LGBBROSLTD trade ideas

LG Balakrishnan & Bros looking upwards L.G. Balakrishnan and Bros Ltd. engages in the manufacture and trade of automotive parts and equipment. It operates through the segments Transmission and Metal Forming. The Transmission segment produces chains, sprockets, tensioners, belts and brake shoes. The Metal Forming segment includes fine blanking, machined components, and wire drawing products.

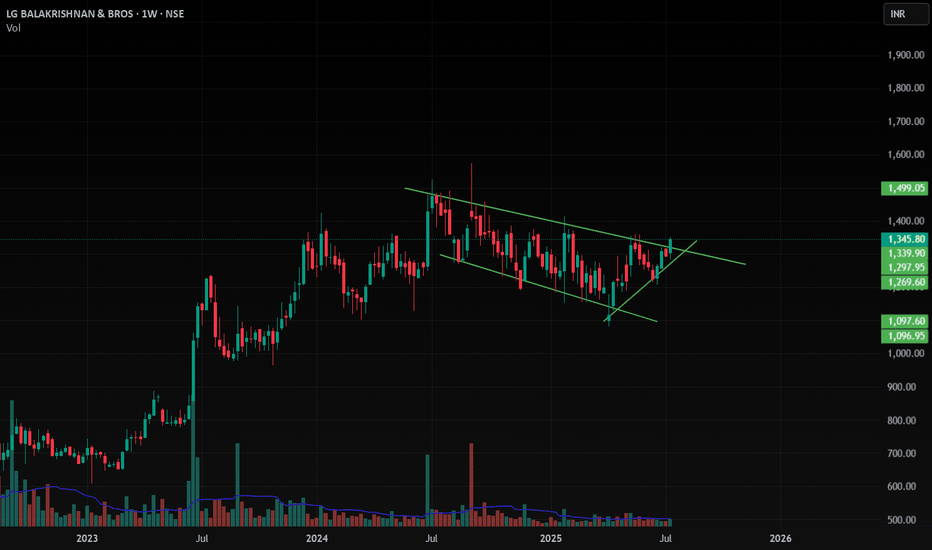

L.G. Balakrishnan and Bros Ltd. CMP is 1384.80. The positive aspects of the company are cheap Valuation (P.E. = 15.7), Company with Low Debt, Company with Zero Promoter Pledge, MFs increased their shareholding last quarter, Dividend yield greater than sector dividend yield and Strong Performer, Under Radar Stocks. The Negative aspects of the company are MACD Crossover Below Signal Line, Declining profits every quarter for the past 3 quarters, Inefficient use of capital to generate profits and Increasing Trend in Non-Core Income.

Entry can be taken after closing above 1394 Targets in the stock will be 1435, 1464 and 1500. The long-term target in the stock will be 1527 and 1572. Stop loss in the stock should be maintained at Closing below 1330 or 1279 depending on your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Resistance BreakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

8 Stocks for the weekNotes

#MOL Retraced to 9EMA with lower volume

#Jamna Retraced to top of box with lower volume

#Cummins Broke the box and is a buy as per last week

#Meto - Waiting to break the box

# LG Bala - Good setup. Box. Dobule bottom. Present target 736. Close open 736 another 150 Rs possible

# CoalIndia Broke. So is a buy above high on weekly time frame

#PCBL need to cross 135

# CCL broke box. So possible a 10% move this to previous box high?

Buy Today, Sell Tomorrow: LGBBROSLTDDON'T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Book profits within the first 30 minutes of the market opening

- Try to exit by taking 3-5% profit of each trade

- SL can be taken when the 5/15 min candle closes below 44EMA

- SL can also be maintained as 1% or closing below the low of the breakout candle

The levels mentioned on the chart are calculated using the BREAKOUT INDICATOR

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in LGBBROSLTD

Buy Today, Sell Tomorrow: LGBBROSLTD

LGBROSLTD - High probability bullish setup observed.LGBROSLTD

CMP 1220.

Target 1700 plus

Stop 1100

Weekly chart

Stock has broken out of the cup pattern which is more visible in daily chart.

Stock has broken above convincingly the long term upward sloping trend channel. Upper boundary should ideally act as a support going forward.

Expected target is 1700 plus which is 50% of the width of the channel.

Stop is 1100 which is previous resistance based support.