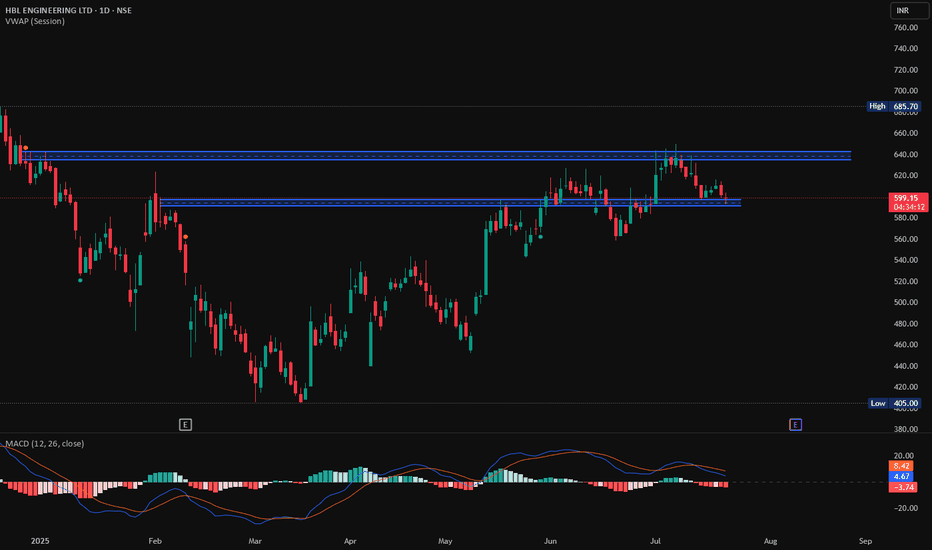

HBL Engineering at support, Long, 1DHBL Engineering is at its support, if it breaks and sustains 600 level then we may see it upward move in it for 620 and 645. Enter in the trade if it show any Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami above 600.

Entry: 600 (only at Bullish candlestick patterns)

Target1: 620

Target2: 645

HBLENGINE trade ideas

BULLISH REVERSAL SETUP SEEN IN HBL ENGINEERING LTD📊 StockTrade Setup Details

Name: NSE:HBLENGINE HBL Engineering Ltd.

Exchange: NSE (National Stock Exchange, India)

📈 Current Market Price (CMP): ₹527.85

💡 Key Levels:

🚀 Entry Point: ₹494.40

Buy when the price reaches this level (near support).

❌ Stop-Loss (SL): ₹472.25

Exit if the price drops below this level to minimize losses.

🏁 Take-Profit (TP) Levels:

TP1: ₹518.65 🏆 (First conservative target).

TP2: ₹594.40 🥈 (Moderate profit zone).

TP3: ₹702.50 🥇 (Aggressive target for maximum gain).

⚖️ Risk-to-Reward Ratio (RRR):

Risk:

Entry to SL: ₹494.40 - ₹472.25 = ₹22.15

Reward:

TP1: ₹24.25 ➡️ RRR ~ 1:1.1

TP2: ₹100.00 ➡️ RRR ~ 1:4.5

TP3: ₹208.10 ➡️ RRR ~ 1:9.4

📈 Technical Observations

📉 Trend Analysis:

A sharp bearish move recently (large red candle).

Anticipating a bullish reversal from the support zone.

🛠️ Support Levels:

Zone: ₹472 – ₹494

SL is placed slightly below this zone for risk management.

📏 Resistance Levels:

TP1: ₹518.65

TP2: ₹594.40

TP3: ₹702.50

Extended Target: ₹740.35

📊 Volume: Moderate to high volume shows active trading interest.

🔴Disclaimer:

I am not a SEBI-registered advisor. Investments and securities are subject to market risk. Please Read carefully this idea.This analysis and the suggested levels are for educational purposes only Trade responsibly and at your own risk.

If you find this analysis helpful, please like and share

@Alpha_strike_trader