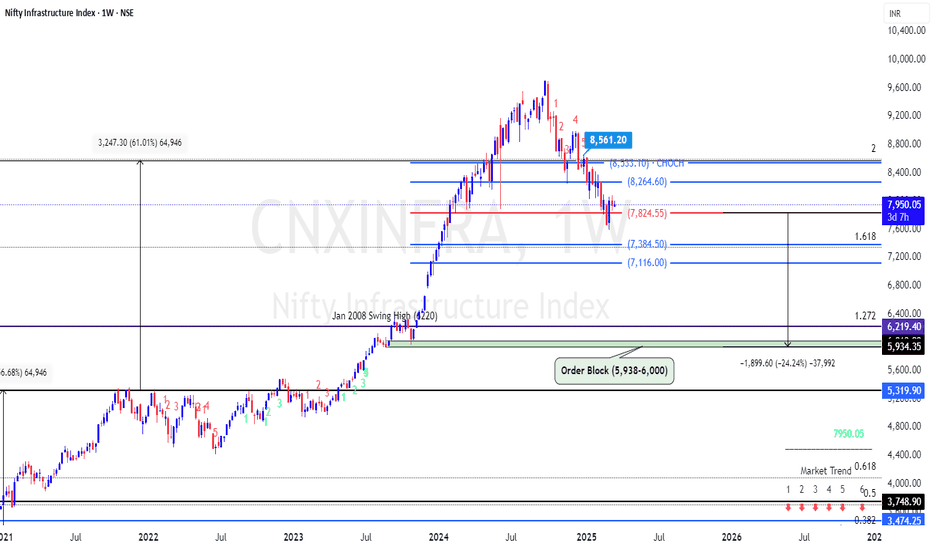

NIFTY INFRASTRUCTURE : POISED FOR ANOTHER 25% CORRECTIONNIFTY INFRASTRUCTURE : POISED FOR ANOTHER 25% CORRECTION

1. Sustaining Below 8,500 for over 2 months, this level will act as an immediate resistance.

2. We may expect approx. 25% downside from the current levels

3. Most likely it may retest JAN 2008 Swing top (Around 6,000) that confluences with the Weekly Order Block

4. We may find levels around these levels on peer group stocks for better R:R

CNXINFRA trade ideas

Review and plan for 5th December 2024Nifty future and banknifty future analysis and intraday plan in kannada.

Positional trading ideas included.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Sectoral Analysis in the beginning of the monthWe use our Customised Indicator called ECG to mark the most important support and resistance zones for the price in the respective time frame. Here we have plotted the index charts on day time frame which gives us the levels for positional trades which are valid for the whole month of August 2024.. Now the yellow colour lines form a zone which makes the home of the price.. Upper yellow line is the breakout line and the lower yellow line is the breakdown line. So if the price gives a valid crossover above the breakout then it is a bullish indication and if the price closes below the breakdown then it is a bearish indication. Above the Breakout zone we have the Upper PRZ zone which is a potential reversal zone and similarly below the breakdown level there is Lower PRZ zone.. the PRZ zones marked in red colour act as a trend changer and major moves are expected from these zones.. the zones are small hence they create good value proposition for us. Beyond the PRZs both on upper and lower end we have the cycle targets depicted in green colour.

So when the month starts we can refer to our Sector Analyser chart Setup and see which sector is looking good for the month and how they are progressing. We can also identify early change in trends from the PRZ zones.

We usually refer to the chart once in a day or at EOD to make our analysis.

Sector Analysis Four sectors that are outperforming NSE:NIFTY

{A} NSE:BANKNIFTY Though not by big margin definitely out performing NSE:NIFTY . Break above 42000 will be a great sign.

Stocks to watch out; 1) NSE:CANBK 2) NSE:ICICIBANK 3) NSE:INDUSINDBK 4) NSE:SBIN

{B} PSU Bank . 1) NSE:CANBK 2) NSE:SBIN 3) NSE:BANKBARODA

{C} NSE:CNXINFRA got a big push at Budget and is evident from stock performance . 1) NSE:LT 2) NSE:SIEMENS 3) NSE:ABB 4) NSE:NTPC

{D} BSE:MIDCAP is best out performer, if overall market improves will run away. 1) NSE:CUMMINSIND 2) NSE:PGHL 3) NSE:HAL 4) NSE:TORNTPOWER