INFOBEANS TECHNOLOGYInfoBeans Technologies Ltd. is a digital transformation and product engineering company offering enterprise solutions, UX-led development, cloud services, and automation frameworks across global markets. With a client base spanning Fortune 500 companies and sectors such as healthcare, finance, and real estate, the company maintains a strong offshore delivery model and innovation culture. The stock is currently trading at ₹423.60.

InfoBeans Technologies Ltd. – FY22–FY25 Snapshot

Sales – ₹164 Cr → ₹198 Cr → ₹223 Cr → ₹249 Cr – Consistent growth through contract wins and diversification

Net Profit – ₹30.7 Cr → ₹35.8 Cr → ₹41.2 Cr → ₹47.6 Cr – Expanding margins backed by digital and automation

Company Order Book – Moderate → Strong → Strong → Strong – Robust pipeline in cloud modernization and UI/UX platforms

Dividend Yield (%) – 0.00% → 0.00% → 0.00% → 0.00% – Reinvestment-focused strategy with no distributions

Operating Performance – Moderate → Strong → Strong → Strong – SaaS-led leverage improving delivery efficiency

Equity Capital – ₹9.02 Cr (constant) – Lean capital structure without dilution

Total Debt – ₹0 Cr (debt-free) – Zero leverage, fully equity-financed operations

Total Liabilities – ₹72 Cr → ₹78 Cr → ₹84 Cr → ₹91 Cr – Gradual scale-up with delivery expansion

Fixed Assets – ₹28 Cr → ₹30 Cr → ₹33 Cr → ₹36 Cr – Light capex aligned to facility upgrades and automation tools

Latest Highlights FY25 net profit rose 15.5% YoY to ₹47.6 Cr; revenue increased 11.7% to ₹249 Cr EPS: ₹10.53 | EBITDA Margin: 28.3% | Net Margin: 19.11% Return on Equity: 24.86% | Return on Assets: 18.65% Promoter holding: 72.44% | Dividend Yield: 0.00% New service lines launched in DevOps automation and AI-powered enterprise apps Delivery centers expanded with focus on tier-2 cost-efficient tech hubs

Institutional Interest & Ownership Trends Promoter holding remains strong at 72.44% with zero pledging or dilution. Institutional activity is limited, typical of niche mid-caps, with HNI and PMS desk accumulation seen in volume spikes. Delivery trends signal quiet confidence from domestic tech-focused allocators.

Business Growth Verdict Yes, InfoBeans continues to compound steadily across enterprise digital domains Margins remain robust with operational discipline and client retention Debt-free balance sheet and consistent earnings boost investor visibility Capex is lean and well-aligned to growth without financial stress

Company Guidance Management projects double-digit revenue growth in FY26, driven by rising U.S. client demand, cloud migration services, and proprietary product offerings in AI-led automation.

Final Investment Verdict InfoBeans Technologies Ltd. represents a scalable, high-ROE digital services player with zero leverage and strong promoter backing. Its consistent profitability, efficient cost structure, and client retention across geographies position it well for long-term accumulation. The company’s focus on enterprise modernization and automation gives it durable relevance in mid-cap IT, appealing to investors seeking margin-stable, debt-free tech exposure.

INFOBEAN trade ideas

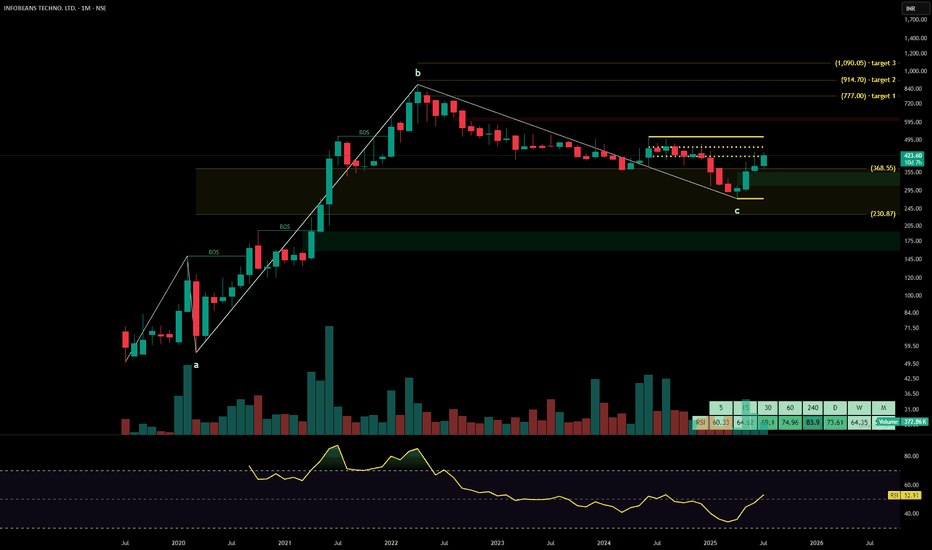

INFOBEANHi guys,

In this chart i Found a Demand Zone in INFOBEAN CHART for Positional entry,

Observed these Levels based on price action and Demand & Supply.

*Don't Take any trades based on this Picture.

... because this chart is for educational purpose only not for Buy or Sell Recommendation..

Thank you

INFOBEANHi guys, In this chart i Found a Demand Zone in INFOBEAN CHART for Positional entry,

Observed these Levels based on price action and Demand & Supply.

*Don't Take any trades based on this Picture.

... because this chart is for educational purpose only not for Buy or Sell Recommendation..

Thank you

INFOBEANS TECHNOLOGIES 1:4 RR🎯1000NSE:INFOBEAN broke out from an ascending triangle (cup and handle) consolidation pattern and gave a retest after a very bullish uptrend, suggesting a trend continuation.

Breakout volumes are very high, hitting fresh all time highs.

One can enter entire position after price crosses and sustains the psychological 600 levels and hold for 1000 targets.

Shown setup is a Positional Trade. Holding period is anywhere between 1 month to 6 months.

Targets: 650/800/950/1000+

Place a deep sl for this trade below 440 levels.

High risk, high reward, high probability trade.

Script also has good fundamentals, and continues to have demand when the markets are selling off.

Position size accordingly. Gut feeling says this trade is a good bet.

HAPPY TRADING!

InfoBean Technologies IndiaSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions