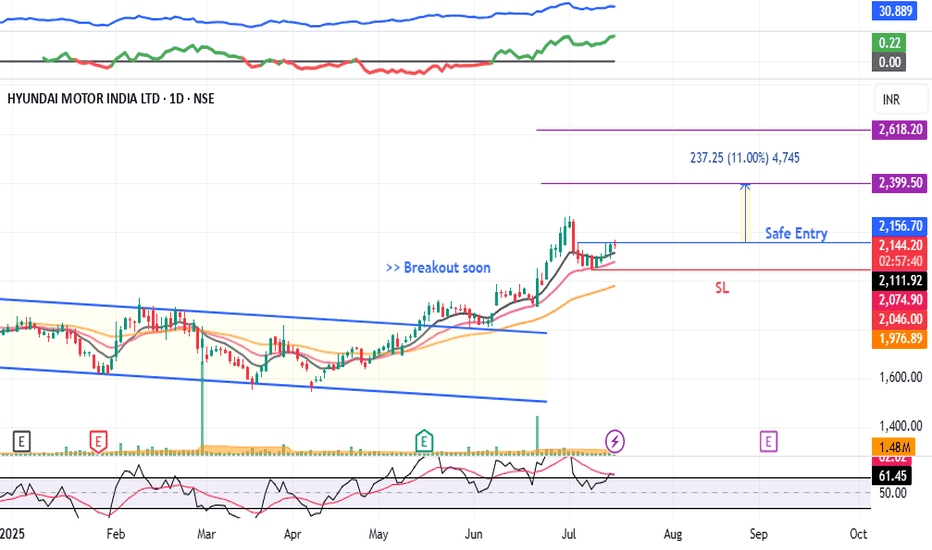

HYUNDAI - Swing Trade#HYUNDAI #swingtrade #trendingstock #momentumtrading #breakoutstock

HYUNDAI : Swing Trade

>> Breakout soon

>> Trending Stock

>> Volume Dried up

>> Good strength

>> Low Risk Trade ( RR - 1:2 or 1:3 )

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, like and comment if u like the a

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

67.95 INR

56.40 B INR

691.93 B INR

141.57 M

About HYUNDAI MOTOR INDIA LTD

Sector

Industry

CEO

Unsoo Kim

Website

Headquarters

Gurugram

Founded

1996

ISIN

INE0V6F01027

FIGI

BBG01NLC3XN7

Hyundai Motor India Ltd. engages in the manufacture and export of motor vehicles, engine, transmission and other parts. It also provides after-sales activities, related engineering, and broking services. Its vehicle model lineup includes Grand i10 NIOS, i20, TUCSON, and IONIQ 5. The company was founded on May 6, 1996 and is headquartered in Gurugram, India.

Related stocks

HYUNDAI MOTORS LTD BREACHING ATHHyundai Motor India is one of the leading car manufacturers in the country, known for its wide range of vehicles—from hatchbacks and sedans to SUVs and electric cars. Some of its most popular models include the Creta, Venue, Verna, and the all-electric Ioniq 5.

If Hyundai Motor India has broken pa

Hyundai Motor India Ltd view for Intraday 19th May #HYUNDAI Hyundai Motor India Ltd view for Intraday 19th May #HYUNDAI

Resistance 1870 Watching above 1876 for upside momentum.

Support area 1840 Below 1860 ignoring upside momentum for intraday

Watching below 1835 for downside movement...

Above 1860 ignoring downside move for intraday

Charts for Education

Hyundai Motors Set to Fall After Disappointing Quarterly ResultsHyundai Motor India reported a 19% year-on-year (YoY) decline in its consolidated net profit for the December quarter. The profit stood at Rs 1,161 crore, compared to Rs 1,425 crore during the same period last year. This decline was attributed to lower domestic sales and exports.

As the stock has b

HYUNDAI MOTOR INDIA LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

Hyundai India Stock AnalysisTechnical Analysis of Hyundai India (1-Hour Timeframe)

1. Falling Wedge Pattern

The chart displays a falling wedge pattern, which is a bullish reversal setup. After a prolonged downward movement, the price has broken out of the wedge, indicating a potential upward trend.

The breakout is supported

HYUNDAI MOTORS INDIA LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of HYUNDAI is 2,181.00 INR — it has increased by 1.36% in the past 24 hours. Watch HYUNDAI MOTOR INDIA LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange HYUNDAI MOTOR INDIA LTD stocks are traded under the ticker HYUNDAI.

HYUNDAI stock has risen by 4.12% compared to the previous week, the month change is a −2.66% fall, over the last year HYUNDAI MOTOR INDIA LTD has showed a 12.77% increase.

We've gathered analysts' opinions on HYUNDAI MOTOR INDIA LTD future price: according to them, HYUNDAI price has a max estimate of 2,600.00 INR and a min estimate of 1,700.00 INR. Watch HYUNDAI chart and read a more detailed HYUNDAI MOTOR INDIA LTD stock forecast: see what analysts think of HYUNDAI MOTOR INDIA LTD and suggest that you do with its stocks.

HYUNDAI reached its all-time high on Jul 1, 2025 with the price of 2,265.30 INR, and its all-time low was 1,541.70 INR and was reached on Apr 7, 2025. View more price dynamics on HYUNDAI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HYUNDAI stock is 2.57% volatile and has beta coefficient of 0.90. Track HYUNDAI MOTOR INDIA LTD stock price on the chart and check out the list of the most volatile stocks — is HYUNDAI MOTOR INDIA LTD there?

Today HYUNDAI MOTOR INDIA LTD has the market capitalization of 1.77 T, it has increased by 1.89% over the last week.

Yes, you can track HYUNDAI MOTOR INDIA LTD financials in yearly and quarterly reports right on TradingView.

HYUNDAI MOTOR INDIA LTD is going to release the next earnings report on Nov 18, 2025. Keep track of upcoming events with our Earnings Calendar.

HYUNDAI earnings for the last quarter are 16.90 INR per share, whereas the estimation was 15.39 INR resulting in a 9.78% surprise. The estimated earnings for the next quarter are 16.74 INR per share. See more details about HYUNDAI MOTOR INDIA LTD earnings.

HYUNDAI MOTOR INDIA LTD revenue for the last quarter amounts to 164.13 B INR, despite the estimated figure of 167.55 B INR. In the next quarter, revenue is expected to reach 177.38 B INR.

HYUNDAI net income for the last quarter is 13.69 B INR, while the quarter before that showed 16.14 B INR of net income which accounts for −15.18% change. Track more HYUNDAI MOTOR INDIA LTD financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HYUNDAI MOTOR INDIA LTD EBITDA is 87.99 B INR, and current EBITDA margin is 12.94%. See more stats in HYUNDAI MOTOR INDIA LTD financial statements.

Like other stocks, HYUNDAI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HYUNDAI MOTOR INDIA LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HYUNDAI MOTOR INDIA LTD technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HYUNDAI MOTOR INDIA LTD stock shows the buy signal. See more of HYUNDAI MOTOR INDIA LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.