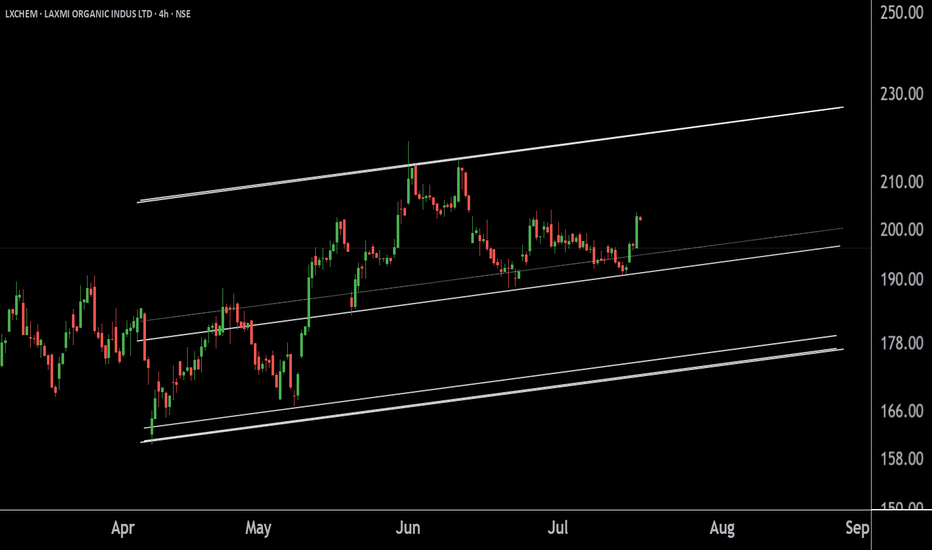

LXCHEM trade ideas

Expecting Good resultsIf possible take a break Till US Elections.

Jubilant Ingrevia results are good. Expecting Laxmi Organics results to be good as they operate in the similar segment.

Observe Market conditions then decide on the trade.

They will release the results after market. So BTST or intraday makes sense if market is weak .

You don't have to take the trade , observe the price movement then apply the idea next time.

Laxmi Organic The stock is currently near its support level of 310-315, which could act as a strong base for further upward movement. Above that we can see upside potential of 350-400+.

The next major resistance is at 480-490 INR. Breaking this level could lead to significant upside potential.

Laxmi Organic Industries Ltd. shows promising signs both technically and fundamentally. The stock is currently near a strong support level, and recent bullish trends suggest potential for further gains. Comparing it with peers, Laxmi Organic holds a strong market position with healthy financials.

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:2.

Stop loss can be Trail when it make new box.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

Laxmi organic Forming Double bottom on Daily & Weekly chartLaxmi organic is in sideways trend since almost 1.5 y ...Now it going to form double bottom on Daily & Weekly chart ..Stock also trading above it's 200 DMA(which is in 260 range).Stock can give good move after closing above 319 level. Target will be 400 & stoploss will be 200DMA level

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

LXCHEM - DOUBLE BOTTOM IN MAKING ON MONTHLY CHARTSWING TRADING IDEA:

-Volume based buying is seen in the past days on daily chart .

-On monthly chart we can see double bottom formation in progress and it's confirmation will happen when the stock closes above 315 on daily or weekly basis.

-Strong support near 220

-Traders with high risk appetite can do preemptive buying @290-270 with a SL of 261.80

-Traders with low risk appetite can do buying around 321-315 with a SL of 286.75

- TGT - 430+

Laxmi organic is ready to fly highLaxmi organic can double from here with in few years. Sl below the trend line.

Chart is self explanatory. Please follow the price action & take the trade as per your appetite.

The information provided here is only for educational purpose. The information provided here is not intended to be any kind of financial advice, investment advice, and trading advice. Investment in stock market is very risky and trading stocks, options and other securities involve risk. The risk of loss in stock market can be substantial. Moreover, I am not a SEBI registered analyst, so before taking any decision or before investing in any Share consult your financial advisor and also do your analysis and research.

Request your support and engagement by liking and commenting & follow to provide encouragement.

Elliott Wave (3) Awakening: Laxmi Organic Industries Ltd.Laxmi Organic Industries Ltd. has completed wave (1) in blue Intermediate degree on the weekly chart from its inception till the peak in September 2021. Wave (2) has completed at the bottom in June 2024. We are now possibly starting to unfold wave (3) in blue Intermediate degree on the weekly chart, which is generally a strong impulse wave.

Wave (3) Characteristics and Strength:

- Strong Impulse: Wave (3) is typically the most powerful and extended wave in the Elliott Wave cycle, characterized by strong price movements and high trading volumes.

- Fibonacci Extension Target: The ideal target for wave (3) is the 161.8% extension of wave (1). Using the Trend-based Fibonacci Extension tool, this projects a price target near 1000.

- Subdivisions: Wave (3) is expected to subdivide into five smaller waves (minor degree), each representing a smaller impulse move within the larger wave.

Current Price Action:

- Current Price: 265

- Key Levels:

- Invalidation Level: 220 (last swing low)

- Breakout Confirmation: 277 (a break and close above this level will confirm the start of wave (3))

Technical Indicators:

- Bullish Divergence: At the bottom in June 2024, double bullish divergence was observed, signaling potential reversal.

- Dow Theory Confirmation: We are waiting for the first higher high and higher low formation to confirm the bullish impulse. This pattern will strengthen the case for wave (3) initiation.

Risk-Reward Ratio:

- Risk: Very low, with the stop-loss set at the invalidation level of 220.

- Reward: Potentially huge, with a target of 1000 or more, aligning with the 161.8% Fibonacci extension of wave (1).

- Risk-Reward Ratio: Excellent, considering the low risk and high reward potential.

Trading Strategy:

- Entry Point: Consider entering a position now while the price is at 265, with a stop-loss at 220.

- Confirmation Entry: A more conservative entry can be made once the price breaks and closes above 277.

Conclusion:

Laxmi Organic Industries Ltd. appears to be in the early stages of wave (3) in blue Intermediate degree. Given the characteristics of wave (3) and the current technical setup, this presents an attractive trading opportunity with a favorable risk-reward ratio. Monitoring the price action for a break above 277 will provide further confirmation of the bullish impulse wave.

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Laxmi Organic Industries LtdLaxmi Organic Industries Limited was established in 1989 and is in the business of specialty chemicals. The Company primarily manufactures Ethyl Acetate, Acetic Acid and Diketene Derivative Products (DDP). DDP is a specialty chemical group, the technology and business of which has been acquired by the company from Clariant Chemicals India Limited.