MANGCHEFER trade ideas

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

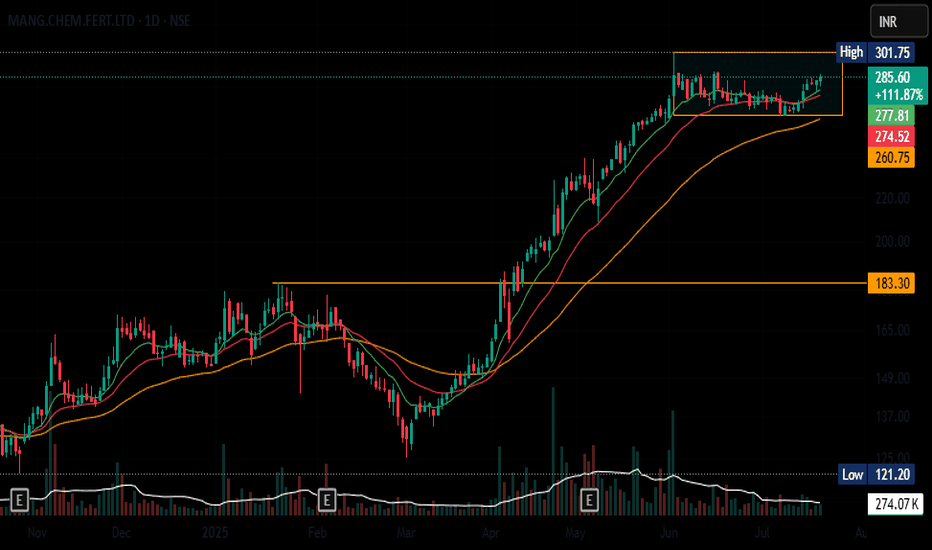

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:2

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

MANGALORE CHEMICAL Support & ResistanceSupport and Resistance Levels:

Based on the price action, you have to identify two significant levels: the red line acting as resistance and the green line acting as support. Additionally, there have marked red and green shades to represent resistance and support zones, respectively.

Support: The green line and green shade represent support levels. These levels are where the price tends to find buying interest, preventing it from falling further. Traders can consider these levels as potential buying opportunities.

Resistance: The red line and red shade represent resistance levels. These levels are where the price tends to encounter selling pressure, preventing it from rising further. Traders can consider these levels as potential selling opportunities.

Breakouts: If the price breaks above the resistance zone (red shade) convincingly, it may indicate a bullish breakout, and the price could move higher to the next resistance level. On the other hand, if the price breaks below the support zone (green shade) convincingly, it may indicate a bearish breakout, and the price could move lower to the next support level.

Keltner Channel:

The Keltner Channel is a technical indicator that uses an exponential moving average (EMA) to create an upper and lower channel around the price action. Traders can use this channel to identify potential long and short positions.

Long Position: If the price is above the upper line of the Keltner Channel, it may indicate a potential long opportunity, as it suggests the price is trading above the average range and might continue in an upward trend.

Short Position: If the price is below the lower line of the Keltner Channel, it may indicate a potential short opportunity, as it suggests the price is trading below the average range and might continue in a downward trend.

Disclosure: I am not SEBI registered. I just wanted to let you know that the information provided here is for learning purposes only. Please consult your financial advisor before making any decisions. Tweets neither advice nor endorsement.

BUY KARO Mangalore Chemicals and Fertilizers Limited (MCF)Mangalore Chemicals and Fertilizers Limited (MCF) is primarily engaged in the manufacture, purchase, and sale of fertilizers. It is a subsidiary of Zuari Fertilisers and Chemicals Limited, an Adventz Group.

Company ka result bahut acha hai.... Net profit of Mangalore Chemicals & Fertilizers jumped 145.16 percent to Rs 76.17 crore in the quarter ended December 2022 as against Rs 31.07 crore during the previous quarter ended December 2021.

Sales of the company rose 54.03 percent to Rs 1173.24 crore in the quarter ended December 2022 as against Rs 761.70 crore during the previous quarter ended December 2021.

Market Cap

₹ 1,017 Cr.

Current Price

₹ 85.8

High / Low

₹ 132 / 64.4

Stock P/E

14.5

Book Value

₹ 55.6

Dividend Yield

1.42 %

ROCE

10.7 %

ROE

14.3 %

Face Value

₹ 10.0

Debt

₹ 1,429 Cr.

EPS

₹ 5.93

PEG Ratio

0.40

Promoter holding

60.6 %

Intrinsic Value

₹ 70.1

Pledged percentage

63.1 %

EVEBITDA

9.67

Company is expected to give good quarter

Company has delivered good profit growth of 36.3% CAGR over last 5 years

Debtor days have improved from 122 to 83.8 days.

Kharid lo qki bad me ye price mile ya na mile ye kahna mushkil hai,,best investment stock and short term me bhi paisa kama k dega..for target and stop loss please see on chart,

Please like and follow for more updates.

Thankyou.

MANGCHEFER 52 week high pullback retestHow it has been identified:

Came in the following scanner:

1. Mark Minervini Template.

2. 20 day Kelter channel squeeze.

3. Within 10% of 52 week high zone.

This criteria was met when the scanner was run on 16th September, 2022.

Additional characteristics that were looked at:

1. Volume dry-up on pullback.

2. Fertiliser stocks are in an uptrend.