Nifty 17.04.2024 Analysis As of April 16, 2025, Foreign Institutional Investors (FIIs) have exhibited a mixed stance on Indian equities, particularly the Nifty 50 index.

Tickertape

+1

Reuters

+1

Recent FII Activity:

April 16, 2025: FIIs were net buyers in the cash segment, purchasing ₹15,286.90 crore and selling ₹11,350.48 crore, resulting in a net inflow of ₹3,936.42 crore.

The Economic Times

+2

Business News Today

+2

Trendlyne.com

+2

Month-to-Date (April 1–16, 2025): Despite the positive activity on April 16, FIIs have been net sellers overall, with gross purchases of ₹143,676.11 crore against gross sales of ₹168,315.70 crore, leading to a net outflow of ₹24,639.59 crore.

Business News Today

Market Impact:

The Indian markets have shown resilience amid global uncertainties. Domestic institutional investors (DIIs) have continued to invest, cushioning the market against FII outflows. Analysts are favoring sectors less exposed to international volatility, including banking, power, telecoms, autos, and consumer goods.

While FIIs have been net sellers in April, the positive activity on April 16 suggests a potential shift in sentiment. However, sustained inflows would depend on global market stability and domestic economic indicators.

Reuters

For real-time updates on FII and DII activities, you can refer to the following resources:

DII ** 16-Apr-2025 11,065.94 13,578.71 -2,512.77

FII/FPI * 16-Apr-2025 15,286.90 11,350.48 3,936.42

NIFTY trade ideas

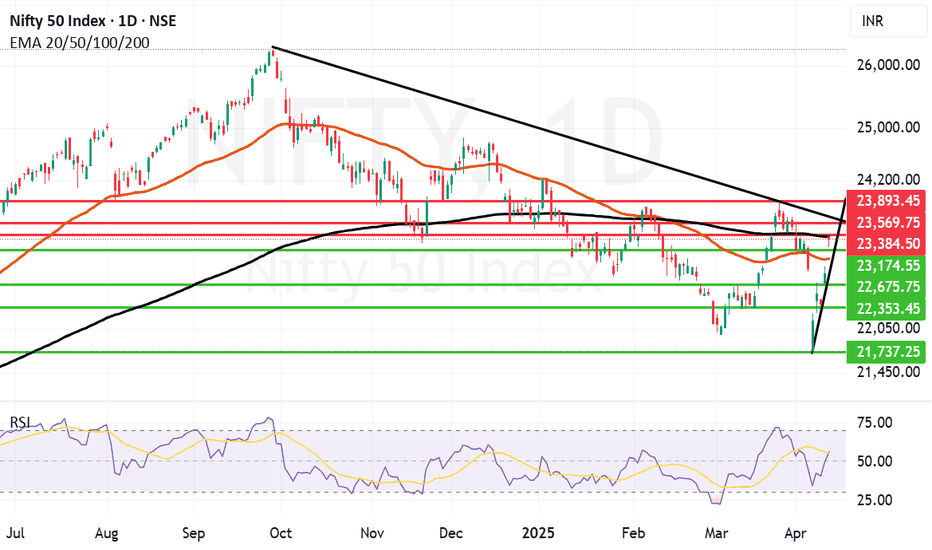

Nifty near the trendline resistance now after another good day.Nifty has cleared the 200 days EMA or the Father line on Daily chart. But in the hourly chart depicted here has hit a resistance zone which happens to be a trend line resistance.

RSI of Nifty is currently above 73 and the scope for upside is there but limited. With a shortened week tomorrow we will have a weekly closing. So a positive closing tomorrow can place us in a good space for a next week. However with everchanging trade war scenario it is difficult to guess if investors will encash their long positions or carry them forward into the next week.

The next resistances for Nifty remain at 23456, 23621, 23713, 23784 and 23915 before Nifty regains 24K levels. The support zones for Nifty remain at 23292, 23156, (Mother and Father lines of hourly chart are close by near) 23017 and 22980. So this zone will be a strong support. A closing below 22980 can drag Nifty down towards 22771 or even 22361 region.

Also one must keep an eye on Reliance result tomorrow. As it is a index power house it can single handedly make or break the weekly closing. Flat or positive closing tomorrow will be very helpful for the bull run to continue.

Disclaimer:The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Scalping with ATM Options Using Candle + OI Confirmation!Hello Traders!

If you love quick entries and fast exits with defined logic, then ATM Option Scalping is your game. But scalping without confirmation often leads to stop-loss hits. That’s why combining candlestick structure with live Open Interest (OI) data gives you a serious edge. Let’s break down the exact setup I use to scalp with ATM options in Nifty & BankNifty .

Why ATM Options for Scalping?

Better Liquidity: ATM strikes have tight spreads and high volumes, making execution quick and efficient.

Quick Premium Movement: Even small index moves reflect fast in ATM premiums.

Less Theta Decay (Intraday): Within first half of day, theta doesn’t hurt much. Scalping avoids time decay traps.

Scalping Strategy: Candle + OI Confirmation

Step 1 – Watch 5-Min Candle Setup:

Look for strong breakout candles, bullish/bearish engulfing, or reversal candles at key zones like VWAP/PDH/PDL.

Step 2 – Confirm with OI Shift:

Check ATM strikes on option chain.

Put OI rising + Price sustaining = bullish confirmation.

Call OI rising + Price rejecting = bearish confirmation.

Step 3 – Take Trade in ATM Option:

Enter CE or PE near breakout candle close with proper SL below/above that candle.

Step 4 – Exit Fast (Scalp Mode):

Book partial profits at 30–40% or when next resistance/support is hit. Avoid overholding!

Bonus Risk Management Tips

Avoid Trading Near News or Events: OI gives false signals in high volatility zones.

1 Trade = 1 Risk Unit Only: Do not revenge trade. Scalping is about accuracy, not frequency.

Trade only when both candle + OI align: No confirmation = no entry.

Rahul’s Tip

Let the chart speak, but let the OI validate. When both agree — that’s where scalpers win big.

Conclusion

Scalping with ATM options using candle structure + OI shift is a powerful setup if executed with discipline. It’s fast, clean, and logical. Focus on 1–2 setups a day — and make them count.

Do you scalp ATM options? Share your entry rules or struggles in the comments below!

Is Nifty gearing up for bullish rally?Nifty 50 Daily Chart Analysis (Heikin Ashi)

Nifty is trading around 23,437, showing a strong short-term rebound from recent lows near 22,260. The price has moved above the red SuperTrend resistance cloud and is now testing key Fibonacci levels.

Key Observations:

SuperTrend Cloud has turned green again, suggesting a bullish shift in trend.

Fibonacci Levels:

0.236 at 22,802 (strong support).

0.382 at 23,454 — current price is near this resistance zone.

0.5 at 23,981 and 0.618 at 24,508 are higher resistance levels to watch.

Trendline Resistance (dashed line) is approaching — a breakout above that could confirm further upside.

EMA Stack Strength Meter is turning positive (green) again, showing improving momentum.

Volume remains stable, no major spikes yet.

Summary:

Short-Term: Bullish momentum is picking up. Break above 23,500 can lead to a move toward 24,000+.

Medium-Term: Watch for a clean break and close above 23,981 to confirm trend reversal.

Downside Risk: If price fails to hold 23,200–23,000 zone, it could retest 22,800 support.

The trend is cautiously bullish but facing resistance. Bulls need follow-through above 23,500–24,000 for sustained upside.

Nifty levels - Apr 17, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

March Pain Point in $NSE:NIFTY | Best Support is Coming !NSE:NIFTY

Hi

Green Area Is Best Time to Accumulate Stocks.

Best Support, and Stocks with Low Beta are the Gems So Accumulate them with Nifty Supports.

Too Much is Happening, like Nifty Rebalancing, Nifty50 Next Rebalancing, Global Sentiments with Indian Govt Love for Tax Policy.

Be Prudent !

Let Them Short and Long on the Other Side.

Make Good Position on Nifty Stock !

thanks

Expecting to reach 23412In order to balance price, buyers must offer fair value at 23,412 on the 4H timeframe. If that level is reached, a decline may follow; otherwise, we may see a run on liquidity.If you see the 1H candle wick down into the 1H IFVG , then in my view, buyers are likely planning to seek or trigger a run on liquidity at 23,412.

#NIFTY Intraday Support and Resistance Levels - 16/04/2025Today will be slightly gap up opening expected in nifty. After opening if nifty sustain above 23300 level then possible upside rally upto 23500 in opening session. This rally can be expected for further 200+ points in case nifty gives breakout and starts trading above 23550 level. Any major downside only expected below 23250 level.

Resistance Zone approaching. Can the bulls defy the odds?Nifty is rallying for the last few days along with global markets due to relief provided by US President Donald Trump due to Tariff pause but we are approaching a zone where the maniac rise might halt or it might take some time to relax and catch a breath or two.

The zone of concern starts from Father line of daily chart which is near 23360. Once we get a closing above this point the zone between 23569 and 23893 will be little difficult to cross as it has the trend line resistance. Once we get a closing above 23893 the Bulls can be in very strong space where they can try to pull the market further 500/800 points upwards.

However we comment about it when we reach there. The support for Nifty in case the Father line or the Resistance zone of 23569/23893 plays a spoil sport will be 23174, 23039 (Strong Mother Line Support of Daily chart).

If the Mother line is broken and we get a weekly closing below the same Bears will come back into action and can try to drag the Nifty towards 22675, 22353 and finally 21737.

Disclaimer:The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

NIFTY-15MHere are the levels for nifty to trade for tomorrow intraday and mark these levels on the chart.

Price if opened gap up don't go for long trades it may be trap for buyers and price may come down. So try to look for short trades near the 0.786 fib level. If there any buying opportunity price has trap the sellers near the 23290 and day low levels, or else if the price forms any consolidation for more than 2 hours and on the breakout look for buying trades.

It is just my thoughts it does not mean it will exactly the same it is just my view.

If you think I am wrong you can share you views below thank you.

TIP: Always buy the at low and sell at high.

Here I mention only the high probability trades only. as intraday trader you can have multiple entries and exits according to your setups.

DISCLAIMER: This is my own analysis and you do your own analysis before you take any trade and I am not SEBI registered and contact your financial adviser before taking any trades .I am not responsible for your profit or loss. This is only for educational purpose and learning.

comment below if you have any doubts.

Signs of REJECTION around 23400 levels..?As we can see NIFTY is heading towards 23400 levels which previously acted as a SUPPORT and now can act as a potential resistance hence as long as NIFTY doesn’t sustain itself above 23400 levels one should not go long aggressively and think of booking profits partially here.

#16 April Nifty50 trade zone

#Nifty50

99% working trading plan

👉Gap up open 23418 above & 15m hold after positive trade target 23482, 23640

👉Gap up open 23418 below 15 m not break upside after nigetive trade target 23262, 23188

👉Gap down open 23262 above 15m hold after positive trade target 23418 , 23482

👉Gap down open 23262 below 15 m not break upside after nigetive trade target 23188, 23084

💫big gapdown open 23188 above hold 1st positive trade view

💫big Gapup opening 23482 below nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education following me

Nifty levels - Apr 16, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

LONG NIFTYBased on recent price action if Nifty 50 hold 22350-22450 range then we can expect the market to Rally further one can enter a buy position above 22505-22535 which can give immediate move to 22600-22700 break above this will take nifty to the levels mentioned in the charts these are positional levels and not intraday

#NIFTY Intraday Support and Resistance Levels - 15/04/2025Nifty will open gap up in today's session. Expected opening above 23050 level. After opening if it's sustain above this level then possible short upside rally upto 23300+ level in opening session. 23300 level will act as an immediate resistance. Expected reversal from this level. Any further upside rally only possible above this level. Major downside expected if nifty starts trading below 23000 level in today's session.

Will 23000 psychological level act as a RESISTANCE..!?As we can see following the global cues we can expect another strong opening for NIFTY but it can be seen heading towards psychological level 23000 and hence this level could act as a support hence one should not go long aggressively unless it sustains itself above 23000 levels so plan your trades accordingly and keep watching everyone.

NIFTY-30MHere are the levels for nifty to trade for tomorrow intraday and mark these levels on the chart.

We can find the trade opportunities when the day high or low is broken and price may be in the region and we can not see any momentum if the previous day range is not broken.

TIP: Always buy the at low and sell at high.

Here I mention only the high probability trades only. as intraday trader you can have multiple entries and exits according to your setups.

DISCLAIMER: This is my own analysis and you do your own analysis before you take any trade and I am not SEBI registered and contact your financial adviser before taking any trades .I am not responsible for your profit or loss. This is only for educational purpose and learning.

comment below if you have any doubts.