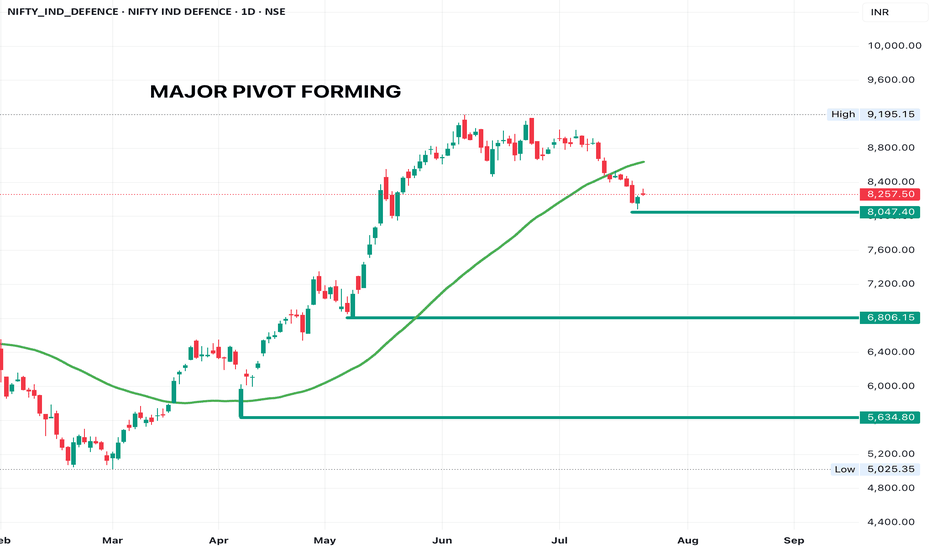

Dont Miss this Pullback in Defence!Missed the rally in defence stocks during Apr-May? Make use of the pullback now!

People who came in late are getting thrown out. Start nibbling in stocks that are still near ATH.

This is a decadal theme.

Stocks I like - MIDHANI, AXISCADES, APOLLO

What stocks are you tracking?

NIFTY_IND_DEFENCE trade ideas

NIFTY INDIA DEFENCE SHOULD CORRECT TO FILL GAP.. CAUTIOUSThis is a technical analysis chart of the NIFTY IND Defence Index (1D timeframe),

📊 Current Market Status:

• Last Close: ₹8,752.95

• Day’s Change: -₹105.60 (▼1.19%)

• Day’s Range: ₹8,714.55 – ₹8,884.40

🟢 Uptrend Summary (Recent Past):

• Low: ₹5,632.70 (March 2025)

• High: ₹9,204.95 (recent peak)

• Gain: +₹2,688.55 (≈+30.76%)

🧭 Fibonacci Retracement Levels (from swing low to swing high):

• 0.236: ₹8,361.90

• 0.382: ₹7,840.35

• 0.5: ₹7,418.80

• 0.618: ₹6,997.30

• 0.786: ₹6,391.15

🔴 Bearish Signals:

1. Price rejection from top of upward channel

• Price has moved out of the rising red parallel channel.

• Currently testing support, and breakdown seems underway.

2. Break below dotted descending trendline

• Indicates short-term weakness.

3. Gap zone between ~₹7,840–₹7,418 could act as a demand/support zone, but also a magnet if breakdown accelerates.

4. Targeted Downside Projections:

• 1st Target: ₹7,884 (▼9.91% from peak)

• 2nd Target: ₹7,474 (▼14.18% from peak) — aligned near the 0.5 retracement level

🔵 Key Support Zones:

• ₹7,884.15 — Previous strong support zone

• ₹7,518.85–₹7,474.05 — Confluence of gap support and 50% Fibonacci

🔺 Resistance Levels (Upside Challenges):

• ₹9,204.95 — Recent peak (0% retracement)

• ₹9,311.35 — Upper projection/resistance

• ₹9,412.65 — Red dashed resistance line

• ₹9,832.90 — 0.382 projection from upward move

📉 Conclusion & Strategy Outlook:

🔻 Bearish Bias (Short-Term)

• Breakdown of trendline and channel signals a likely correction phase.

• Look for support at ₹7,884, and if breached, expect deeper correction to ₹7,474–7,518.

🔼 Reversal Confirmation (Bullish if):

• Price reclaims and sustains above ₹9,000, breaking past previous swing high.

✅ Action Points:

• Long Holders: Watch ₹8,360 (0.236 fib) — if broken, tighten stop-loss.

• Short Opportunities: Breakdown below ₹8,468 could trigger downside to ₹7,884 and ₹7,474.

• Fresh Entry (Positional Longs): Consider near ₹7,474–7,518 if price shows bullish reversal signals there.

DO YOUR OWN D/D