LICHSGFIN trade ideas

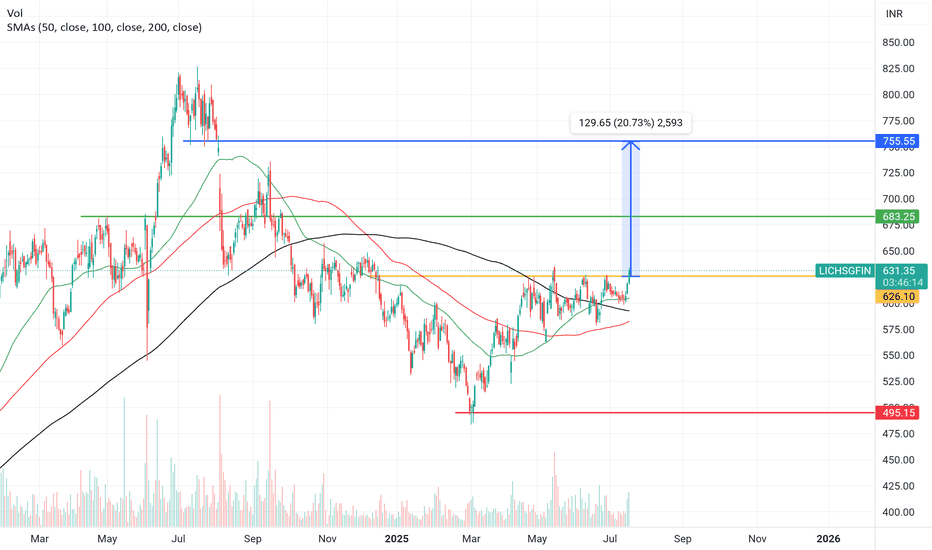

Strong reversal seen in LIC HSG FIN ????Hi Guys !

• As it is clearly visible from the chart that in downtrend LIC Hsg fin has formed inverse H&S, not only formed but it has break the neckline also with good volume.

• Now to participate in rally wait for another green candle which will also called confirmation candle.

•Once it confirms then enter the trade and target will be 20%-21% from the first broken candle.

• Don't get confuse between target and entry should be after 2nd confirmation candle.

• Stoploss will be low of right shoulder which will be 10%-11%.

***This are all my personal views and thoughts and not any recommendations***

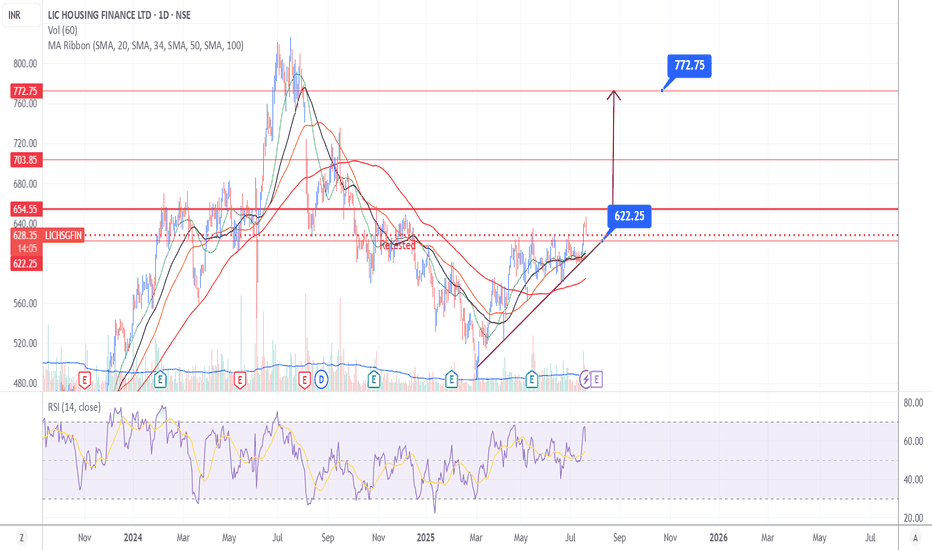

LIC HOUSING FINANCEThe idea has been explained in chart on technical basis.

This chart is for knowledge purpose only and is not a recommendation for buying.

Kindly follow strict stoploss and consult your financial advisor before investing.

Happy Trading..

Disclosure : I have invested in this stock from 580 level.

LIC HOUSING FINANCE (for 1-2 Quarters)Stock retraced from its life time high.. currently trading at 651 which is 21% down from the higher levels.

As per Fibonacci levels.. the stock is in reversal zone. since the broader markets are correcting due to weak global cues.. this may see further fall and touch 605 to 542 levels

As a long term investment this can be accumulated in this zone and wait for 1-2 quarters for further growth

some body who is already carrying positions can continue to hold and add more in dips

First Target - 826

Second Target - 962

Third Target - 1180

Stop-loss - 446 (This is highly unlikely but keep this level in mind for exit)

This idea is just for education and analysis purpose only and not for real time investment.. kindly consult your financial adviser before taking investment decision

LIC Housing Finance LtdLIC Housing Finance Limited is a housing finance company registered with National Housing Bank (NHB) and is mainly engaged in financing purchase / construction of residential

flats / houses to individuals and project finance to developers, Loan against Property (LAP), Lease Rental Discounting (LRD)for commercial properties as well as purchase of commercial shops/showrooms.

TARGETS MENTIONED IN CHART - SL 373

Market Cap

₹ 22,742 Cr.

Current Price

₹ 413

Stock P/E

7.87

Book Value

₹ 494

Dividend Yield

2.06 %

ROCE

7.57 %

ROE

11.1 %

Face Value

₹ 2.00

Promoter holding

45.2 %

EPS last year

₹ 52.6

EPS latest quarter

₹ 21.6

Debt

₹ 2,44,913 Cr.

Pledged percentage

0.00 %

Net CF

₹ -183 Cr.

Price to Cash Flow

-1.16

Free Cash Flow

₹ -19,673 Cr.

Debt to equity

9.01

OPM last year

87.0 %

OPM 5Year

89.3 %

Reserves

₹ 27,075 Cr.

Price to book value

0.84

Int Coverage

1.22

PEG Ratio

1.04

Price to Sales

1.00

LICHSGFINLICHSGFIN is currently trading around its all-time high (ATH) and presents an opportunity for a long trade with a promising risk-reward profile. The strategy involves entering a position at 4% above the ATH and employing a dynamic stop-loss approach to manage risk and maximize potential gains.

Entry: Enter a long position at LICHSGFIN's ATH price + 4% (825.75)

Initial Stop-Loss: Set an initial stop-loss at 20% below the entry price (660.60) or Weekly Swing Low

Targets:

First Target: 1,170.20 (Fibonacci 1.618 level)

Second Target: 1,402.75 (Fibonacci 2 level)

Third Target: 2,011.50 (Fibonacci 3 level)

Position Sizing: Limit the trade size to ensure that no more than 5% of your capital is at risk. In case the stop-loss is triggered, the maximum capital loss will be limited to 1%

The dynamic stop-loss adjustment after reaching the first target further protects capital and locks in profits.

The position sizing ensures that you are not risking more than you can afford to lose.

Disclaimer:

This trading strategy is for informational purposes only and should not be construed as financial advice. Please conduct your own research and due diligence before making any trading decisions.

Additional Notes:

Consider using technical indicators and chart patterns to refine your entry and exit points.

Monitor market conditions and adjust your strategy accordingly.

Practice risk management techniques to protect your capital.

Please let me know if you have any other questions.

Head and shoulder formation on LICHSGFINLICHSGFIN is forming what that appears to be a reverse head and shoulder pattern on daily chart. Stock has been on a steady uptrend for more than a year now. Note the run up prior to formation of head and shoulder pattern with good volume. Also during selloff there wasnt much volume indicating sellers are dried out. On the right shoulder there was a hammer pattern formation forming a good support if entered at right price after breakout. Bullish finish today indicates there is more buying to come. However wait for a strong close before entry.

Hope you liked this idea. If you like please boost this idea or leave a comment down on what you think. Otherwise, happy trading :-)