent Performance Highlights:

The company has delivered a commendable profit CAGR of 20.5% over the past five years, underscoring consistent earnings growth.

Stock price performance has been exceptional, with a CAGR of 23% over 10 years, accelerating to 48% over 5 years, 45% over 3 years, and an impressive 83% in the last year alone.

Compounded profit growth remains strong, with 19% over 10 years, 21% over 5 years, 29% over 3 years, and 24% trailing twelve months (TTM).

Latest Quarterly and Annual Results:

Q4 FY25 disbursements rose 7% year-on-year to ₹26,417 crore, while annual disbursements crossed the ₹1 trillion mark at ₹1,00,869 crore, a 14% increase.

Assets Under Management (AUM) surged 30% year-on-year to ₹1,99,876 crore.

Net income for Q4 FY25 increased by 29% to ₹3,758 crore; Profit After Tax (PAT) grew 20% to ₹1,267 crore for the quarter and 24% to ₹4,259 crore for the full year.

The company maintains strong capital adequacy with a CAR of 19.75%, well above regulatory norms, and a comfortable liquidity position.

Asset quality remains robust with Gross NPA stable at 3.97% and NNPA at 2.63%, below RBI’s PCA threshold.

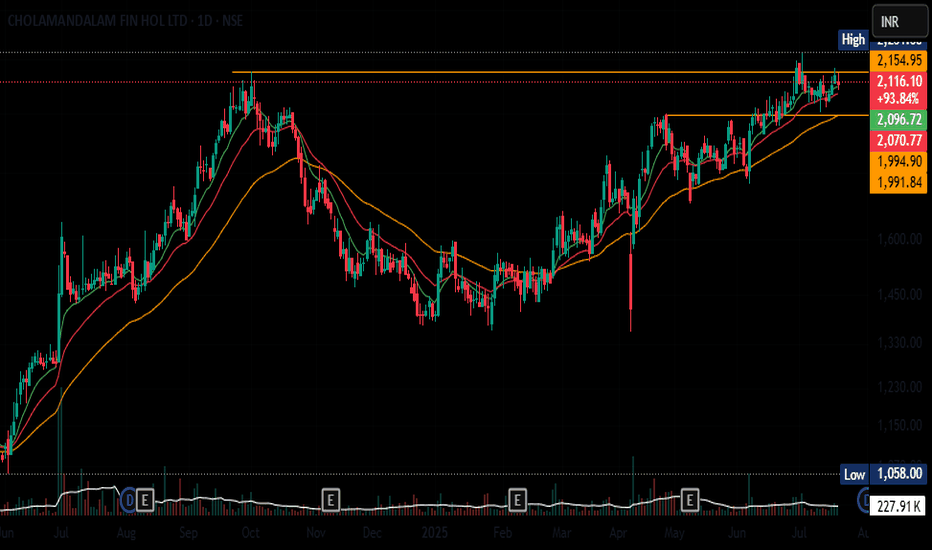

Technical Outlook:

From a technical perspective, the stock is poised for a breakout, perfectly positioned at the golden ratio level on the Fibonacci retracement, forming a classic cup pattern-an ideal setup signaling strong upside potential. The financial sector, particularly NBFCs, is currently in favor, and Cholamandalam stands out as one of the hottest picks in this space.

Investment Strategy:

Given the strong fundamentals and technical setup, this is an opportune moment to consider a position in CFHL. Investors should calibrate their stop-loss levels according to individual risk tolerance to safeguard capital while participating in the anticipated upward momentum.

This synthesis combines strong fundamentals with favorable technical signals, making Cholamandalam Financial Holdings a compelling investment candidate in the current market environment.

Cholamandalam Finance Near Key Support – Bullish Reversal SetupCholamandalam Finance Near Key Support – Bullish Reversal Setup

4/1/24 Daily/Weekly Analysis

CHOLAHLDNG is currently trading near a strong support zone of around ₹1,309.30, reinforced by a diagonal support trendline. Technical indicators suggest the stock is bullish and undervalued, with TradingView scans supporting this view.

Key Levels:

Buy Entry: Around ₹1,552.75, with a stop-loss below ₹1,309.30 to manage risk.

First Target: ₹2,154.95, where the price may encounter resistance.

Second Target: ₹2,363.50, for extended gains if the uptrend continues.

Technical Setup:

Support: The ₹1,309.30 level has been strong support, confirmed by multiple touchpoints.

Trendline Analysis: The price is maintaining a bullish channel, suggesting a potential continuation.

Risk-Reward: The stop-loss at ₹1,309.30 limits downside risk, while the upside targets provide a favourable reward.

This setup offers a promising swing trade opportunity, with strong support levels and potential for upward movement. Monitoring price action near resistance levels will be crucial.

Disclaimer:

This analysis is for informational purposes only and should not be considered as investment advice. Trading in the stock market involves risks, and it is important to conduct your own research or consult with a financial advisor before making investment decisions. Past performance is not indicative of future results. Always trade with risk management strategies in place.

SWING IDEA - CHOLAHLDNGStock has been under consolidation since 6 months.

MACD Cross seems to be in play. But has tried crossing since 3 months now.

Lets wait for the MACD Cross to happen successfully and the consolidation could complete around same time.

Stock has been having multiple good Earnings. This should definitely take it to new highs.

Keep a close eye.

go long - swing pick- this stock shows signficant delivery percentage value

- possible chances for accumulation

- may perform good in upcoming days

- this stock is picked after market close based on delivery qty data.

- follow this stock for next 5 days , if entry not triggered with in 5 days , ignore pick

- line marked in chart is the day it showed huge delivery percentage.i consider it as signal candle.i marked its high and low

entry

- go long with 1:1.5 RR

- take entry if 15min close crosses the line , ignore entry if it made gap ups

- i prefer entry with in 5 days , if not triggered ignore this pick

sl

- candle close below signal candle's low

target

- keep 1.5 times of sl.

CHOLAHLDNG - Bullish SetupStock name - Cholamandalam Financial Holdings Limited.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Master Score - B

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trades.

CHOLAHLDNGNSE:CHOLAHLDNG

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

Resistance BreakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose