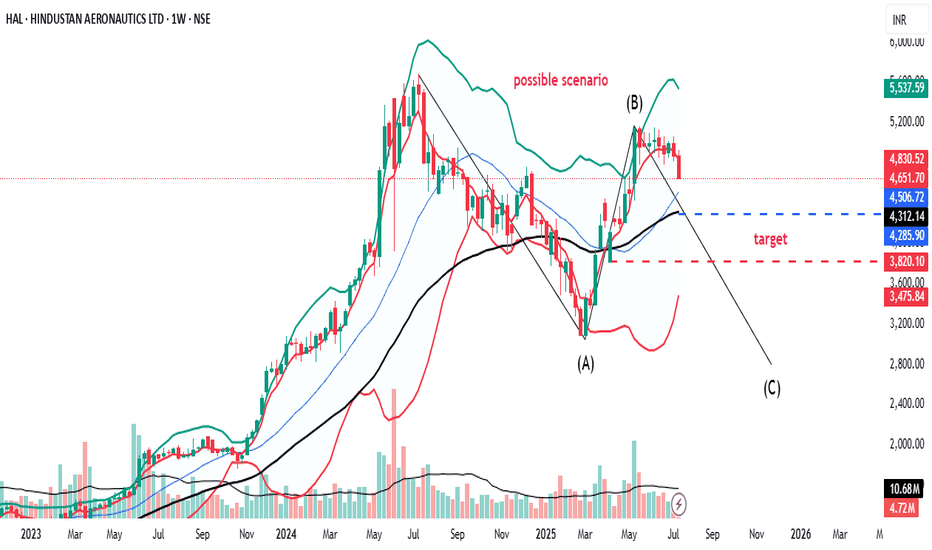

HAL bearish, Kindly do your own studyHAL is looking bearish on higher time frame.

Monthly price action is bearish

Monthly MACD is NCO stat

Weekly bearish price action. Price has broken last 8 weeks range. Looks like C wave is pending

Weekly MACD has given downtick

Weekly RSI is below 60

Daily price has challenged lowe bollinger b

Key facts today

Anand Rathi recommends 'Buy' for Hindustan Aeronautics Ltd (HAL) with a target price of Rs 5,950, highlighting a strong order book of Rs 1.89 trillion and a 19% CAGR through FY28.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

125.05 INR

83.64 B INR

309.81 B INR

189.07 M

About HINDUSTAN AERONAUTICS LTD

Sector

Industry

CEO

D. K. Sunil

Website

Headquarters

Bangalore

Founded

1963

ISIN

INE066F01020

FIGI

BBG00283XBT8

Hindustan Aeronautics Ltd. engages in the manufacture of aerospace products. Its products include aircraft, helicopters, future products, power plant, avionics, system and accessories, and aerospace and materials. The company was founded on August 16, 1963 and is headquartered in Bangalore, India.

Related stocks

HAL: fake breakdown and a possible bullish move.Stock: Hindustan Aeronautics Ltd NSE:HAL

• Timeframe: 1-day candles (each candle represents one day of trading)

1. Consolidation Zone: A grey rectangular box highlights an area of "consolidation" starting from around May 14th. This means the stock price has been trading sideways within a relati

HAL📈 Final Trade Plan – HAL

Component Value

Trade Direction BUY

Entry Price 4675

Stop Loss (SL) 4360

Risk ₹315

Target Price 7343

Reward ₹2668

Risk-Reward Ratio 8.5

Last High 5674

Last Low 3006

✅ Trade Strengths

✅ Strong Uptrend across all timeframes.

✅ HTF & MTF align – weekly and daily zones overlap

Go long in HALIt's a very good breakout in Hindustan aeronautics Ltd. 4755 was an important resistance in HAL on daily frame basis. Now it's breakout of this level. From here (CMP - 4877) we can expect upside targets in HAL: 4925,5065, 5320 & 5620.

Stoploss against this investment can be placed near 4740.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of HAL is 4,498.00 INR — it has decreased by −0.19% in the past 24 hours. Watch HINDUSTAN AERONAUTICS LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange HINDUSTAN AERONAUTICS LTD stocks are traded under the ticker HAL.

HAL stock has fallen by −5.80% compared to the previous week, the month change is a −6.97% fall, over the last year HINDUSTAN AERONAUTICS LTD has showed a −9.07% decrease.

We've gathered analysts' opinions on HINDUSTAN AERONAUTICS LTD future price: according to them, HAL price has a max estimate of 6,545.00 INR and a min estimate of 4,475.00 INR. Watch HAL chart and read a more detailed HINDUSTAN AERONAUTICS LTD stock forecast: see what analysts think of HINDUSTAN AERONAUTICS LTD and suggest that you do with its stocks.

HAL stock is 2.68% volatile and has beta coefficient of 1.72. Track HINDUSTAN AERONAUTICS LTD stock price on the chart and check out the list of the most volatile stocks — is HINDUSTAN AERONAUTICS LTD there?

Today HINDUSTAN AERONAUTICS LTD has the market capitalization of 3.01 T, it has decreased by −0.88% over the last week.

Yes, you can track HINDUSTAN AERONAUTICS LTD financials in yearly and quarterly reports right on TradingView.

HINDUSTAN AERONAUTICS LTD is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

HAL earnings for the last quarter are 59.46 INR per share, whereas the estimation was 50.92 INR resulting in a 16.76% surprise. The estimated earnings for the next quarter are 16.55 INR per share. See more details about HINDUSTAN AERONAUTICS LTD earnings.

HINDUSTAN AERONAUTICS LTD revenue for the last quarter amounts to 137.00 B INR, despite the estimated figure of 122.32 B INR. In the next quarter, revenue is expected to reach 48.95 B INR.

HAL net income for the last quarter is 39.77 B INR, while the quarter before that showed 14.40 B INR of net income which accounts for 176.19% change. Track more HINDUSTAN AERONAUTICS LTD financial stats to get the full picture.

HINDUSTAN AERONAUTICS LTD dividend yield was 0.96% in 2024, and payout ratio reached 31.98%. The year before the numbers were 1.05% and 30.71% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HINDUSTAN AERONAUTICS LTD EBITDA is 96.08 B INR, and current EBITDA margin is 31.01%. See more stats in HINDUSTAN AERONAUTICS LTD financial statements.

Like other stocks, HAL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HINDUSTAN AERONAUTICS LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HINDUSTAN AERONAUTICS LTD technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HINDUSTAN AERONAUTICS LTD stock shows the buy signal. See more of HINDUSTAN AERONAUTICS LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.