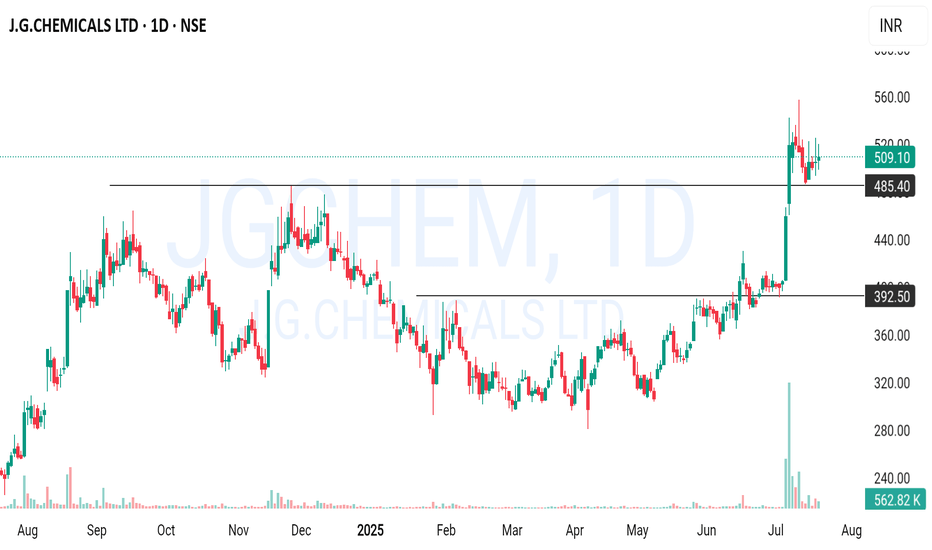

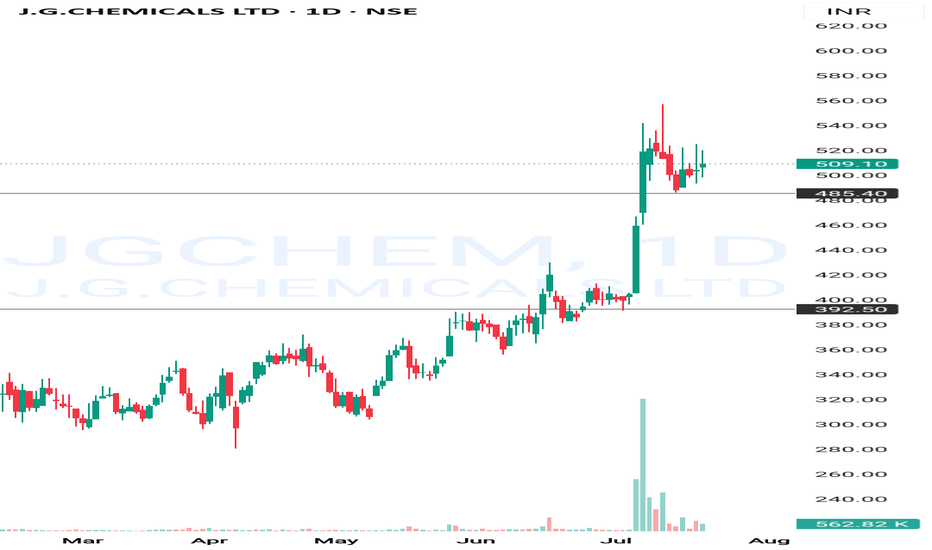

JGCHEM trade ideas

[J.G.Chemicals Ltd ] CMP 409Date:26-12-2024

Time: 12:12PM

CMP: 409

Report by : Mujadid Saad

Evaluation of J.G. Chemicals Ltd for Long-Term Investment

1. Financial Health

• Revenue Growth: Revenue grew from ₹398 Cr (Mar 2020) to ₹757 Cr (TTM), with a notable dip in FY 2024 (₹666 Cr). TTM shows recovery.

• Net Profit Margin: Improved from ~3.5% (Mar 2020) to ~7.5% (Mar 2024), reflecting better operational efficiency.

• Debt-to-Equity Ratio: Reduced to 0.03, indicating financial prudence.

• ROE: Declined from 20% (3-year avg.) to 10% last year, suggesting recent inefficiencies.

• Free Cash Flow: Significant positive shift to ₹76 Cr (Mar 2024) from marginal levels earlier.

• EPS: Fluctuating, with recent growth to ₹14.65 (TTM). Dividend payout remains nil.

2. Market Position

• Market Share: Largest zinc oxide manufacturer in India with 30% share; global top 10 producer.

• Competitive Positioning: Leader in the sector, leveraging advanced French process technology.

• Customer Loyalty & Innovation: Stable but needs further emphasis on innovative applications for diversification.

3. Management and Governance

• Leadership Track Record: Stable leadership but lacking aggressive expansion strategies.

• Governance: No significant red flags, though dividend policy may signal management conservatism.

• Litigation/Ethical Concerns: No notable controversies observed.

4. Industry Trends

• Growth Outlook: Positive, driven by increased demand for zinc oxide in industrial and cosmetic applications.

• Emerging Trends: Limited focus on ESG initiatives and digital transformation, which are becoming critical in global markets.

• Macroeconomic Factors: Vulnerable to commodity price volatility, regulatory changes, and inflation.

5. Risk Analysis

• Market Volatility: Sensitive to zinc price fluctuations.

• Operational Inefficiencies: Decline in recent ROE and revenue suggests areas of improvement.

• Geopolitical Factors: Export reliance makes it prone to global trade dynamics and regulatory risks.

6. Valuation

• P/E Ratio: At 29.9, below industry average (34.6), indicating reasonable valuation.

• P/B Ratio: Higher than peers but supported by leadership position.

• Overall: Stock appears fairly valued with potential for growth.

7. Performance Metrics

• ROI/ROA: Moderately improving; needs consistent growth.

• CAGR: Sales CAGR at ~15% (3 years); profit CAGR at ~12%.

• Achievements: Market leader with improved cash flow and reduced debt.

Investment Decision: Yes

Justification:

1. Market Leadership: Dominant position with 30% market share in India.

2. Financial Prudence: Strong debt reduction and improving cash flows.

3. Valuation: Fairly valued relative to peers with potential upside as industry demand grows.

4. Growth Prospects: Supported by recovery trends in revenue and net profit.

Recommendations for Further Due Diligence:

• Analyze customer concentration risks and reliance on exports.

• Assess plans for diversification and ESG adoption.

• Monitor upcoming quarterly results for sustained recovery in financials.