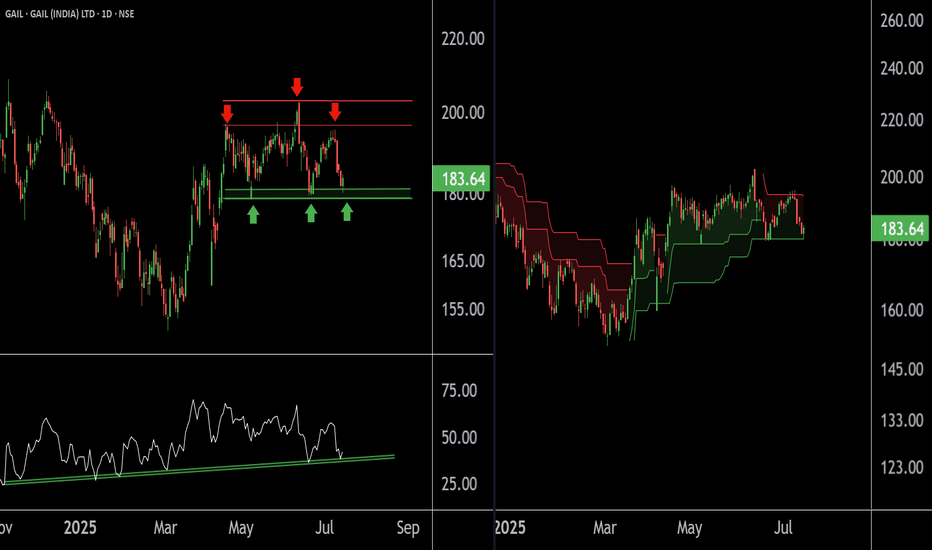

GAIL at Best Support zone !! There are two chart of Gail on Daily timeframe.

On the first chart Gail is moving in well defined parallel channel with support near at 178-180 zone.

Daily RSI is also taking support and bouncing back, indicating a revival in short-term momentum and strengthening the overall bullish setup.

On the second chart , the stock is bouncing from the supertrend support around ₹180, reinforcing bullish sentiment. However, on the shorter timeframe, the supertrend indicator is acting as resistance near ₹192, which needs to be breached for further upside continuation.

Thank You !!

GAIL trade ideas

GAIL 1H Chart Analysis (Trendline Breakout Setup)NSE:GAIL GAIL 1H Chart Analysis (Trendline Breakout Setup)

The 1-hour chart of GAIL (India) Ltd shows a clean descending trendline breakout followed by higher lows, indicating strength building up. The price is consolidating just below a horizontal resistance around ₹193, forming a potential ascending triangle pattern.

Trendline Breakout:

Price has broken a long-standing descending trendline.

Retest and higher lows have followed the breakout, showing bullish intent.

Ascending Triangle Pattern:

Horizontal resistance near ₹193 is tested multiple times.

Rising trendline support suggests buyers are becoming aggressive.

Volume Confirmation Needed:

A breakout above ₹193.10 with volume would validate the bullish setup.

Trade Setup:

Buy Entry: Above ₹193.10 (confirmed breakout

Stop Loss: Below ₹190.00 (below rising trendline) CLOSING BASIS

Target 1: ₹196.85 (resistance zone)

Target 2: ₹204.50 (swing high)

The combination of trendline breakout and ascending triangle formation indicates a strong bullish continuation setup. Entry above ₹193.10 is ideal after confirmation, with targets up to ₹204 and risk well-managed below ₹190.

Disclaimer: I am not a SEBI-registered advisor. The analysis shared is purely for educational and informational purposes only. Please consult your financial advisor before making any investment or trading decision. Trading and investing in the stock market involves financial risk. The author will not be held responsible for any losses incurred.

@thetradeforecast

NSE:GAIL NSE:NIFTY

GAIL INDIA - Trying to come out of falling wedge (Bullish)Falling wedge breakout pattern will be valid when the stock is closing above 165 on daily chart. Wait for it to close above the mentioned level. Once the follow through is seen one can enter with the stop loss of 149.

Disclaimer: I'm not a SEBI registered advisor. This is a paper trade idea for educational purposes. Not to be performed in their real accounts. Always consult your financial advisor before taking trading and investment decisions. You are liable for your profits and losses, and nobody will be held responsible.

$GAIL REVIVES US LNG PLANS POST-TRUMP BAN LIFTNSE:GAIL REVIVES US LNG PLANS POST-TRUMP BAN LIFT

1/7

Good morning, energy traders! ☀️⚡️

Major shake-up in the LNG world: India’s GAIL is back on the hunt for a US LNG stake or long-term deals. What’s fueling this move? Let’s break it down!

2/7 – THE BACKSTORY

• Trump administration lifts the ban on new LNG export permits.

• GAIL had plans on ice since 2023—now they’re back in action.

• Sandeep Kumar Gupta (GAIL’s chairman) says: “We’re reviving our plans to buy a stake or sign long-term LNG contracts.”

3/7 – WHY IT MATTERS

• LNG Prices: Expected to soften post-2026 as supply ramps up.

• Impact on India: Cheaper energy imports, eye on boosting gas to 15% of energy mix by 2030. ♻️

• US Benefit: Strengthens position as a global LNG exporter—hello, bullish signals for Cheniere Energy (LNG) and Venture Global!

4/7 – MARKET IMPACT

• Prices: More supply could translate to downward pressure on LNG prices.

• Investment Angle: US LNG producers & infrastructure might see capital inflows. Keep an eye on relevant tickers!

• Energy Security: India aims for a cleaner, more reliable energy mix—this is long-term strategy at play.

5/7 – STRATEGIC ANGLE

• Aligns with India’s push to expand natural gas usage from ~6% to 15% by 2030.

• US Gains: Jobs, economic boost, and stronger foothold in global energy markets.

• Trade Partnerships: Could deepen economic ties between US & India.

6/8 What’s your take on GAIL’s US LNG strategy?

1️⃣ Bullish on US LNG exports 🐂

2️⃣ Bearish on LNG prices post-2026 🐻

3️⃣ Waiting for more clarity ↔️

Vote below! 🗳️👇

7/7 – YOUR TRADING PLAYBOOK

• Short-Term: Watch for volatility in LNG stocks (like LNG, Venture Global). GAIL might see a spike on renewed interest.

• Long-Term: Growing LNG supply + India’s energy push = potential contrarian bet on energy stocks before the broader market catches up.

GAIL Showing Strength Above 10 EMA: Key Support & Resistance NSE:GAIL Showing Strength Above 10 EMA: Key Support & Resistance Levels (Daily & Weekly Analysis)

NSE:GAIL is currently trading at ₹229.40, maintaining strength above the 10 EMA on the daily chart, indicating positive short-term momentum. A similar setup is reflected on the weekly chart, where the stock is trading well above its 50 EMA, reinforcing a bullish bias.

Key Resistance Levels:

₹236 – Immediate resistance zone, significant on both daily and weekly timeframes. A breakout above this level could trigger further bullish momentum.

₹246 – The 52-week high, acting as a strong resistance on the weekly chart. A decisive move above this would mark a fresh bullish breakout, potentially leading to accelerated gains.

Key Support Levels:

₹226 – Crucial short-term support on the daily chart, aligning closely with the 50 EMA (₹226.29). Holding this level is essential for sustaining the positive trend.

₹216 – Next significant support zone on both timeframes. A break below this could signal weakening momentum.

₹196 – Major support level corresponding to the weekly 50 EMA. This level acts as a long-term safety net, and a breach below would indicate a shift in the broader trend.

Outlook:

The stock’s alignment above key EMAs on both the daily and weekly charts suggests that GAIL is in a strong uptrend. A break above ₹236 could lead to a test of the 52-week high at ₹246, where a breakout would be a strong bullish signal. Traders should monitor price action around these levels closely.

If GAIL faces a pullback, holding support at ₹226 will be crucial to maintain its short-term momentum. A break below ₹216 could indicate potential weakness, with ₹196 (weekly 50 EMA) serving as a critical long-term support.

Disclaimer: I am not a SEBI Registered Research Analyst (RA). This analysis is for educational purposes only and should not be considered as investment advice. Please conduct your own research or consult a financial advisor before making any trading decisions.

GAIL (INDIA) LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Technical Analysis of GAIL (India) Ltd - Bullish MomentumTechnical Analysis of GAIL (India) Ltd

Overview of the Stock - The chart provides a technical analysis of GAIL (India) Ltd, focusing on identifying potential support and resistance levels, as well as potential trading zones. The analysis utilizes Fibonacci retracement levels, moving averages, and RSI to determine potential price movements.

Key Indicators and Analysis - In my technical analysis, I am using EMA(200), RSI(14) and Fibonacci Tool along with support, resistance and trendline, all are explained below:-

Fibonacci Retracement Levels: - These levels, represented by horizontal lines, are used to identify potential support and resistance areas. The chart shows key Fibonacci levels at 0.236, 0.382, 0.5, 0.618, and 1.0.

EMA (200, high): The 200-day exponential moving average (EMA) is plotted at 228.18. It's often used as a long-term trend indicator.

RSI (14, high): The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. An RSI value above 70 is generally considered overbought, while below 30 is oversold. Currently, the RSI is at 44.00, suggesting the stock is not overbought or oversold.

Support and Resistance Zones: The chart identifies potential support zones around 211-219 and 224.71. Resistance levels are seen at 232.00, 236.00, 239.09, and 246.39.

Trading Recommendations: - The analyst suggests buying in the 211-219 zone and potentially adding more positions if the price moves higher. The target price levels are TP1 at 239.09 and TP2 at 246.39.

Interpretation

Based on the technical analysis, this stock has a bullish outlook. The stock price is currently above the 200-day EMA, suggesting a potential uptrend. The RSI indicates that the stock is not overbought, which could provide room for further price increases.

However, it's crucial to remember that technical analysis is just one tool, and other factors like fundamental analysis and market conditions should also be considered before making investment decisions.

Disclaimer: This analysis is based solely on the provided chart and does not constitute financial advice. It's essential to conduct thorough research and consider multiple factors before making investment decisions.

Thanks for your support as always

GAIL: This is why People lose moneyThis is one important case study as to why investors lose money in the stock market.

Now if you look at the chart, Here is what you see:

1. 32 Months of pure range-bound consolidation

2. Clearly defined support and resistance zones

3. Five months of consolidation at the resistance zone

4. A beautiful high-volume breakout followed by a retest.

5. This is one textbook setup for a long trade

So, We should go long here, right?

If I zoom out of the chart, Here is what you will see.

- We have a strong resistance zone sitting just above the breakout level.

- The price took a strong rejection from the exact resistance zone.

Also, Observe the volatile consolidation zone that lasted almost 2 Years. That volatile zone may not be passed through in one instant.

What we investors do is draw conclusions based on partial data and predict the price action that is yet to come. What we fail to do is observe the previous price action in its entirety.

Does that mean that GAIL will not rise in value, Absolutely not. It just means that the uncertainty it has on the charts for a mere 10% gain ( breakout to ATH Distance) is super high.

The market is full of opportunities. Why invest in something that already has a foreseeable red flag?

If you liked the read, Would you give us a boost and a follow for our efforts?

Have Requests, Questions, or Suggestions? Let us know in the comments below.👇

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

GAIL swing to positional GAIL can give a good swing to positional trade with a decent stoploss and for good Targets

ENTRY - 213

STOPLOSS - 210.7

TARGETS - 220, 225, 230++

Note- if any trade or value that's gone from the marked levels then that's not our trade just let it go or wait for it to come back

I'm not sebi registered this is my personal view

Please like or boost my idea if you like it or traded it

Thankyou

GAIL An extremely bullish Reversal, Poised to break it's ATHThe stock is in continuous uptrend , with no evidence of sellers in major time frames.

The stock has reversed from 38.2% retracement in weekly.

I am looking to enter this counter at cmp with 184.20 as SL and minimum 15% ROI - 224 and then trail further.

Gail India Ltd - An Opportunity to Buy & HoldHere's a summary of GAIL India Ltd's technical analysis based on various sources:

As per previous chart history and technical analysis, read technical analysis done by me before entering into the trade...

All major points are mentioned on the chart...

Overall Analysis:

Neutral: The current technical rating for GAIL is neutral across multiple timeframes.

Mixed signals: While some indicators suggest a buy trend, others show neutrality.

Key Indicators:

Moving Averages: Neutral overall, with some short-term averages suggesting a buy trend.

MACD: Neutral, with the MACD line above the signal line.

RSI: Neutral, hovering around the 50 level.

Stochastic: Neutral, not indicating overbought or oversold conditions.

Do your own research because I am Not SEBI registered person to suggest any stock...

Thanks for your support as always

GAIL U TURNGail might take a U TURN and give us a good swing or positional trade with a decent stoploss and good Targets

ENTRY - 202

STOPLOSS - 198.5

TARGETS - 210, 215,220++

Note- if any trade or value that's gone from the marked levels then that's not our trade just let it go or wait for it to come back

I'm not sebi registered this is my personal view