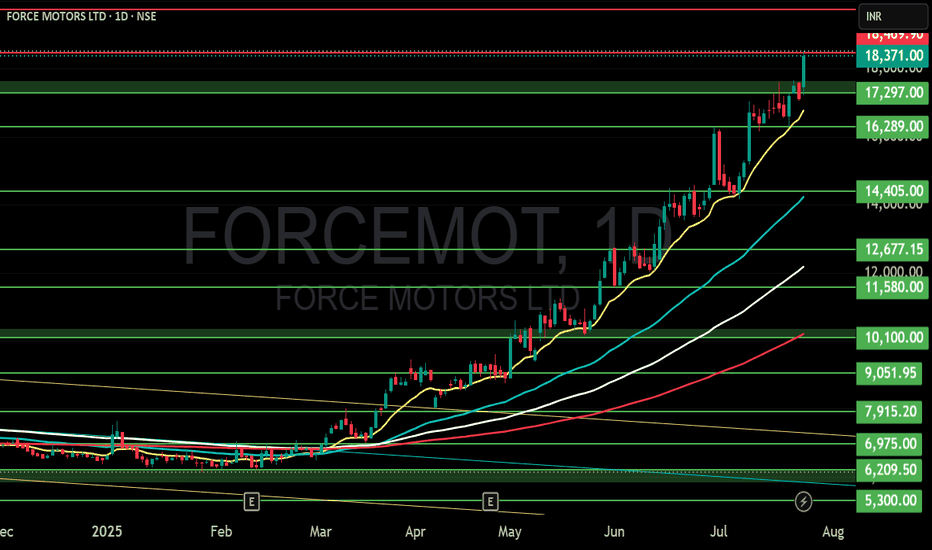

FORCE MOTORS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

FORCEMOT trade ideas

Long above 13960Nonstop move after the breakout of 10,350, stock is moving in a upward channel respecting upper and lower bend as resistance and support, out of 3 past sessions, stock formed 2 weak candles, today's low at 13,620 can act as immediate support (Not marked), below that stock may find next support at 13,285, 12,720 and zone at 12,010 - 12,210 can be the good support to hold the price from further fall, above 13,960 stock may chase for 14,775, 15,385 and 15,920. (On a weekly TF stock looks quite week so far.) CMP: 13,705

Force motors a strong stockThis is what a strong stock looks like in volatile market. Quick bounce to new high ground after a short pullback.

Due to market pressure stock briefly crossed all time highs but came back in the same day of breakout.

But now as the geopolitical situation improved stock quickly bounced back to all time highs with high relative volume. This shows the strength in stock and kind of support to stock.

Keep watching NSE:FORCEMOT

Force Motors Ltd - Long Trade Setup (NSE)📈 Technical Setup (Daily Chart)

Current Price: ₹10,062.50 (+12.88%)

Key Levels:

Support: ₹8,900 (Recent Swing Low)

Resistance: ₹10,200 (Immediate) → ₹11,500 (Next)

All-Time High: ₹13,000 (Long-term Target)

Indicators:

Supertrend (10,3): Bullish (Green) - Confirms uptrend

TEMA (5,9,20): Rising - Strong momentum

Volume: High volume breakout (NR7 pattern) - Institutional interest

Trade Plan:

✅ Entry Zone: ₹9,800-10,000 (Pullback to breakout level)

🛑 Stop Loss: ₹9,400 (Below recent swing low)

🎯 Targets:

₹11,000 (9% upside)

₹13,000 (30% upside)

📊 Risk-Reward: 1:3 (Excellent for positional trades)

🏭 Business Fundamentals

Sector: Automobiles (Commercial Vehicles & SUVs)

Why This Trade?

Growth Catalysts:

New SUV launches (Force Gurkha 5-door)

EV expansion plans

Government infrastructure push boosting CV demand

Financials:

Revenue growth: 18% YoY (Q3 FY25)

Debt-to-Equity: 0.3x (Healthy)

Valuation: Still trading below peers (Mahindra, Tata Motors)

Risks:

Commodity price inflation

Rural demand slowdown

🎯 Execution Strategy

Confirmation: Wait for close above ₹10,200 with volume

Position Sizing: Allocate 3-5% of capital

Exit Plan:

Book 50% at ₹11,000

Trail SL to ₹10,500 for remaining

Anticipated Price MovementExpect the price to pick up from the current demand zone @ 7,277 and reach for breaking the first supply zone @ 8,123. Following this, the price could face a little hurdle at the second supply zone @ 8,892 where the price will be pushed down. Breaking past this supply zone @ 9,127. The price is to move upwards and reach for the third supply zone @ 9,496. Here the price will be chasing a target of 9,750.

FORCE MOTORS LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

FORCE MOTORS - ALL TIME HIGH AGAIN ? WHATTTTTTTT....???

HELL YES..

A big OPPORTUNITY in FORCE MOTORS LTD🚀🚀

We saw that this stock was in correction mode since it made an all time high of ₹ 10,100

BUT NOW, it is giving the reversal sign by giving a breakout of downward sloping trendline with good intensity of volume.

* As per ELLIOT WAVES the stock is getting ready to move all time high to unfold the WAVE 5th

* Stock can be a buy on dip till it touches all time high with the same stoploss mentioned in trading plan at the last with expected targets.

Technical view- a simple understanding for beginners

* The stock has given a breakout with good intensity of volume.

* The price changed its structure from lower low to higher high

* Stock price is challenging Upper Bollinger Band in Daily Time Frame

* RSI ( a strength indicator) is above 60 in Daily Time Frame which indicates strong momentum

* All the momentum indicators such as MACD, DMI etc., are giving positive signals.

For those who are new to WAVES, let's Understand the basics of Waves 📈

Key Elliott Wave Principles:

1. Five-Wave Impulse Pattern: The primary trend unfolds in five waves (1-2-3-4-5). Waves 1, 3, and 5 move in the direction of the trend, while waves 2 and 4 are corrective.

2. Three-Wave Corrective Pattern: After a five-wave sequence, a correction typically follows, consisting of three waves (A-B-C) that move against the primary trend.

3. Wave Relationships: Fibonacci ratios play a crucial role in Elliott Wave analysis, often governing the length of the waves.

4. Wave Characteristics: Each wave has its own set of characteristics. For example, Wave 3 is usually the most powerful, showing the strongest price movement, while Wave 5 may signal the final push before a significant correction.

TRADE PLAN

* one can add at current levels and again if it comes down you will get an opportunity to add more till 6500

* Targets - 8000/9000/9500/10000/ All time high

(note- Targets may also react as resistance / hurdle)

* Stop Loss - 6160

* Invest keeping in mind for short to long term view, not for speculation.

* Always invest only after calculating the financial risk with the given stop loss and then decide your quantity.

Thank You

KARANN DINGRA 💰🚀

Force Motors under the garb of descending triangle nowThis chart shows a technical analysis of the stock price for Force Motors. The pattern displayed is a descending triangle, which is typically considered a bearish pattern. Here are the key features and interpretations:

Descending Triangle Pattern :

# Resistance Line (White Line): This is the downward sloping trendline connecting the lower highs. It indicates that the stock has been consistently making lower highs, suggesting a downward trend.

# Support Line (Green Line): This is the horizontal line connecting the lows, showing that the stock price has found a support level where buyers come in to prevent the price from falling further.

Price Movement :

The stock price is moving between these two lines, bouncing off the support and resistance levels.

As the price continues to test the support level (green line) without breaking through, it signifies strong support at this price point. However, the descending resistance line indicates sellers are consistently pushing the price lower at each rally.

Potential Breakout :

If the price breaks below the support level (green line) with significant volume, it could indicate a bearish breakout, leading to a further decline in price.

Conversely, if the price breaks above the descending resistance line (white line), it could suggest a bullish reversal, with the potential for an upward movement.

Volume Analysis :

Typically, volume plays a crucial role in confirming the breakout. An increase in volume on a breakout below the support line would confirm the bearish trend, while an increase in volume on a breakout above the resistance line would confirm a bullish trend.

In summary, this chart suggests that Force Motors is currently in a descending triangle pattern, which is a bearish signal. Traders and investors should watch for a breakout from this pattern to determine the next potential move of the stock.

Major levels to consider:

Support - 7850

Stoploss - 7450

NOTE : Please consult your financial advisor before taking any trade/decision in Force Motors

Force Motor India Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Breakout in Force Motors...Chart is self explanatory. Entry, Targets and Stop Loss are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.