MANKIND trade ideas

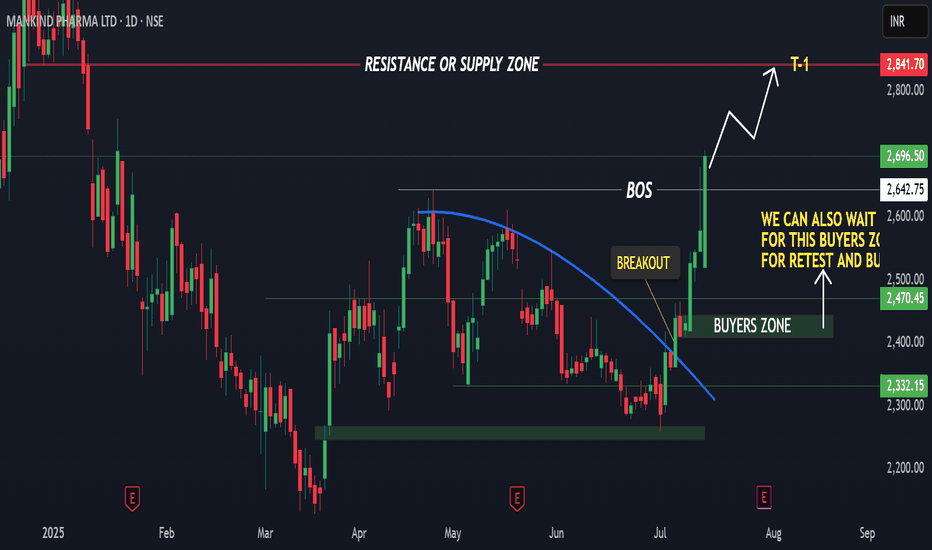

MANKIND PHARMA - For swing Trade1. In monthly time frame price is looking very bullish.

2. In weekly time frame price has given a breakout of double bottom pattern which is also showing bullish sign. And also from last 4 weeks price is making a good bullish move upside.

3. In daily time frame price has given a curve line breakout and make a good bullish move upside today.

4. Current price is 2696

2642 was the breakout level and also a break of structure(BOS)

5. Next Target can be 2840 to 2940

NOTE -

2445 to 2410 is the Bullish reversal zone.

Mankind Pharma Ltd view for Intraday 22nd May #MANKIND Mankind Pharma Ltd view for Intraday 22nd May #MANKIND

Resistance 2550 Watching above 2555 for upside momentum.

Support area 2500 Below 2520 ignoring upside momentum for intraday

Watching below 2498 for downside movement...

Above 2520 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

MANKIND PHARMA LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

MANKIND PHARMA- MULTIPLE SUPPORTS & RESISTANCESI have drawn support and resistance lines. it may be following the trend lines. May not be as well... need more time to see if the trend lines are being supported by the stock. As of now, volumes are missing and stock has held its price. Earnings on 28th August. Stock likely to remain range bound. May mint some money. Also since nifty has made ATH, holding on to a pharma stock not bad idea.

MANKIND PHARMA making breakout from 3-month consolidation rangeMANKIND PAHRMA is making breakout from a 3-month consolidation range. Its relative performance to CNX 500 turned positive, & the momentum indicator, RSI has not gone below its bull support zone of 60 during the entire consolidation period & that indicats strength in its bullish momentum. The structure on its weekly & monthly charts also is quite good. On the fundamentals too it has been doing good as its EPS and sales have been growing for the last 4 quarters.

Only personal analysis. No recommendation

3rd of the 3rd is coming in MANKINDIn the weekly timeframe, it is evident that mankind has successfully navigated through its first and second wave, and is now poised for the commencement of its third wave. Transitioning to the daily chart, we observe the initiation of this anticipated third wave, with the completion of its first sub-wave. Subsequently, the price retraced into the range of the first wave, suggesting the possibility of sub-waves within the third wave.

Presently, the first sub-wave of the third wave has concluded, setting the stage for the impending third wave. The intricate structure implies the development of sub-waves within the overarching third wave, leading to the formation of the third of the third wave. As we anticipate substantial upward momentum in the future, strategic entry points can be identified by patiently waiting for a confirmed price action breakout.

In the upcoming market movements, significant gap-ups in mankind can be anticipated. For tactical entries, it is advisable to await a decisive break in price action and position entries with stop-loss orders set at the low of the second sub-wave. Further updates on this analysis will be provided in due course.

Wait and then make Position.

In the last 6 months, it has given a 50% return.

And now it is consolidating from last 3 months.

This is new IPO, and we can not give so much early commentary on this, I want to build position but I am waiting for the breakout.

If it gives upside breakout, then fresh mid-term position can be made and if gives downside breakout then it will consolidate there for some time and then it will give upside breakout.

For this we will have to wait and see.

Talking about the fundamentals, They are completely fine and are growing, company also proper mix of geographical presence.

If you find this valuable, do Boost my post.

MANKIND PHARMA broke from bullish flagscript taken support from 60 level of RSI and already given breakout from triangle /flag and pole pattern upside target could be next Fib level as pl on chart with breakout candle lower level as support.

I am not sebi registered : all posts are for study only. :)

Mankind Pharma hold with stop loss 1564

**Disclaimer:** I am not a registered investment advisor and this is not financial advice. Please do your own research before investing in any stock.

**Hold:** Mankind Pharma is a good stock to hold for the long term. The company has a strong financial performance and a wide range of products. The company is also expanding into new markets, which will help to boost its growth.

**Stop loss:** The stop loss for Mankind Pharma is 1564. This means that if the stock price falls below 1564, you should sell your shares.

**Long target:** The long target for Mankind Pharma is 2121. This means that if the stock price rises above 2121, you can sell your shares for a profit.

**More:** You can also set a higher target for Mankind Pharma, such as 2500 or 3000. However, it is important to remember that there is no guarantee that the stock price will reach these levels.

It is important to note that the share price of Mankind Pharma is volatile and can fluctuate significantly. Investors should carefully consider this risk before investing in the company.

* **Company overview:** Mankind Pharma is an Indian pharmaceutical company headquartered in Delhi. The company was founded in 1991 by R. C. Juneja. Mankind Pharma is one of the leading pharmaceutical companies in India, with a market capitalization of over Rs. 10,000 crore. The company has a wide range of products, including generic drugs, branded generics, and over-the-counter (OTC) products. Mankind Pharma exports its products to over 80 countries.

* **Financial performance:** Mankind Pharma's financial performance has been strong in recent years. The company's revenue has grown at a compound annual growth rate (CAGR) of 15% for the past five years. The company's profit has also grown at a CAGR of 20% for the past five years.

* **Business segments:** Mankind Pharma's business segments include:

* **Generics:** Mankind Pharma is a leading player in the generics market in India. The company has a wide range of generic drugs, including anti-infectives, cardiovascular drugs, anti-diabetics, and anti-cancer drugs.

* **Branded generics:** Mankind Pharma also has a strong portfolio of branded generics. The company's branded generics are sold under the brand names Manforce, Prega News, and Gas-O-Fast.

* **OTC products:** Mankind Pharma also has a portfolio of OTC products. The company's OTC products are sold under the brand names Mankind Pain Relief, Mankind Cold & Flu, and Mankind Cough Syrup.

* **Strengths:**

* Strong financial performance

* Wide range of products

* Strong brand portfolio

* Experienced management team

* Strong distribution network

* **Weaknesses:**

* Reliance on generic drugs

* Competition from other pharmaceutical companies

* High research and development costs

* Volatility in the pharmaceutical industry

* **Opportunities:**

* Growing demand for generic drugs in India and other emerging markets

* Expansion into new markets

* Development of new products

* Acquisition of other pharmaceutical companies

* **Threats:**

* Competition from other pharmaceutical companies

* Price erosion in the generics market

* Regulatory changes

* Changes in the healthcare landscape

Overall, Mankind Pharma is a well-managed company with a strong financial performance. The company has a wide range of products, a strong brand portfolio, and an experienced management team. However, the company faces some challenges, such as reliance on generic drugs and competition from other pharmaceutical companies. Investors should carefully consider these challenges before investing in Mankind Pharma.

Here are some of the factors that could impact the share price of Mankind Pharma:

* **Company performance:** The company's financial performance is one of the most important factors that could impact its share price. If the company reports strong financial results, it could lead to a rise in the share price.

* **Industry trends:** The industry that the company operates in can also impact its share price. If the industry is growing, it could lead to a rise in the share price.

* **Macroeconomic factors:** Macroeconomic factors, such as interest rates and inflation, can also impact the share price of Mankind Pharma. If interest rates rise, it could lead to a fall in the share price.

Investors should carefully consider all of these factors before investing in Mankind Pharma.