Nifty Faces Range-Bound Phase,brace for volatility till Mid ApriNifty ended the week at 22,397, marking a decline of about 150 points from the previous week's close. The index reached a high of 22,676 and a low of 22,314, trading in a narrow range of just 360 points. This suggests that next week, Nifty could experience a wider range, with potential moves between 22,850 and 21,950 .

Despite the weakness seen on both the monthly and weekly charts, Nifty remains range-bound as long as the critical support level of 21,950 holds. However, with the end of March approaching, many investors will likely start booking losses to offset any gains they’ve made this year. This could trigger another round of selling pressure in the market. As a result, we may not see a meaningful recovery until mid-April, meaning we could face one more month of market volatility and pessimism.

It's crucial to keep cash ready to invest in fundamentally strong stocks during this period of market uncertainty. On the global front, the S&P 500 closed the week at 5,521, slipping below its 50-week exponential moving average (50WEMA). It seems likely that the index will test the 100-week exponential moving average (100WEMA) at around 5,240–5,250, which is about 4% below its current level. If this happens, we could see additional pressure across global markets, including India.

In summary, brace yourself for another month of market negativity before any potential relief arrives. Stay cautious and focus on high-quality stocks for the long term.

NIFTY trade ideas

Nifty has made its bottom Nifty CMP 22397

Trendlines- Without knowing the two points, it is impossible to draw what u see on this chart. And mostly the trendlines drawn from top and bottom do not reflect the true geometry on the charts.

Fibs- the confluence is right there at the point further cementing the zone.

RSI - on the monthly chart the oscillator is at its long term support zone.

Conclusion - The bottom is made .. the mkt is all set to rally..Have a wonderful Holi folks.

Nifty Levels using Elliot Wave theoryThe Nifty is currently undergoing a correction from the 26,200 level, following a WXY pattern to complete the correction. It is likely to form a WXY-XZ pattern in the coming days if the momentum fails

A temporary reversal could occur around the 21,714 level. If the index falls below 21,340, it may move towards deeper levels.

14 March Nifty50 important levels trading zone 14 March Nifty50 important level trading zone

#Nifty50

99% working trading plan

Gap up open 22568 above & 15m hold after positive trade target 22710, 22890

Gap up open 22568 below 15 m not break upside after nigetive trade target 22388,22268

Gap down open 22388 above 15m hold after positive trade target 22568, 22710+

Gap down open 22388 below 15 m not break upside after nigetive trade target 22268, 22148

💫big gapdown open 22710 above hold 1st positive trade view 22710 below nigetive view

💫big Gapup opening 22268 below nigetive trade view 22268 above positive trade view

📌For education purpose I'm not responsible your trade

More education following me

NIFTY50 Intraday Analysis for 14 March 2025On 15m TF, NSE:NIFTY has given a ChoCh and taken out last swing low, confirming the temporary swing high of 22676. Price is still trading in the premium zone, with an accumulation forming in the last 2 sessions (Wednesday and Thursday)

Price is likely to take out the Sell Side Liquidity of this accumulation and likely to do a reversal from 22100-22180 levels, with an upside target of 22700.

Reasons:

If Market has to do a complete reversal from this level, it has to generate enough liquidity to take market up for next couple of days, hence this accumulation to generate liquidity and once Sell side liquidity is taken out, we can expect a reversal from the below demand zone (FVG).

If price breaks below the demand zone

1. Price may sweep the low at 21970 and reverse.

2. Price closing below the 21970 means, trend continuation for further fall.

Conclusion:

Opening is crucial, if the price dips to 22100-22180 range, observe price action in 1m or lower timeframes to enter long, with a tight SL below last swing low 21970.

If the price opens higher, it is likely to take out Buy Side Liquidity first and then fall to collect Sell side liquidity and then make the upside move.

NB: Not a financial advise, just sharing my observation for educational purposes.

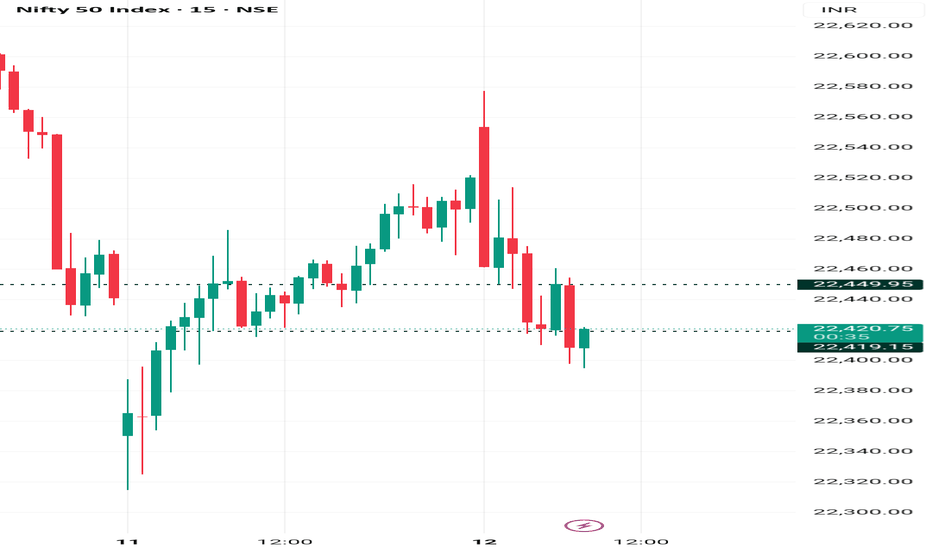

#NIFTY Intraday Support and Resistance Levels - 13/03/2025Flat opening expected in index. After opening if nifty starts trading above 22500 level then expected upside rally upto 22650+ in today's session. 22650 level will act as an immediate upside resistance. Expected reversal from this level. Major downside expected if nifty not sustain above 22500 and starts trading below 22450 level.

Nifty Might Be More Bearish TodayNIFTY Trading Strategy Based on Data Analysis

Key Observations: 🔍

Spot Price: 22,470.50

Max Pain:

22,450 → This suggests options sellers will benefit if Nifty expires near this level.

OI (Open Interest) Analysis:📊

Total Calls OI: 1,758.40 L

Total Puts OI: 1,527.76 L

Call OI Change:

+192.31 L (Increase in call writing, indicating resistance)

Put OI Change:

-157.51 L (Decrease in put positions, indicating weaker support)

PCR (Put Call Ratio):

0.8688A PCR below 1 indicates bearish sentiment as more calls are being written than puts.

Nifty Chart:📈📉

Resistance Levels: 22,500 - 22,600 (heavy call writing)

Support Levels: 22,300 - 22,400 (some put writing but weaker)

Trading Strategy 🧠

1. Bearish Bias (Short Nifty)📉

Entry: Sell Nifty near 22,480 - 22,500

Target: 22,350 (near support level)

Stop Loss (SL): 22,550 (above strong resistance)

Reasoning:🔍

Max Pain at 22,450: Expect Nifty to hover near this level.

High Call OI at 22,500 & 22,600: Indicates strong resistance.

PCR < 1: More calls written than puts → Bearish sentiment.

OI Change: Call writing is increasing, confirming resistance at 22,500.

2. Alternative Bullish Strategy (Only If Nifty Holds 22,400)📈

Entry: Buy Nifty near 22,400 (support zone)

Target: 22,520 (near resistance)

SL: 22,350 (below support)

Reasoning:🔍

If Nifty holds 22,400 and PCR rises above 1, bullish strength can return.

However, current data suggests bearish pressure is stronger.

Final Recommendation:

Primary View: Bearish → Sell on Rise (Short at 22,480-22,500)

Alternative View: Buy Only if Nifty Holds 22,400 with Strength

Nifty Analysis 13.3.2025As of March 12, 2025, the Nifty 50 index closed at 22,470.50, reflecting a slight decrease of 0.12% from the previous day. citeturn0search1

Recent technical analyses suggest a bearish outlook for the Nifty 50:

- **Head and Shoulders Formation**: A head and shoulders pattern has been identified, with a breakdown through the support at 22,779, signaling a potential further decline towards 20,405. citeturn0search2

- **Elliott Wave Analysis**: The index reached a peak around 26,300 in September 2024. Subsequent movements suggest a corrective phase, with potential targets between 22,500 and 22,550. citeturn0search3

Fundamentally, the Indian stock market has experienced significant challenges:

- **Prolonged Downturn**: The Nifty 50 is on track for its fifth consecutive monthly decline, marking its longest losing streak since 1996. This downturn has led to a 15% drop from its September peak, erasing nearly $1 trillion in investor wealth. Factors contributing to this decline include weak earnings, persistent foreign outflows, and uncertainties regarding U.S. tariffs. citeturn0news22

- **Investor Behavior**: Foreign investors have sold approximately $25 billion in Indian equities since September. While local institutional investors continue to buy, inflows are slowing, indicating cautious sentiment among domestic investors. citeturn0news22

In summary, both technical indicators and fundamental factors point towards a cautious outlook for the Nifty 50 in the near term. Investors are advised to monitor these developments closely and consider appropriate risk management strategies.

NIFTY : Intraday Trading levels and Plan for 13-Mar-2025📘 NIFTY Trading Plan for 13-Mar-2025

Chart Reference: Nifty is currently trading near 22,468, with price showing rejection from near-term resistance. Multiple levels such as 22,435, 22,496, and 22,600 are key zones to watch.

Let’s break down the trading approach into opening scenarios 👇

✅ 1. GAP-UP OPENING (100+ points above previous close)

If NIFTY opens near or above the Opening Resistance Zone – 22,600 to 22,626 :

📍 This zone has acted as a supply area earlier, and a gap-up into this area could trap late buyers if not sustained.

🟧 Scenario 1 – Rejection at Resistance:

🔻 If NIFTY opens within this resistance zone and shows early weakness (such as a bearish engulfing, evening star, or rejection wick), short trades can be considered.

🎯 Targets:

➤ 22,496 (Initial Support)

➤ 22,435 (Next Support)

🟩 Scenario 2 – Breakout Above 22,626:

✅ A strong 15-min bullish candle above 22,626 with volume confirmation can trigger a long entry.

🎯 Targets:

➤ 22,680

➤ 22,800 (Last Intraday Resistance)

🧠 Tip: In gap-up opens, avoid immediate entries. Wait 15–30 mins for the market to establish direction. If upside sustains with strength, trail using VWAP or 5-min EMA.

⚖️ 2. FLAT OPENING (within ±100 points)

If NIFTY opens between 22,435 – 22,496:

This region is the Opening Support/Resistance Zone , meaning both bulls and bears will be active here. The key is to observe who dominates.

🟩 Long Setup:

If NIFTY holds above 22,496 and gives a breakout above 22,600, it will confirm bullish strength.

🎯 Upside Targets:

➤ 22,680

➤ 22,800

🟥 Short Setup:

If price fails to hold above 22,435 and breaks below it with momentum:

🎯 Downside Targets:

➤ 22,319 (Opening Support)

➤ 22,208 (Last Intraday Support)

🧠 Tip: Use option strategies like straddles or strangles near this flat zone if expecting a breakout or expansion in volatility. Avoid naked directional trades unless there is strong confirmation.

🔻 3. GAP-DOWN OPENING (100+ points below previous close)

If NIFTY opens near or below 22,319 (Opening Support):

📍 The area between 22,319 – 22,208 is critical for support. Watch closely for price action.

🟩 Reversal Setup:

If NIFTY opens near 22,208–22,319 and holds this support with signs of strength (bullish pin bar, morning star, or strong bullish volume), a reversal trade can be taken.

🎯 Targets:

➤ 22,435

➤ 22,496

🟥 Breakdown Setup:

If support at 22,208 breaks with a large red candle and follow-through, short trades can be initiated.

🎯 Targets:

➤ 22,140–22,100 Zone (Intraday Expansion Move)

🧠 Tip: Gap-downs can lead to high implied volatility. Be cautious of IV crush if reversal happens. Consider bear put spreads to manage premium risk.

💡 Risk Management Tips for Options Traders

Avoid buying deep OTM options post 12 PM unless there is strong trend confirmation. Always trade with a defined stop-loss. Use 15-min closing basis for better validation. Consider spreads (bull call, bear put) to reduce the impact of theta decay. On volatile days, reduce position size and hedge your trades. Don’t trade immediately after a gap — let the first 15–30 mins settle to avoid traps.

📌 Summary & Conclusion

✅ Key Resistance Zones:

➤ 22,600–22,626 (Opening Resistance)

➤ 22,800 (Last Intraday Resistance)

✅ Key Support Zones:

➤ 22,435 (Pivot Zone)

➤ 22,319 (Opening Support)

➤ 22,208 (Last Support Zone)

🎯 Let price action guide your trade around these key levels. Remember — reacting to the market is better than predicting it.

⚠️ Disclaimer

I am not a SEBI registered analyst. This trading plan is shared purely for educational purposes. Please do your own research or consult your financial advisor before making any investment or trading decisions.

13 March Nifty50 important level trading zone #Nifty50

99% working trading plan

Gap up open 22568 above & 15m hold after positive trade target 22732, 22868

Gap up open 22568 below 15 m not break upside after nigetive trade target 22378,22242

Gap down open 22378 above 15m hold after positive trade target 22568, 22732+

Gap down open 22378 below 15 m not break upside after nigetive trade target 22242, 22138

💫big gapdown open 22242 above hold 1st positive trade view

💫big Gapup opening 22732 below nigetive trade view

📌For education purpose I'm not responsible your trade

More education following me

Nifty 50 Forecast by NEoWaveOn the 2H timeframe, the recent price correction appears to be a diametric one. When a Diametric Zigzag forms, it usually forms a combination pattern, so we consider 2 scenarios:

Scenario 1

Diametric wave-(g) ends in the range of 21050 – 21473 or even higher and the upward movement begins

Scenario 2

a- Wave-(g) continues to the range of 21050 – 21473 and then, in order to complete the time correction, a combination pattern of Diametric – X – Triangle is formed on the support range.

b- Wave-(g) continues to the range of 21050 – 21473 and then a small X wave is formed, but the price crosses the support range of 21050 – 21473, in this case, the combination pattern will still form, but the price can decrease to 19993 or the price range of 18993-18744 according to the second pattern.

The second scenario is more likely to form.

NIFTY FORMING A BEAR FLAG ON 1 HOUR TIME FRAMENifty has retraced form the recent lows of 21964 and has formed a high of 22676 we did see an up move today but in order for this move to sustain Nifty needs to trade above 22550 for 1 hour if it breaks the 22480-22450 zone we may see Nifty falling to the new levels mentioned in the chart as of now the chart appears to bearish in nature

NIFTY:STRUCK BETWEEN 10DEMA AND 10DEMA&50DEMA IN WKLY CHARTNIFTY: Nifty trading between 22300-500 and remains volatile and lack direction,going by the trend long shall be considered if it holds above 22625-650 on closing basis for 22800-23000 tgt on the contrary NIFTY breaching 22000 on closing basis will trigger a selling spree and expect a sharp fall by 300-400 points.As of now for me Long above 22650 and short below 22000(For educational purpose only)

#NIFTY Intraday Support and Resistance Levels - 12/03/2025Flat opening expected in nifty. After opening if nifty sustain above 22500 level then possible upside rally upto 22750+ level in today's session. Any major downside only expected if nifty not sustain above level and starts trading below 22450. This downside rally can goes upto 22300 level after the breakdown.

Selling the RISE as per our PLAN!! As we can see NIFTY has recovered considerably despite the weak opening and weak global cues which could be due the factored fall which has already taken place in NIFTY. Hence any weakness is not impacting NIFTY any further. Now we will stick to our plan and sell the rise as it can still be seen trading around resistance which previously acted as a SUPPORT hence as long as we are below the structure and doesn’t closes above 600 levels every rise can be sold so plan your trades accordingly and keep watching.

Nifty Intraday Support & Resistance Levels for 12.03.2025Tuesday’s session saw Nifty opening gap-down due to negative global cues, hitting a low of 22,314.70 before gradually recovering to a high of 22,522.10 by the end of the day. It closed at 22,497.90, gaining 37 points over the previous close. The Weekly Trend (50 SMA) remains negative, while the Daily Trend (50 SMA) has turned negative from oversold levels.

Demand/Support Zones

Near Demand/Support Zone (Daily): 21,964.60 - 22,261.55

Far Support: 21,281.45 (Low of 4th June 2024)

Far Demand/Support Zone (Daily): 20,769.50 - 20,950

Supply/Resistance Zones

Near Minor Supply/Resistance Zone (75m): 22,595.90 - 22,676.75

Far Supply/Resistance Zone (Weekly): 23,222 - 23,807.30

Outlook

After making a recent high of 22,676.75 on Monday, Nifty faced selling pressure but managed to recover from 22,314.70 on Tuesday, closing near 22,500, showing some bullish strength. However, the index has not retraced much from its fall between 23,807.30 to 21,964.60. If the Daily Demand Zone support holds, we could see a potential move towards 22,885 or even 23,100 in the coming days.