GODREJAGRO trade ideas

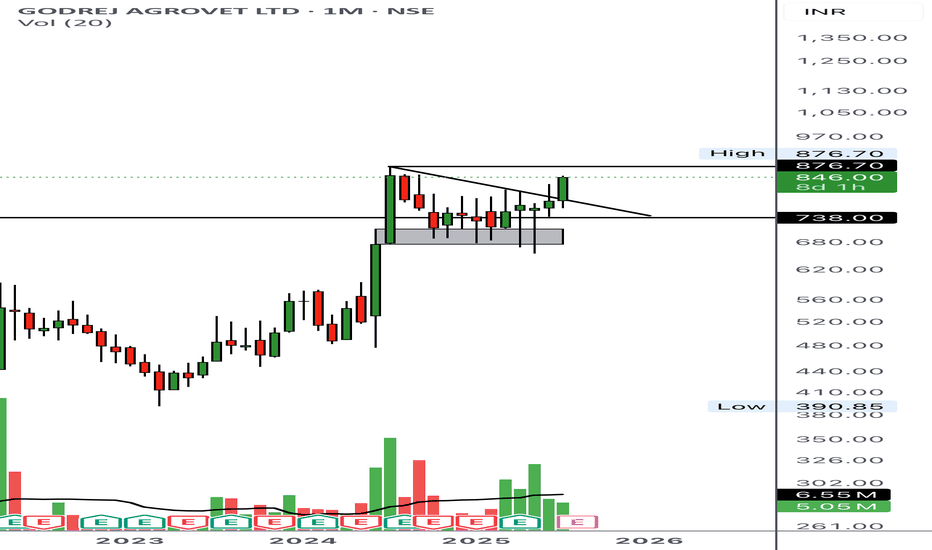

GODREJ AGROVET (Weekly Chart)* **Structure Insight:**

* **Price:** ₹814.95

* **All-Time High Zone:** \~₹900

* **Current Setup:** Tight **consolidation** near ATH — a **classic bullish base-building pattern**, indicating absorption of supply.

* **Moving Averages:**

* **20 MA (Blue)**: Rising and hugging the price, showing short-term momentum.

* **200 MA (Red)**: Strong uptrend — long-term trend confirmed.

* **Volume:** Noticeable spike during breakout attempts and base formation. **Volume supports accumulation.**

---

🔍 **Multi-Timeframe Confirmation (Daily Chart)**

* **Golden Crossover:** 20 MA > 200 MA

* **Price Action:** Holding above MAs after shakeout – tight range = potential **volatility contraction**.

* **Volume Trend:** Rising on green candles, declining on red = bullish bias.

---

### 🎯 **Trading Plan (Swing / Positional)**

| Element | Details |

| ---------------- | -------------------------------------------- |

| **Buy Zone** | ₹810–₹825 (on breakout or small dip) |

| **Stop Loss** | ₹740 (below consolidation base + MA cluster) |

| **Target 1** | ₹900 (previous ATH) |

| **Target 2** | ₹1,050 (measured move from base) |

| **Risk\:Reward** | \~1:2.5 minimum |

---

### 🛡️ **Risk Management:**

* **Position Size:** Based on 1–2% of capital at risk.

* Avoid chasing — wait for breakout **with volume** or dip near MA confluence.

---

**Pro Trader Insight:**

> “Consolidation near ATH with rising MAs and strong volume = a sign of strength, not exhaustion. Let the market show its hand — enter with precision, not prediction.”

GODREJAGRO1. This stock after a long time it is breaking the down trenline

2. Also formed triangle patter, and breaking out at the neckline

3. At this stage the risk seems very low

Consider the April US tax tariff impliment

Please do your own research before you take trade. also encourage me if you do see this is usfull to you. thanks to all learners

#GODREJAGRO

Company has been maintaining a healthy dividend payout of 51.6%

Debtor days have improved from 37.4 to 22.4 days.

Company's working capital requirements have reduced from 58.6 days to 46.1 days

Strengths:

Diversified business presence: The company’s focus on diversification into newer segments such as palm oil, crop protection, dairy and poultry over the past 7-8 fiscals in order to lower its concentration in the animal feed business (revenue contribution down to around 49% for the first nine months of fiscal 2024 from 80% in fiscal 2012) supports its overall business risk profile and provides cushion against slowdown in any business segment.

In the first nine months of fiscal 2024, overall revenue saw modest growth of 2% year-on-year, largely on account of healthy volume growth in most of the business segments, apart from the business under the subsidiary, Astec Lifesciences, which faced competitive pressures for its key enterprise products. The volume growth was offset by negative or modest expansion in realisations, especially in the palm oil, poultry and animal feed segments, leading to a muted revenue growth.

Operating margin, however, improved on a year-on-year basis, to 7.7% for the first nine months of fiscal 2024, as against 5.7% for fiscal 2023, backed by lower input prices in dairy and poultry segments and higher operating levels in the animal feed and crop protection segments. The improvement in operating margin was the highest in crop protection segment, supported by strong volumes and realisations in the in-licensed product portfolio, apart from the dairy segment where operating margin improved substantially, on the back of lower milk procurement prices and operating efficiency, from operating losses seen last year. On the other hand, operating margin declined in the Astec Lifesciences segment, as it faced continued price erosion and subdued demand for its key enterprise product, despite robust performance by its contract manufacturing segment.

Dominant position in the domestic animal feed and palm oil segments: GAL enjoys a dominant position in the domestic organised animal feed industry with presence across various sub-categories such as cattle, broiler, layer, fish, shrimp and other feeds. The company's efforts are driven by research and development to achieve cost leadership and competitiveness, which have supported its volume growth. The segment continued to see traction across sub-segments, especially in cattle feed and aqua feed, during the first nine months of fiscal 2024.

Being the second largest consumer of palm oil in the world, India’s demand for domestic palm oil is expected to remain robust. The segment registered compounded annual growth rate of 16% over the eight fiscals through 2023, with healthy operating margin of above 19% over the period. Strong volume growth expected over the medium term, along with the longer shelf-life volumes coming from company’s newly set up oil refinery, would help keep operating margins healthy.

Strong financial risk profile: Financial risk profile remains strong as reflected in gearing of 0.48 time as on December 31, 2023 and interest coverage of 7.55 times in the first nine months of fiscal 2023, versus 0.44 times and 5.62 times, respectively, as on December 31, 2022. Debt levels declined slightly to Rs 1,203 crore as on December 31, 2023 from Rs 1,321 crore as on March 31, 2023. Debt levels are expected to remain range-bound over the medium term on the back of strong cash accruals from the business, despite the capital expenditure (capex) plan and working capital requirements, because of which the overall financial risk profile would remain comfortable.

Strong financial flexibility from being part of the Godrej group: GAL enjoys strong financial flexibility being part of the Godrej group and has the ability to raise debt at competitive rates and on short notice. It is able to directly derive implicit benefits being part of the Godrej group and without a formal arrangement of support with the parent, group companies or promoters.