−9.54 INR

−16.87 B INR

68.88 B INR

610.04 M

About NETWORK18 MEDIA & INV LTD

Sector

Industry

CEO

Rahul Joshi

Website

Headquarters

Mumbai

Founded

1996

ISIN

INE870H01013

FIGI

BBG000NWYSG7

Network18 Media & Investments Ltd. engages in the provision of media and entertainment services. It manages digital businesses including media platforms, such as Moneycontrol, News18.com, CNBCTV18.com, and Firstpost. The company was founded by Raghav Bahl and Sanjay Ray Chaudhuri on February 16, 1996 and is headquartered in Mumbai, India.

Related stocks

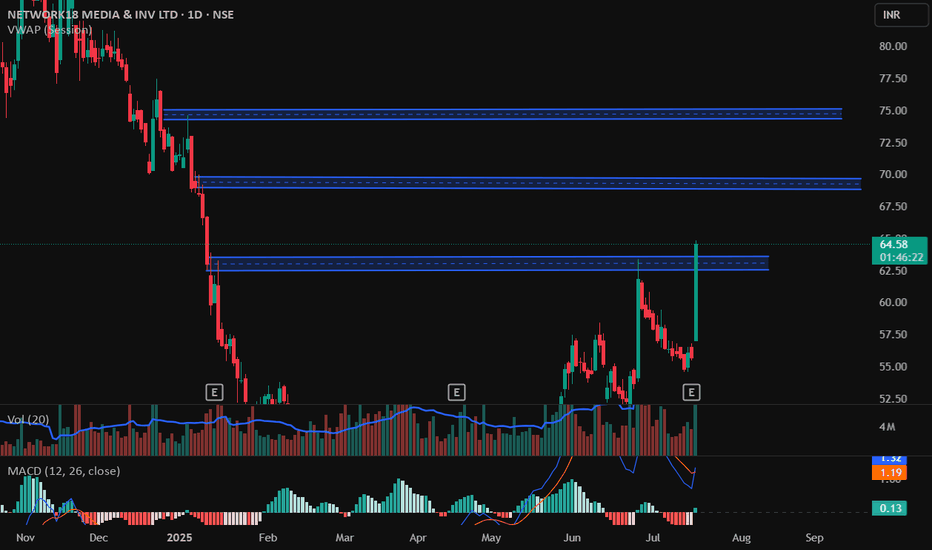

SWING IDEA - NETWORK 18 MEDIANetwork 18 Media , a prominent player in the media and entertainment industry, is showing signs of a promising swing trade opportunity based on several key technical indicators.

Reasons are listed below :

75-80 Support Zone : The 75-80 level is a crucial support zone that has held multiple times

NETWORK 18 - RANGE BREAKOUT FOR SWINGRANGE BREAKOUT FOR SWING TRADING

NEW BUY PRICE : 95

SL : 85 (only for swing traders)

TARGET : 120, 135 (40%)

Disclaimer - All information on this page is for educational purposes only, we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters bef

Ready to jump Company Overview:

Network18 Media & Investments Limited is a media and entertainment conglomerate based in India. The company operates a diverse portfolio of media properties, including television channels, digital content platforms, films, and print publications. As a key player in the Indian media

Network18 looks bullishNetwork18 is looking bullish on monthly, weekly and daily time frames. It has crossed 60 RSI levels monthly, weekly and daily. You can see volume has been increasing recently. It has been forming a rounding bottom. It has broken resistance at 77 with significant volume. If it retraces 78-77 levels,

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of NETWORK18 is 55.71 INR — it has decreased by −0.46% in the past 24 hours. Watch NETWORK18 MEDIA & INV LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange NETWORK18 MEDIA & INV LTD stocks are traded under the ticker NETWORK18.

NETWORK18 stock has fallen by −4.75% compared to the previous week, the month change is a −5.45% fall, over the last year NETWORK18 MEDIA & INV LTD has showed a −38.98% decrease.

NETWORK18 reached its all-time high on May 23, 2007 with the price of 631.20 INR, and its all-time low was 14.70 INR and was reached on Mar 25, 2020. View more price dynamics on NETWORK18 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NETWORK18 stock is 2.74% volatile and has beta coefficient of 1.37. Track NETWORK18 MEDIA & INV LTD stock price on the chart and check out the list of the most volatile stocks — is NETWORK18 MEDIA & INV LTD there?

Today NETWORK18 MEDIA & INV LTD has the market capitalization of 87.03 B, it has decreased by −4.16% over the last week.

Yes, you can track NETWORK18 MEDIA & INV LTD financials in yearly and quarterly reports right on TradingView.

NETWORK18 net income for the last quarter is 1.48 B INR, while the quarter before that showed −303.10 M INR of net income which accounts for 588.39% change. Track more NETWORK18 MEDIA & INV LTD financial stats to get the full picture.

No, NETWORK18 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 31, 2025, the company has 4.89 K employees. See our rating of the largest employees — is NETWORK18 MEDIA & INV LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NETWORK18 MEDIA & INV LTD EBITDA is −1.78 B INR, and current EBITDA margin is −4.93%. See more stats in NETWORK18 MEDIA & INV LTD financial statements.

Like other stocks, NETWORK18 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NETWORK18 MEDIA & INV LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NETWORK18 MEDIA & INV LTD technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NETWORK18 MEDIA & INV LTD stock shows the sell signal. See more of NETWORK18 MEDIA & INV LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.