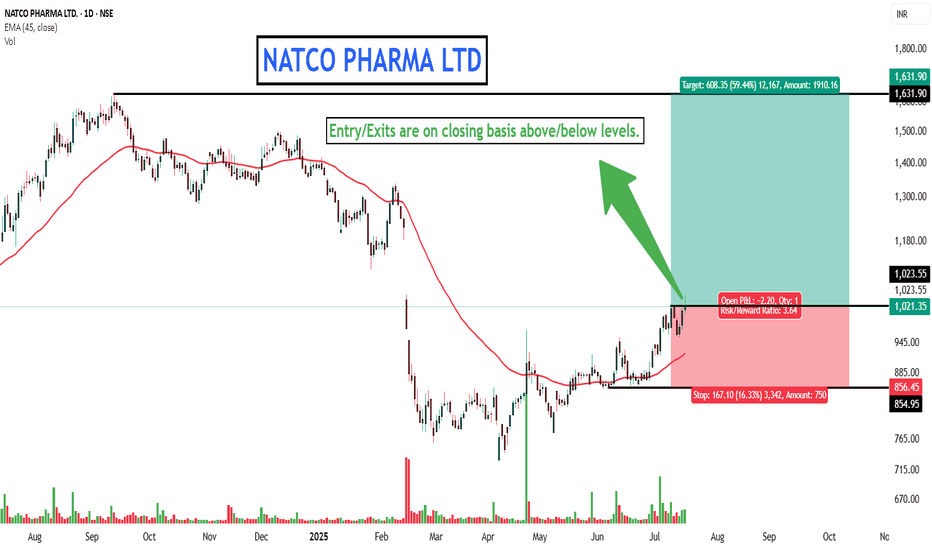

NATCO PHARMA LTD FOR YOU!Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

Kindly dm for further assistance it is for free just for this stock.

Thank you and invest wisely.

NATCOPHARM trade ideas

Natco Pharma Breakout Stock Natco Pharma (NATCOPHARM) is showing a strong breakout on the charts, supported by positive price action and increased buying interest. The stock has moved above key resistance levels, indicating bullish momentum. With improving volumes and a solid technical setup, NATCOPHARM looks well-positioned for short-term upside. Keep this stock on your watchlist for potential trading opportunities.

Review and plan for 29th May 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

SAR+ GANN9+ FIBO Retracement TAParabolic Stop and Reverse (SAR, PSAR) was originally developed by J. Welles Wilder. It derives its name from the fact that when charted, the pattern formed by the points resembles a parabola. A buy label is observed on the chart . The dots show the support points for the rising trend.

The price was facing resistance at 850 and is observed to be broken. The candle in progress is strong and tall nearing the Fibonacci level of 961.40 . The Fibonacci retracement is drawn from high of 1341 to low of 726.80 . The resulting Price levels are as observed on the charts.

The GANN square of 9 provides important support and resistance levels . The price is nearing 946 an important GANN 9 level.

Natco Pharma - Bullish - Long termStock is looking bullish above 1400 levels

Long term investors can accumulate in every dips and maintain a stop loss of 1175

Short term traders wait for retracements below 1400 level to accumulate and wait for the target of 1650

Hold for long term targets of 1700, 1850, 1900, 2000 levels

Short term stop loss 1275 levels

This idea is just for education purpose only and not a serious trading idea. kindly consult your financial advisor before taking any decision of investment or trade

UPSIDE potential in Natco pharmabreak of inverse head and shoulder pattern can be witnessed in natco pharma AND overall sentiment in pharma sector are also bullish . IT may try to break its all time high level in upcoming few month as per my expectation dec end might be the one looking for.

Can be good trade for swing. Time around 1 TO 2 month

Chart say everything with Elliott wave counts and Chart PatternsChart say everything with Elliott wave counts and Chart Patterns

Looks like Inverted Head n Shoulder chart pattern, yet to Break above Neckline.

Scenario also aligns with Impulse wave counts.

Elliott Wave Counts

Inverted Head n Shoulder Chart Pattern Yet to confirm Breakout

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

NATCOPHARMA :NSE BULLISH FLAG & TRENDLINE BO DTF/WTFNATCOPHARMA STOCK Analysis

TRADE PLAN (DTF Close Price for SWING /POSITIONAL)

ENTRY - 1413 50% Qty, Add 50% qty 1482 DTF Close

SL - 1320

TARGET --01- 1482 SWING , TGT02--1624

Hold For a 6M -1 Year or TGT 2

Chart Pattern :

STOCK had a 3Month Streak to Touch an ATH of 1639, Retracing to 50% FIBO Level forming a Bullish Flag Pattern.

INDICATORS EMA :

The Price is Currently Trading near 50EMA, and 20EMa below 50EMA in DTF. STOCK EMAs are currently in Transitional stage of alignment where this week an. 8%+ price rise with reasonable Volumes indicating start of a bullish Trend on DTF/WTF.

FIBO/E :

Currently the price is above the 38.2% FIBO Retracement Level, Early Entry can be take as per your risk ability. Safe Investors Enter as above .

Volumes: After the surge in volumes in the past 3months There is a muted in Volume on the selling side of the Weekly Charts after the 4 weeks Pullback. Results a=for the Quarter are due next week.

Keep in your Priority Watch List

Disclaimer: For Education/Reference Purpose Only, Trade at your Own Risk with correct position sizing and SL based on your Risk appetite (Exit when price closes 7to8% below your Entry).and re enter when trend reverses...

Trail Your SL progressively. Learn/Know and Review the Stock trading Technical Terminology. Check Verify the Financial fundamentals of the Stock and Seek Advice from a Certified Financial Advisor prior to Investing. Prefer Entry with 25% quantity, Add in Tranches of 25%-50% as prices moves upwards recommended.

MTFA- Multiple Time Frame Analysis

DTF -Daily Time Frame

WTF-Weekly Time Frame

MTF- Monthly Time Frame

ATH-All Time High

LTH -LifeTime High

RBC&H-Rounding Bottom Cup/Handle

BO- Breakout Close

EMA -Exponential Moving Average

FIBO R/E -Trend based Fibonacci Retracement/Extension

SL Stop Loss

TBD- To be Decided

CHoCH- Change of Character Bullish/Bearish

MSB/BOS -Break Out Structure

FVG Fair Value Gap

20VMA -20Volume Moving Average

SWING/POSITIONAL Trade

Natco Pharma- A multibagger?NATCO Pharma Limited (NATCO) is a vertically integrated, research and development focused pharmaceutical company engaged in developing, manufacturing, and marketing complex products for niche therapeutic areas.

The Company has also forayed into Crop health and completed state-of-the-art greenfield manufacturing facilities for agro technical and formulation products, with a total Capex spend of over INR 150 crores located in Nellore, AP.

The company is making strategic investments and buying stakes in multiple companies.

The management is looking keen to grow the company and reach the whole world.

Some technical of the company-

Return on capital employed >30 AND

Debt to equity <0.1 AND

Net profit preceding 12months >500 AND

Net Profit latest quarter >100

This stock looks excellent for long term growth and may become a multibagger in the future.

Do keep it in your watchlist and keep a sharp eye on the results.

I am not a SEBI registered analyst.

Please do your own analysis before investing.

Do like and follow and share among your friends and family.

Thank you.

NATCOPHARM - Bullish oNStock name - Natco Pharma Limited.

✅#NATCOPHARM

✅Next resistance 670

✅Moved 52% in 27 weeks.

Weekly chart

Chart is self explanatory everything.

Master score - B

Disclaimer : This is for demonstration and education purpose only. This is not buying and selling recommendation. I'm not SEBI registered.

Natco Pharma Breakout Retest! 🚀

Hey Dosto! 👋

🔍 Chart Analysis: Natco Pharma - CMP 980 📊

🚀 Reasons for Trade:

Strong Uptrend

Cup and Handle Breakout Retest

💹 Trade Details:

CMP: 980

SL: 918

Targets: 1090, 1188

🌟 Why Natco Pharma? After a cup and handle breakout, Natco Pharma has retraced for a retest, indicating potential upward momentum.

💡 Trade Strategy:

📈 Enter after retest confirmation.

⚖️ Set SL at 918.

🎯 Targets at 1050, 1110, and 1200.

📈 Disclaimer: I'm not a SEBI registered analyst. Trade at your own discretion.

🚀 Excited about this trade? Share your thoughts below! Let's discuss! 🤝💬

#NatcoPharma #StockMarket #TradeAlert #TechnicalAnalysis #BreakoutRetest 📈✨

NATCO PHARMA LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/share) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Momentum Trading Picks - Pharma Stock Natco Pharma.This chart is very interesting as well as confusing at the same time for some people let's break it down step by step.

If you see the monthly chart of Natco Pharma you will notice many patterns there like:-

Cup pattern

W pattern

Pole and flag Pattern

Volume is increasing significantly on the monthly chart

Breakout already happened last week but those who are willing to take risks can still participate in it because the stop loss will be a bit on the higher side.