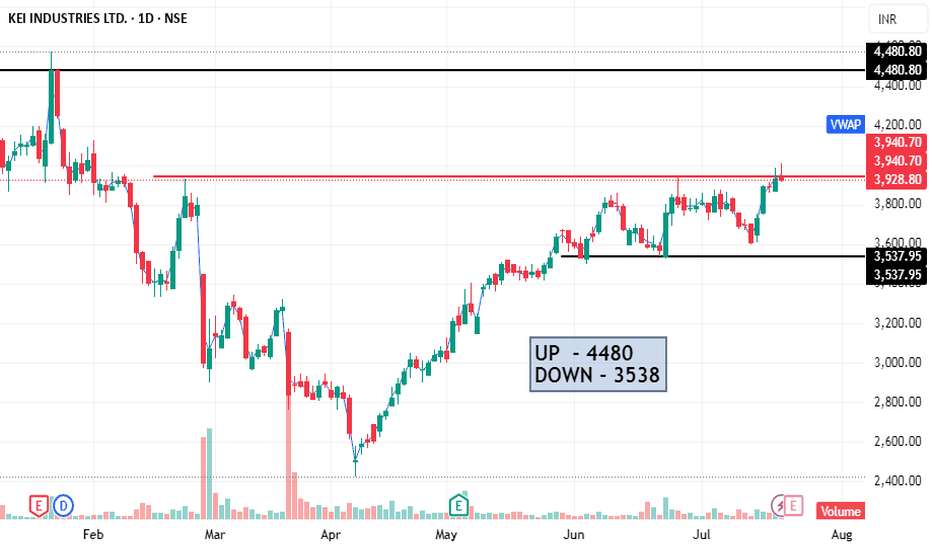

KEI is upside trend Bullish.Sharing the chart of KEI in deatil research as my opinion Trend is Bullish, if market close above 3950. TG open - 4480- 4500 with in 1 month etc.

I AM NOT A SEBI REGISTER,

Before invest or trade please consult with financial advisor.

SO This is not TIPS, SUGGESTIONS. Just Sharing my Experience.

KEI trade ideas

KEI FOR FURTHER ANALYSISKEI FOR FURTHER ANALYSIS

Thanks for stopping by.

All analysis here is done strictly from an investor’s perspective — focusing on risk, return, valuation, and potential upside.

The notes cover key details. I’ve backed every thesis with my own analysis — no fluff, just what matters to investors.

If you find the idea useful or have suggestions, feel free to leave a comment. Always open to fresh insights.

Kind regards,

Psycho Trader

Kei Industries Ltd view for Intraday 26th May #KEI Kei Industries Ltd view for Intraday 26th May #KEI

Resistance 3480 Watching above 3485 for upside momentum.

Support area 3400 Below 3440 ignoring upside momentum for intraday

Watching below 3390 for downside movement...

Above 3440 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

KEI Industries | 51% Correction | Monthly POI Tapped | High Prob📉 Correction & Location Insight

All-Time High: ₹5,039

Current Low: ₹2,424

✅ Correction from Top: ~51%

✅ Price has now entered a Monthly Point of Interest (POI) after taking liquidity and showing reaction.

This level is crucial as the price has dropped significantly and is now tapping into a major institutional demand zone, signaling a potential bottom formation.

🧠 Smart Money Perspective

🔍 Price has cleared Monthly IDM and tapped into the POI.

📉 Weekly 200 EMA tapped for the first time since 2020 – a major technical signal.

🟪 FVG (Fair Value Gap) available in this zone – indicating an unfilled value area that price could revisit quickly.

📊 Daily Doji Candle shows a tug of war between bulls and bears – potential reversal setup building.

🕵️♂️ Refined Entry Zone (1-Day POI)

📌 Entry Range: ₹2,437 – ₹2,321

📌 Stop-Loss: ₹2,300 (strict for safety)

✅ This tight stop offers high risk-to-reward potential.

🎯 Profit Targets

1️⃣ Target 1: ₹2,941

2️⃣ Target 2: ₹3,330

3️⃣ Target 3: ₹3,751+

🔄 Long-term breakout may follow after reclaiming mid-zones.

⚡ Sector Insight

KEI plays a key role in the electrical manufacturing segment – a growing and crucial sector for cables and wires producer and supplier and EHV (extra high voltage) power cable development. The stock has underperformed over the past year, but this deep correction paired with strong technical confluence now presents a rare opportunity.

💡 Final Thoughts

This is one of the most favorable setups seen in recent times for KEI Industries. Price has done its job: corrected heavily, entered the POI, and shown early signs of a reversal. With proper stop-loss discipline, this is a BTST to Swing setup that could yield significant returns.

📢 Don’t Miss Out!

✅ Follow for more high-quality analyses

👍 Like if you found this helpful

💬 Drop your thoughts in the comments – let’s discuss!

KEI INDUSTRIES - Short Term Trade Setup with Liquidity Grab!INDUSTRIES LTD today. This one’s looking interesting, with the stock currently in a consolidation phase , stuck between a supply zone and a demand zone . The best part? We’ve had a liquidity grab near the demand zone, which means the stock is back in a sweet spot for a potential move upwards. If the price starts bouncing off that level again, we could see some nice profits.

For the entry point , you want to get in around ₹3,750-3,700 , right where the stock is testing the demand zone. The stop loss should be just around at ₹3,500 , giving you some room to manage the trade. The profit target is around ₹4,560 , near the supply zone. That gives you a good risk-to-reward ratio and the potential for a solid move if the stock continues up.

Disclaimer:- This analysis is for educational purposes only. Please trade responsibly and consult a financial advisor before making any decisions.

If you found this analysis helpful, don’t forget to like, follow, and share your thoughts in the comments below! Your support keeps me motivated to share more insights. Let’s grow and learn together—happy trading!

KEI INDUSTRIES LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

KEIStock name = Kei Industries Limited.

Daily chart setup

Chart is self explanatory. Possible up-moves.

Master Score - B

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

ATH Breakout Are you looking for a Breakout Stock? It's right here.

What's your view on this? Please share.

Contact 8130724243 for Stock Market Courses from NSE Academy. We are affiliated with Empirical F&M Academy and NSE Academy.

Hope this post adds valuable insights to your trading/investment journey.

Don't forget to share with your friends. (*Bcz as your friends join you will have someone like-minded with whom you can share and discuss and bring clarity to your learning and life.*)

***

Disclaimer:

Please note that this is only for Study Purpose and not a recommendation.

So please do your own research before investing in market.

KEI BrekoutTraders, keep an eye on this good looking stock that has recently displayed a series of consolidation patterns, is trading above all key moving averages, and has broken out to new all-time highs.

The series of consolidation patterns can be an indication that the stock is gearing up for a significant move, and trading above all key moving averages can suggest a strong bullish trend. Finally, the recent all-time high breakout is a clear signal of the stock's upward momentum.

While there is no guarantee that this stock will continue to perform well, it is certainly worth keeping on your radar. With careful analysis and a well-planned trading strategy, this stock could present a profitable opportunity for traders looking to capitalize on the current market trends.

Remember to always trade with caution and to carefully consider your risk management strategy before making any trades. Happy trading!